Get the free Coverdell Education Savings Account Transfer Form

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Complete Guide to the Coverdell Education Savings Account Form

Overview of Coverdell Education Savings Accounts

A Coverdell Education Savings Account (ESA) is a tax-advantaged savings account designed specifically for educational expenses, including K-12 and higher education costs. It permits individuals to save for a beneficiary's educational needs while benefiting from tax-free growth and distribution. The contributions to a Coverdell ESA can be significant, offering an opportunity for families to lighten the financial burden of education expenses.

The primary purpose of a Coverdell ESA is to encourage families to save for educational costs. Among the many benefits, contributions to a Coverdell ESA grow tax-free, and withdrawals used for qualified education expenses are exempt from federal taxes. Unlike some other education savings plans, a Coverdell ESA can be used for a broad range of educational expenses, including tuition, fees, books, supplies, and even room and board for post-secondary education.

To be eligible for opening a Coverdell ESA, individuals must meet certain requirements. Generally, only single filers with modified adjusted gross incomes less than $110,000, and joint filers with incomes less than $220,000 can contribute to this type of account. Additionally, contributions are capped annually at $2,000 per beneficiary, and these contributions must be made before the beneficiary turns 18 unless the beneficiary is a special needs individual.

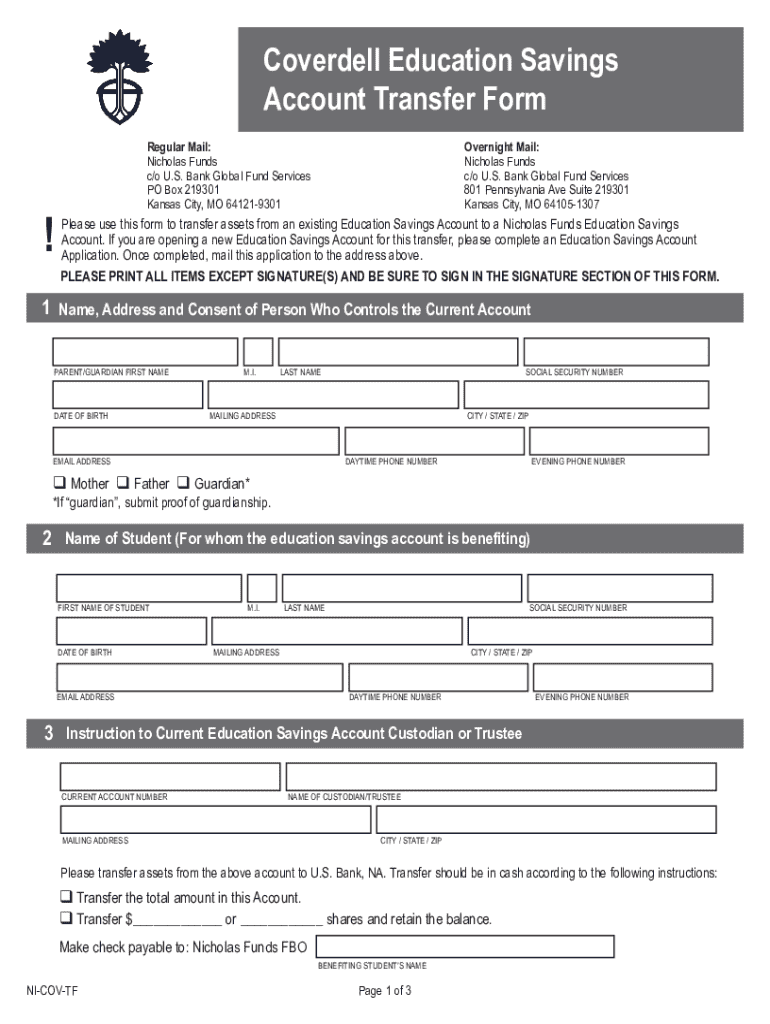

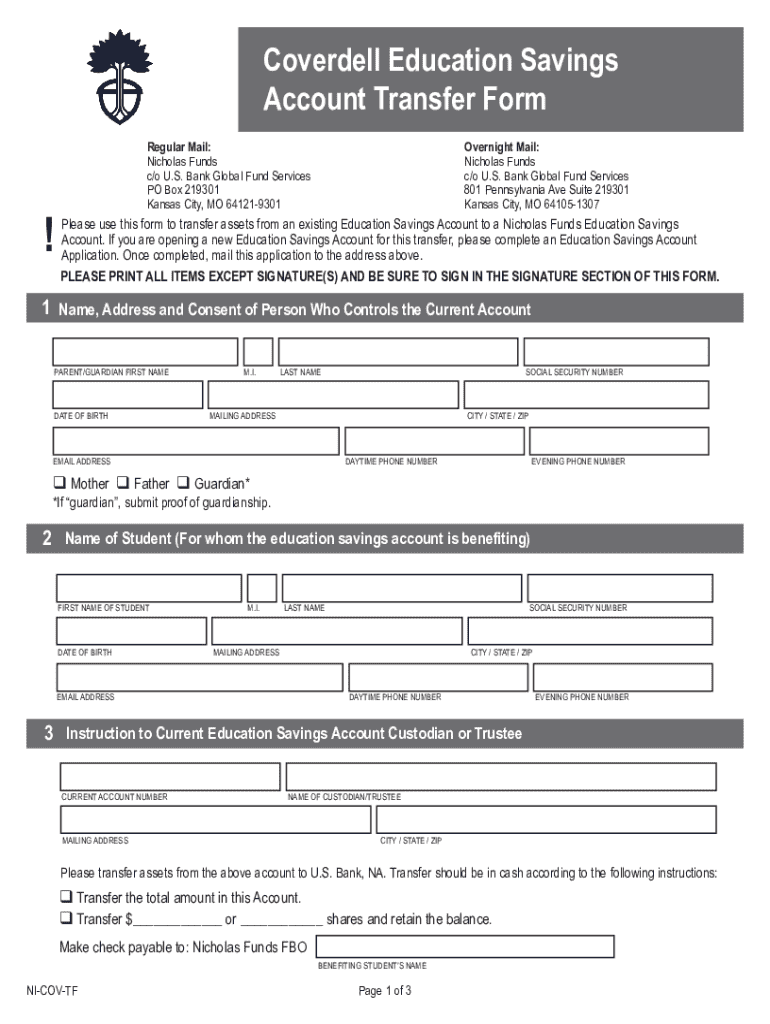

Understanding the Coverdell ESA form

The Coverdell ESA form is an essential document for initiating the account setup and contribution process. It includes various key sections that require careful attention. These sections typically cover personal information, beneficiary details, contribution information, and investment selections, all of which are critical for the correct setup of the account.

A common question surrounding the Coverdell ESA form centers on its complexity compared to other educational savings options, such as 529 plans. Unlike 529 plans which tend to focus solely on post-secondary education, Coverdell ESAs allow for K-12 expenses as well. Furthermore, while 529 plans have higher contribution limits and tax benefits that vary by state, Coverdell ESAs offer flexibility in investment choices, which can be pivotal for some savers.

Step-by-step guide to filling out the Coverdell ESA form

Filling out the Coverdell ESA form requires careful preparation and organization. Before you begin, gather essential documentation such as Social Security numbers for both the account holder and beneficiary, along with banking information for the fund transfers. Having this information readily available can make the process smoother and more efficient.

Follow these detailed instructions for each section of the Coverdell ESA form:

To avoid errors, double-check all entries for accuracy, especially names and Social Security numbers. Common mistakes include missing signatures, incorrect contribution amounts, or failing to provide the required documentation.

Editing and managing your Coverdell ESA form with pdfFiller

pdfFiller offers an intuitive online platform for editing your Coverdell ESA form efficiently. Once you obtain the form, logging into pdfFiller allows you to upload and edit it directly. You can fill out sections interactively, providing a more streamlined and less daunting experience compared to traditional paper forms.

Using pdfFiller’s interactive tools, you can easily add text, checkmarks, or even digital signatures ensuring that all required parts of the form are completed. This online solution also allows for easy collaboration, enabling teams or family members to provide input seamlessly. Comments and suggestions can be shared within the platform, making it a versatile tool for collective contributions.

Signing and submitting your Coverdell ESA form

Once the Coverdell ESA form is completed, it's time to sign and submit it. You can choose between digital signatures and traditional handwritten methods. If you opt for a digital signature, be sure that it complies with the requirements stipulated by financial institutions or state agencies to avoid complications.

For traditional signatures, print the completed form, sign it, and prepare it for submission. When submitting, ensure that you are sending it to the correct address and that all accompanying documents, such as identification or bank details, are included. Adhering to best practices during submission can ensure your application is processed without delay.

Managing your Coverdell ESA online

Management of your Coverdell ESA can be done efficiently online, allowing for easy tracking of contributions and account performance. Many financial institutions provide an online dashboard that shows current balances, contribution limits, and growth over time. Understanding these elements is crucial for effective financial planning.

It's also important to comprehend withdrawal rules for tax-free distributions. Typically, funds must be used for qualified education expenses, and there are deadlines associated with contributions and withdrawals that must be adhered to. Mark your calendar for key dates each year to ensure you meet all requirements.

Frequently asked questions (FAQs) about the Coverdell ESA form

Many individuals have questions regarding the Coverdell ESA form, particularly about eligibility and contributions. One common query revolves around the caps on contributions: the annual maximum is $2,000 per beneficiary. Additionally, families often wonder about tax implications for contributions and the penalties associated with early withdrawals.

Upon submission, changes to your Coverdell ESA can be made, but they must comply with certain IRS guidelines. You can update beneficiary details or adjust investment selections by contacting your financial institution directly. Understanding these facets helps in maintaining effective oversight of your educational savings.

Utilizing pdfFiller for document management

Using pdfFiller extends beyond filling out just the Coverdell ESA form; it offers ongoing document management solutions. With the ability to access and manage multiple forms from a single platform, users can maintain oversight of all educational savings documentation and other important files.

The cloud-based functionality means that you can securely store documents, access them from any device, and share them with necessary parties effortlessly. Relying on a centralized solution enhances organization and reduces the risk of paperwork getting lost or misplaced.

Success stories: How pdfFiller has helped others

Testimonials from users highlight the transformative impact pdfFiller has had on managing educational savings accounts. Many have described how easy it was to navigate the Coverdell ESA form online, allowing families to focus more on saving and less on paperwork. These stories emphasize the platform's user-friendly design and collaborative features.

Case studies demonstrate how individuals and families successfully elevated their educational finances using pdfFiller's innovative features. Whether it's ensuring all forms are filled correctly or collaborating with advisors, users report increased confidence and efficiency in their educational savings planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit coverdell education savings account online?

Can I create an electronic signature for signing my coverdell education savings account in Gmail?

How do I edit coverdell education savings account straight from my smartphone?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.