Get the free Credit Card Authorization Letter

Get, Create, Make and Sign credit card authorization letter

How to edit credit card authorization letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization letter

How to fill out credit card authorization letter

Who needs credit card authorization letter?

Understanding the Credit Card Authorization Letter Form: A Comprehensive Guide

Understanding the credit card authorization letter form

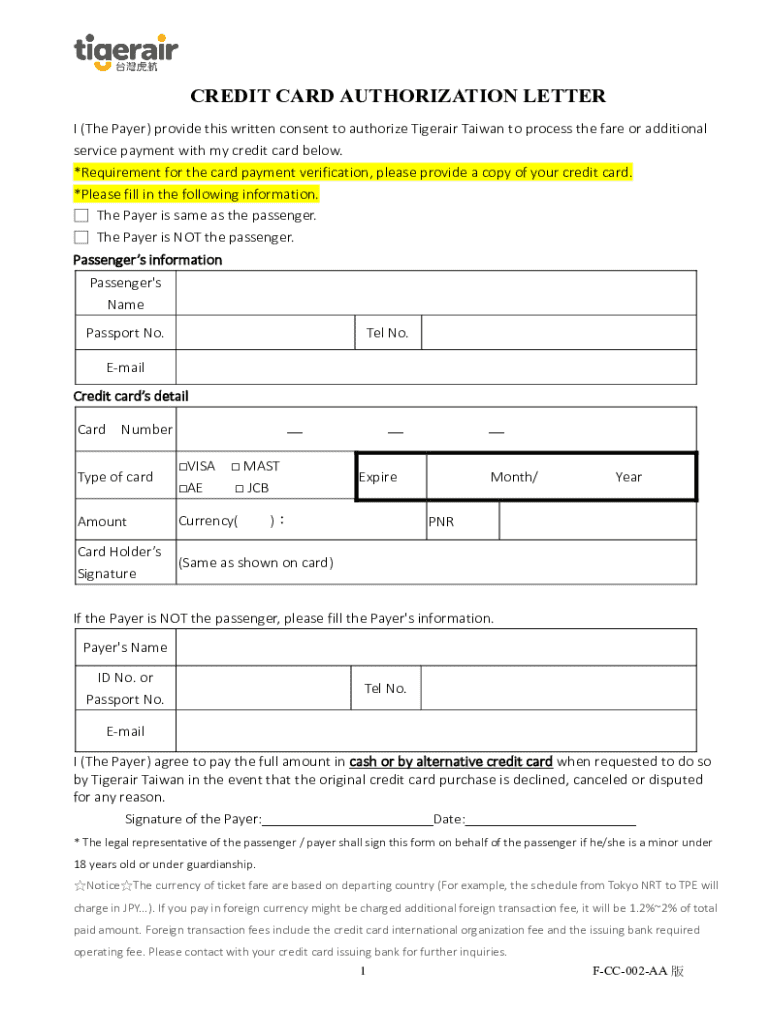

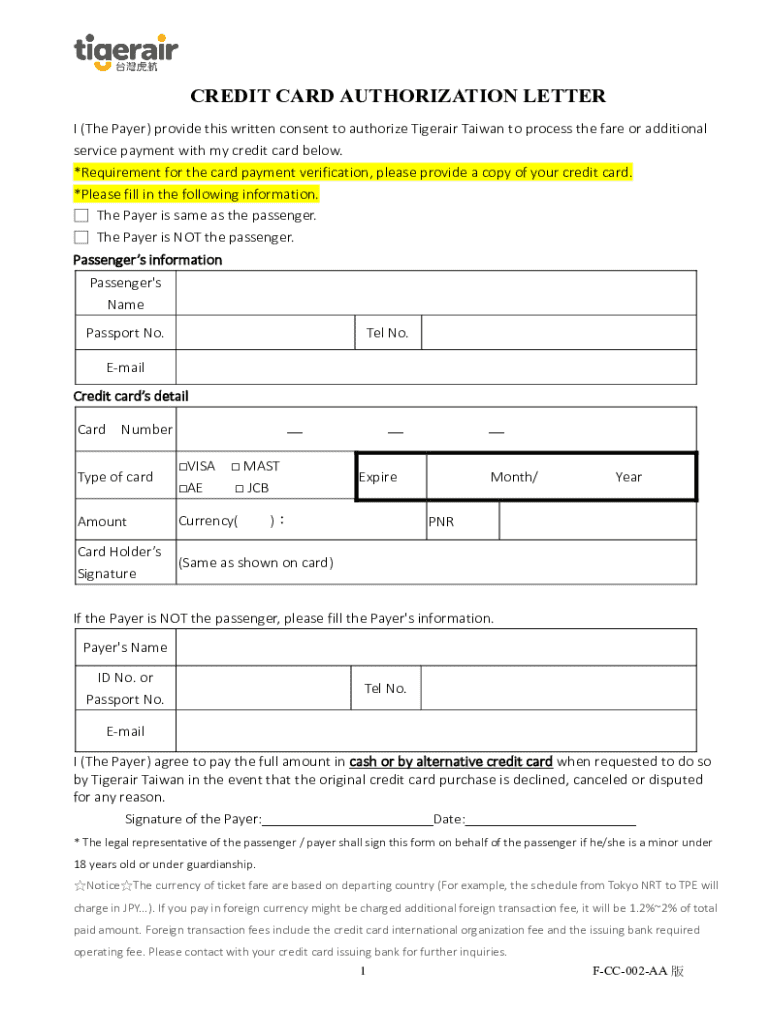

A credit card authorization letter form is a document that allows a business to charge a customer's credit card, typically for a one-time purchase or a recurring payment service. This form serves as a contract between the cardholder and a merchant, authorizing the merchant to process transactions on behalf of the customer.

The importance of using a credit card authorization letter cannot be understated. It helps legitimize the transaction and mitigates risks associated with chargebacks and fraud. Without proper documentation, merchants may face challenges in disputing unauthorized claims made by customers.

Businesses should consider using this form in several scenarios. For instance, if recurring payments are involved, or when a customer is making a significant purchase without being physically present, such as an online transaction or over the phone, using an authorization letter ensures all parties are protected.

Key components of a credit card authorization letter form

A well-structured credit card authorization letter form includes several key components that are essential for ensuring legality and clarity. These components typically fall into two categories: required information and optional details.

Optional components may include additional notes and instructions, such as specific payment periods, and contact information for any inquiries about the transaction. Including these details can enhance the clarity of the authorization.

Benefits of using a credit card authorization form

Employing a credit card authorization letter form offers multiple benefits to both merchants and customers. First and foremost, it acts as a precautionary measure against chargeback abuse and fraudulent activities. By obtaining documented consent for transactions, businesses can significantly reduce the risk of financial losses.

Additionally, this form provides protection for customers by ensuring their consent is properly documented. Transactions become clearer and more transparent, helping to build trust between the customer and the merchant. Moreover, for businesses with recurring payments, such authorization simplifies the billing process, minimizing repeated efforts in re-verification.

Step-by-step guide to creating a credit card authorization letter

Creating a credit card authorization letter can be straightforward if you follow specific guidelines. Here’s a detailed, step-by-step approach:

Electronic vs. paper authorization forms

With technological advancements, businesses now frequently opt for electronic authorization forms. One of the key advantages of digital signatures and eSigning rests in their convenience and time-saving properties. Electronic forms allow for instant transmission, making them ideal for fast-paced business environments.

Additionally, electronic forms often come with advanced security features, such as encryption and authentication measures, which bolster data protection. However, it’s essential to stay compliant with relevant laws like the eSign Act, which safeguards the legality of electronic signatures.

Managing and storing signed authorization forms

Proper management of signed credit card authorization forms greatly affects a business's operational integrity. For efficient document management, consider these best practices:

Legal considerations surrounding credit card authorization forms

When using credit card authorization forms, it's crucial to be aware of the legal landscape surrounding them. Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is essential for businesses accepting card payments. This encompasses guidelines on how to process and store customers' sensitive information safely.

Non-compliance with these regulations can lead to severe consequences, including hefty fines and loss of card processing privileges. Hence, understanding these legal obligations and addressing them properly within your authorization forms is vital for any business.

Frequently asked questions about credit card authorization forms

As businesses navigate the complexities of credit card transactions, several common questions arise regarding authorization forms. Addressing these inquiries can help businesses establish best practices.

Tips for businesses in adopting credit card authorization practices

For businesses looking to implement credit card authorization forms effectively, training employees on handling these documents is essential. Understanding compliance requirements and the correct procedures to follow enhances the overall transaction process.

Moreover, communicating transparently with customers about authorization practices reinforces trust. They should clearly understand what they are agreeing to and how their information is protected. Monitoring transaction trends can also optimize payment methods and improve customer satisfaction.

Related business practices and documentation

Beyond credit card authorization letters, several other practices are important for a comprehensive financial strategy. Developing 'Card on File' agreements can facilitate repeat transactions smoothly. Understanding how to securely process credit card transactions should also be a foundational principle for any business.

For eCommerce businesses, setting up robust recurring billing systems while integrating authorization forms into workflows is key to maintaining operational efficiency. Resources like pdfFiller’s customizable templates can further streamline this process.

Most popular templates and resources

Accessing quality templates for credit card authorization forms significantly eases the administrative burden on businesses. At pdfFiller, you can find the top downloaded credit card authorization forms that cater to various business needs.

Additionally, exploring featured articles and guides on document management will broaden your understanding of effective operational strategies. Utilizing document creation tools available on pdfFiller enables businesses to efficiently generate and manage necessary paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization letter directly from Gmail?

How can I edit credit card authorization letter on a smartphone?

How do I edit credit card authorization letter on an iOS device?

What is credit card authorization letter?

Who is required to file credit card authorization letter?

How to fill out credit card authorization letter?

What is the purpose of credit card authorization letter?

What information must be reported on credit card authorization letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.