Get the free Comprehensive Insurance for Student Lives Coupled With 'gakkensai' for International...

Get, Create, Make and Sign comprehensive insurance for student

How to edit comprehensive insurance for student online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comprehensive insurance for student

How to fill out comprehensive insurance for student

Who needs comprehensive insurance for student?

Comprehensive insurance for student form: A detailed guide

Understanding comprehensive insurance for students

Comprehensive insurance for students provides coverage that encompasses various risks and liabilities students may face while pursuing their education. This type of insurance is essential not only for safeguarding health and well-being but also for protecting against unforeseen circumstances that can disrupt academic progress.

The importance of comprehensive insurance for students cannot be overemphasized. With a multitude of responsibilities and potential hazards—from studying abroad to engaging in extracurricular activities—students need a safety net to mitigate financial burdens. Unlike basic insurance plans, comprehensive coverage extends beyond mere health costs, ensuring students are also protected against personal liabilities and accidents.

Types of coverage in comprehensive insurance

When exploring comprehensive insurance, understanding the various types of coverage is critical. Each element of the policy can cater to different student needs, ensuring they have the necessary support during their studies.

Health insurance coverage

Health insurance is a cornerstone of comprehensive coverage, providing financial support for medical expenses incurred due to illnesses or accidents. This coverage often includes routine check-ups, emergency room visits, and hospital stays, which are vital for maintaining the health of students.

In addition to physical health, mental health support is increasingly recognized as essential. Many comprehensive insurance plans now include options for counseling sessions and therapeutic support, addressing the growing need for mental health resources among students.

Personal liability coverage

Personal liability coverage protects students from claims of property damage or personal injury he may cause to others. This part of the policy is crucial for students living in shared accommodations or participating in various recreational activities.

Having personal liability insurance can save a student from costly legal fees and settlements, making it an essential consideration when choosing a comprehensive policy.

Accidental death and dismemberment insurance

Accidental death and dismemberment insurance is particularly relevant for students who may travel or engage in high-risk activities. This coverage often provides financial support in the unfortunate event of severe accidents, offering peace of mind.

For those studying abroad, having this kind of insurance is vital. Different environments can present unique risks, and students should be prepared for any eventualities that may arise while away from home.

Key considerations before choosing comprehensive insurance

Selecting the right comprehensive insurance requires careful consideration of multiple factors. Understanding your specific needs as a student will significantly influence your decision.

Evaluating your needs

Think about your field of study and the activities you engage in. For instance, a student studying engineering may face different risks compared to someone in the arts. Additionally, analyzing potential risks based on your location—be it a bustling city or a quieter college town—can guide your insurance selections.

Duration and scope of coverage

Deciding between short-term versus long-term insurance plans is another key consideration. If you're studying for a single semester abroad, a short-term plan might suffice. However, for those pursuing a full four-year degree, ensuring robust long-term coverage is essential.

It’s also crucial to verify whether your insurance plan provides international coverage, especially if you plan to travel or study outside your home country.

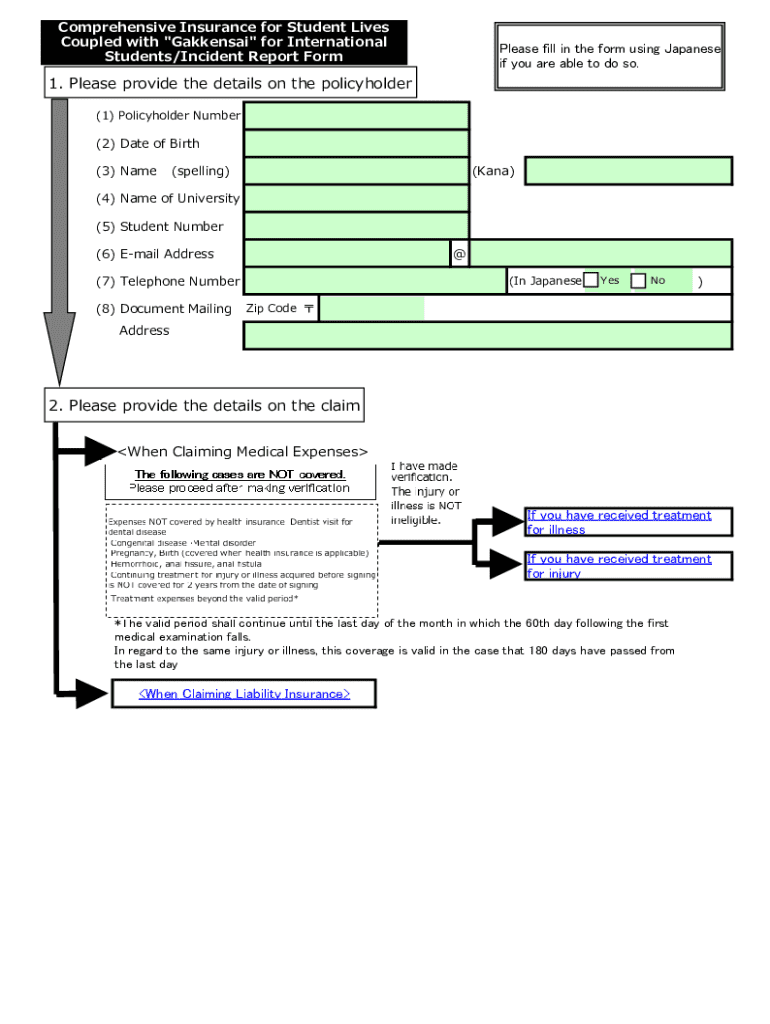

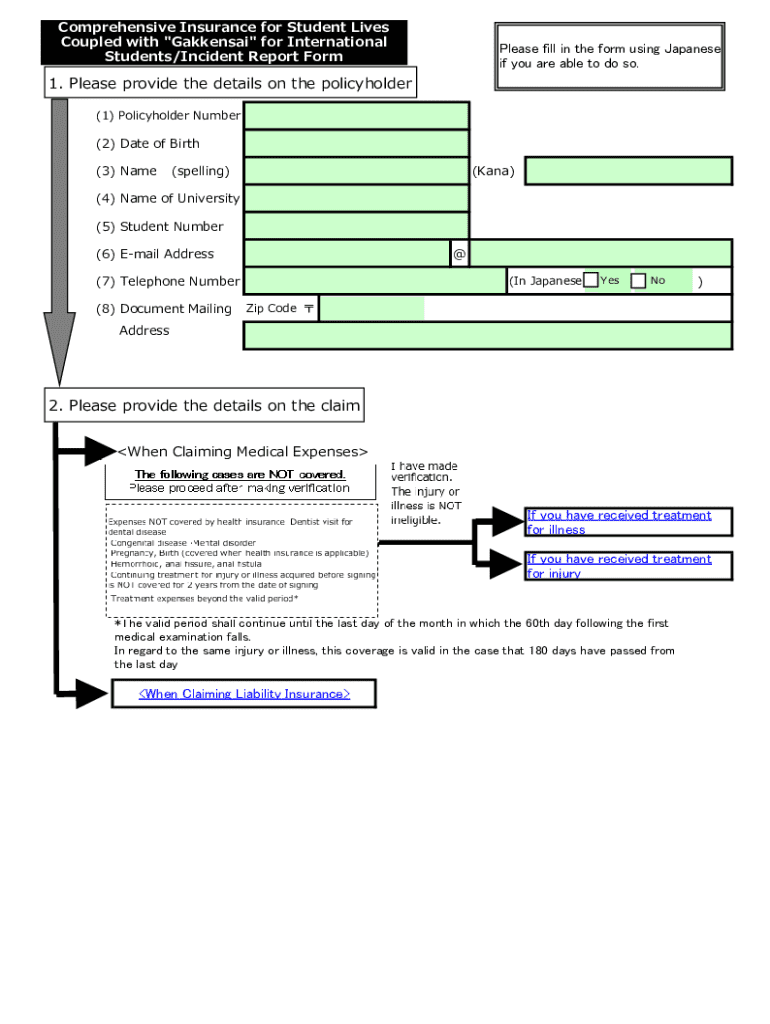

Steps to fill out the comprehensive insurance for student form

Once you decide on the coverage plan that suits your needs, it's time to fill out the comprehensive insurance for student form. A well-prepared application can help smooth the process.

Initial requirements

Before starting, gather necessary documents such as your student ID, proof of enrollment, and any existing health records. Personal information required typically includes your full name, address, date of birth, and contact information.

Filling out the application

Follow these steps for a successful application process: 1. Read through the form instructions carefully. 2. Fill in your personal information accurately. 3. Select the desired coverage options based on your needs. 4. Review your application for any errors before submission.

Submission process

After completing the form, submission can typically be done digitally through platforms like pdfFiller. Simply upload your completed PDF and ensure you receive a confirmation email acknowledging receipt after submission.

Managing your comprehensive insurance

Successfully managing your comprehensive insurance requires staying organized and proactive. Keeping track of your insurance details allows for efficient handling of any claims or issues that may arise.

Keeping track of your insurance details

Utilizing tools like pdfFiller can assist in storing and editing your insurance documents. Regularly updating your information ensures your policy reflects your current situation, which is vital for uninterrupted coverage.

Renewing your insurance

Know when and how to renew your policy to prevent lapses in coverage. Most providers will send reminders, but it’s wise to set your own calendar alert and review your options before renewal to ensure you still have the best plan for your current needs.

Claim process overview

Filing claims can often seem daunting, but understanding the process helps streamline your experience. Start by collecting the necessary documentation to support your claim, which generally includes receipts and reports detailing the incurred costs.

Reach out to your insurance provider to notify them of your claim, providing all required information for a smooth claim process.

Interactive tools for students

To enhance your understanding and decision-making regarding comprehensive insurance, interactive tools can be invaluable. Many platforms, including pdfFiller, offer resources tailored to student needs.

Coverage estimator tool

Using a coverage estimator tool allows students to calculate their insurance needs based on various factors such as location, course of study, and lifestyle. This estimation helps to visualize what level of coverage is truly necessary.

Insurance comparison chart

An insurance comparison chart helps in evaluating different plans side-by-side. Leveraging this to compare factors like costs, coverage limits, and specific terms allows students to make informed selections that best serve their interests.

Frequently asked questions about comprehensive insurance

Students often have many queries when it comes to comprehensive insurance. Here are some frequently asked questions that can aid in clarifying common uncertainties.

Testimonials and user experiences

Real-life experiences from international students highlight the importance of comprehensive insurance. Many students have shared that having coverage eased their worries about potential health crises or accidents during their studies.

Additionally, students have praised how pdfFiller has simplified the paperwork process, making it manageable and intuitive, allowing them to focus on their education rather than the complexities of insurance.

Contact support for your insurance queries

For further questions or personalized assistance, leveraging resources through pdfFiller can make navigating insurance easier. Quick access to support via chat, email, or phone can streamline your experience and address any concerns you're facing.

Finding timely assistance can provide peace of mind, ensuring that you remain well-informed throughout your insurance journey.

Best practices for insurance management

Effective insurance management is vital for students to ensure they have the support they need when it matters most. Here are some best practices to follow:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send comprehensive insurance for student for eSignature?

How can I get comprehensive insurance for student?

How do I complete comprehensive insurance for student on an Android device?

What is comprehensive insurance for student?

Who is required to file comprehensive insurance for student?

How to fill out comprehensive insurance for student?

What is the purpose of comprehensive insurance for student?

What information must be reported on comprehensive insurance for student?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.