Get the free Cr Part 1 (jan 2025)

Get, Create, Make and Sign cr part 1 jan

How to edit cr part 1 jan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cr part 1 jan

How to fill out cr part 1 jan

Who needs cr part 1 jan?

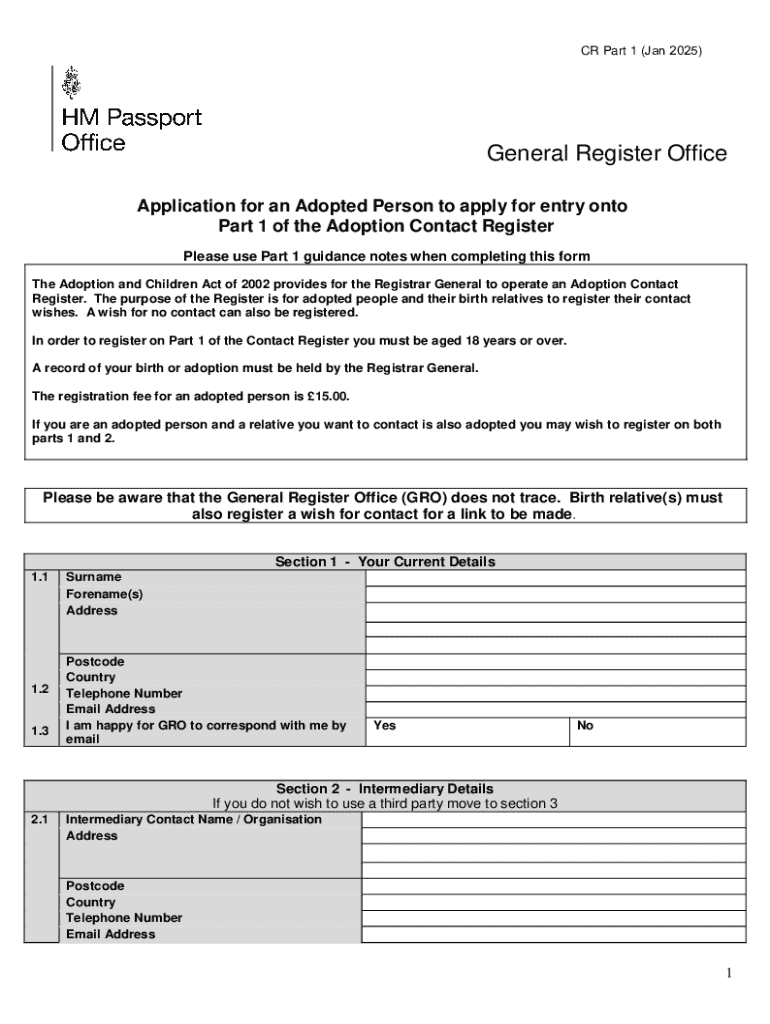

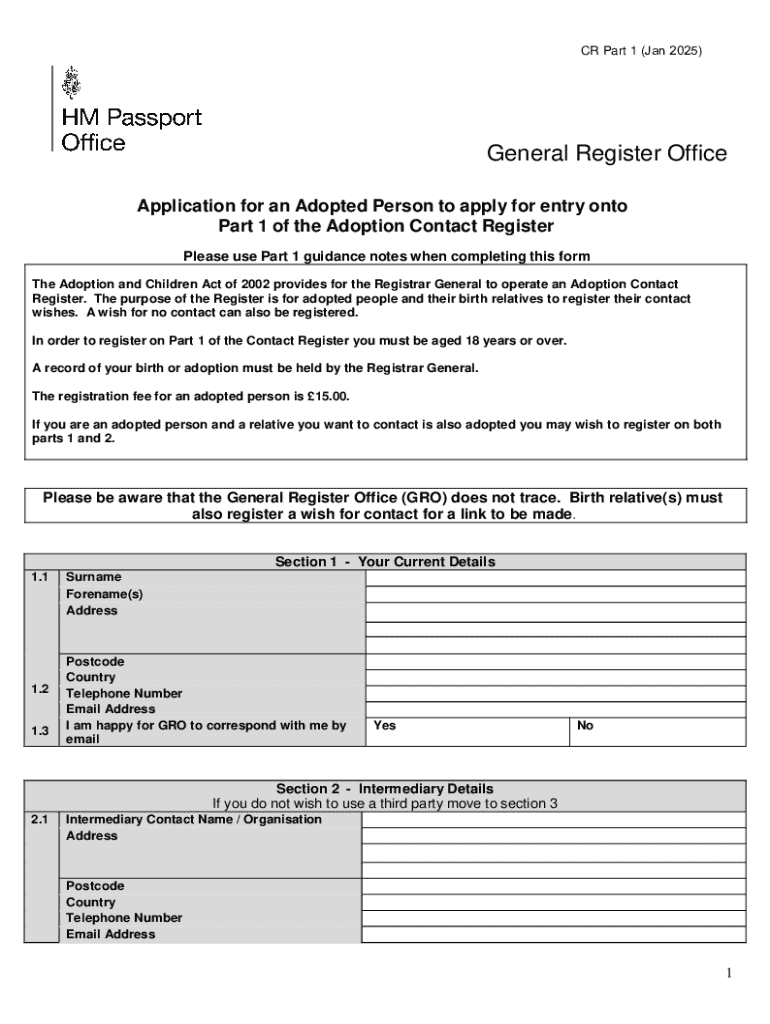

A comprehensive guide to the CR Part 1 Jan Form

Overview of the CR Part 1 Jan Form

The CR Part 1 Jan Form is a crucial document required for various reporting and regulatory compliance purposes. It serves to provide necessary information to government agencies, ensuring that organizations and individuals adhere to legal requirements. Accuracy in filing this form is imperative, as inaccuracies can lead to penalties or delays in processing.

The significance of submitting the CR Part 1 Jan Form on time cannot be understated. Strict deadlines are enforced, and failing to submit on time can result in automatic fines or complications in subsequent filings. Therefore, understanding the key deadlines and submission guidelines is essential for both individuals and organizations.

Who should use the CR Part 1 Jan Form?

The CR Part 1 Jan Form is utilized primarily by individuals and organizations who are obligated under local regulations to submit annual reports. This includes businesses of various sizes and sectors, as well as independent contractors. Individuals earning above a certain threshold may also need to complete this form for tax purposes.

For teams and organizations, understanding obligations surrounding the CR Part 1 Jan Form is key. Designated team members should ensure that the form is completed accurately and submitted on time, maintaining compliance with local regulations. This responsibility may fall to a financial officer or an entire administrative team based on the organization's structure.

Step-by-step instructions for completing the CR Part 1 Jan Form

To successfully complete the CR Part 1 Jan Form, follow these steps. Each step is designed to ensure that your submission is complete, accurate, and compliant with regulations.

Step 1: Gather necessary information

Start by collecting all requisite identification and financial data needed for the form. This includes personal identification numbers, details of your financial performance over the previous year, and any relevant supporting documentation.

Step 2: Filling out the form

While filling out the form, take the time to accurately complete each section. Familiarize yourself with the specific requirements of each part of the form. Common mistakes to avoid include transcribing errors and failing to enter data where required.

Step 3: Reviewing your entries

After filling out the form, thoroughly review your entries. Create a checklist to ensure that all necessary fields are completed and all data is correct. Remember that a single mistake could trigger an audit or a query from regulatory bodies.

Step 4: Signing and submitting the form

Finally, sign and submit the completed form. PDF Filler offers options for electronic signatures, making submission straightforward. Regardless of how you choose to submit—whether online through the PDF Filler portal or through postal mail—ensure you follow the outlined submission methods.

Interactive tools to assist with form completion

PDF Filler provides unique features that simplify the process of filling out and managing the CR Part 1 Jan Form. From intuitive PDF filler features that allow users to edit and sign forms directly, to tools that enable team collaboration and review, PDF Filler enhances the entire documentation experience.

Tools for team collaboration and review

Employ sharing capabilities that enable multiple team members to access and contribute to the form. Real-time editing features help teams ensure that everyone is on the same page, reducing errors and improving final submission quality.

FAQs about the CR Part 1 Jan Form

Addressing common questions can provide clarity as you navigate the CR Part 1 Jan Form. Understanding the steps to take in the event of mistakes or missing information can save time and alleviate stress.

What if make a mistake on my form?

If a mistake is made, review and correct the errors directly on your form, then resubmit it. Be proactive in communicating with the regulatory agency if the mistake needs immediate addressing.

How to handle missing information?

In cases where information is missing, reach out directly to the relevant parties or organizations for the required data. Don't delay filing; if you cannot obtain the information, provide a reasonable estimate and notes on the discrepancies.

Managing your completed CR Part 1 Jan Form with PDF Filler

Once the CR Part 1 Jan Form is completed and submitted, it is important to efficiently manage your documents. PDF Filler provides robust storage solutions that allow users to easily find and retrieve documents when needed.

Track your submission status via the platform, ensuring you are always updated. Maintaining organized records can streamline future filings and help avoid unnecessary complications.

Related forms and templates

In addition to the CR Part 1 Jan Form, you may need to familiarize yourself with related forms such as the CR Part 2. Understanding how these forms interconnect can provide a coherent approach to compliance and reporting.

PDF Filler also offers links to other relevant forms, allowing users to navigate and complete all necessary documentation seamlessly.

Advanced tips for efficient document management

Using a cloud-based platform such as PDF Filler significantly improves the efficiency of managing forms like the CR Part 1 Jan Form. Cloud features not only facilitate easy access from anywhere but also enable real-time updates and sharing among team members.

Integrating e-signatures into your business processes can enhance workflow efficiency. Consider setting up collaborative spaces within PDF Filler for teams dealing with forms together, which can reduce the time spent on document preparation.

Legal considerations when filing the CR Part 1 Jan Form

Filing the CR Part 1 Jan Form comes with legal responsibilities, and understanding compliance is essential to mitigate risk. Incorrect information could result in severe penalties, audits, or even delays in future filings.

It is wise to seek professional advice when needed, especially if there are uncertainties regarding the completion of the form or your obligations surrounding it.

Customer success stories

Numerous customers have experienced improved efficiency and reduced stress through the use of PDF Filler for their document needs, including the CR Part 1 Jan Form. Testimonials from satisfied users highlight the ease of document management and collaboration features.

Case studies demonstrate real-life examples of organizations that have successfully streamlined their filing processes using PDF Filler, showcasing its powerful attributes in enhancing overall document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my cr part 1 jan in Gmail?

How can I edit cr part 1 jan on a smartphone?

How do I fill out the cr part 1 jan form on my smartphone?

What is cr part 1 jan?

Who is required to file cr part 1 jan?

How to fill out cr part 1 jan?

What is the purpose of cr part 1 jan?

What information must be reported on cr part 1 jan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.