Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-to Guide

Understanding credit card authorization forms

A credit card authorization form is a document that allows merchants to secure payments from customers using credit or debit cards. This form is vital in the payment process, especially for transactions where the cardholder is not present, often referred to as 'card-not-present' transactions. By obtaining authorization through this form, businesses protect themselves from potential chargebacks, which occur when customers dispute a charge on their card.

The key terminology surrounding these forms includes chargebacks—fees incurred when a customer disputes a charge—and merchant agreements, which outline the terms between a business and its payment processor. Understanding these terms enhances the ability of businesses to navigate payment processing effectively.

Benefits of using a credit card authorization form

Implementing a credit card authorization form benefits businesses in multiple ways. Primarily, it serves to prevent chargeback abuse, making it harder for customers to claim that they did not authorize a transaction when they genuinely did. This boost in security is crucial in a landscape where online fraud is ever-evolving.

Furthermore, these forms streamline payment processes, reducing friction for both customers and businesses. By establishing clear payment terms upfront, companies foster trust with their clientele, ensuring that customers are aware of what they're signing up for. This transparency can lead to improved customer satisfaction and loyalty.

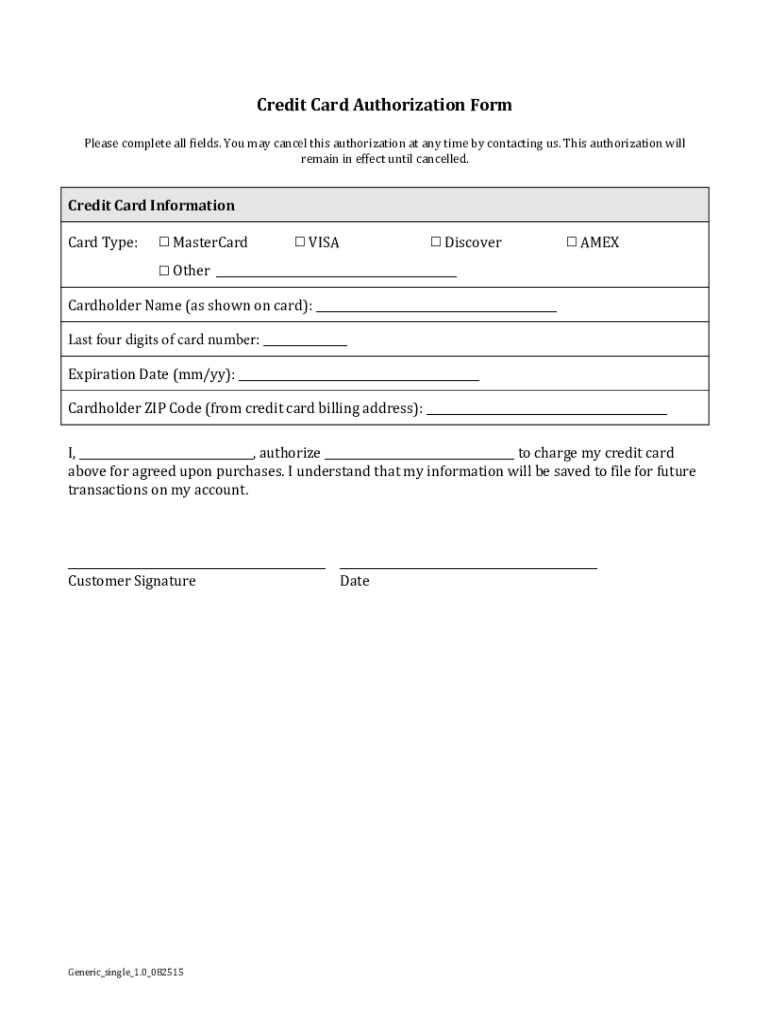

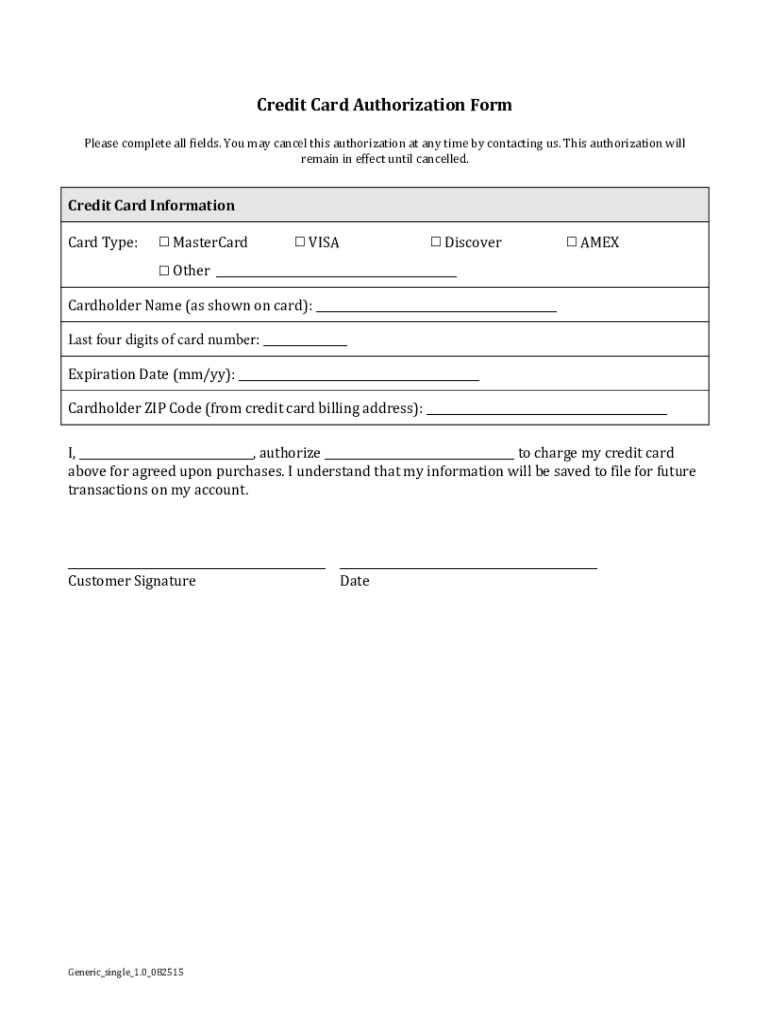

Key components of a credit card authorization form

A well-structured credit card authorization form includes several essential sections. First is the customer information section, which should gather the customer's name, address, and email. This information is crucial for verifying the cardholder’s identity and ensuring that any disputes can be resolved more easily.

Next is the payment details section, where the credit card number, expiration date, and amount to be authorized are recorded. The signature line is of paramount importance, as it establishes the customer's consent for the transaction. Including digital signatures facilitates a smooth process in today's eCommerce landscape. Lastly, the terms and conditions, including any legal considerations, must be clearly stated to ensure compliance.

When to use a credit card authorization form

Credit card authorization forms are particularly useful in various scenarios for sellers. E-commerce transactions often require such forms to verify legitimacy, especially when the card is not physically present. In service agreements or for recurring payments, these forms protect both customer and seller, providing clarity on payment schedules and amounts.

Common mistakes to avoid include failing to use the form for card-not-present transactions and neglecting to capture necessary customer and payment information. Not using the form diligently can lead to increased disputes and loss of revenue.

How to efficiently fill out a credit card authorization form

Completing a credit card authorization form is a straightforward process that requires careful attention to detail. Start by gathering all required information from the customer, including their personal and payment details. Second, input customer and payment data diligently, ensuring accuracy to avoid future disputes.

Next, include a clear description of the services provided and the terms of authorization. It’s critical to explain how and when the payment will be processed. Once completed, thoroughly review the form to confirm that all entries are accurate. Consider using checklists or validation tools on platforms like pdfFiller to ensure compliance and clarity.

Storing and managing credit card authorization forms

Once credit card authorization forms are completed, secure storage and effective management are essential. Best practices for digital storage include using encryption to protect sensitive information, implementing access control measures to limit who can view these documents, and establishing retention timeframes. Most businesses should retain copies of these forms for at least three years, depending on industry regulations.

Legal obligations in managing these forms can vary by state or country, so it's advisable to stay informed about any requirements specific to your operations. Utilizing a cloud-based platform like pdfFiller not only secures documents but also makes them accessible from anywhere, allowing for efficient recovery and management.

Common questions about credit card authorization forms

Many questions arise concerning the use of credit card authorization forms. A common inquiry is whether you are legally obligated to use them. While not always mandated, they offer considerable protection against chargebacks, making them a best practice for risk management.

Download our credit card authorization form templates

To simplify the process of creating a credit card authorization form, pdfFiller offers customizable templates that can be easily modified to suit your business's specific needs. Using our interactive tools, users can adjust fields as necessary and integrate additional terms that reflect your operational practices.

These templates facilitate a seamless editing experience and ensure compliance with legal standards. Customization options enable tailoring to your business model, enhancing both workflow efficiency and customer experience.

Related resources and further reading

For those looking to enhance their understanding of payment processing, a wealth of articles and guides are available at pdfFiller. Exploring best practices for online transactions can illuminate strategies to improve security and efficiency in your payment processes.

Additionally, resources on crafting other essential business forms can empower individuals and teams to build an effective document management system. These materials contribute to a more robust operational framework and enrich customer interactions, ultimately driving growth.

Subscribe for updates and resources

Staying abreast of changes in financial document management is crucial for any business. By subscribing to pdfFiller’s updates, you can receive exclusive content and insights related to credit card authorization forms and broader payment processing updates.

Joining our community not only enhances your knowledge but also fosters collaboration with others committed to improving customer payment experiences.

Popular articles and guides

Expert insights and case studies

Dive into success stories of businesses that have effectively utilized credit card authorization forms to protect their revenue streams. Interviews with financial compliance experts shared on pdfFiller reveal valuable insights into the evolving landscape of digital payments and the integral role of security in building customer confidence.

Additionally, relevant case studies illustrate how trends in payment processing and customer security initiatives positively impact businesses of all sizes, enhancing operational resilience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the credit card authorization form electronically in Chrome?

How can I fill out credit card authorization form on an iOS device?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.