Get the free Corporate Credit Information Report

Get, Create, Make and Sign corporate credit information report

Editing corporate credit information report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate credit information report

How to fill out corporate credit information report

Who needs corporate credit information report?

A Comprehensive Guide to the Corporate Credit Information Report Form

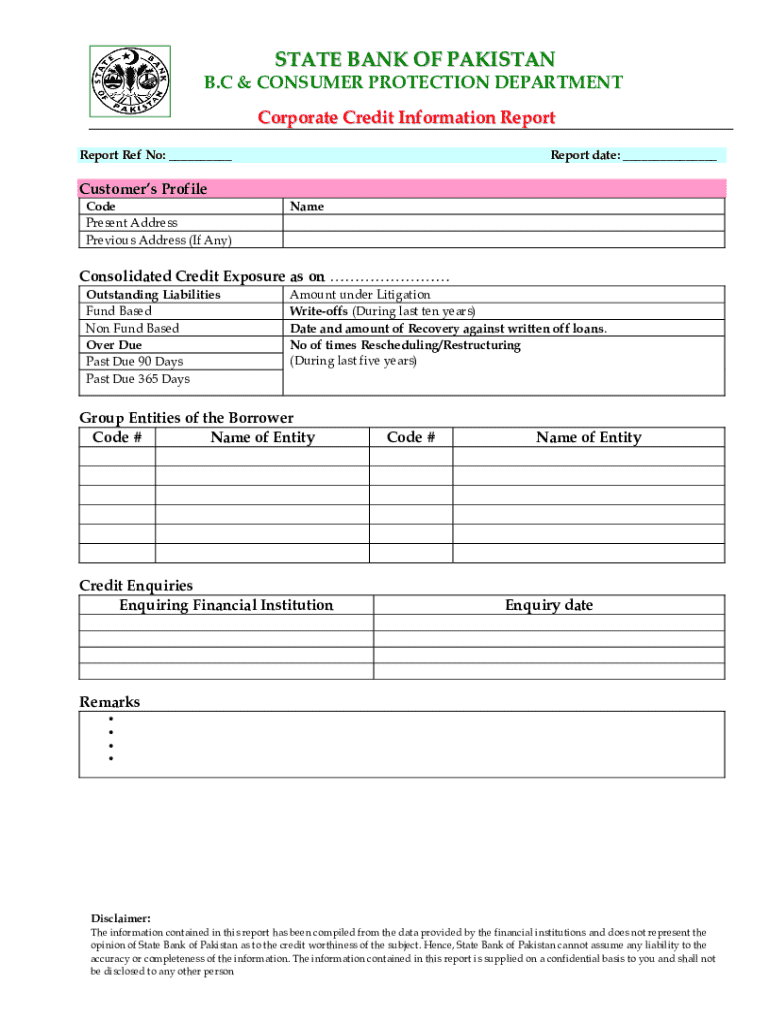

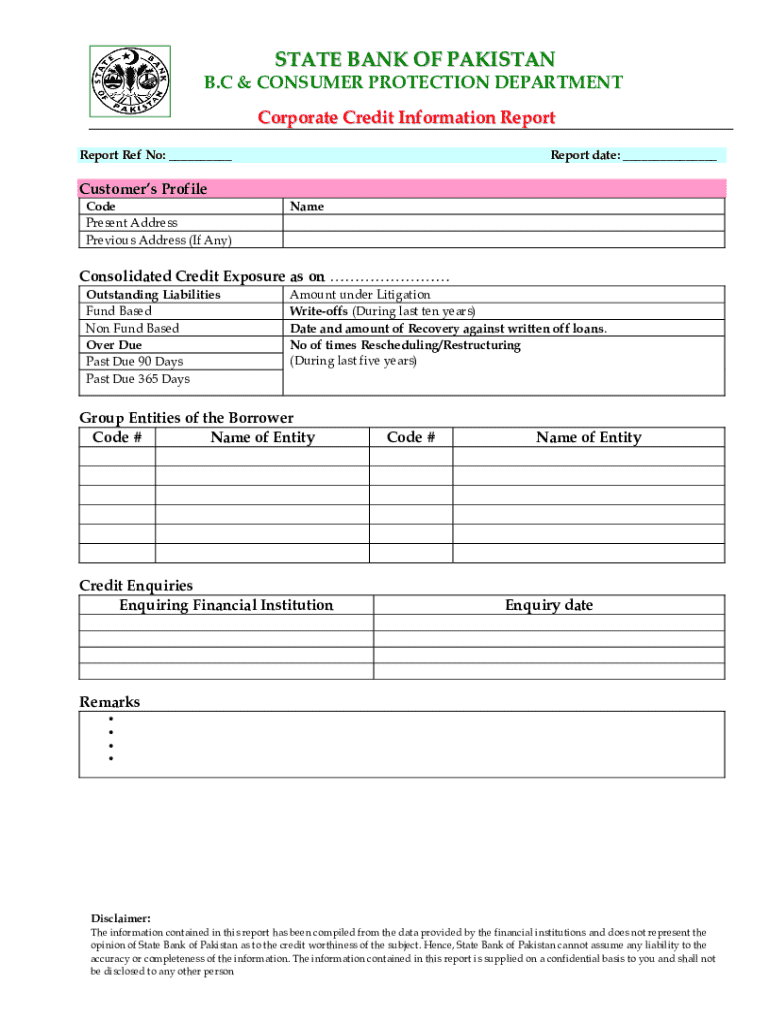

Understanding the Corporate Credit Information Report

A corporate credit information report is a critical document that provides an assessment of a company's creditworthiness. It compiles various financial metrics and business behaviors, allowing lenders, suppliers, and investors to evaluate the financial health of an organization. Understanding this report is intrinsic to making informed decisions in business operations.

The importance of corporate credit information cannot be overstated. It serves as a tool for assessing risk when extending credit lines, determining loan rates, or engaging in major business transactions. Accurate credit information facilitates trust and reliance between parties who engage in financial dealings.

Key components of a corporate credit report often include:

What you need to gather before filling out the corporate credit information report form

Before completing the corporate credit information report form, businesses must gather pertinent financial and operational data. This preparatory step is crucial to ensure accuracy and comprehensiveness of the information shared.

Essential information typically includes:

It's also important to include supporting documentation, such as bank statements, tax returns, and any legal documentation that may impact credit reporting. Accurate data collection is facilitated by establishing effective communication among departments to ensure completeness.

To emphasize precision in data, consider the following tips:

Steps to fill out the corporate credit information report form

Filling out the corporate credit information report form systematically can ease the process and enhance accuracy.

Step 1: Accessing the Form

The first step is to access the corporate credit information report form, which can be found on platforms like pdfFiller. Ensure you're using the latest version to avoid any outdated information.

Step 2: Filling Out Basic Company Information

Fill out all mandatory fields in the form, including company name, registration number, and contact information. This section lays the groundwork for the report and allows others to identify your business.

Step 3: Reporting Financial Health

An accurate depiction of your business's financial health can vastly affect its credit perception. When reporting revenue, expenses, and debts, include recent financial statements to provide clarity.

Step 4: Adding Additional Details

Provide any additional information that could paint a fuller picture of your company. This could include an executive summary, details of business activities, and future projections.

Step 5: Reviewing and Editing the Form

Before submission, carefully review the form for accuracy. Proofreading can prevent errors that may hurt your company's credit evaluation. The editing tools provided by pdfFiller allow for an easy review and correction process before finalizing the report.

Interactive tools and features of pdfFiller for managing your corporate credit report

pdfFiller provides an array of interactive tools designed to streamline the management of your corporate credit report. These features empower businesses to enhance collaboration and ensure document security.

eSignatures integration

With pdfFiller, businesses can easily eSign the corporate credit information report form. This feature eliminates the need for physical signatures, enhancing efficiency while maintaining the integrity of the document.

Collaboration tools

Sharing the corporate credit report form with team members for feedback is straightforward within pdfFiller. This ensures that input from various departments is included and can streamline the reporting process.

Saving and storing your reports

pdfFiller allows for the secure saving and management of all documents online. Easily access past reports and mitigate the risk of losing critical data, making it a comprehensive solution for corporate document management.

Common mistakes to avoid when filling out the corporate credit information report

Understanding potential pitfalls in the reporting process can significantly enhance the precision of your corporate credit information report.

Understanding your rights and obligations regarding corporate credit reports

Navigating the corporate credit reporting landscape requires an understanding of both rights and obligations. Businesses must be aware of their privacy rights, as credit reporting involves handling sensitive information.

Corporations are legally obligated to ensure that the information they submit is accurate and up-to-date. This diligence is crucial to avoiding disputes over corporate credit information. In cases where discrepancies arise, understanding your dispute resolution rights can facilitate corrective actions promptly.

Related pages and resources on corporate credit reports

It’s advisable to remain informed about your corporate credit report and related resources. Familiarize yourself with how to access your report through various platforms. Having a foundational understanding of common credit reporting terms can also provide clarity on the nuances of your corporate credit report.

Frequently asked questions regarding corporate credit reporting can offer additional insights and help clarify any uncertainties you may have about the process.

Enhancing your business’s credit health

Maintaining a positive corporate credit report is paramount for securing favorable credit terms and business opportunities. Adopt best practices such as regularly monitoring your corporate credit information to ensure accuracy and relevancy.

Implementing effective strategies can also help improve your credit score. Focus on making timely payments, reducing existing debts, and managing credit utilization rates wisely. Developing a proactive approach will help cultivate a positive credit narrative for your business.

Additional tips and tools for corporate document management

Beyond the corporate credit report, having a variety of essential business forms at your disposal is beneficial for smooth operations. Consider utilizing additional templates for contracts, invoices, and compliance forms that can further enhance your professional documentation.

pdfFiller supports these needs with a comprehensive suite of tools tailored for business document management. From creation to execution, pdfFiller integrates features that simplify document handling, guaranteeing a streamlined experience across various platforms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in corporate credit information report without leaving Chrome?

How do I fill out corporate credit information report using my mobile device?

Can I edit corporate credit information report on an Android device?

What is corporate credit information report?

Who is required to file corporate credit information report?

How to fill out corporate credit information report?

What is the purpose of corporate credit information report?

What information must be reported on corporate credit information report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.