Get the free Council Tax Application for Severely Mentally Impaired

Get, Create, Make and Sign council tax application for

Editing council tax application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out council tax application for

How to fill out council tax application for

Who needs council tax application for?

Your Comprehensive Guide to Council Tax Application for Form

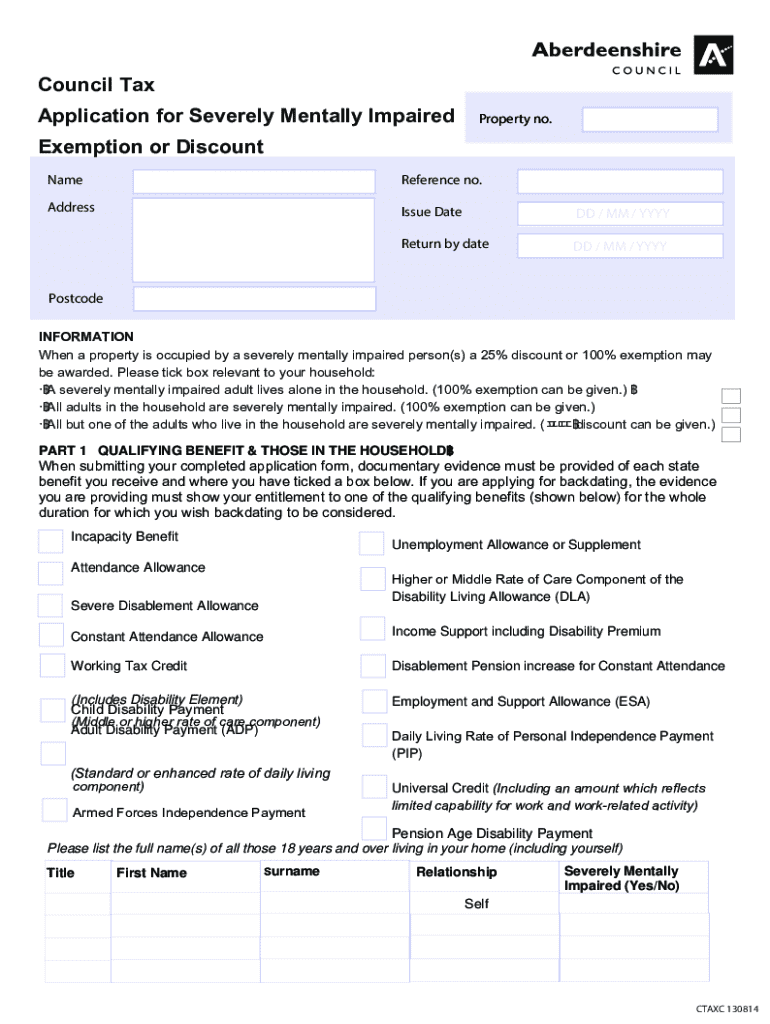

Understanding council tax applications

Council tax is a local taxation system in the United Kingdom that is charged on residential properties. It contributes to local services such as waste collection, education, and social care. The amount you pay varies depending on the valuation band of your property and the local council's budget. Understanding council tax applications and the forms associated with them is crucial for maximizing financial benefit through discounts and exemptions.

Council tax forms play a vital role in determining eligibility for reduction in payments or total exemptions. You must apply for these benefits promptly and accurately to ensure you are not overpaying and to receive the financial relief you deserve.

Types of council tax forms

There are several forms related to council tax applications, each serving distinct purposes based on your situation.

Standard council tax application

A standard council tax application is necessary when moving into a new property or if there’s a change in household circumstances. To be eligible, you must be at least 18 years old and reside in the property that is liable for council tax.

Council tax reduction applications

If you are on a low income or receiving certain benefits, you may be eligible for council tax reduction. This form allows you to detail your financial situation.

Exemption forms

Certain groups of people may be exempt from paying council tax, including full-time students, individuals living in care homes, or those with severe mental impairments. The exemption application form requires specific details to support the exemption claim.

Refund requests

If you’ve overpaid your council tax, you can request a refund by filling out a refund request form. Ensure you provide the necessary details to expedite the process.

Navigating the council tax application process

Completing a council tax application or exemption form may seem daunting, but understanding the steps can simplify the process. Start by gathering all necessary documentation before you begin filling out the forms.

You can access council tax forms directly from your local council’s website. Many councils provide downloadable PDFs, or you can request paper forms through the mail. Additionally, using pdfFiller allows you to fill out and edit forms online easily.

Tools for easy completion

pdfFiller provides an intuitive platform for editing and managing council tax forms. Its features allow users to edit PDFs seamlessly, ensuring you can easily fill out the required information.

By utilizing pdfFiller, your council tax forms can be filled out efficiently without the hassle of printing and scanning physical copies.

Common challenges and troubleshooting

Applicants often face several challenges when submitting council tax applications, such as missing documentation or completing forms incorrectly. It's essential to thoroughly check your application before submission.

If you encounter issues during the application, your local council has dedicated teams to help address common problems. Always keep records of your submissions for follow-ups.

Resources for council tax information

Staying informed about council tax policies and forms is crucial for smooth applications. Each local council has its guidelines accessible through their official websites.

User tips for successful applications

To ensure that your council tax applications are effective and timely, consider the following best practices:

These strategies can minimize errors and streamline the application process.

Interactive guidance: Making use of interactive tools

pdfFiller not only simplifies filling out forms but also enhances collaboration among team members. Its interactive features allow users to work together on council tax applications, ensuring accuracy and completeness.

These tools foster teamwork and produce high-quality contributions to your application.

Important deadlines and timelines

Council tax forms usually have specific submission deadlines depending on local council policies. It’s vital to keep track of these dates to avoid penalties or late fees.

FAQs about council tax applications

Many individuals have common questions when it comes to council tax applications. The following frequently asked questions can provide clarity:

Addressing these queries can help applicants navigate possible concerns effectively.

Feedback and improvements

User feedback is invaluable when it comes to improving the council tax application process. Listening to other applicants' experiences can provide insights and highlight potential areas for changes.

Contributing your input helps councils understand user needs better and encourage ongoing improvements in services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit council tax application for from Google Drive?

How can I get council tax application for?

How do I make changes in council tax application for?

What is council tax application for?

Who is required to file council tax application for?

How to fill out council tax application for?

What is the purpose of council tax application for?

What information must be reported on council tax application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.