Get the free Credit Card Direct Debit Request Form Instructions

Get, Create, Make and Sign credit card direct debit

Editing credit card direct debit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card direct debit

How to fill out credit card direct debit

Who needs credit card direct debit?

How to Create a Credit Card Direct Debit Form: A Comprehensive Guide

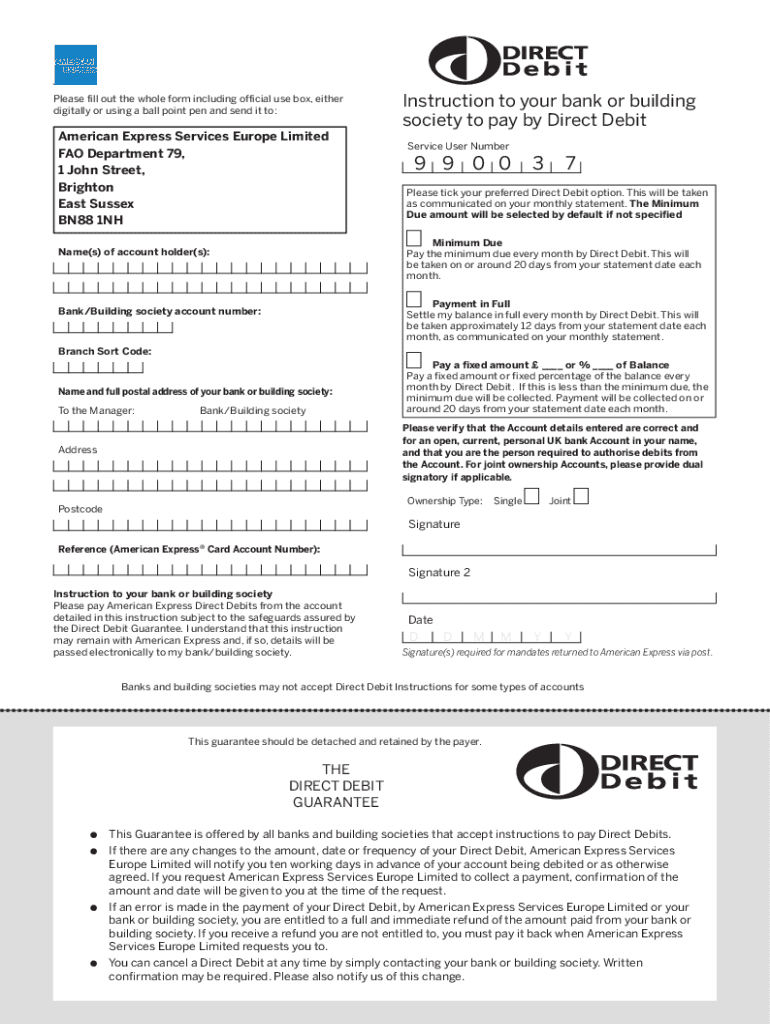

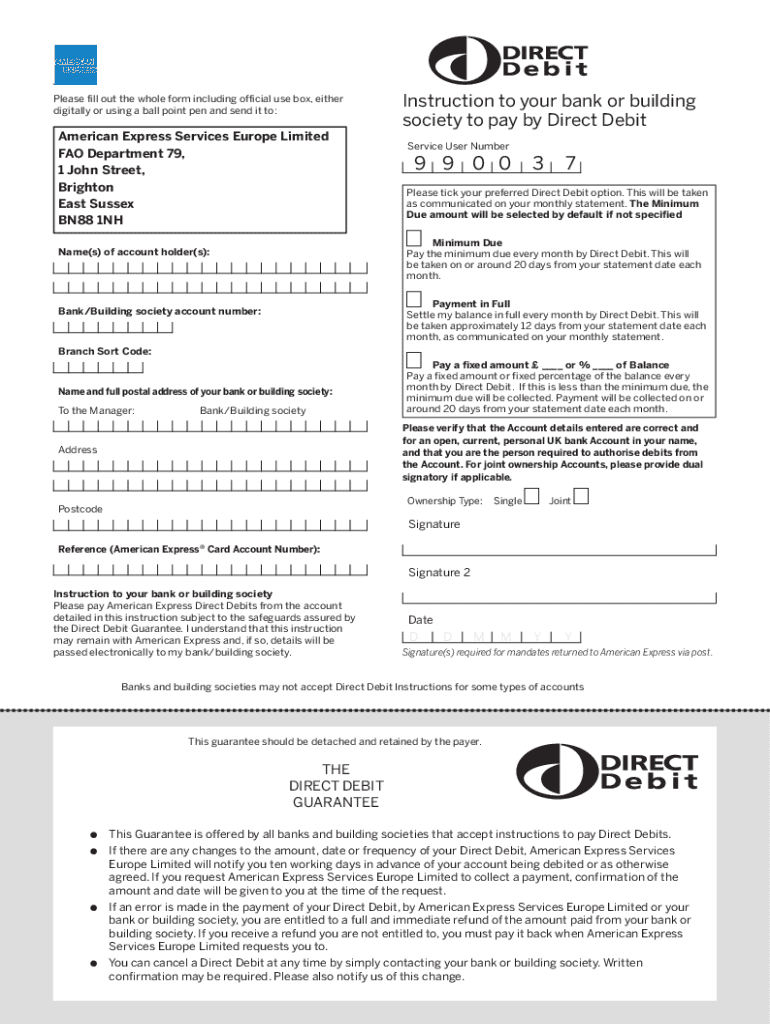

Understanding the credit card direct debit form

A credit card direct debit form is a document that authorizes a financial institution or service provider to automatically withdraw funds from a cardholder's credit card account on a recurring basis. Its primary purpose is to facilitate timely payments for services or subscriptions, ensuring that both parties adhere to agreed payment schedules without manual intervention.

These forms are essential in various sectors, including utilities, subscription services, and loan repayments. By providing clear authorization, they enhance the trust and efficiency of financial transactions.

Key components of a credit card direct debit form

Filling out a credit card direct debit form involves providing critical information that confirms your identity and outlines your payment authorization. The essential components include the cardholder's name, the credit card number, expiry date, CVV/CVC code, billing address, and an authorized signature.

For added security, optional fields such as a phone number, email address, and details of alternative payment methods can be included, providing both the cardholder and service provider assurance.

Step-by-step instructions for filling out the form

Gathering the necessary documents is the first step in filling out a credit card direct debit form. Identification documents and recent bank statements can help verify your identity and account status. Having these at hand streamlines the process.

The process of filling out the form can be detailed as follows:

Common errors to avoid include incorrect card numbers, mismatched signatures, and missing information, all of which can lead to declined transactions.

Editing your credit card direct debit form

Once the form is filled out, you might need to make changes or corrections. Utilizing pdfFiller's editing tools can simplify this process significantly, allowing for easy modifications.

Key features of pdfFiller's editing tools include add or remove fields, reorder sections for clarity, and adjust formatting to enhance visual appeal.

Best practices for editing forms include reviewing all changes for accuracy and seeking feedback if necessary, ensuring a coherent final product.

Signing the credit card direct debit form

Signing the form, whether electronically or manually, is crucial for validating the authorization process. Electronic signatures have become increasingly accepted and provide a convenient option for those who prefer digital documentation.

Using pdfFiller, signing the form can be accomplished through a straightforward eSigning process:

It’s important to be aware of the legal considerations surrounding digital signatures, which vary by jurisdiction but generally hold the same validity as handwritten signatures.

Managing your credit card direct debit transactions

The ease of managing transactions through a credit card direct debit form is one of its most appealing aspects. Setting up automatic payments can significantly enhance efficiency in managing finances.

When establishing automatic payments, remember to consider factors such as payment frequency and maximum limits to avoid unexpected charges.

Additionally, tools available on pdfFiller allow you to monitor transactions easily, and keeping records helps in tracking expenses over time. Handling potential disputes or cancellations requires understanding the processes involved, which can often be initiated directly through the service provider.

Troubleshooting common issues

Despite the convenience of a credit card direct debit form, issues may arise, such as declined transactions. Knowing how to react can save time and frustration.

Common responses include checking with your financial institution regarding declined transactions, ensuring that all submitted information matches bank records, and correcting any inaccuracies promptly.

Being proactive and understanding the processes involved in handling these issues is key to maintaining smooth transactions.

Enhancing security for your credit card direct debit form

Security is paramount when managing financial documents. Protecting personal information must always be a top priority, and there are several best practices to follow.

Utilizing pdfFiller's built-in security features can provide layers of protection, including encryption and user authentication protocols.

By arming yourself with knowledge and utilizing secure platforms like pdfFiller, you can safeguard your financial transactions effectively.

Real-life examples of credit card direct debit applications

Understanding how credit card direct debit forms are utilized in real life can help you appreciate their versatility and efficiency. For instance, service providers across various sectors have reported significantly improved cash flow management by implementing these forms.

Testimonials from users often highlight the ease of managing subscriptions and the peace of mind that accompanies automatic payments.

These examples illustrate the tangible benefits of adopting credit card direct debit forms in both personal and business finance contexts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card direct debit to be eSigned by others?

How do I edit credit card direct debit in Chrome?

How can I fill out credit card direct debit on an iOS device?

What is credit card direct debit?

Who is required to file credit card direct debit?

How to fill out credit card direct debit?

What is the purpose of credit card direct debit?

What information must be reported on credit card direct debit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.