Get the free Comprehensive Policyholder Application Form

Get, Create, Make and Sign comprehensive policyholder application form

Editing comprehensive policyholder application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comprehensive policyholder application form

How to fill out comprehensive policyholder application form

Who needs comprehensive policyholder application form?

Understanding the Comprehensive Policyholder Application Form

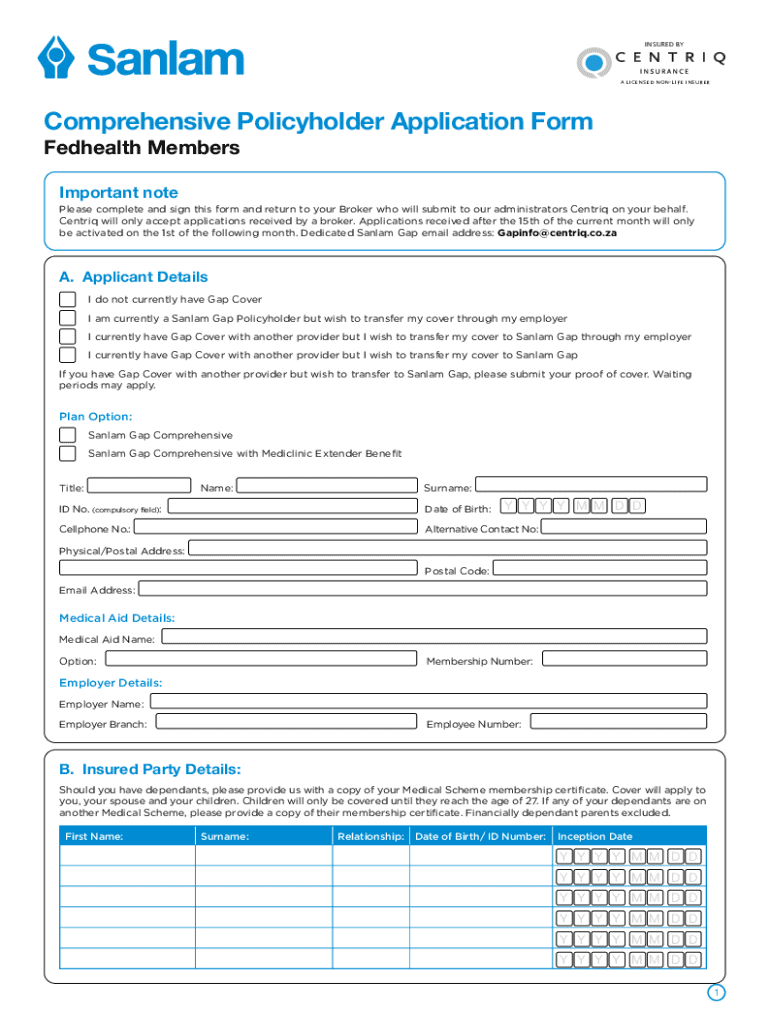

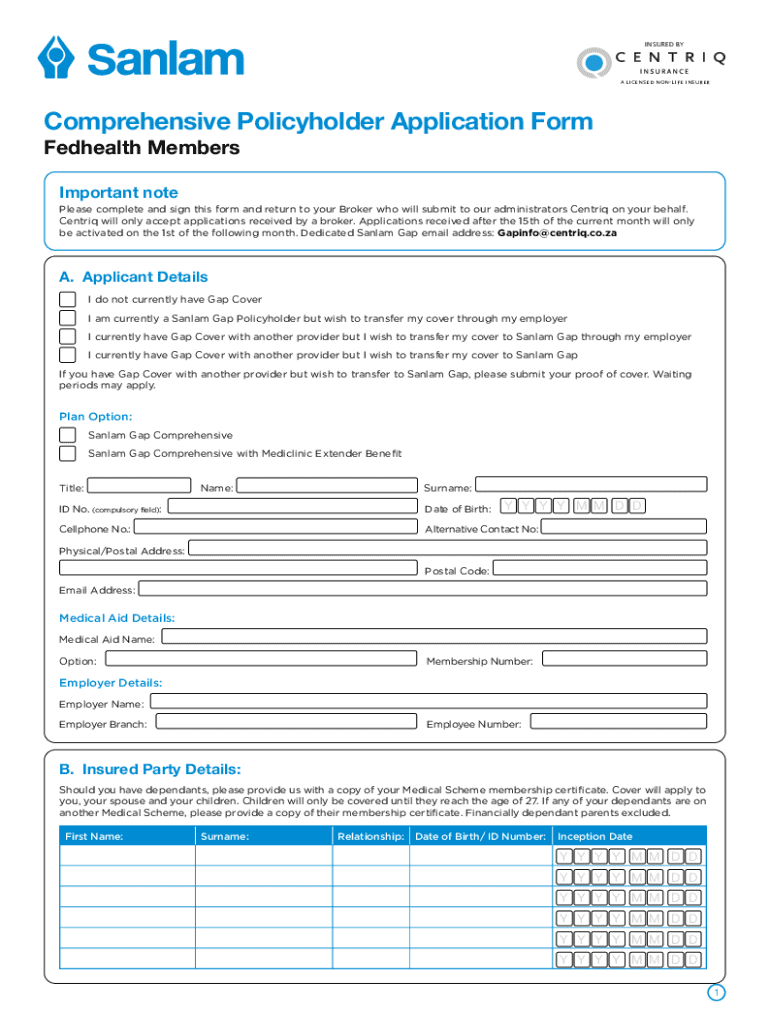

Overview of the comprehensive policyholder application form

The comprehensive policyholder application form is a critical document used by insurance companies to collect essential information about potential policyholders. Its main purpose is to gather the necessary details regarding an applicant's personal background, health, financial status, and the specific insurance coverage they seek. Accurate completion of this form is vital as it directly influences the underwriting process and the determination of coverage rates.

It is essential for applicants to understand the significance of providing thorough and truthful information, as any discrepancies can lead to delays or denials in coverage. The policies typically covered by this form range from life and health insurance to property and casualty coverage, signifying its comprehensive nature.

Key sections of the form

A comprehensive policyholder application form is composed of several key sections that ensure all relevant details are collected. Here are the primary components:

Step-by-step instructions for filling out the form

Filling out a comprehensive policyholder application form can feel overwhelming, but breaking it down into manageable steps simplifies the process.

Interactive tools to enhance user experience

To further assist you in the application process, various interactive tools can significantly enhance your experience. For instance, an online calculator can help determine your coverage needs based on key parameters such as income and family size.

Managing your application after submission

Once the comprehensive policyholder application form has been submitted, it is crucial to manage your application actively. Understanding the subsequent steps can alleviate any anxiety that arises during this waiting period.

Tips for successful policyholder applications

Honest disclosures are paramount when filling out the comprehensive policyholder application form. Ensure that all information presented is truthful to avoid complications later on. Here are some strategies to improve your application success rate:

Enhancing document efficiency with pdfFiller

pdfFiller offers a comprehensive suite of features that streamline the policyholder application process. With their cloud-based document management system, users can edit PDFs, eSign documents, and collaborate with others seamlessly.

Insightful case studies

Learning from others' experiences can provide valuable insights into the application process. Examining successful applications reveals effective strategies, while assessing common mistakes can help avoid pitfalls.

Comparing application forms across different providers

Not all comprehensive policyholder application forms are created equal. Different insurance providers have unique formats and requirements. Understanding these differences can help streamline your application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get comprehensive policyholder application form?

Can I edit comprehensive policyholder application form on an Android device?

How do I complete comprehensive policyholder application form on an Android device?

What is comprehensive policyholder application form?

Who is required to file comprehensive policyholder application form?

How to fill out comprehensive policyholder application form?

What is the purpose of comprehensive policyholder application form?

What information must be reported on comprehensive policyholder application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.