Get the free Credit Card Authorization Form 2024/25

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-To Guide

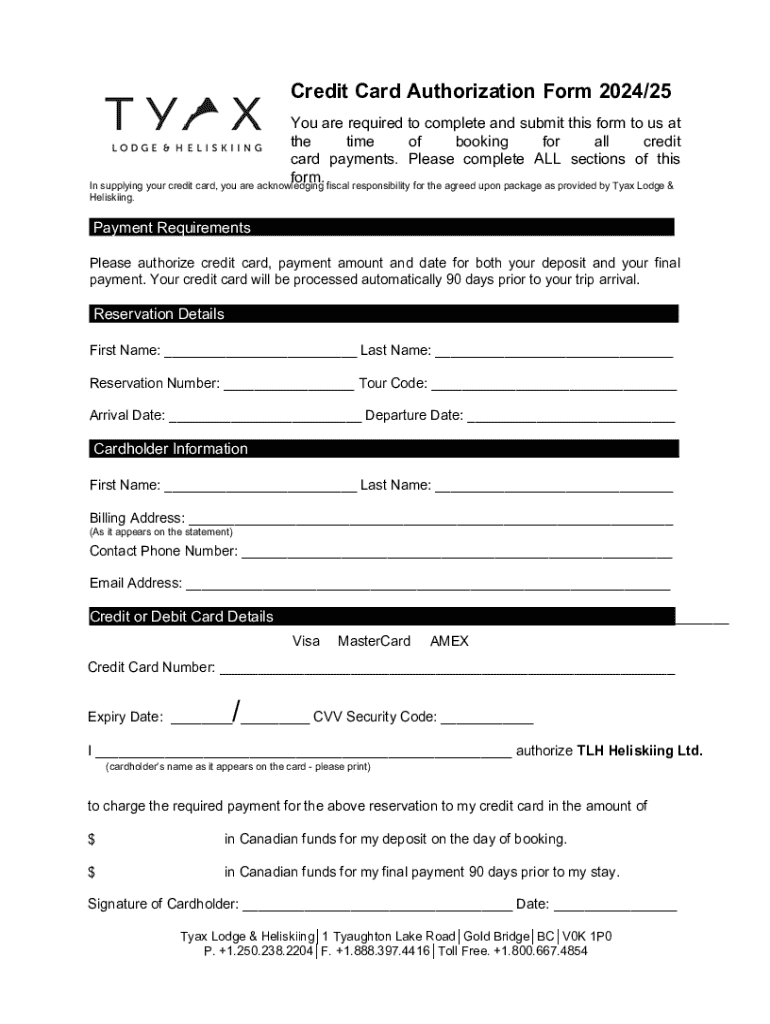

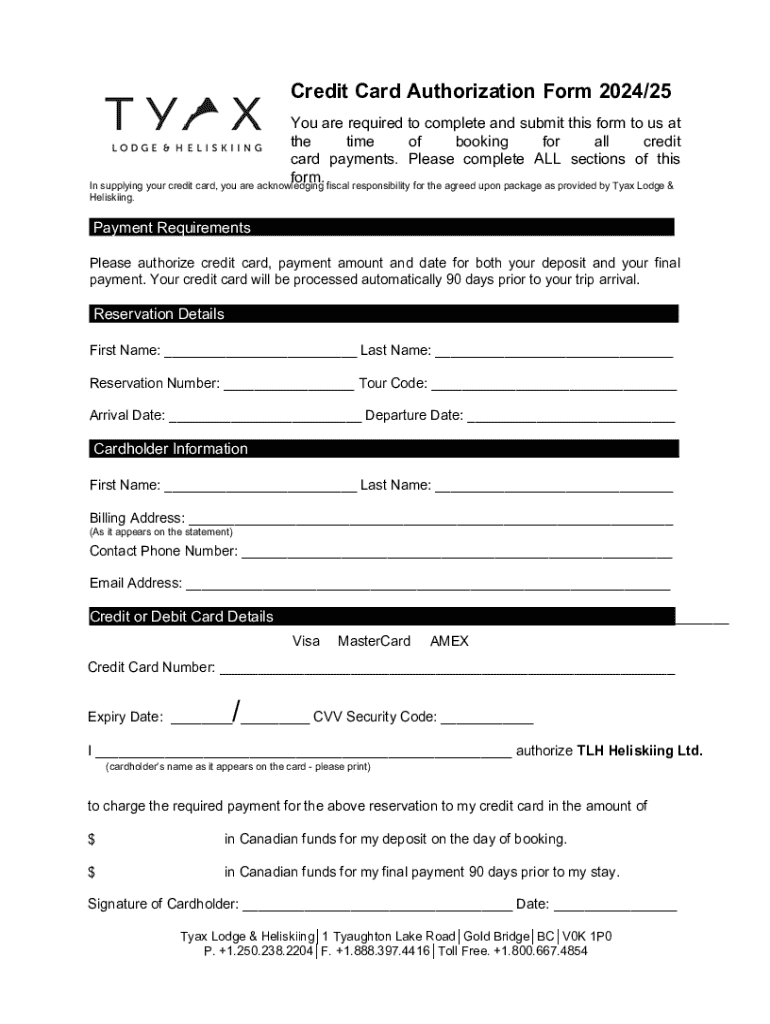

Understanding the credit card authorization form

A credit card authorization form is a document that allows a merchant to charge a customer's credit card for goods or services rendered. It captures permission from the cardholder to process payments, ensuring that they consent to the transaction. This form is particularly essential in scenarios where the card is not physically present during the transaction, such as online purchases.

The primary purpose of this form is to protect both the merchant and the consumer by establishing a clear agreement regarding payment terms. It ensures that businesses have the necessary authorization to conduct charges and can help reduce disputes associated with unauthorized transactions.

Benefits of using credit card authorization forms

Utilizing a credit card authorization form can provide numerous advantages for both merchants and consumers alike. For starters, it serves as a deterrent against chargeback abuse, a growing issue for online retailers. With the formal permission documented, merchants have a stronger case when responding to disputes.

Additionally, these forms help build trust with customers. By seeking their permission explicitly, businesses demonstrate transparency, enhancing the relationship with their clientele. Moreover, authorization forms streamline payment processing by providing a clear record of agreed-upon charges and reducing the necessary back-and-forth communication needed during disputes.

Components of a credit card authorization form

An effective credit card authorization form consists of several essential components that ensure both clarity and compliance. Key fields include customer information, which must be filled accurately, including the name, address, and contact details of the individual making the payment.

Payment details are crucial; they include the type of card, the card number, and the amount to be charged. One of the most critical elements is the authorization signature, which acts as proof that the customer agrees to the charges outlined. Additionally, including optional security fields, such as the CVV and expiration date, enhances the security of the transactions.

Maintaining privacy compliance is also imperative. Businesses must ensure that they adhere to regulations such as PCI-DSS when processing payment information, safeguarding customers’ data effectively.

How to fill out a credit card authorization form

Filling out a credit card authorization form correctly is crucial to ensure its validity. Here’s a step-by-step guide to accomplish this efficiently.

While filling out the form may seem straightforward, there are common mistakes to avoid, such as misspelling customer names or entering incorrect card information, which can lead to transaction failures.

Using pdfFiller for your credit card authorization form needs

pdfFiller offers a powerful, cloud-based platform that simplifies the creation, management, and processing of credit card authorization forms. One of the main advantages of using pdfFiller is its seamless editing capabilities, allowing users to modify existing PDFs conveniently.

Additionally, the platform supports eSigning, enabling both parties to sign the document electronically, which saves time and minimizes paperwork. Users can easily share their forms for collaboration, ensuring that modifications can be made collectively. Security is paramount with pdfFiller, so users can store completed forms securely while ensuring regulatory compliance.

Creating and managing your form on pdfFiller is straightforward. You can start by uploading a form template, make necessary edits, share it for collaboration, and finally, securely store the completed documents—all in one solution.

FAQ regarding credit card authorization forms

Understanding the nuances of credit card authorization forms can be challenging for some, so here are some frequently asked questions.

Best practices for storing and handling credit card authorization forms

Storing credit card authorization forms securely is of utmost importance to protect sensitive customer data. Businesses should prioritize secure storage solutions, whether through encryption, password protection, or secure physical locations for paper documents.

Additionally, it is vital to stay compliant with regulations such as HIPAA (for health-related transactions) and PCI-DSS to avoid legal repercussions. Following these compliance guidelines ensures that customer information is managed securely, reducing the risk of data breaches.

Related resources and tools

To aid in your journey of managing credit card authorization forms, we provide several additional resources and tools. You can download our customizable credit card authorization form templates, which are designed to meet various business needs.

Moreover, consider utilizing tools to enhance the security of your online transactions, ensuring that sensitive information stays protected during transfers.

Stay updated with pdfFiller

Staying informed about document management and eSigning is crucial for any business. By subscribing to our newsletter, you can receive the latest resources and tips directly in your inbox. Additionally, following us on social media platforms can provide valuable insights into optimizing your document processes.

For personalized support, reach out to our dedicated customer service team, who can guide you through any tricky situations you may encounter while using our platform.

Explore more topics

The financial landscape is consistently evolving, making it essential for businesses and individuals to stay informed about various topics related to payments and documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

How can I get credit card authorization form?

How do I edit credit card authorization form in Chrome?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.