Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide

Understanding the credit card authorization form

A credit card authorization form is a document that enables a business to securely process payments using a customer's credit card details. By providing essential cardholder information, the form authorizes the merchant to charge the designated amount from the customer's credit card. This is particularly crucial for businesses that deal with transactions requiring pre-approval or recurring billing.

The primary purpose of the authorization form in payment processing is to establish consent from the cardholder. It protects both the merchant and the consumer in terms of trust and accountability. For businesses that process online transactions, having a standardized form is essential to ensure compliance with payment processing regulations.

Importance of credit card authorization forms

Credit card authorization forms play a critical role in the financial transaction landscape. One of their most important functions is to prevent chargeback abuse, which can heavily impact sellers by penalizing them for refunds or disputes initiated by consumers. By having a signed authorization form, businesses can substantiate their claims and minimize losses due to chargebacks.

These forms also help mitigate fraud risks for sellers and service providers. When a customer's information is on file and they have provided explicit consent, it compels both parties to maintain security protocols. Furthermore, this builds customer trust by making it clear that transactions are being managed responsibly and transparently.

When to use a credit card authorization form

Businesses should utilize credit card authorization forms in specific scenarios to ensure both legality and customer protection. For instance, recurring payments—like monthly subscriptions—require authorization to establish a payment cycle without further approvals each time. Similarly, one-time transactions should ideally have this form to prevent any post-transaction disputes.

Pre-authorizations for services, such as hotel bookings or car rentals, also call for an authorization form. In these contexts, funds may be held against a card without being charged, and the the form ensures that the customer has acknowledged this procedure. The timing of when to request these forms is crucial, as it should be done at the point of sale or before services are rendered.

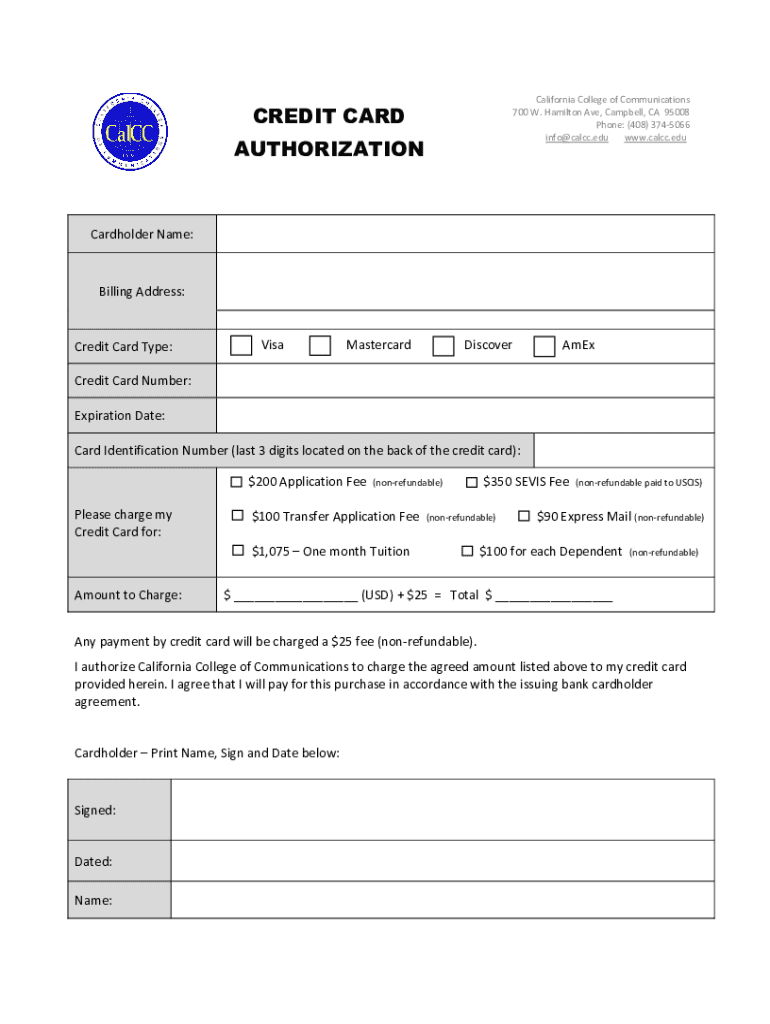

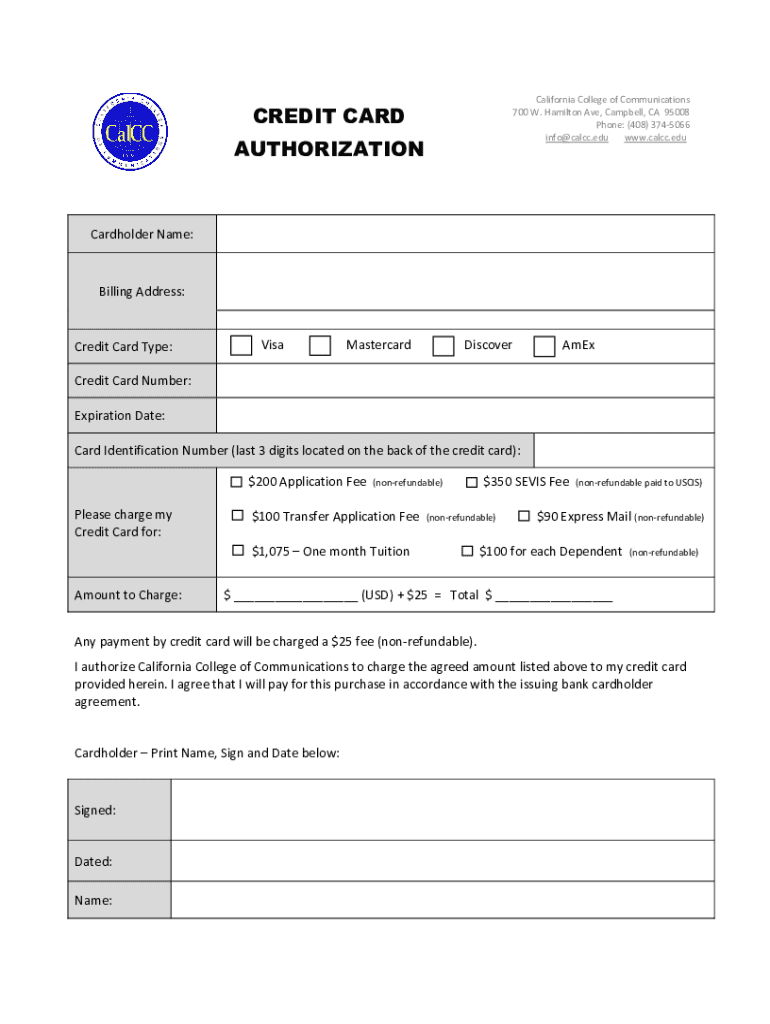

Components of a complete credit card authorization form

A comprehensive credit card authorization form comprises several standard fields. These fields typically include the cardholder's name, billing address, and contact details. Furthermore, transaction details such as the amount, date of charge, and description of the service should be explicitly mentioned to avoid confusion.

Merchant details are also essential, highlighting the business name and contact information. Additionally, optional fields like the card's CVV and expiration date enhance security, providing additional layers of verification. Lastly, the form must include a section for the cardholder's signature and the date to confirm consent.

How to fill out a credit card authorization form

Filling out a credit card authorization form is a straightforward process if you follow several key steps. First, collect all necessary information, such as the cardholder's name, card details, and transaction specifics. This ensures accuracy and completeness from the onset.

Next, systematically fill out the cardholder information section, ensuring that the names and numbers correspond with what’s on the credit card. Providing detailed transaction information—including the amount and nature of the service—is vital for clarity and record-keeping.

It's also essential to understand and accept the terms and conditions associated with the payment. Upon final review and ensuring all information is correct, the cardholder should sign the form and submit it. This authorization is not just a procedural formality but a critical security measure.

Editing and customizing your credit card authorization form

With pdfFiller, users can easily create and edit credit card authorization forms to meet their specific business needs. The platform offers robust editing tools and a user-friendly interface, allowing individuals and teams to modify existing templates or create new ones from scratch.

Interactive tools enable dynamic editing capabilities. Users can insert company branding, change field names, and even modify the layout to suit their preferences. This level of customization ensures the forms align with your business's visual identity while meeting legal requirements.

Storing and managing signed credit card authorization forms

Data security is paramount when managing signed credit card authorization forms. Best practices include using secure cloud storage solutions that comply with legal and financial regulations. This safeguards sensitive customer information against breaches and unauthorized access while providing easy access for legitimate business needs.

Retaining authorization forms for a specified duration enhances historical record-keeping. The general practice suggests retaining forms for a period of three to six months post-transaction, but this may vary based on industry requirements. Solutions like pdfFiller offer secure cloud storage, ensuring that your documents remain organized and easily retrievable.

Frequently asked questions (FAQ)

Key queries about credit card authorization forms often arise among users. Many wonder if they are legally obligated to use these forms. The answer is yes; using a credit card authorization form is a best practice that helps mitigate financial risk for both merchants and customers alike.

Another common concern is what happens if authorization isn't obtained before charging a credit card. If a charge occurs without prior consent, the merchant could face disputes and potential chargebacks, resulting in financial losses. If mistakes are noticed on the form, such as incorrect information, swift correction and reauthorization are necessary to ensure compliance.

Downloadable templates and resources

For those looking for a comprehensive approach to managing credit card authorization forms, pdfFiller provides an array of downloadable templates. These templates can be easily customized to suit your business’s specific requirements, ensuring you have a professional and compliant document every time.

Customization options available through pdfFiller help streamline your workflow. You can ensure that every authorization form is tailored to your branding and accurately captures all necessary customer details. This capability not only enhances professionalism but also fosters trust with your clients.

Case studies and user experiences

Real-life scenarios underscore the effectiveness of credit card authorization forms in practice. Users on pdfFiller have shared testimonials chronicling how these forms helped mitigate chargeback issues and improved their transaction management processes. For instance, an e-commerce retailer explained how having signed authorization forms reduced disputes with unsatisfied customers.

Additionally, businesses that did not use authorization forms reported financial losses from chargebacks. By understanding these experiences, other businesses can grasp the value of implementing structured payment practices to protect themselves and their customers.

Related tools and services for seamless payments

Choosing the right payment gateway options is also crucial for businesses looking to improve their payment processing capabilities. Integrating credit card authorization forms with your payment solutions ensures that all aspects of your transactions are managed seamlessly. This integration enhances efficiency while providing a secure environment for customer information.

Utilizing pdfFiller's features further contributes to payment efficiency. The platform’s eSignature capability allows for quick approvals, while its document management solutions keep your payment records organized and accessible.

Explore our other content and solutions

pdfFiller offers a wealth of additional resources related to payment processing and security. Users can explore guides that detail best practices in managing financial documents, along with tips to ensure compliance in all transactions. Furthermore, resources on document management and editing provide valuable insights for those looking to enhance their business processes.

By delving into these topics, individuals and teams can equip themselves with the knowledge required to navigate the complexities of financial transactions confidently. Whether it’s understanding compliance or efficient document handling, there’s always more to learn.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the credit card authorization form electronically in Chrome?

Can I create an electronic signature for signing my credit card authorization form in Gmail?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.