Get the free Credit Card Application

Get, Create, Make and Sign credit card application

How to edit credit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card application

How to fill out credit card application

Who needs credit card application?

Understanding the Credit Card Application Form: A Comprehensive Guide

Understanding credit card applications

The credit card application form is a critical part of establishing your financial flexibility. It serves as a gateway to accessing credit, which can improve your purchasing power, help manage expenses, and even build your credit history. Understanding its significance in personal finance is crucial for anyone looking to utilize credit responsibly.

Moreover, your credit card application actively impacts your credit score. Each application prompts a hard inquiry, which can lower your score temporarily. Thus, it’s vital to be selective about how and when you apply. Familiarizing yourself with the different types of credit card applications—be it online, in-person, or mail-in—can also enhance your chances of approval based on your convenience and comfort level.

Preparing for your credit card application

Before delving into the credit card application process, assessing your financial situation is paramount. Start by reviewing your credit report to identify any discrepancies or areas of concern. A clearer picture of your credit history will set a foundation for your application and help you understand what lenders might see.

Another essential metric to consider is your debt-to-income ratio, which shows how much of your monthly income goes toward debt obligations. A lower ratio indicates better financial health, thus enhancing your eligibility for a credit card. Additionally, nurturing a clear idea of your needs—be it travel rewards, cash back options, or other benefits—will further aid in selecting the best card for you. Understanding interest rates and fees can also prevent unpleasant surprises later on.

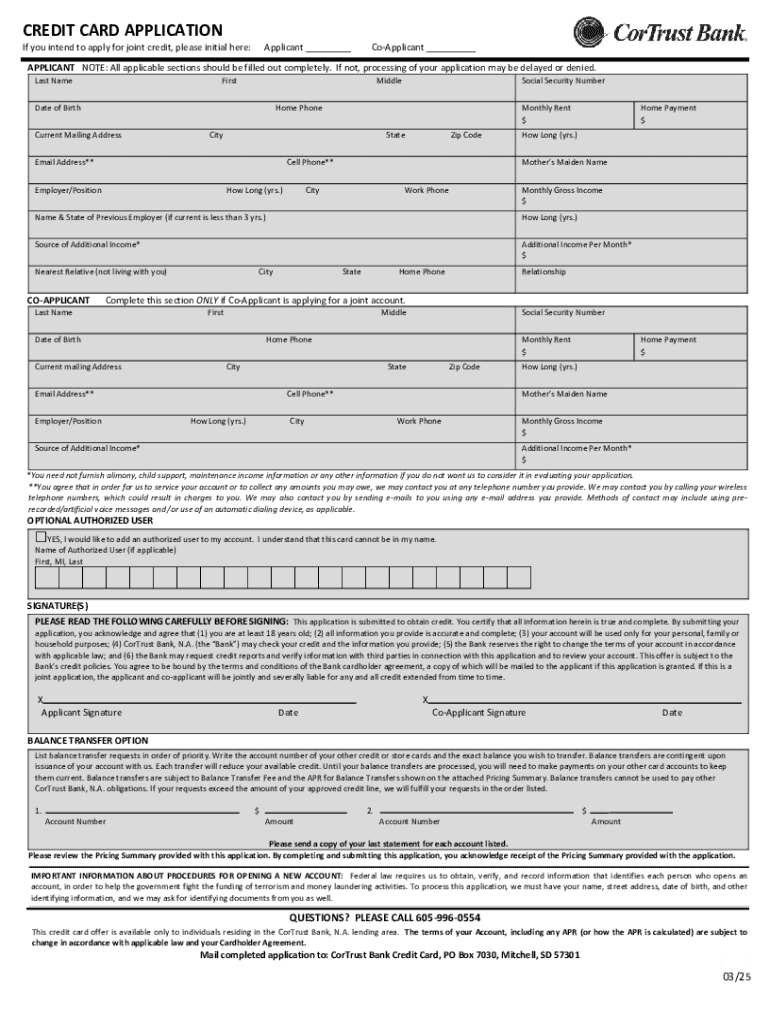

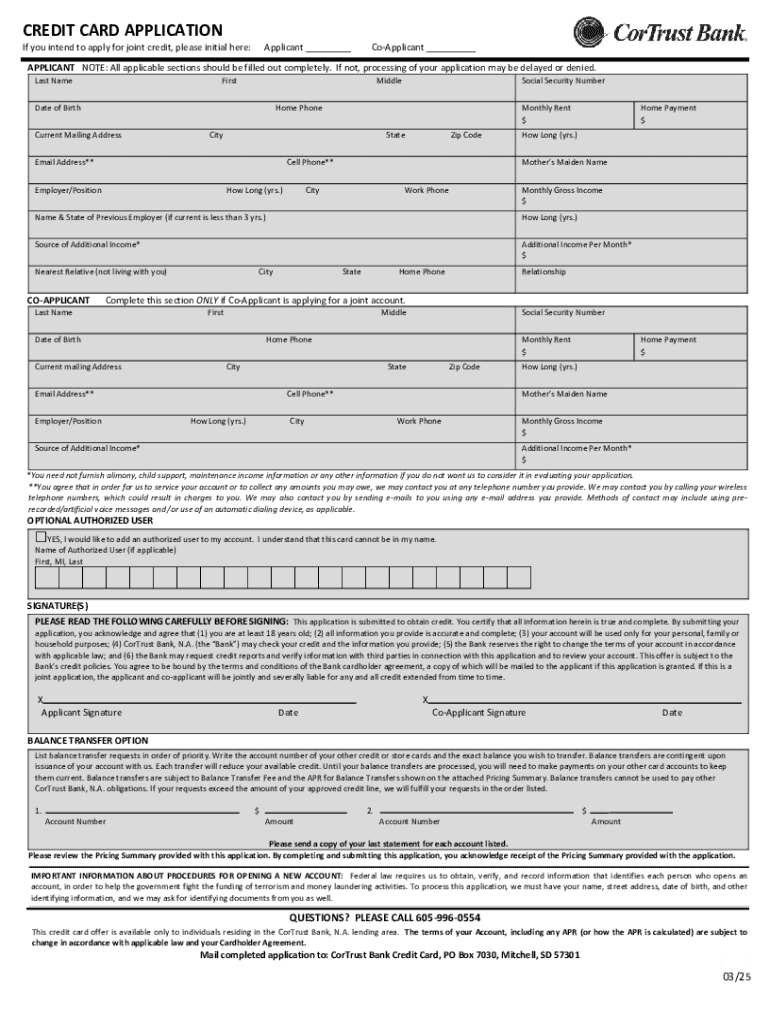

Essential information required on a credit card application form

Filling out the credit card application form is a critical step. Personal details are mandatory, such as your full name, current address, and contact information, along with your Social Security number and date of birth for identity verification. These basic details help lenders ascertain your identity and credit history.

Additionally, financial information is crucial. Be ready to disclose your employment status, income details, and your monthly housing payments along with any other financial obligations like loans or mortgages. Providing accurate credit history information is equally important, as any discrepancies could lead to application denial. The credibility of your credit history will directly influence your chances of approval.

Navigating the credit card application process

Completing the application form requires careful consideration. Start by selecting the right credit card that aligns with your financial goals. Then gather the necessary documentation that supports your application—this may include pay stubs, tax returns, or other proof of income.

When filling out the application form, accuracy in each section is key to avoiding delays. Double-check your information to minimize the chances of errors. After completing the application, take a moment to review your entry for any mistakes. The submission process itself can vary; some applications receive instant approval while others may undergo a manual review. Understanding these processes helps set realistic expectations regarding turnaround times.

After submitting your application

Once your credit card application is submitted, tracking its status becomes essential. Generally, you can check your application status online, which gives you a glimpse into its approval process. Typically, lenders provide an estimated timeframe for responses; knowing this can ease your mind during the waiting period.

If approved, expect to receive further instructions on activating your card and utilizing its benefits. Conversely, if your application is denied, it's crucial to take proactive steps. Reviewing the reasons for denial can offer insights into what might be improved for future applications, allowing you to take corrective measures before trying again.

Managing your new credit card effectively

Once you secure your new credit card, responsible management is key. Start by creating a budget that accommodates your incoming and outgoing payments. It's essential to keep track of your spending to avoid falling into debt.

Making timely payments is paramount; not only does this help maintain your credit score, but it can also prevent unnecessary fees and interest rate hikes. Additionally, understanding your credit card terms and conditions—including fees, interest rates, and the rewards framework—will empower you to take full advantage of your card without incurring unexpected charges.

Enhancing your experience with pdfFiller

Navigating the credit card application form can be a straightforward task with tools from pdfFiller. Their interactive features allow users to fill, edit, and manage PDF forms seamlessly. This is particularly beneficial for simplifying the application process.

Additionally, pdfFiller’s secure eSigning feature enables you to sign your application online, enhancing convenience without compromising safety. Furthermore, collaborating with advisors or family members on the application can help you make well-informed decisions, and pdfFiller allows you to share forms easily while maintaining document integrity.

Frequently asked questions about credit card applications

Navigating the complexities of credit card applications often comes with questions. For individuals with limited credit history, specialized approaches may be needed, like applying for secured credit cards. It’s also essential to know that reapplying after a denial is possible, although understanding the reasons for initial denial is crucial for improvement.

Another common query pertains to how long applications remain on your credit report. Typically, a hard inquiry can stay on your report for up to two years, which underscores the importance of making informed decisions about applying.

Insights for teams applying for multiple credit cards

For teams looking to streamline applications for business credit cards, meticulous documentation is key. Organizing information and ensuring all team members are on the same page will simplify the process, allowing for successful collective applications.

Using pdfFiller’s collaborative features can be enriching as it allows team members to manage credit applications effectively. This platform offers tools that not only facilitate superior documentation but also make collaboration less cumbersome.

Optional considerations for specialized credit card applications

When considering co-signing an application, it’s important to be aware of both benefits and risks. Co-signing can enhance approval chances but can also impact your credit score if the primary applicant fails to manage payments effectively. Similarly, understanding how credit card issuers evaluate joint applications can provide insight into whether this approach is right for you.

Secured credit cards represent another option for those looking to manage their credit more carefully. They typically require a cash deposit, which can serve as your credit limit, making them a practical option for individuals looking to build or rebuild their credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the credit card application in Chrome?

How do I fill out the credit card application form on my smartphone?

How do I fill out credit card application on an Android device?

What is credit card application?

Who is required to file credit card application?

How to fill out credit card application?

What is the purpose of credit card application?

What information must be reported on credit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.