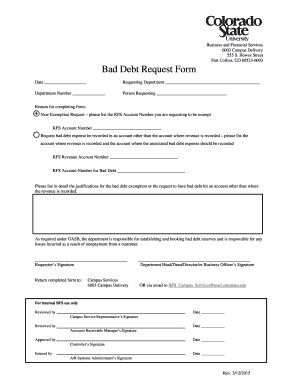

Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to Sec Form 4: Filling, Managing, and Submitting with pdfFiller

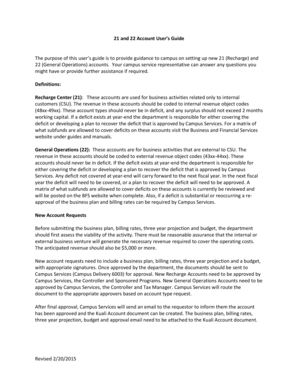

Understanding Sec Form 4

Sec Form 4 is a crucial document required by the U.S. Securities and Exchange Commission (SEC) for reporting the changes in ownership of securities by corporate insiders, such as executives and board members. The form serves the primary purpose of maintaining transparency in stock trading activities and holds significant importance in the regulatory landscape.

The importance of Sec Form 4 cannot be overstated. It promotes fair trading by ensuring that insiders publicly disclose their transactions, helping to prevent insider trading and maintain market integrity. The key stakeholders who are typically involved in filing Form 4 include corporate officers, directors, and large shareholders who are subject to periodic reporting requirements.

Key features of Sec Form 4

Sec Form 4 incorporates several mandatory disclosure requirements. These requirements vary depending on the nature of the transaction and include details such as the date of the transaction, the number and type of securities involved, and whether the transaction was executed as a purchase or sale.

The structure of Sec Form 4 consists of several components: The Personal Information Section captures identification details of the reporting person. The Transaction Information Section logs transaction specifics, while the Signature Section is where the reporting party attests to the accuracy of the information provided. It's essential to familiarize oneself with common terminology used in Form 4, such as 'direct ownership,' 'indirect ownership,' and 'exempt transactions' to ensure proper reporting.

Step-by-step guide to filling out Sec Form 4

Before starting on Sec Form 4, it’s vital to prepare the necessary documents that outline all relevant transaction details. This could include trade confirmations and any supporting financial documents.

For an accurate and compliant submission, consider these additional tips: double-check to ensure all fields are complete, use clear and concise language, and keep a copy of the submitted form for your records.

Tips for editing and managing Sec Form 4 with pdfFiller

pdfFiller offers a suite of interactive editing tools, making it easier for users to fill out Sec Form 4 digitally. With features like drag-and-drop editing, you can swiftly add or modify information, saving time and reducing the potential for errors.

Collaboration is also facilitated through pdfFiller, allowing team members to work together on form preparation. The platform supports e-signatures, ensuring a seamless signing process that can be completed in just a few clicks. Additionally, the ability to store forms in the cloud allows for easy access from any location.

Common mistakes to avoid when submitting Sec Form 4

Despite the straightforward nature of Sec Form 4, several common mistakes can lead to compliance issues. Incomplete disclosure is one of the primary pitfalls, as missing details can undermine the form's intent and lead to penalties.

Resources for Sec Form 4

To deepen your understanding of Sec Form 4, consider utilizing various resources. Common resources include a detailed FAQ section, which tackles the most frequently asked questions about the form.

Additionally, accessing regulatory guidelines from the SEC can shed light on compliance requirements, while pdfFiller provides online tutorials and webinars that teach users how to fill out the form effectively.

Transaction codes associated with Sec Form 4

Transaction codes are critical for accurately reporting different types of transactions on Sec Form 4. The SEC provides specific codes that denote the nature of each transaction, from purchases to options exercises.

Utilizing these codes correctly is vital, as accurate code entry helps ensure the integrity of the reported data. A quick reference guide is often provided by the SEC, assisting filers in categorizing their transactions appropriately.

Advanced features of pdfFiller for managing Sec Form 4

pdfFiller stands out with its advanced features that cater to teams managing Sec Form 4. Its cloud-based accessibility allows for seamless document sharing and collaboration among team members, regardless of their location.

Furthermore, pdfFiller provides integration options with other business tools, enhancing workflow efficiency. Security features are also paramount; they ensure that all sensitive information remains protected throughout the process.

Best practices for teams handling Sec Form 4

Establishing a well-defined team review process is essential to ensure everyone is on the same page when it comes to filling out Sec Form 4. By setting up notifications and reminders for filing deadlines, teams can avoid last-minute scrambles.

Support and further assistance

For users of pdfFiller, customer support is readily accessible to assist with any questions related to Sec Form 4 submissions. Community forums and user groups offer platforms for sharing tips and strategies among peers.

Moreover, staying updated on changes to Sec Form 4 regulations is paramount, and pdfFiller provides resources to help users remain informed on any modifications or updates to the filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 4 directly from Gmail?

Can I sign the sec form 4 electronically in Chrome?

How do I edit sec form 4 straight from my smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.