Get the free Partial Payment Options - 2023

Get, Create, Make and Sign partial payment options

Editing partial payment options online

Uncompromising security for your PDF editing and eSignature needs

How to fill out partial payment options

How to fill out partial payment options

Who needs partial payment options?

Comprehensive Guide to Partial Payment Options Form

Understanding partial payment options

Partial payments refer to the practice of making a payment that is less than the total amount due on a financial obligation. This method allows individuals or businesses to manage their cash flow more effectively, especially in situations with limited funds. Partial payment options are integral to financial contracts, providing flexibility for all parties involved.

The importance of partial payments cannot be overstated. They enable both creditors and debtors to navigate financial challenges while maintaining a positive relationship. Common scenarios where partial payments may be applicable include rental agreements, loan repayments, and service contracts. In these cases, a well-structured partial payment agreement can help ensure all parties understand their obligations and rights.

How partial payment options work

Several key elements comprise a partial payment agreement, including the amounts to be paid, due dates, and specific terms and conditions. Defining these elements clearly helps prevent misunderstandings and protects the interests of both parties.

The benefits of establishing a partial payment plan extend beyond simple flexibility; they include improved cash flow management, reduced stress for both creditors and borrowers, and the maintenance of amicable relationships. When both parties agree in writing, it ensures expectations are clear and provides a framework for resolving potential issues down the line.

Types of partial payment agreements

Different sectors utilize partial payment agreements distinctively. For instance, in rental agreements, landlords may offer the flexibility of partial payments to tenants facing financial hardships. Sample terms for landlords may include specifics on the payment schedule and penalties for late payments to minimize their risk.

In loan agreements, partial payment structures might allow borrowers to reduce their monthly burdens, with interest accrual potentially adjusted to favor the borrower's cash flow. Real-life examples illustrate how organizations have successfully implemented this strategy, thus enhancing customer satisfaction.

Similarly, service contracts – prevalent in industries like construction, maintenance, or consulting – can be structured to enable clients to manage payments in line with project milestones. This approach mitigates risks for service providers and ensures steady cash flow.

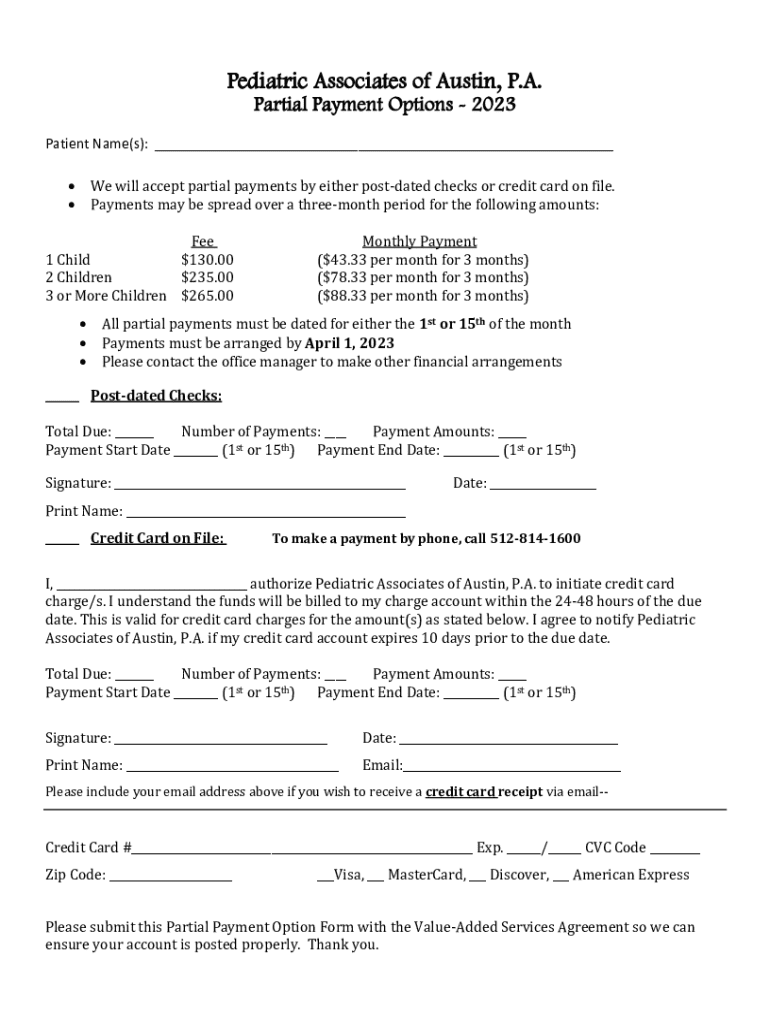

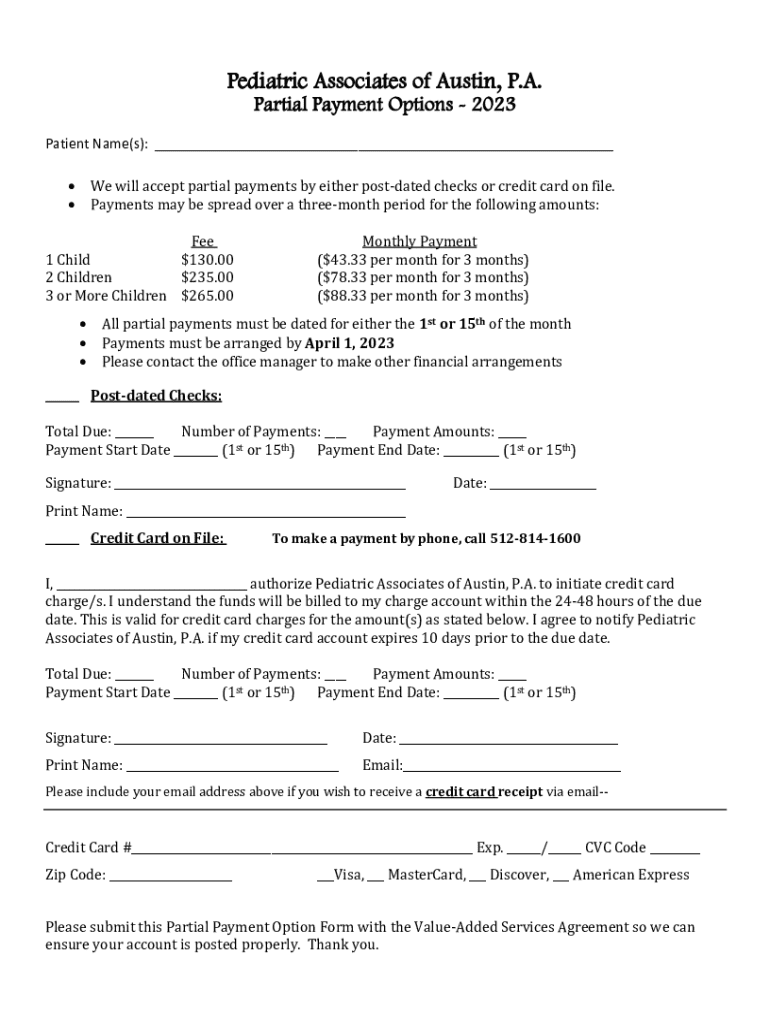

Creating a partial payment options form

Drafting a robust partial payment options form involves several critical steps. First, identify all parties involved and ensure their information is accurately documented. Then detail the payment structure clearly, including specific amounts, due dates, and any sliding scale provisions.

Outlining terms and conditions is equally vital; this section should cover aspects like late fees, grace periods, and any necessary consequences for non-payment. Finally, include designated areas for signatures and dates to formalize the agreement. Templates are readily available on pdfFiller to simplify this process significantly.

Interactive tools for managing partial payments

Utilizing pdfFiller's robust features can simplify the process of managing partial payment options. The platform allows you to edit forms efficiently, adapt them to your requirements, and streamline the signing process with eSigning options. Additionally, collaboration tools can facilitate communication among team members or between landlords and tenants.

Real-time document tracking and updates ensure that all involved parties are aware of changes and can stay informed about payment status, making it easier to manage ongoing agreements successfully. These interactive tools help maintain structure and efficiency in the complex world of partial payments.

Common challenges and solutions

Partial payments can sometimes lead to challenges. For example, rental situations may create friction between landlords seeking full payment and tenants who cannot fulfill their obligations. Strategies can be employed to alleviate such issues, such as encouraging open communication to identify financial difficulties and allowing for structured solutions.

Dealing with non-payment or late payments requires a proactive approach. Maintaining regular communication helps establish a rapport, making it easier to navigate potential financial hurdles together. Additionally, understanding the legal implications of partial payment agreements is crucial, as regulations can vary by region.

The positive side of partial payments

The advantages of partial payments extend to both tenants and borrowers. For them, these options offer much-needed flexibility, reducing financial strain. With the option to make smaller payments, they can manage their finances more effectively, ultimately leading to a more stable financial environment.

On the other hand, landlords and creditors benefit by maintaining relationships and minimizing vacancies. When payment arrangements are flexible, tenants are more likely to stay long-term, which can enhance stability and reduce turnover costs.

Case studies and real-life applications

Many success stories highlight the effectiveness of partial payment agreements across various sectors. For example, a renowned rental agency recently adopted a partial payment framework, allowing tenants to pay 70% of the rent upfront, with the remainder adjusted in monthly installments according to the tenant's income schedule.

These kinds of agreements not only support tenants in maintaining their housing stability but also ensure landlords receive consistent payments. Testimonials from businesses also show how partial payment structures can lead to increased customer loyalty, demonstrating the versatility and effectiveness of such agreements.

Frequently asked questions (FAQs)

Creating a partial payment options form involves several key considerations. Typically, it should include the identity of parties involved, clear payment terms, due dates, and any penalties for late payments. Understanding these components helps in ensuring a fair agreement.

Negotiating a partial payment agreement often requires transparency and understanding. Open discussions about capacities and limitations can lead to favorable terms for both parties. Lastly, it’s essential to note how partial payments might affect credit scores; while they don’t directly impact credit, failure to keep agreements might cause issues.

Expert insights

Consultations with financial advisors highlight the benefits of utilizing partial payments as a strategic financial tool. They advocate for clear communication and set expectations as foundational elements in crafting an effective partial payment agreement.

Legal experts emphasize the importance of understanding state laws governing partial payments. They advise parties to draft comprehensive agreements to protect their interests and prevent future disputes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send partial payment options to be eSigned by others?

How can I get partial payment options?

How do I make changes in partial payment options?

What is partial payment options?

Who is required to file partial payment options?

How to fill out partial payment options?

What is the purpose of partial payment options?

What information must be reported on partial payment options?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.