Get the free Credit Application Information

Get, Create, Make and Sign credit application information

How to edit credit application information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application information

How to fill out credit application information

Who needs credit application information?

Credit Application Information Form - How-to Guide

Understanding Credit Application Information Forms

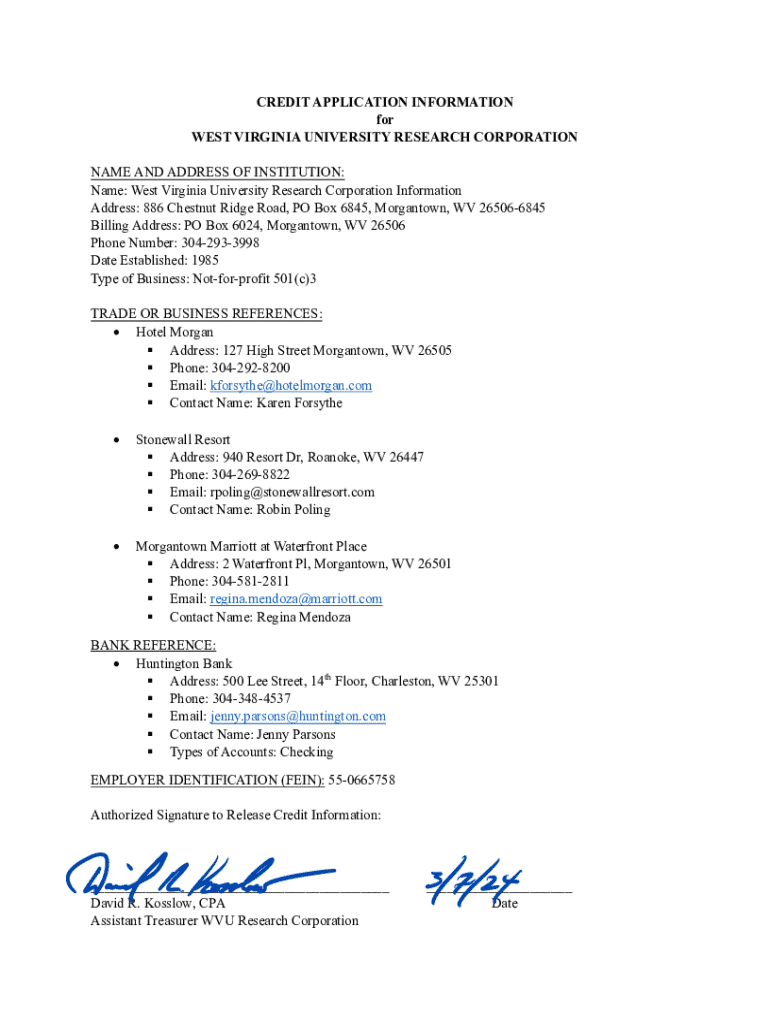

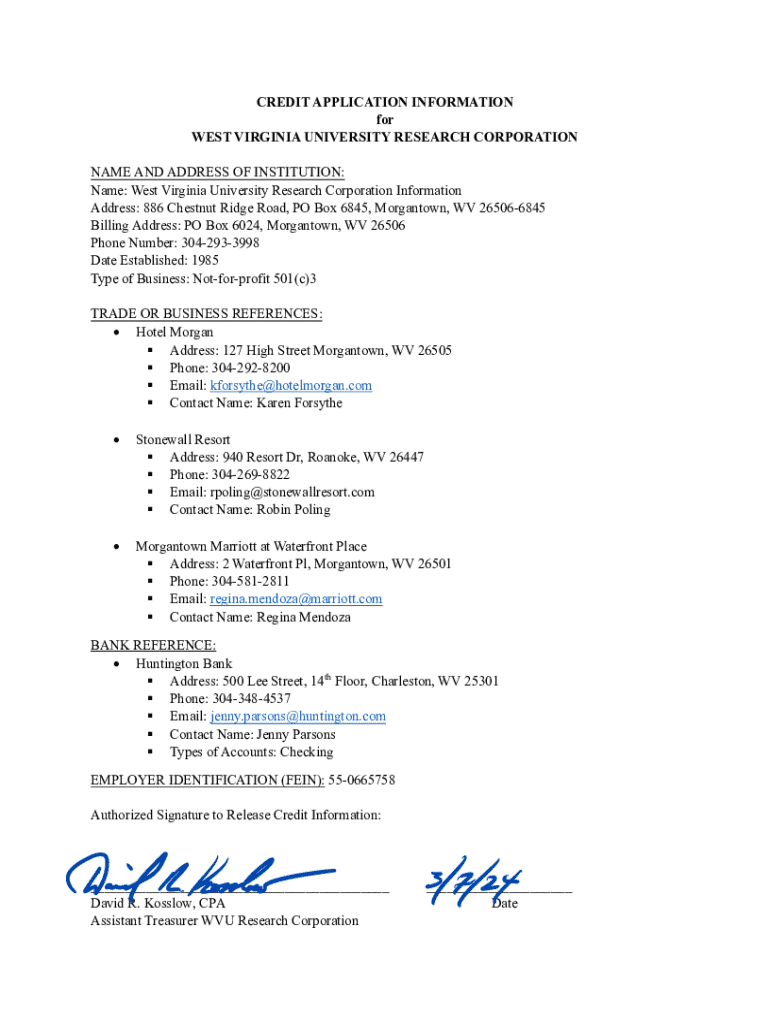

A credit application information form is an essential document used by lenders to evaluate potential borrowers. This form collects crucial information about your financial situation and creditworthiness, which banks and financial institutions analyze to make lending decisions.

The purpose of the credit application form is to provide a comprehensive view of your financial background. By filling out this form accurately, you can enhance your chances of securing credit, whether it's a personal loan, a mortgage, or a credit card.

Preparing to complete your credit application

Before you fill out your credit application information form, it's crucial to gather all necessary documentation. This preparation allows for a smoother application process and ensures that you provide accurate information.

Understanding your credit history is also vital. Checking your credit score provides insight into how lenders will perceive you. You can obtain your credit report for free from several reputable services. Knowing your credit history can help you identify areas for improvement and prepare to address any potential concerns with lenders.

Step-by-step guide to completing the credit application information form

Filling out your credit application information form correctly is essential. Start with your personal information. Clearly write your name, address, and Social Security number. Double-check for typos, as these can lead to significant delays.

When providing employment information, include your current employer’s name, your job title, and how long you have been employed. This information demonstrates your stability and ability to repay loans.

Reporting your financial information accurately is crucial. It's essential to list your income and monthly expenses. Be transparent; lenders appreciate honesty. Indicate your main sources of income and mention any side jobs or additional income streams. Don't forget to detail your monthly expenses, including rent or mortgage payments, utilities, and other financial obligations, as these figures help lenders assess your debt-to-income ratio.

Finally, answering additional questions, such as consent for a credit check and financial obligation statements, is part of the form. Ensure you understand what you’re consenting to and that you're aware of your financial commitments.

Tip for ensuring accuracy and completeness

Accuracy is paramount while filling out the credit application information form. After completing the form, take a moment to double-check your entries. This step can save you from unnecessary delays or potential denials.

Submitting your credit application

Once you've completed the credit application information form, it's time to submit it. There are two common methods of submission: online or by mail. Each method has its own advantages, and your choice may depend on the lender's preferences and your convenience.

After submitting, confirm the receipt of your application with the lender. This proactive step ensures that your form has arrived and reduces anxiety about the status of your application.

What happens next? Generally, the lender will review your application and financial details to determine if you meet their criteria. The review process may take several days to a few weeks, depending on the lender's workload and internal processes.

Understanding the approval process

Approval processes for credit applications vary by lender, but they typically rely on certain criteria. Factors include your credit score, income stability, debt-to-income ratio, and employment history. Make sure your application aligns with these expectations to increase your chances of approval.

If your application is denied, don't be discouraged. Understanding the reasons for denial can offer valuable insights. Common reasons include insufficient income, a low credit score, or a high debt-to-income ratio. Once you know the cause of denial, you can work on improving those areas before submitting a re-application.

Managing your approved credit application

Once your credit application is approved, it’s important to keep track of your documentation, including the loan agreement and payment schedule. Organizing these materials can help you stay on top of your financial obligations and ensure timely payments.

Responsible management of your credit is vital. Make use of budgeting tools and financial tracking software to help monitor your expenditures and cash flow.

Frequently asked questions (FAQs)

Navigating the credit application information form process often raises questions. Here are some frequently asked ones that may help you.

pdfFiller's role in the credit application process

pdfFiller streamlines the credit application process by enabling users to edit and complete their forms online. This makes it easier to provide accurate information efficiently. With pdfFiller, you can also utilize eSign features to speed up your submission process.

Interactive tools to enhance your experience

As you manage your credit application information form and subsequent financial commitments, utilizing interactive tools can greatly enhance your experience. Various tools can assist in understanding your finances better.

Additional considerations

In certain regions, state-specific regulations and requirements might affect how you complete your credit application information form. It’s wise to consult resources or legal advice to ensure compliance.

Additionally, keep an eye on future trends in credit applications. The finance sector is undergoing significant changes, including digital transformation and the growing role of AI in credit assessments. These advancements could further streamline the application process and enhance decision-making efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application information from Google Drive?

How can I send credit application information to be eSigned by others?

How do I edit credit application information in Chrome?

What is credit application information?

Who is required to file credit application information?

How to fill out credit application information?

What is the purpose of credit application information?

What information must be reported on credit application information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.