Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

A comprehensive guide to the credit application form

Understanding the credit application form

A credit application form serves as a crucial tool within the lending process, allowing financial institutions to evaluate potential borrowers. It is designed to gather pertinent information about an applicant's financial situation to determine their creditworthiness. This form is integral because it ensures lenders have a comprehensive understanding of an applicant's ability to repay the debt they are requesting.

Typically, a credit application will include several key components, such as personal identification details, financial obligations, and employment history. By providing this information, applicants enable lenders to make informed decisions regarding loans or credit extensions.

Types of credit applications

Credit applications can vary significantly based on the structure and context in which they are used. Individual applications are common for solo borrowers, while joint applications are suited for couples or partners seeking credit together. Each type has unique implications regarding liability and credit scores.

The format of the credit application can also differ, with options for both online submissions and traditional paper forms. The online route often proves more efficient, allowing for immediate transmission of information and quicker feedback, while paper applications may be preferred in certain demographic areas.

Preparing to fill out a credit application

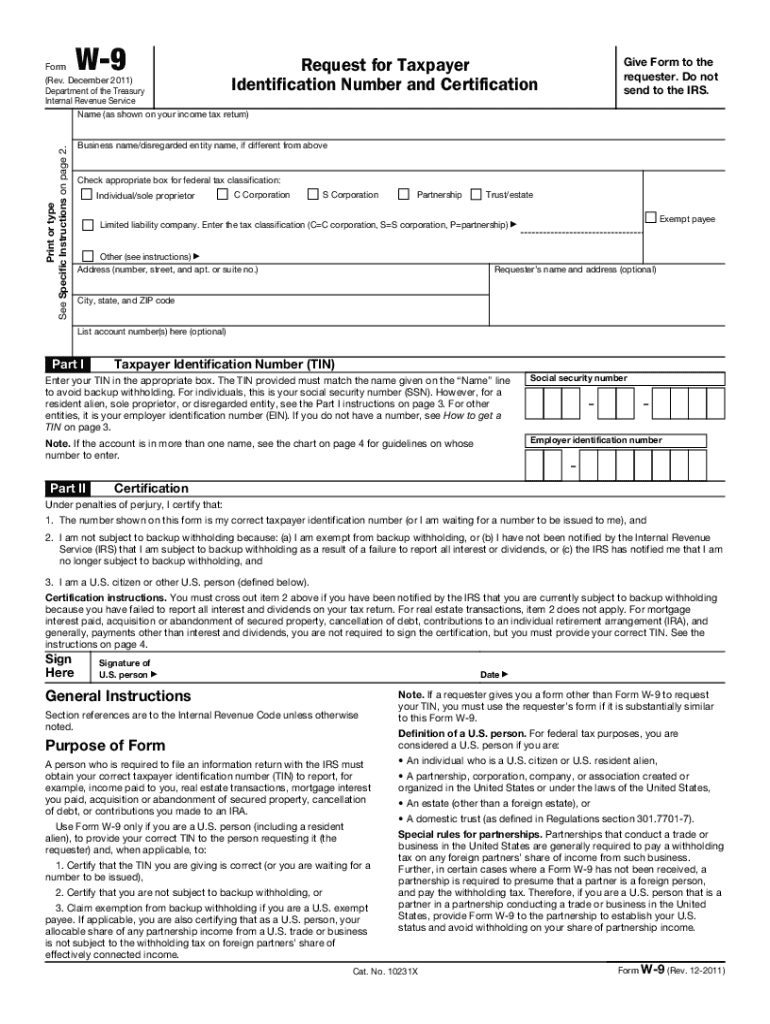

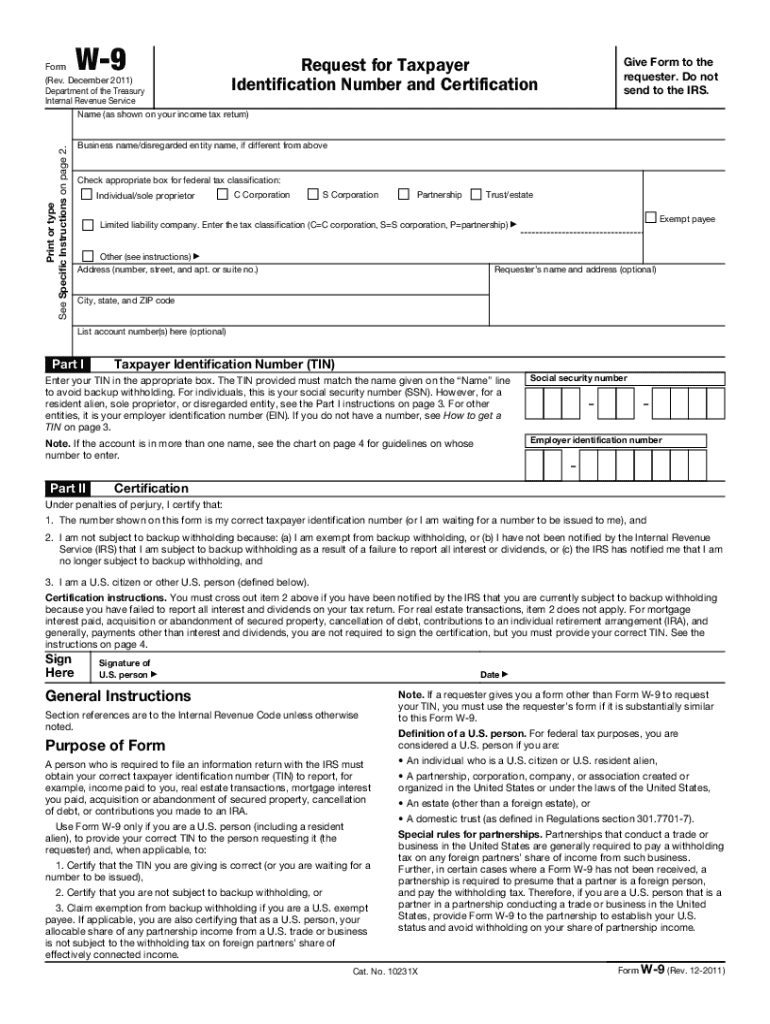

Before diving into the specifics of the credit application form, it is wise to prepare by gathering essential documents and information. This preparation helps streamline the process and minimizes errors. Identification is a primary requirement; applicants should have their driver's license or government-issued ID, along with their social security number readily accessible.

Financial documents play a pivotal role as well. Prepare income statements, tax returns, and any documentation that supports your financial standing, such as bank statements or pay stubs. Having these documents on hand can expedite the process, ensuring that you present an accurate overview of your financial health.

Common terminology in credit applications

Understanding the terms commonly used in credit applications is crucial for accurate completion. 'Credit score' refers to a numerical representation of your credit history and reliability. Lenders use this score to evaluate your creditworthiness before deciding to approve or deny your application.

Another vital term is 'annual percentage rate (APR)', which indicates the cost of borrowing expressed as a yearly interest rate. Being familiar with these terms not only simplifies the filling process but also aids in making informed decisions when discussing potential loans or credit products with lenders.

Step-by-step guide to completing your credit application form

The credit application form may seem daunting, but it can be navigated smoothly with a structured approach. Begin with the personal information section, wherein you input accurate details such as your name, address, and contact information. Accuracy is paramount in this section, as any discrepancies could delay the evaluation process or result in application rejection.

Next, you will provide employment and income information. This entails outlining your current job status, including duration of employment, job title, and income details. Be certain to document your income correctly, reflecting any bonuses or additional income streams that showcase your overall financial capabilities.

Following this, list your financial obligations and assets. Document any significant debts or monthly obligations, like loan repayments and credit card debts. This section helps lenders gauge your financial commitments and ascertain your ability to manage new credit responsibly.

Lastly, respond to additional questions or disclosures. These queries may vary by lender but generally concern your financial habits, employment stability, or recent loan applications. Understanding the purpose of these questions ensures the form is filled out thoughtfully, reflecting your financial narrative accurately.

Editing and managing your credit application form

Once your credit application form is filled out, editing becomes essential. Tools like pdfFiller can be advantageous here, allowing you to edit fields, add information, and correct mistakes efficiently. The platform offers user-friendly features that simplify these edits, ensuring your application remains polished and accurate.

One of the compelling aspects of pdfFiller is its capability to assist users in organizing multiple applications effectively. You can save your credit application versions and access them whenever required. This can be especially helpful if you are applying through different lenders or in varying formats.

Collaborating with others

Collaboration can streamline the credit application process considerably. Using pdfFiller, applicants can share their application forms for input or verification. This feature fosters teamwork for individuals applying jointly or requiring assistance from family or financial advisors.

When collaborating, it is crucial to manage feedback efficiently. pdfFiller allows for easy commenting and revisions, ensuring that everyone involved can contribute effectively to the application process.

Signing and submitting the credit application

Understanding electronic signatures' role in credit applications is paramount. eSignatures are legally binding in most jurisdictions, providing a secure and efficient way to finalize documents. The process usually involves clicking a designated button to apply your signature electronically, affirming your agreement to the terms outlined in your credit application.

The submission process can vary depending on the lender. Applications can be submitted online, in person, or via fax. Each method has its own timeline for feedback, with online submissions typically offering the fastest return times. Once submitted, tracking your application status should become a priority; follow-up tips can include reaching out to the lender after a week to inquire about your application's progress.

Common pitfalls to avoid when submitting your credit application

Even after thorough preparation, common pitfalls can impact the success of your credit application. One major issue is providing inaccurate or incomplete information. Even minor discrepancies, like misspelled names or incorrect income figures, can lead to delays or denial of your application.

Failing to review your application before submission is another frequent oversight that can have serious consequences. Practicing meticulous proofreading ensures that all elements of the application are correct and aligned with the documentation provided.

Misunderstanding the terms and conditions of your application can lead to unwanted surprises or unfavorable loan terms. Areas of the application that often cause confusion include the APR and various fees associated with the credit application process. Take the time to read and understand these sections to make informed decisions.

Understanding what happens after submission

After submission, a review process ensues wherein lenders evaluate the credit applications they receive. This evaluation often includes assessing the applicant’s credit score, income history, employment stability, and overall financial health. Lenders aim to gauge risk and affordability based on these factors.

Possible outcomes of this review include approval or denial of the application, with specific factors influencing each decision. For instance, existing debt-to-income ratios and credit histories could determine whether a loan offer will be extended or if further requirements will be made.

Tips for successful credit application management

Regular check-ins on your credit score can greatly enhance your ability to secure favorable lending terms. Monitoring your credit health regularly helps you understand your standing and make informed decisions when applying for credit. Utilize free resources available online or through your financial institution to keep track of your credit score.

Keeping documents organized is another crucial strategy for managing credit applications efficiently. Whether physical files or digital folders, having an organized system for your financial documentation can save valuable time and reduce stress during the application process.

By leveraging pdfFiller's management features, applicants can ensure they maintain a seamless flow for filling out and submitting applications. Utilize organizational tools within the platform to streamline your credit application journey.

Sample credit application forms

To assist you further, several downloadable templates for credit application forms are available. These fillable forms can be tailored to suit your specific borrowing needs, whether for a personal loan, mortgage, or other financial products.

When customizing templates, it's essential to ensure that all information requested aligns with your particular situation. Avoid unnecessary fields that may confuse the lending decision. Customize your template to provide as much relevant information as possible without overwhelming the reviewer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application from Google Drive?

How do I fill out credit application using my mobile device?

How do I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.