Get the free Credit Card Authorization

Get, Create, Make and Sign credit card authorization

Editing credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization

How to fill out credit card authorization

Who needs credit card authorization?

Credit Card Authorization Form - How-to Guide

Understanding credit card authorization forms

A credit card authorization form is a document that allows a merchant to charge a customer's credit card for a specified amount. Business owners collect this authorization to secure consent before processing payments, ensuring transparency and legality in the transaction process.

The importance of authorization forms in payment processing cannot be overstated. They act as proof that the cardholder has approved the transaction, reducing the risk of disputes and chargebacks. This not only protects sellers from fraud but also reassures customers that their financial information is handled responsibly.

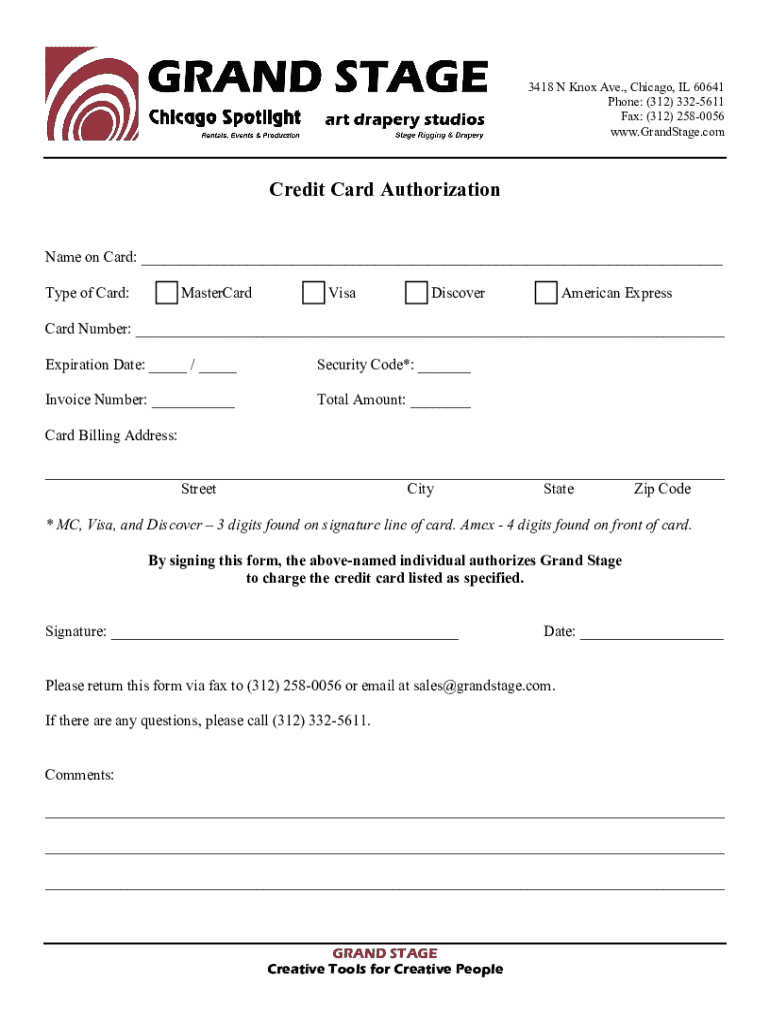

Components of a credit card authorization form

Essential elements of a credit card authorization form include detailed cardholder information, transaction specifics, and necessary authorization signatures. Cardholder information typically encompasses the name, billing address, and contact information, while transaction details outline the amount to be charged and the purpose of the transaction.

Signatures serve to validate the authorization, reaffirming that the cardholder agrees to the terms outlined. To further enhance security, optional sections may include a space for the CVV code, which provides an additional layer of verification, and a 'Card on File' section for businesses that store card details for recurring transactions.

The role of credit card authorization forms in fraud prevention

Credit card authorization forms play a vital role in combating fraud, particularly in preventing chargeback abuse. Chargebacks occur when customers dispute a transaction, and without prior authorization, merchants can find themselves at a disadvantage. By maintaining written proof of authorization, businesses can defend against unwarranted disputes.

Best practices for utilizing authorization forms include ensuring all required fields are completed accurately and keeping records in a secure environment. Additionally, always educate employees on fraud prevention techniques tied to payment processes, which not only protects the business but enhances customer trust.

When to use a credit card authorization form

Credit card authorization forms are necessary in various scenarios. For recurring payments, these forms provide clear documentation of ongoing agreements. One-time purchases also benefit from authorization to confirm consent, while high-value transactions significantly reduce the risk of fraud through strict validation processes.

Industry-specific use cases illustrate the versatility of authorization forms. E-commerce platforms rely heavily on them to secure online transactions, while service providers often use authorization forms for automatic billing purposes, ensuring all parties are protected.

Legal considerations surrounding credit card authorization forms

Legally, businesses are not always obligated to use credit card authorization forms; however, doing so greatly enhances transaction security and reduces liability. It's crucial to understand that having proper documentation can be invaluable should disputes arise or if a fraudulent transaction occurs.

Compliance with data protection regulations such as GDPR and PCI DSS is also paramount. These regulations set forth guidelines that govern how personal and financial data is collected, processed, and stored. Companies must ensure that they adhere to these standards to protect customer information and avoid hefty fines.

How to fill out a credit card authorization form correctly

Filling out a credit card authorization form correctly is crucial to ensure that payments are processed without delays. Start by providing accurate cardholder information, which includes the name, address, and contact number. Ensure that you specify the exact payment amount and the transaction date to avoid discrepancies.

Both the cardholder's signature and the date are required at the end of the form, serving as confirmation of consent to process the payment. Common mistakes include omitting critical details, such as the transaction amount or signing the form without dating it, which can lead to confusion later.

Storing signed credit card authorization forms

Storing signed credit card authorization forms securely is essential for maintaining customer trust and complying with legal requirements. Businesses should keep these forms for a specified duration, usually determined by payment processing agreements or state's legal requirements, but ensure they do not retain them longer than necessary.

When choosing a storage solution, businesses must consider digital versus physical storage. Digital storage is often more secure and easier to manage, offering encryption and cloud-based access. However, hard copies should be kept in a locked file and only accessible to authorized personnel.

Interactive tools for managing authorization forms

pdfFiller provides a range of tools designed to streamline the management of credit card authorization forms. Users can easily edit and eSign forms, simplifying the process of obtaining customer approvals. The platform also features collaborative tools that facilitate teamwork, enabling multiple users to engage with a document in real time.

The availability of form templates within pdfFiller ensures users can quickly get started, reducing the time spent on document creation. The platform’s user-friendly interface allows for easy navigation, making document management efficient for individuals and teams alike.

Frequently asked questions (FAQ)

Many users have questions regarding credit card authorization forms. One common query is why the form might not have a space for the CVV. While it's a security measure, some businesses choose not to include it due to PCI compliance regulations. If you don't use an authorization form, you risk unauthorized transactions and inadequate documentation, which can lead to disputes.

Another question often arises about modifying a completed authorization form. To amend a form, ensure that both parties, the merchant and the cardholder, agree on the changes and re-sign the document to validate modifications.

Explore more resources

For those looking to dive deeper into the topic of credit card authorization forms, additional articles and guides are available. Whether you want to expand your knowledge on payment processing or sharpen your document management skills, there are resources tailored to meet your needs.

Subscribe for updates

Stay informed on the latest resources and news regarding document management by subscribing to our newsletter. Get insights directly related to forms, document processing, and essential updates delivered to your inbox.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization without leaving Google Drive?

How can I send credit card authorization to be eSigned by others?

How do I fill out credit card authorization on an Android device?

What is credit card authorization?

Who is required to file credit card authorization?

How to fill out credit card authorization?

What is the purpose of credit card authorization?

What information must be reported on credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.