Get the free Confirmation of Accident-related Loss

Get, Create, Make and Sign confirmation of accident-related loss

Editing confirmation of accident-related loss online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation of accident-related loss

How to fill out confirmation of accident-related loss

Who needs confirmation of accident-related loss?

Understanding the Confirmation of Accident-Related Loss Form

Understanding the confirmation of accident-related loss form

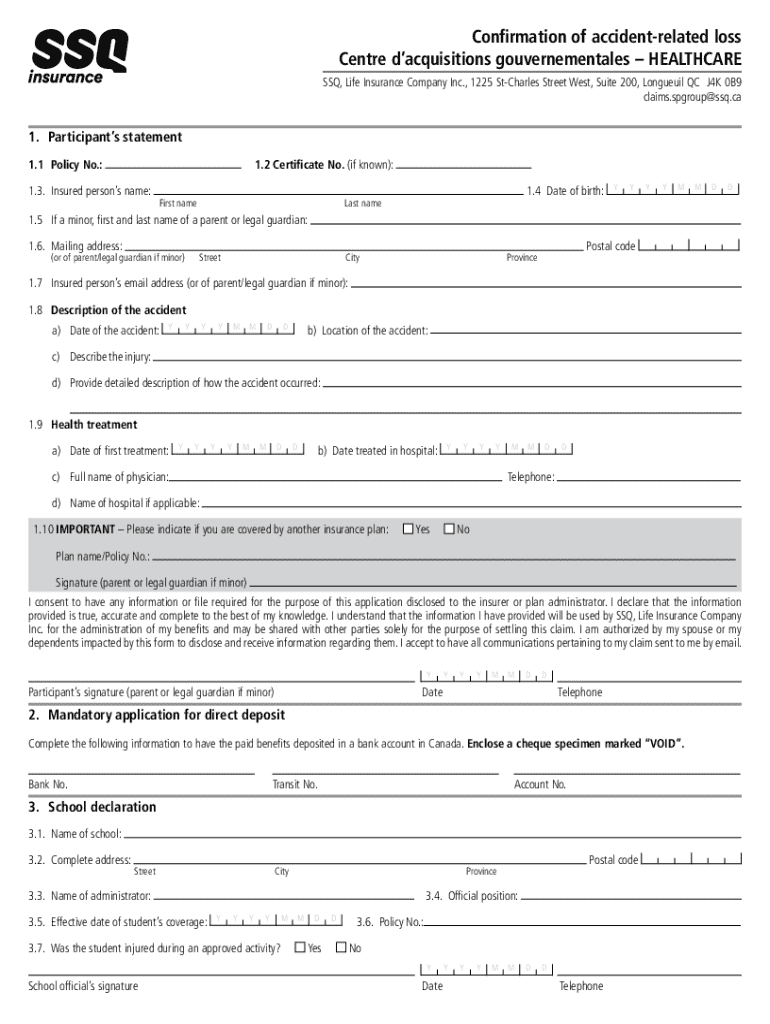

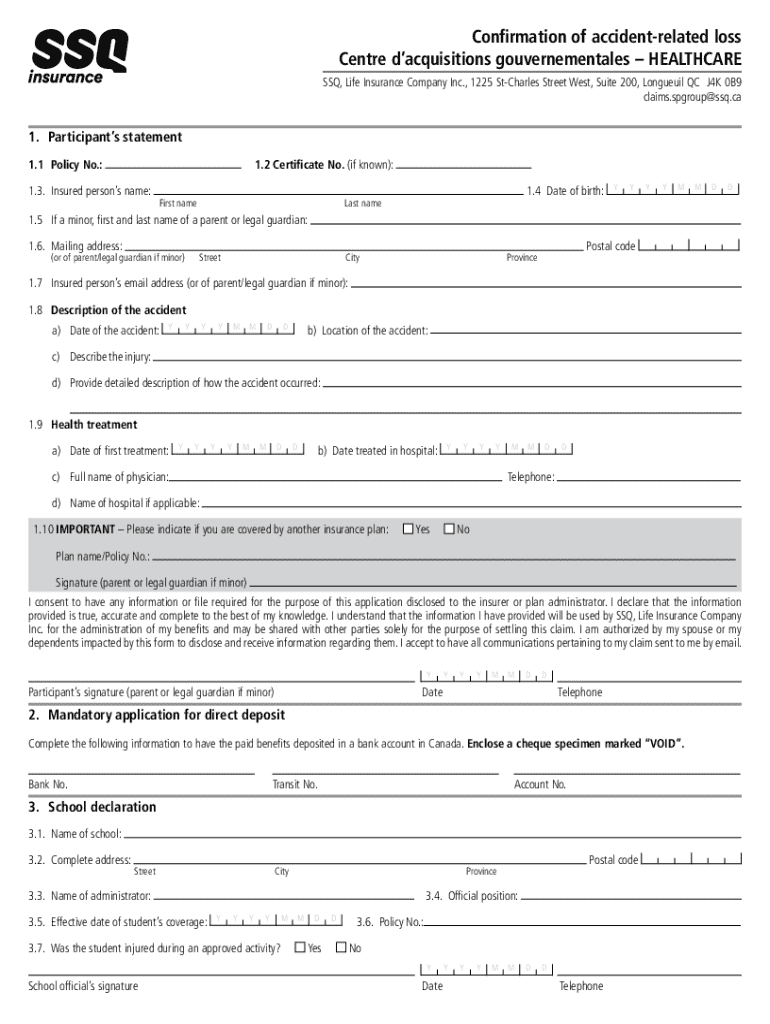

The confirmation of accident-related loss form is a crucial document when dealing with insurance claims following an accident. It serves as an official declaration that outlines the details of the incident and the losses incurred as a result. This form is essential for individuals seeking compensation for damages, injuries, or losses sustained during an accident.

Its significance in the claims process cannot be overstated. Insurers rely heavily on this document to evaluate the legitimacy and extent of the claim. By providing comprehensive details about the incident, including the involved parties, circumstances, and damages, this form aids insurance companies in making informed decisions about claim approvals.

How to fill out the confirmation of accident-related loss form

Filling out the confirmation of accident-related loss form can seem daunting. However, following a structured approach makes the process more manageable. First, gather all necessary information, ensuring you have everything at hand before you begin.

Start by collecting your personal identification details, including your name, address, and contact information. Next, document the specifics of the accident — date, time, location, and a brief description of the events. Additionally, having your insurance policy information ready is vital, as it helps communicate your coverage details clearly.

Once you have gathered this information, it’s time to complete the form. Break it down into manageable sections — document the date of the accident, names of witnesses, and a detailed account of damages or injuries sustained. Use common terminology that accurately reflects your situation, and format your statements clearly to enhance readability.

Mistakes to avoid when filling out the form

Filling out the confirmation of accident-related loss form requires attention and diligence. Numerous common pitfalls can compromise the effectiveness of your claim. One of the most frequent mistakes is providing incomplete information. Leaving out crucial details or failing to answer questions can lead to delays or outright denial of your claim.

Another common error is misunderstanding coverage details. Make sure you fully understand what your insurance policy covers before submitting the form. Forgetting to include supporting documents like photographs or police reports can also hinder the progress of your claim. Each supporting document strengthens your case, so ensure you include everything that is relevant.

Consequences of errors can range from delays in processing your claim to outright denial. Therefore, taking the time to ensure accuracy and completeness is essential for a successful claims experience.

What happens after submitting the form?

Once the confirmation of accident-related loss form is submitted, it enters a review process wherein the insurance company evaluates the information provided. Each claim moves through stages of assessment that may involve internal reviews and, in some cases, consultations with third-party adjusters or specialists.

The expected timeline for claim processing can vary significantly based on the complexity of the incident and the company's specific procedures. Typically, simple claims can be processed within a few weeks, while more complicated claims may take longer, often months. Clear communication channels should be established for follow-ups to keep track of your claim’s status.

The role of supporting documentation

Supporting documentation is critical when submitting a confirmation of accident-related loss form. Essential documents to include typically comprise of photographs of any damages sustained, police reports that officially record the incident, and medical records if injuries are involved. These items add credibility to your claim and provide concrete evidence of the incident's aftermath.

Compiling and presenting this evidence effectively is important. Organize your documents in a logical order and provide explanations where necessary, linking them back to specific sections of the confirmation form to strengthen your connection to the claim.

Legal considerations

When completing the confirmation of accident-related loss form, it's essential to consider the legal implications of inaccuracies. Any misrepresentation or omission can harm your credibility, potentially resulting in reduced payouts or claims being denied outright. Providing accurate and detailed information is not only best practice but also a legal requirement.

Moreover, the importance of honesty and transparency throughout this process cannot be overstated. Insurance fraud is a serious offense with severe consequences, including criminal charges and financial repercussions. It is vital to avoid any temptation to exaggerate claims or submit false information, as the repercussions can be far-reaching.

Benefits of using pdfFiller for managing your confirmation of accident-related loss form

pdfFiller offers a convenient and streamlined approach to managing the confirmation of accident-related loss form. With its cloud-based access, users can edit their documents seamlessly, collaborate in real-time with stakeholders, and share the completed forms with insurers without any hassle.

Additionally, the eSigning features available through pdfFiller empower users to validate their documents electronically. This not only speeds up the submission process but also ensures that documents are securely signed and easily traceable.

Interactive tools available on pdfFiller

The interactive tools available on pdfFiller make completing forms like the confirmation of accident-related loss form incredibly user-friendly. Features such as auto-fill capabilities can save users time and minimize errors when filling out repetitive sections.

Moreover, digital signature options provide flexibility, allowing users to sign forms on the go, which is particularly convenient for individuals managing claims amid demanding schedules. This mobile access ensures that document management isn't restricted to a desktop environment, enabling you to complete forms no matter your location.

Frequently asked questions about the confirmation of accident-related loss form

Understanding who needs to fill out the confirmation of accident-related loss form is crucial. Typically, any individual involved in an accident who wishes to file a claim needs to complete this document. It's also essential to know how this form affects your insurance claim, as it serves as the foundational evidence your insurer will use for evaluation.

For those concerned about a denied claim, it’s vital to understand the appeals process and what steps to take next. Doing so can ensure you have the opportunity to contest the insurance company’s decision effectively.

Final tips for a successful claim

For a successful claim, best practices for documenting your accident are essential. This includes taking detailed notes immediately after the incident, gathering witness statements, and documenting any injuries and property damage thoroughly. Using concise and factual language will lend credibility to your claim.

Keeping records organized is another vital aspect. Store all documents related to your claim in a dedicated folder and label them appropriately. Additionally, effective communication with insurance adjusters can facilitate the claims process, so always be open, clear, and polite in your interactions.

Importance of keeping your form updated

Keeping your confirmation of accident-related loss form updated is essential. As circumstances surrounding your claim evolve, such as receiving new medical information or updates regarding damages, it's crucial to inform your insurance company of these changes promptly.

Updates ensure that the insurer has the most current information to evaluate your claim accurately. Keeping the form updated also demonstrates your commitment to transparency, which can positively influence the claims review.

Conclusion

The confirmation of accident-related loss form is a fundamental component in the insurance claims process. Understanding its importance and how to fill it out correctly can significantly impact the outcomes of your claim. Utilizing a reliable platform like pdfFiller not only simplifies the process of managing your forms but also enhances collaboration, document sharing, and overall efficiency in claims management. By adhering to the guidelines discussed in this article, you can position yourself for a successful claim experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my confirmation of accident-related loss directly from Gmail?

How can I edit confirmation of accident-related loss from Google Drive?

How do I complete confirmation of accident-related loss online?

What is confirmation of accident-related loss?

Who is required to file confirmation of accident-related loss?

How to fill out confirmation of accident-related loss?

What is the purpose of confirmation of accident-related loss?

What information must be reported on confirmation of accident-related loss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.