Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A How-to Guide

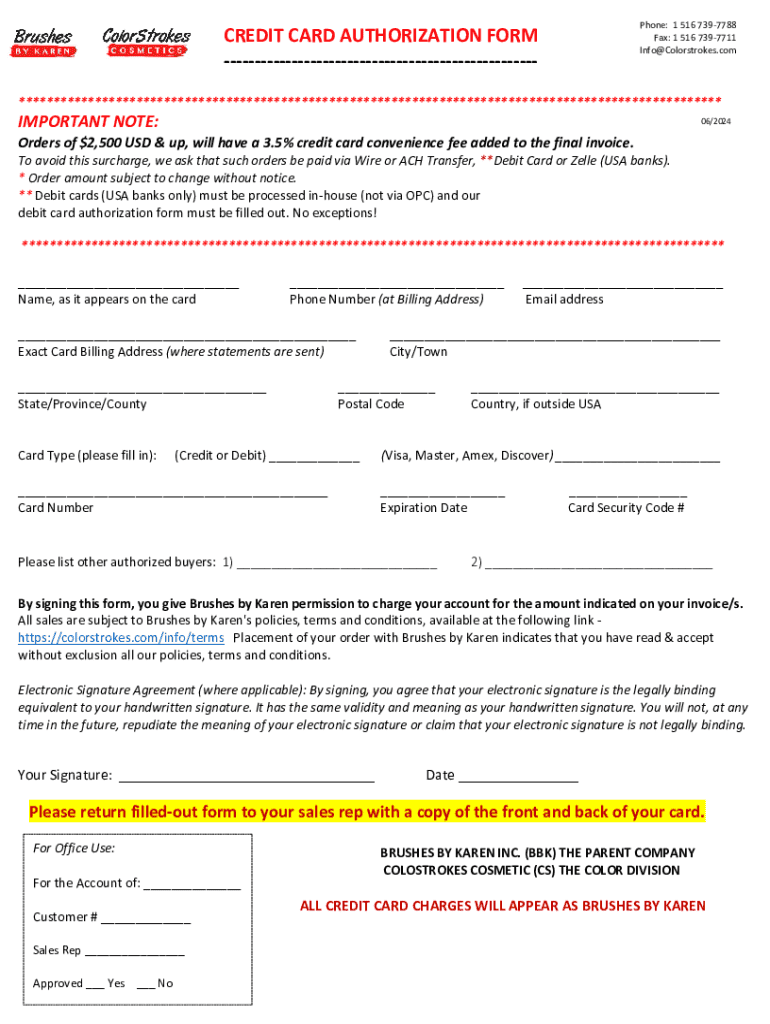

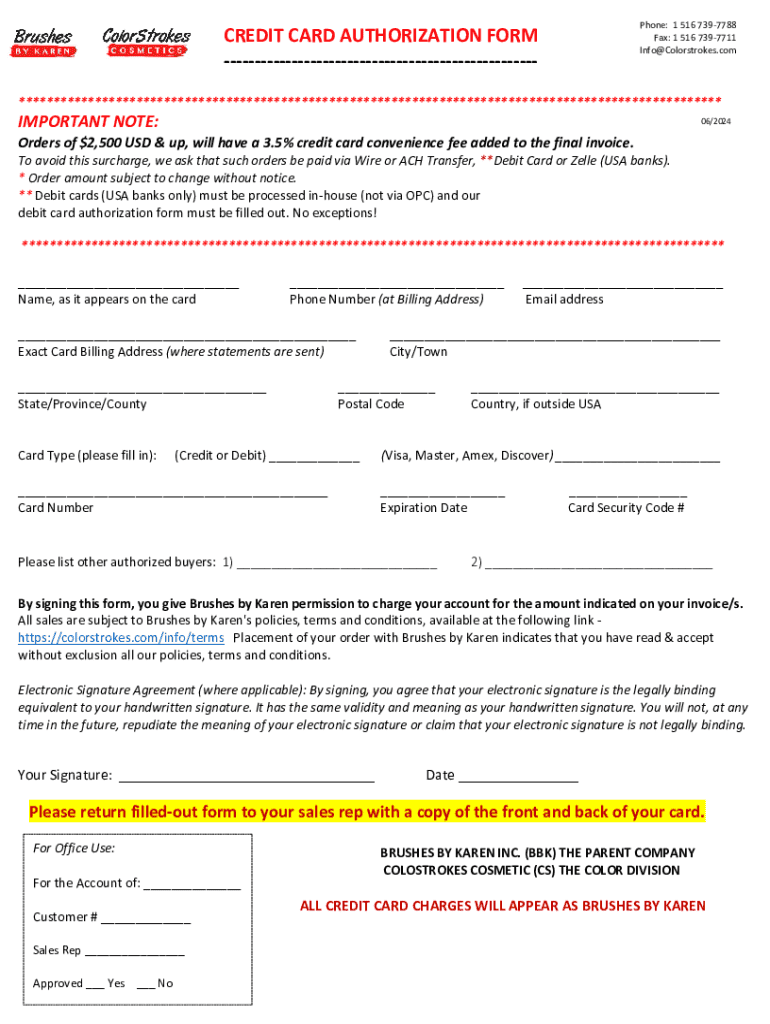

Understanding the credit card authorization form

A credit card authorization form serves as a critical document in a variety of financial transactions. It allows businesses to obtain explicit permission from cardholders to process payments on their behalf. The use of this form is essential in industries such as hospitality and retail, where services and products may often require upfront payment commitments.

This form not only clarifies the agreement between the consumer and the business but also delineates the specific terms of the transaction. By requiring customers to fill out a credit card authorization form, businesses can protect themselves against chargeback fraud, ensuring that they have the necessary documentation to contest a dispute successfully. Chargebacks can result in significant losses, so having this form acts as a safeguard.

Components of a credit card authorization form

A well-structured credit card authorization form contains several essential elements to ensure clarity and security. The key components typically include:

While these elements are essential, optional components enhance the form's effectiveness. Including a signature line, terms and conditions, and a date can help mitigate confusion and clarify the cardholder’s consent.

Types of credit card authorization forms

Two primary types of credit card authorization forms exist: pre-authorization and post-authorization. A pre-authorization form initially captures the cardholder's consent before a transaction is finalized. This is particularly beneficial for businesses that need to confirm a customer’s intention to purchase services without charging the card upfront.

Conversely, post-authorization forms are typically used after the service or product has been delivered or when recurring payments are established, such as for memberships or subscription services.

How to create a credit card authorization form

Creating a credit card authorization form can be streamlined using pdfFiller, a platform designed to simplify document management. Follow these steps to craft your own form efficiently:

Best practices for filling out a credit card authorization form

Filling out a credit card authorization form requires attention to detail to avoid mistakes. Ensure clarity by double-checking that all relevant information has been entered accurately. Common errors include misspelling the cardholder's name or providing incorrect payment details, which can lead to processing delays or disputes later on.

Additionally, protecting sensitive information is paramount. When submitting the credit card authorization form, always ensure that the document is transmitted securely, preferably through encrypted channels. Clear communication with cardholders is essential; always confirm receipt of the completed form and outline any next steps in the process.

Implementing a credit card authorization process

Establishing a robust credit card authorization process not only streamlines transactions but also enhances security. Here’s a step-by-step workflow that businesses can adopt:

Training your staff on best practices related to handling these forms is equally crucial. Your team should be well-informed about compliance and security measures to safeguard customer data effectively.

Impact of chargebacks and how to mitigate risks

Chargebacks have become a significant concern for many businesses, particularly in industries with high transaction volumes. According to recent statistics, millions of dollars are lost annually due to chargeback fraud. Every chargeback can incur fees and damage to a business's credibility.

Utilizing a credit card authorization form serves as a robust defense against disputes over charges. By having recorded consent from cardholders, businesses can provide evidence to support their claims and significantly reduce the likelihood of financial loss from chargebacks.

FAQs about credit card authorization forms

Navigating the nuances of credit card authorization forms can bring about various questions. Typical inquiries include:

Downloadable templates and resources

Accessing both free and paid templates for credit card authorization forms is seamless with pdfFiller. The platform offers a repository of templates ready for customization, designed to meet diverse business needs.

Using interactive tools such as fillable PDFs enhances user experience, enabling users to create, fill out, and store forms efficiently from any device. Leveraging an online platform for document management not only saves time but also promotes accuracy.

Engagement and community

At pdfFiller, we encourage users to stay connected and receive updates about new templates and guides tailored to optimize their document creation process. Sharing real user experiences and testimonials helps foster a community around effective document management practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card authorization form from Google Drive?

How do I edit credit card authorization form in Chrome?

Can I sign the credit card authorization form electronically in Chrome?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.