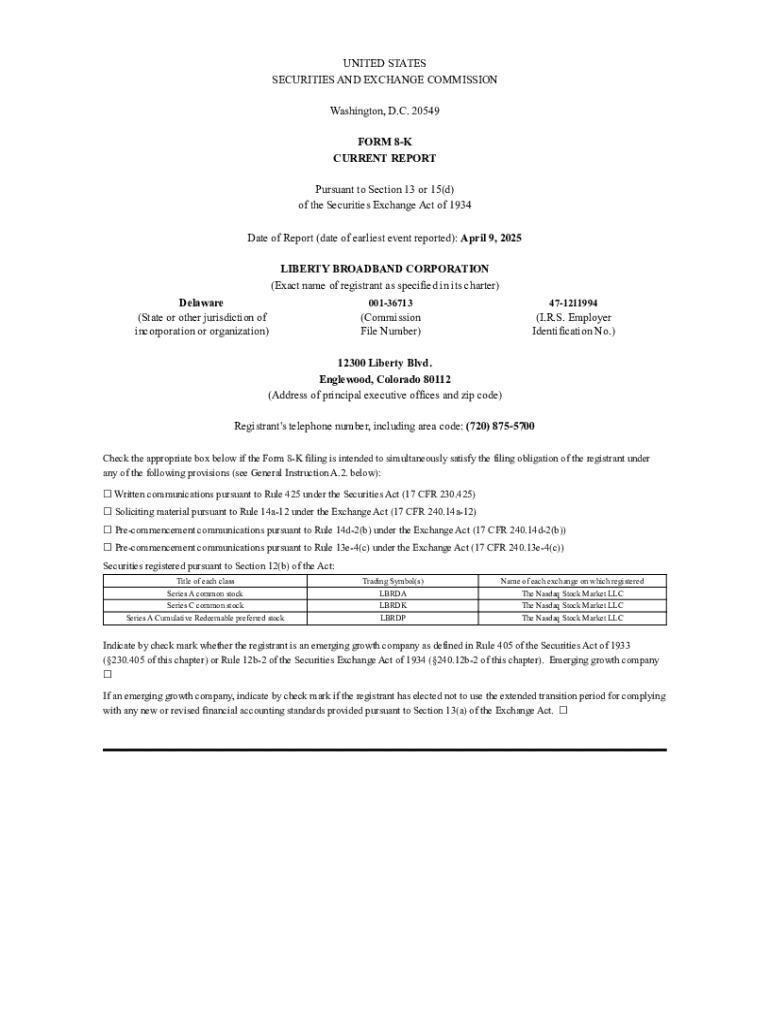

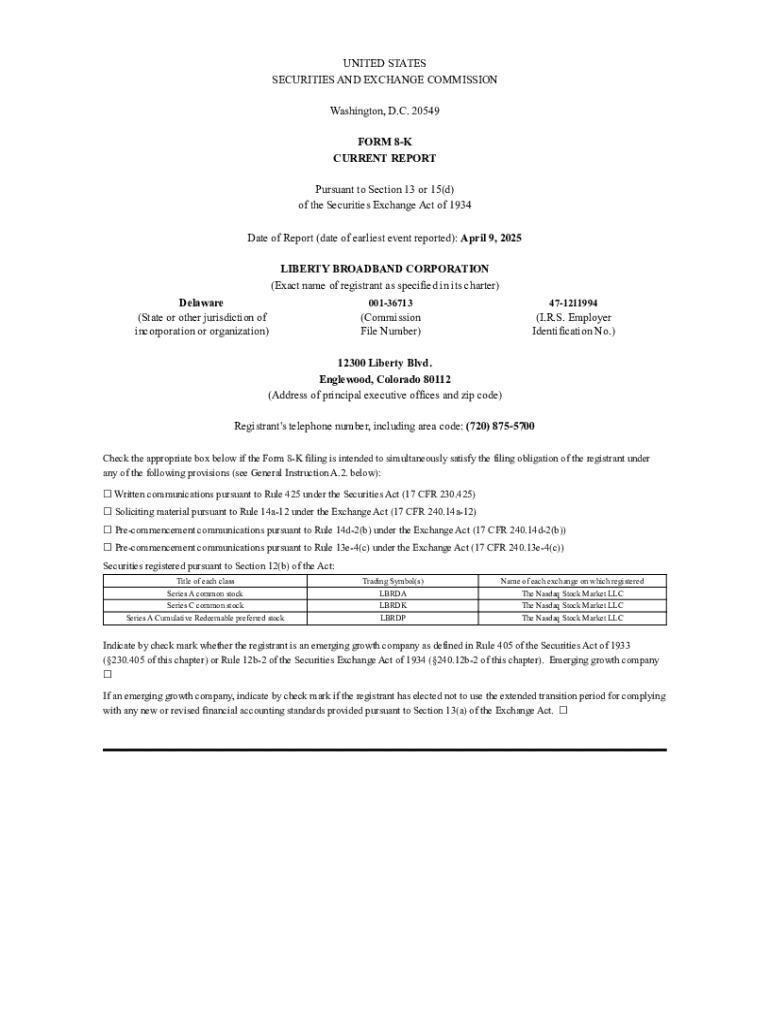

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K Form: A Comprehensive Guide

Understanding Form 8-K

Form 8-K is a significant security filing required by the U.S. Securities and Exchange Commission (SEC) whenever a publicly traded company experiences a major event that shareholders should be informed about. This form serves as a real-time means of communication between companies and their investors, ensuring that decisions are made based on the most current information available.

The essence of Form 8-K lies in its purpose to promote transparency and fairness in the financial marketplace. It is aimed at leveling the playing field for all investors, allowing them access to crucial information at the same time, thereby enhancing investor confidence. Companies must adhere to the strict filing requirements associated with this form to maintain compliance and avoid penalties.

When to use Form 8-K

There are specific triggers that necessitate the filing of Form 8-K. Companies must prepare this form when notable changes or occurrences arise, with the most common triggers including:

Timeliness is crucial when it comes to Form 8-K. Key events must be reported within four business days, underscoring the urgency for companies to stay compliant. Non-compliance can lead to sanctions from the SEC and potential loss of shareholder trust.

Components of the Form 8-K

The Form 8-K consists of several critical sections that provide detailed information about the triggered event. Key components include:

Understanding item numbers is vital in navigating Form 8-K. For instance, Item 1.01 pertains to entering into a material definitive agreement, while Item 2.01 covers the completion of an acquisition or disposition of assets. Each item provides context to the triggering event and allows stakeholders to gauge its potential impact.

Reading and interpreting Form 8-K

To effectively assess a Form 8-K filing, investors should approach it methodically. Here’s how to analyze it effectively:

For clarity, examining case analyses can provide real-world examples of how Form 8-K disclosures affected stock prices and investor sentiment, helping in understanding the tangible ramifications of such filings.

Benefits of filing Form 8-K

Filing Form 8-K offers numerous benefits to companies, shaping their reputation and operational transparency. Some key advantages include:

Additionally, an transparent approach to disclosures attracts investors who are increasingly scrutinizing corporate governance and ethical standards.

Historical context of Form 8-K

Form 8-K has evolved significantly since its inception, mirroring changes in the corporate landscape and regulatory environment. Over the years, the SEC has revised reporting requirements to keep pace with emerging issues in corporate governance.

High-profile filings, including those associated with major corporate scandals, have highlighted the importance of timely and accurate disclosures. Analysis of these cases reveals how investor relations were affected, often leading to drastic share price fluctuations following the announcements.

Best practices for filing Form 8-K

To ensure a smooth and compliant filing process, companies should adhere to the following best practices:

Avoiding common pitfalls, such as misunderstanding the triggers for filing, can prevent costly errors and enhance corporate credibility.

Frequently asked questions about Form 8-K

Many individuals encounter hesitancies or confusions regarding Form 8-K. To clarify some common queries:

Sector-specific insights on Form 8-K impact

The influence of Form 8-K varies across industries. For instance, companies in the finance sector may see more immediate reactions to news of management changes versus tech startups where product announcements might trigger filings.

Industry norms dictate how and when disclosures are prioritized, with recognized practices in each sector shaping stakeholder expectations and regulatory adherence.

News & updates on Form 8-K regulations

Regulatory environments are dynamic, and recent changes have seen updates in Form 8-K reporting requirements, reflecting evolving investor demands and market circumstances. Such adjustments necessitate companies to stay current to maintain compliance.

With the assistance of pdfFiller, companies can easily keep track of updates, ensuring pertinent information is efficiently managed and readily accessible for stakeholders.

Join the community for insights and resources

Companies and individuals looking to deepen their knowledge on Form 8-K and related documentation are encouraged to subscribe to stay updated about changes, best practices, and tools that facilitate document management.

Accessing interactive tools through platforms like pdfFiller allows users to enhance their documentation processes, providing a seamless way to edit, sign, and manage forms from anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

How do I edit form 8-k online?

Can I create an electronic signature for the form 8-k in Chrome?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.