Get the free td1 ontario form

Get, Create, Make and Sign td1on form

Editing td1 ontario 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out td1 form ontario

How to fill out td1on

Who needs td1on?

TD1 Form: A Comprehensive How-to Guide

Understanding the TD1 form

The TD1 Form, also known as the Personal Tax Credits Return, is an essential document for both employees and employers in Canada. This form is designed to determine the amount of federal and provincial tax deductions from an employee's pay. It outlines the individual’s tax credit eligibility which can significantly affect take-home pay.

For employers, accurately processing the TD1 form is crucial, as it ensures compliance with Canada's taxation requirements. Employees, on the other hand, must fill it out to maximize their tax benefits, such as basic personal amounts and other eligible credits.

The role of the TD1 form in Canadian taxation

When completed correctly, the TD1 form influences an individual's taxable income and deductions. The credits applied can reduce the amount of income tax withheld from paychecks, which is particularly important for cash flow throughout the year. Benefits associated with the TD1 form include tax credits for students, caregivers, and those with disabilities, among others.

Understanding how these credits work is vital for both employees wanting to optimize their tax reductions and employers ensuring they withhold the correct amounts.

Essential components of the TD1 form

The TD1 form contains several key sections that must be completed accurately. Primarily, it requires personal information such as the employee's name, address, and social insurance number. Detailed instructions are provided for filling out the different fields, especially regarding tax credits.

Differences between federal and provincial TD1 forms

While the federal TD1 form outlines general tax credits applicable across Canada, each province has its own version of the TD1 that accounts for regional credits. For example, the credits available in Alberta may differ significantly from those in Ontario or British Columbia.

It’s particularly important for employees who work in one province but live in another to understand these differences, as failing to submit the correct provincial TD1 can lead to incorrect tax withholdings.

Filling out the TD1 form

Completing the TD1 form correctly is a straightforward process if approached methodically. Start by gathering personal identification and other necessary documents to ensure that the information is accurate.

Common mistakes to avoid include misreporting personal information or neglecting to claim eligible tax credits. Accurate completion is key to ensuring correct withholdings and avoiding any potential tax issues later.

Special scenarios in TD1 form completion

New employees must submit a TD1 form as part of their onboarding process. It's typically best to do this on or before their first day of work to ensure proper tax deductions are being applied from the start.

In instances where employees experience changes in their personal situation—such as marriage, the birth of a child, or moving to a different province—they must update their TD1 form to reflect these changes.

Responsibilities of employers regarding TD1 forms

Employers have several obligations when it comes to TD1 forms. They are required to collect and process the forms in a timely manner and ensure that employees' tax credits are reflected accurately in their paychecks.

Best practices also include providing information sessions for employees to understand how to fill out their TD1 forms correctly and what credits they may be eligible for.

TD1 forms in practice

The impact of the TD1 form can be profound for employees. For instance, an employee who correctly claims eligible tax credits can see a significant difference in their net pay due to lower tax withholdings.

Employers may also customize TD1 forms if they wish to adapt them for internal purposes, but they must still adhere strictly to payroll laws.

Frequently asked questions about TD1 forms

Many employees wonder if it is necessary for everyone to fill out a TD1. The answer is yes for most employees; even those with no taxable income may still benefit from filing a TD1 to aid in future tax returns.

Downloading and accessing TD1 forms

Finding the official TD1 forms is vital for employees looking to submit or update this important documentation. Both federal and provincial TD1 forms are available on government websites.

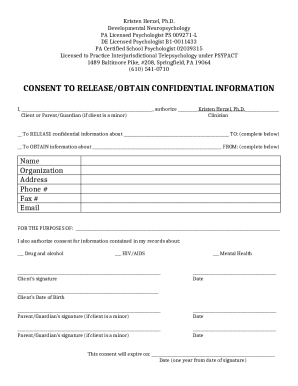

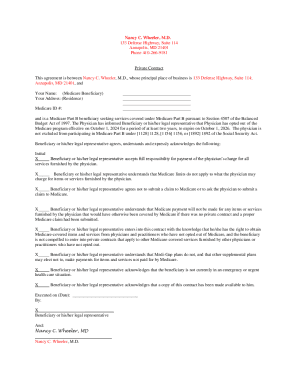

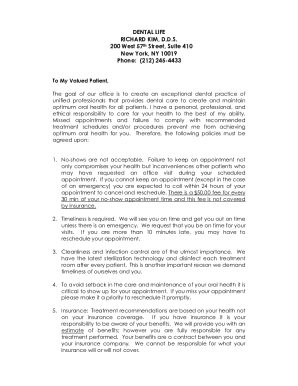

pdfFiller plays a pivotal role in making the TD1 available and manageable. It offers users the capabilities to fill out, edit, and sign these forms without hassle, enhancing overall document management.

Related templates and forms

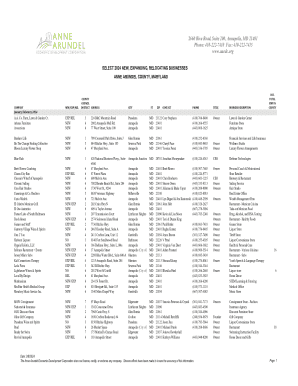

Beyond the TD1 form, various other tax forms exist that may need to be managed in conjunction with it. Some of these include the T4 slip, tax deductions forms, and more, each serving specific purposes in the tax process.

Managing multiple forms efficiently requires an organized approach. Utilizing platforms like pdfFiller can help streamline these processes and maintain proper records.

Useful links and resources

To gain a deeper understanding of the TD1 form and its implications, several government resources provide comprehensive guidelines and updates related to tax credits and forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my td1 ontario form directly from Gmail?

How can I modify td1 ontario form without leaving Google Drive?

How can I edit td1 ontario form on a smartphone?

What is td1on?

Who is required to file td1on?

How to fill out td1on?

What is the purpose of td1on?

What information must be reported on td1on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.