Get the free Credit Card Consent Form

Get, Create, Make and Sign credit card consent form

Editing credit card consent form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card consent form

How to fill out credit card consent form

Who needs credit card consent form?

Understanding and Utilizing Credit Card Consent Forms

Understanding credit card consent forms

A credit card consent form is a crucial document that allows merchants to process payments using a customer's credit card. This form functions as an authorization tool in which the cardholder grants explicit permission for the merchant to charge their credit card for specified transactions. It is a protective measure, ensuring that both the merchant and customer are on the same page regarding payment terms.

The importance of credit card consent in transactions cannot be overstated. It acts as a legal safeguard against fraud and chargebacks. Without clear consent, merchants may find themselves vulnerable to disputes when customers challenge transactions. This form becomes particularly vital in the digital payment landscape, where consumers are increasingly concerned about security.

The legal framework surrounding credit card consent involves adherence to industry standards like the Payment Card Industry Data Security Standard (PCI DSS). Consent is required particularly in situations involving recurring payments, high-value transactions, or transactions without face-to-face interaction.

Common scenarios requiring a credit card consent form include online purchases, rental and subscription services, and instances where a business needs to retain a credit card on file for future use. Understanding these scenarios is vital for any business looking to optimize its payment processes.

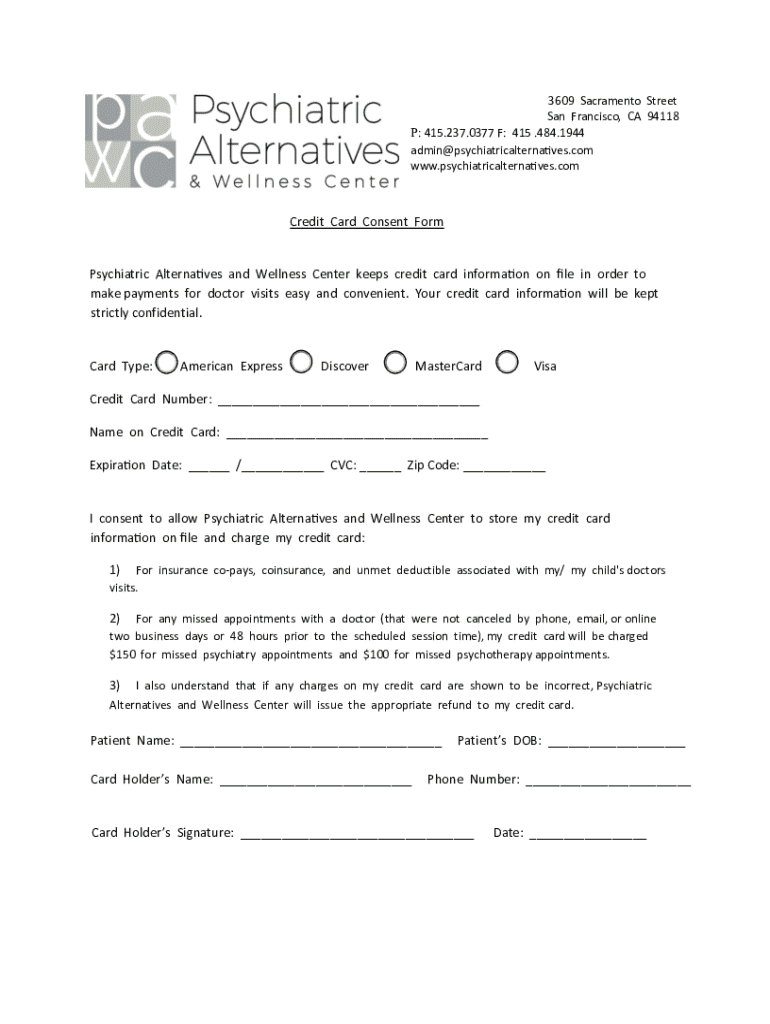

Key components of a credit card consent form

A well-structured credit card consent form must contain several essential fields to facilitate proper authorization and record-keeping. These components include cardholder's information, which details the name, address, and contact details of the cardholder. Moreover, identifying merchant details is crucial for accountability. These details should include the business name, address, and point of contact for any queries related to the transaction.

Payment amounts and terms should also be clear. This section must outline how much will be charged and the frequency of charges—especially essential for recurring payments. Additionally, including contact information for customer queries builds trust and encourages transparency.

Optional fields, such as including the CVV (Card Verification Value), should be approached with caution. While it may enhance security during one-time transactions, storing CVV information is generally against PCI compliance guidelines. Signature requirements can also vary based on transaction methods; however, having a signature on file strengthens the consent process.

It is essential to draft the credit card consent form using clear, concise language to ensure that cardholders fully understand their commitments. Clarity and disclosure help build customer trust, ultimately minimizing disputes.

Benefits of using a credit card consent form

Utilizing a credit card consent form yields substantial benefits for both merchants and customers. One of the primary advantages is the prevention of chargeback fraud. By securing explicit consent, merchants can challenge disputes more effectively. This proactive measure can deter fraudulent behaviors while safeguarding legitimate transactions.

Additionally, a credit card consent form enhances customer trust and security. When customers are informed and involved in the consent process, they feel more secure about how their payment information is handled. This transparency fosters a positive relationship between merchants and their clientele.

Moreover, having a formal consent process streamlines the payment process for businesses, allowing for quicker transactions and better cash flow management. The legal protection afforded by these forms is particularly valuable; in the event of a dispute, merchants have documented evidence of customer consent that stands strong in negotiations.

Types of credit card consent forms

Different situations necessitate various types of credit card consent forms. One-time payment consent forms are commonly used for singular transactions, while recurring payment consent forms are essential for subscriptions and ongoing services. Hospitality providers often employ hotel credit card authorization forms to ensure payment for room bookings and incidental charges.

Group credit card consent forms may be utilized in scenarios where multiple individuals are sharing a charge, such as for event registrations or group trips. Additionally, specialized forms are tailored for e-commerce transactions, addressing unique considerations such as digital product delivery and refund policies.

Understanding the different types of credit card consent forms can help businesses tailor their approach to customer interactions, ensuring that they meet both regulatory requirements and consumer expectations.

Best practices for creating and using credit card consent forms

Drafting effective credit card consent forms requires clarity and adherence to best practices. Ensuring regulatory compliance is paramount; understanding the legal obligations in your jurisdiction regarding data collection, storage, and processing is the first step. It's advisable to apply plain language in the form to enhance understanding while avoiding complicated jargon that may confuse users.

Limiting personal data collection is another critical practice. Only collect information that is necessary for the transaction, thereby reducing the risk of data breaches. Protecting customer information has never been more crucial, and minimizing data collection can help mitigate potential threats.

Another best practice involves the secure storage and management of signed forms. Depending on your business model, consider digital versus physical storage solutions. Digital storage facilitates easier retrieval and sharing, especially when using cloud-based systems like pdfFiller. Regardless of the method, ensure sensitivity and compliance with legal retention periods, by keeping a signed consent form for a specified duration after its use.

For sensitive information, employing encryption is essential. Protecting credit card details and personal data from unauthorized access can significantly enhance the credibility and reliability of your business.

Interactive tools for managing credit card consent forms

Utilizing interactive tools can greatly enhance the management of credit card consent forms. Platforms like pdfFiller provide users with seamless document creation capabilities. These tools allow businesses to generate customized credit card consent forms that align with their specific needs.

pdfFiller offers features such as document editing, enabling customization to adjust terms and conditions directly to suit each transaction. Their eSign capabilities ensure that all consent forms can be securely signed digitally, streamlining the process and reducing physical paperwork. Furthermore, collaboration tools on pdfFiller facilitate teamwork, allowing multiple team members to contribute to form creation and review.

These interactive tools not only make form management easier but also enhance security and compliance, allowing businesses to focus on delivering excellent service to their customers.

Common questions about credit card consent forms

When it comes to credit card consent forms, many people have questions regarding their necessity and effectiveness. A critical question is whether you are legally required to use one. Although it depends on your jurisdiction, obtaining consent is generally advisable to protect both parties in financial transactions.

Another frequently asked question is how long consent forms should be retained. Retention policies can vary, but a good rule of thumb is to keep signed forms for a minimum of three years, ensuring you meet both legal and operational needs.

The distinction between credit card consent forms and standard invoices is also noteworthy. While invoices outline the cost of goods or services rendered, consent forms emphasize authorization, serving a different but equally critical function in the transaction process.

Real-life applications of credit card consent forms

Several businesses have successfully integrated credit card consent forms into their payment processes. For instance, an online subscription service reported a significant decline in chargebacks after implementing a clear consent form detailing payment terms. This transformation not only bolstered their revenue but also enhanced customer satisfaction.

Another compelling example is a hotel chain that utilized hotel credit card authorization forms, allowing them to mitigate payment disputes and improve booking confirmation rates. By securing consent upfront, this hotel group effectively minimized cancellations and no-shows, ultimately driving profitability.

These real-life applications underscore the practical advantages of well-implemented credit card consent forms, offering valuable insights into the optimizations possible in payment processing.

Troubleshooting issues with credit card consent forms

Despite their benefits, businesses can encounter challenges during the processing of credit card consent forms. Common issues include incomplete forms submitted by customers, leading to delays in transaction approvals. It's essential for businesses to have a clear process for following up on these incomplete submissions and addressing any questions customers may have.

Additionally, customer concerns regarding consent form usage can arise. It’s vital to communicate clearly with customers about why their consent is needed and how it will be used. Being transparent can alleviate many of these concerns and foster a trusting relationship.

Having a robust customer service protocol to handle these issues will not only resolve concerns swiftly but also build a positive reputation for the business.

Future trends in credit card consent forms

As the landscape of payment processing continues to evolve, so too will the role of credit card consent forms. Evolving regulatory environments will likely dictate new standards and practices for consent collection. Businesses will need to keep an eye on changes to ensure compliance while meeting consumer expectations.

Innovation in document management technology, especially through services like pdfFiller, will play a significant role in streamlining these processes. Automation features will reduce manual tracking, allowing businesses to focus on customer engagement while maintaining secure practices. Consequently, the future of credit card consent forms lies in enhancing efficiency and security through technology.

By preparing for these trends, businesses can continue to streamline their payment processes while enhancing customer trust in their transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card consent form?

How do I edit credit card consent form online?

How do I fill out credit card consent form using my mobile device?

What is credit card consent form?

Who is required to file credit card consent form?

How to fill out credit card consent form?

What is the purpose of credit card consent form?

What information must be reported on credit card consent form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.