Get the free Certificate of Non-filing of Annual Income Tax Return

Get, Create, Make and Sign certificate of non-filing of

How to edit certificate of non-filing of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of non-filing of

How to fill out certificate of non-filing of

Who needs certificate of non-filing of?

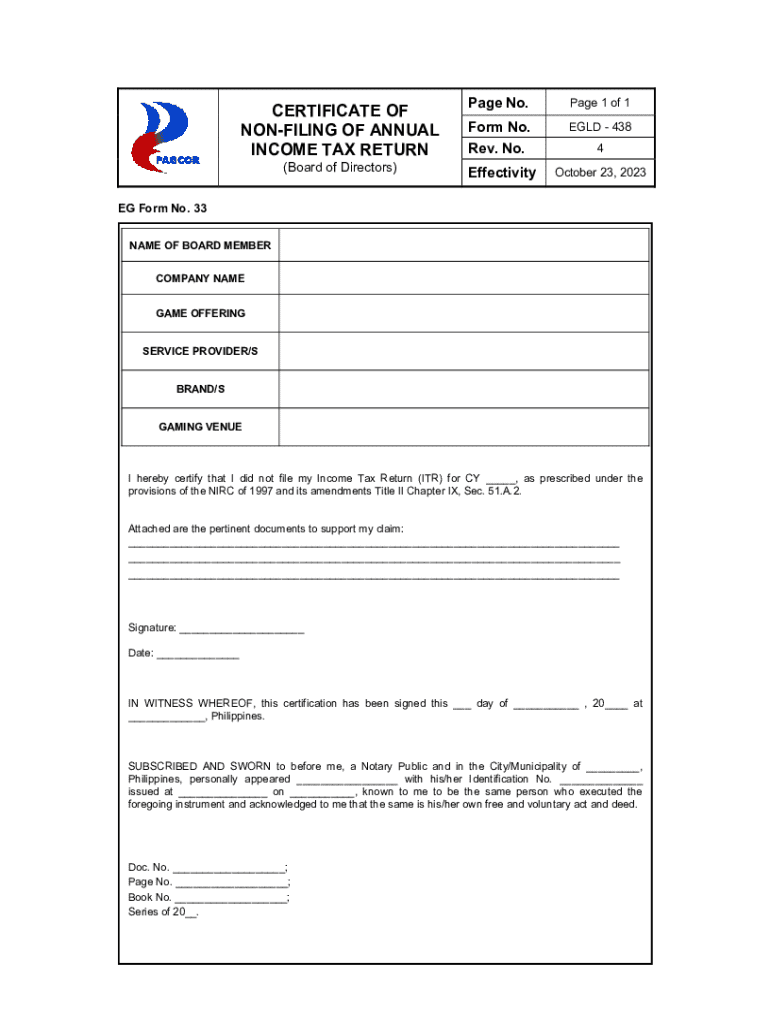

Understanding the Certificate of Non-Filing of Form: A Comprehensive Guide

Understanding the certificate of non-filing

A certificate of non-filing is a formal document issued by the Internal Revenue Service (IRS) stating that a taxpayer has not filed a required tax return for a specific tax year. This certificate serves significant purposes, especially in financial transactions. Individuals commonly require it when applying for financial assistance, such as student loans or financial aid, which mandates proof of non-filing status to verify income levels.

Understanding the purpose and importance of this certificate can help individuals navigate financial obligations effectively. It acts as a shield against potential penalties that could arise from failing to file tax returns when required. Notably, the certificate helps facilitate the processing of financial requests while maintaining transparency between lenders and borrowers.

Common scenarios that may require a certificate of non-filing include situations where individuals planned to file but did not meet the deadline or became ineligible for particular tax benefits due to not having filed. In all these instances, acquiring this document is crucial to prevent misunderstandings or disputes regarding one's financial status.

Eligibility for requesting a certificate of non-filing

Who can request a certificate of non-filing? Any taxpayer who has not filed their tax returns can request this certificate. This includes individuals, corporations, and partnerships. However, it is essential to define specific circumstances where this document is most needed. For instance, if an individual has received a notice from a financial institution requesting proof of non-filing to aid in the loan application process, they may need to procure this certificate.

Furthermore, taxpayers who have been actively self-employed or received non-wage income but failed to file a return may also require this document. Each case differs, emphasizing the need for thorough evaluation before initiating the request. Overall, essential criteria include confirming receipt of income that mandates filing yet not having completed the process, placing potential applicants in a valid position to legally request a certificate.

How to request a certificate of non-filing

Requesting a certificate of non-filing entails several steps. Here’s a detailed breakdown to guide you through the process.

Tracking your request status

Once your request for a certificate of non-filing has been submitted, tracking its status is essential to confirm its processing. You can check the status through the IRS's online tools or by contacting their customer service. This step helps in ensuring there are no delays and you’re updated on your document’s approval.

Common issues may arise, such as discrepancies in personal information or processing delays. It’s advisable to have your confirmation details handy while checking, and if complications occur, reaching out to the IRS customer support will clarify any hindrance to your request.

Using the certificate of non-filing

A certificate of non-filing opens doors for various applications, especially in securing financial aid or loans. Educational institutions and lenders require this certificate as part of their documentation process. It verifies that the individual has not filed a tax return, substantiating claims of income levels during assessments.

When providing this certificate to institutions, ensure that it is presented in an official format and within the stipulated timelines as requested by the lender or educational authority. Not having the document ready can delay application processes or result in missed opportunities.

Addressing common challenges

Several challenges may arise during the request process or after receiving the certificate. One frequent issue is trouble with address matching, particularly if the IRS database doesn’t sync with new address changes. To prevent this, ensure all your information matches the one on file with the IRS.

If your request is denied, it’s crucial to understand the reasoning behind the rejection. You can appeal the decision or rectify the situation by addressing discrepancies in your information. Steps include verifying your identity or providing additional documentation if requested.

Frequently asked questions (FAQs)

Engaging with the process of obtaining a certificate of non-filing often raises several pertinent questions. Here are some insights into common inquiries.

Helpful resources and links

Using credible resources is essential for accurate information when dealing with tax matters. The IRS website provides detailed guidelines and resources pertaining to tax filings and requests for certificates. Additionally, consider utilizing platforms like pdfFiller for document management to streamline your interaction with tax forms and certificates.

Whether you're managing forms, seeking assistance, or simply needing to understand the woman etc document creation, pdfFiller’s tools can simplify the process significantly.

Leveraging pdfFiller for document management

pdfFiller offers innovative solutions for managing your tax documents. This platform not only provides the ability to create and edit forms but also allows seamless eSigning and collaboration features critical for your documentation needs.

Utilizing pdfFiller, you can prepare additional IRS forms needed in conjunction with your certificate of non-filing, ensuring comprehensive management of all your tax-related documents from one cloud-based platform.

Customer support and engagement

Engagement with customer support is vital when navigating the complexities of tax documentation. pdfFiller's support team is equipped to assist users at every step of their document management journey. Whether through direct contact or utilizing interactive tools on the platform, answers to queries are readily available.

By joining the pdfFiller community, users can access updates, additional support, and insights into optimizing their document management processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find certificate of non-filing of?

How do I complete certificate of non-filing of online?

How can I edit certificate of non-filing of on a smartphone?

What is certificate of non-filing of?

Who is required to file certificate of non-filing of?

How to fill out certificate of non-filing of?

What is the purpose of certificate of non-filing of?

What information must be reported on certificate of non-filing of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.