Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms: A Comprehensive Guide

Understanding credit card authorization forms

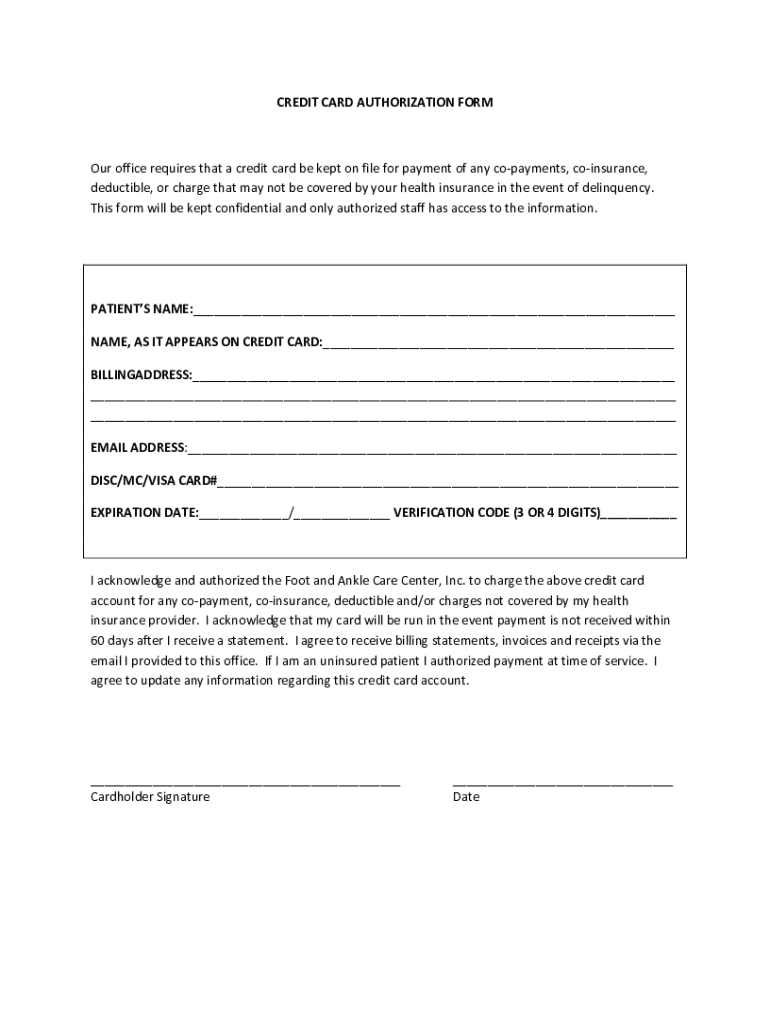

A credit card authorization form is a document that enables merchants to obtain permission from customers to charge their credit card for a specific amount. This form serves as a contractual agreement, detailing the transaction between the merchant and the customer. The primary stakeholders involved are the customers, who provide their credit card details, and the merchants, who rely on this authorization to ensure they can lawfully process the transaction.

These forms are not only vital for securing payments but also play an important role in maintaining trust. When a customer submits their credit card information via this form, they expect their data to be used responsibly and securely. It assures them that their personal and financial information is handled with care, and outlines the specific circumstances under which their card can be charged.

The importance of credit card authorization forms

Using a credit card authorization form is essential in today’s business landscape for several reasons. First and foremost, it helps prevent chargeback abuse, a growing concern for merchants. Chargebacks occur when a customer disputes a charge, and if a merchant does not have a proper authorization in place, they can easily lose that dispute, resulting in lost revenue.

Furthermore, credit card authorization forms are crucial in ensuring payment security. They necessitate careful handling of sensitive credit card information. By having customers provide their consent for charges, merchants build a transparent transaction environment. This transparency fosters trust, ensuring customers feel safe when making their purchases.

Key components of a credit card authorization form

A well-structured credit card authorization form typically includes several essential elements. Key details must cover both customer and merchant information, outlining who is providing the authorization and who will receive it.

Additionally, it is wise to include terms and conditions regarding the transaction. This can cover refund and cancellation policies to ensure that both parties understand their rights and obligations, reducing misunderstandings.

When to use a credit card authorization form

There are specific situations that necessitate the use of a credit card authorization form. Firstly, recurring billing arrangements are an area where consumers should expect this form to ensure they are fully aware of the charges being leveled against their card at regular intervals.

High-value transactions are another scenario where an authorization form is not just advisable, but often necessary. These large transactions bear more risk for both parties, and having a documented authorization helps protect against disputes. Lastly, any remote services or deliveries should employ such a form to create a paper trail and establish an agreement regarding payment and service delivery.

Merchants must avoid common mistakes involving these forms. A significant error would be failing to properly secure the form, putting customer data at risk. Another common pitfall is not informing customers effectively about what information is required, which can lead to incomplete or ineffective forms.

Filling out the credit card authorization form

Completing a credit card authorization form accurately is crucial for ensuring a smooth transaction. Here’s a step-by-step guide to help you fill out the form correctly.

For accurate completion, take time to double-check the information entered, as inaccuracies can lead to disputes or payment failures. Utilize secure methods for form submission to protect sensitive data.

Legal implications of credit card authorization forms

The legal obligation to use credit card authorization forms varies by jurisdiction but is largely considered best practice in most regions. In environments where chargebacks frequently occur, the absence of a proper authorization can create significant legal liability for merchants.

Failure to implement such forms not only exposes companies to potential legal challenges but can also affect their standing with credit card processors, leading to higher fees or losing access to processing privileges altogether. Understanding data security and compliance is fundamental. All merchants dealing with credit card data must be PCI DSS compliant, which mandates stringent security measures for data handling and storage.

Best practices for storing completed forms include avoiding physical storage where possible, using secure digital solutions to minimize risks.

Managing credit card authorization forms

Managing credit card authorization forms efficiently ensures compliance and security. Digital storage solutions provide an excellent method for safely managing these forms, with cloud-based platforms like pdfFiller making it easy to edit, sign, and collaborate on forms from anywhere.

Moreover, it is crucial to determine the duration for which you need to keep authorized forms. Most businesses should retain forms for a minimum of three years, ensuring that outdated documents are securely disposed of to protect customer information.

FAQs about credit card authorization forms

Many queries arise regarding credit card authorization forms that merit further exploration. For instance, what happens if a customer disputes a charge after authorization? Understanding the procedures involved can help merchants navigate this common issue.

Downloadable resources and template access

For a practical approach, you can download our customizable credit card authorization form template. This resource is designed to facilitate smooth transactions and ensure that all necessary components are accounted for.

By staying updated through our newsletter, you can also benefit from ongoing resources that will help keep your operations smooth and compliant.

Related topics and further reading

A well-rounded understanding of credit card authorization forms can be expanded by exploring related topics. For example, understanding payment gateways and their role in facilitating secure transactions can be invaluable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the credit card authorization form in Gmail?

Can I edit credit card authorization form on an iOS device?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.