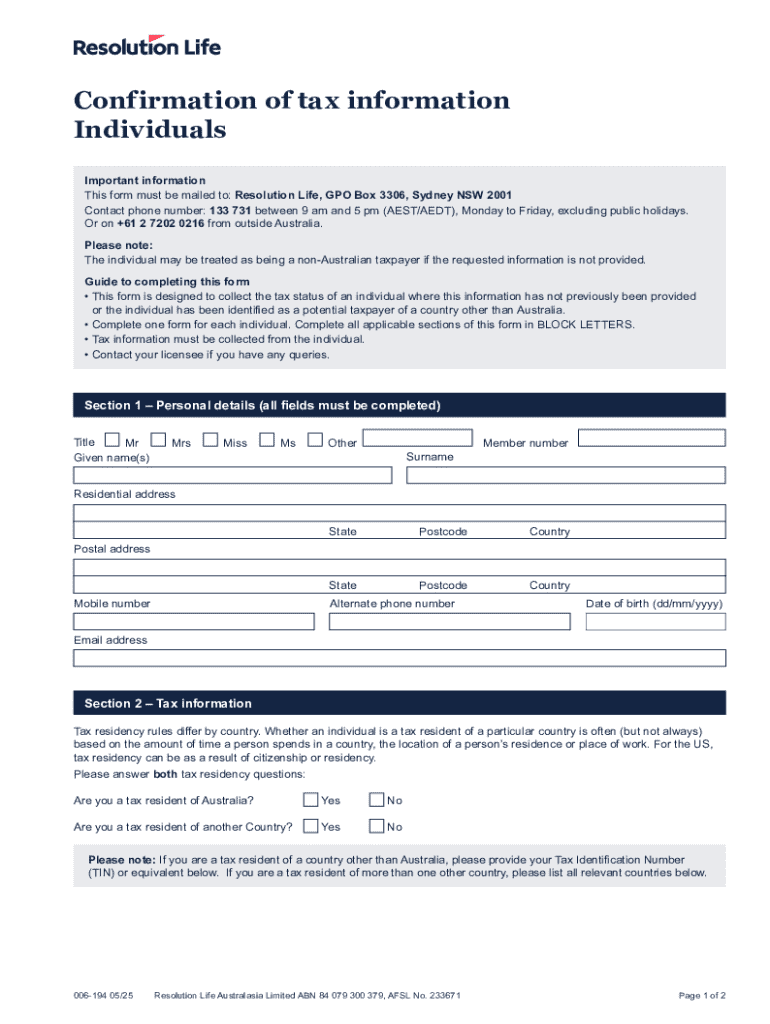

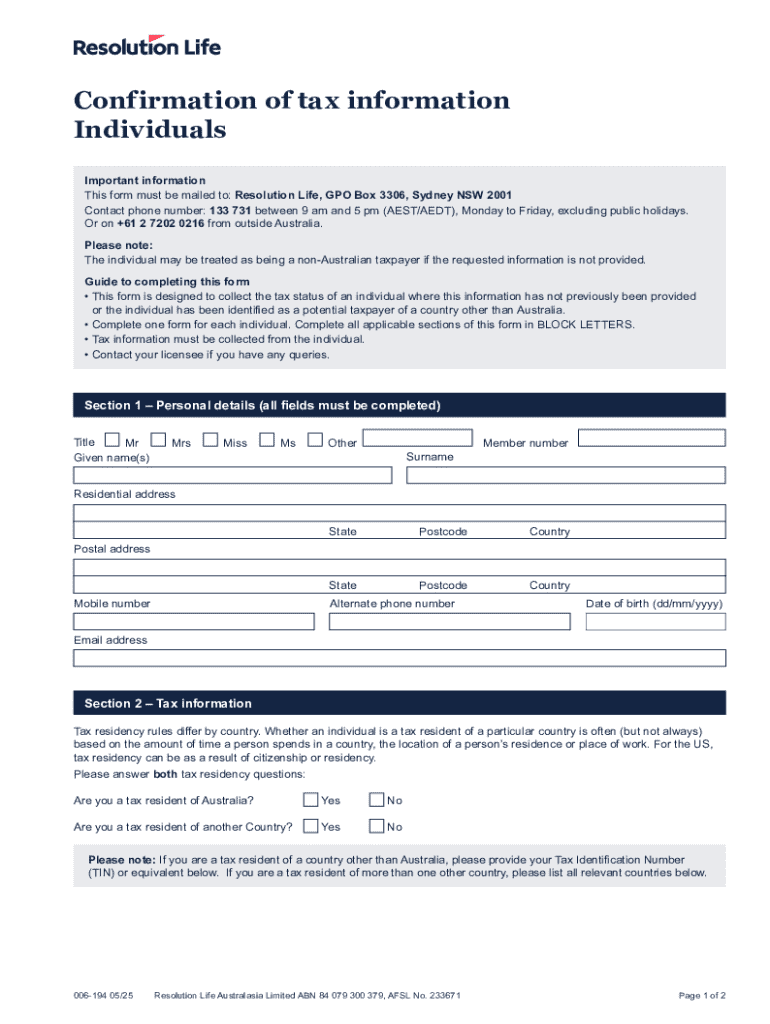

Get the free Confirmation of Tax Information

Get, Create, Make and Sign confirmation of tax information

How to edit confirmation of tax information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation of tax information

How to fill out confirmation of tax information

Who needs confirmation of tax information?

Your Comprehensive Guide to the Confirmation of Tax Information Form

Understanding the confirmation of tax information form

The confirmation of tax information form is a crucial document used to confirm the accuracy of tax-related information submitted to the IRS and other relevant authorities. This form serves a dual purpose: it verifies the information provided by tax filers and assists tax authorities in ensuring compliance with tax regulations. For individuals and businesses alike, accurately completing this form is paramount, as it lays the groundwork for all subsequent tax reporting.

This form is not merely a bureaucratic requirement; it's an essential tool for maintaining transparency in tax matters. By validating the tax information, all parties can mitigate the risk of errors that could lead to complications such as audits, penalties, or delays in processing refunds.

Who needs to fill out this form?

Various individuals and entities are required to fill out the confirmation of tax information form. Primarily, tax filers, including contractors and freelancers, are obligated to complete this document to ensure their reported income aligns with tax obligations. Specifically, self-employed individuals must use this form to declare their earnings to avoid discrepancies that could draw ire from tax authorities.

Further, businesses comprising employers, corporations, and financial institutions must also fill out the form. Employers report employee earnings while businesses report their earnings during annual or quarterly filings. Each category of filers has unique requirements, emphasizing the importance of correctly completing the confirmation of tax information form.

Importance of accurate information

Submitting incorrect information on the confirmation of tax information form can have significant repercussions. Errors may result in incorrect tax assessments, delayed refunds, and even audits. Rectifying such mistakes often leads to additional costs and time spent navigating tax complications, which can detract from focusing on core professional tasks.

On the other hand, ensuring that accurate information is included on this form brings a plethora of benefits. Correct submissions simplify the tax compliance process, fostering a smoother interaction with tax authorities. Moreover, filling out the confirmation form correctly helps businesses and individuals to establish and maintain a good standing, which can be beneficial for loan applications, audits, or any financial inquiries.

Preparing to complete the form

Preparation is key to effectively completing the confirmation of tax information form. Gather all necessary documents and information beforehand to prevent unnecessary delays. A comprehensive list of documents to collect includes W-2s, 1099s, and other income statements that provide proof of earnings. Generally, these documents offer a clear picture of your financial situation during the tax year, ensuring nothing is overlooked.

In addition to financial statements, you must have personal identification details ready, such as your Social Security Number (SSN) or Employer Identification Number (EIN). Understanding related tax terms can significantly help you fill out the form more efficiently. Familiarize yourself with tax identification numbers (TIN) and other relevant tax terminology to ensure accurate disclosures.

Understanding related tax terms

Grasping fundamental tax terminology is essential for completing the confirmation of tax information form accurately. Knowing terms such as tax identification numbers (TIN), Social Security Number (SSN), and employer identification numbers (EIN) equips you with the necessary language to interact with tax documents efficiently. A TIN serves as a unique identifier assigned to individuals and entities to manage tax obligations. In contrast, an SSN serves to identify individuals, while businesses utilize the EIN for similar purposes. Awareness of such terms significantly aids taxpayers in accurately navigating their tax obligations and affirming the correctness of their reported information.

Step-by-step guide to filling out the form

To accurately complete the confirmation of tax information form, begin by accessing the necessary documents. You can find and download the confirmation of tax information form from pdfFiller’s comprehensive library of templates. pdfFiller makes this process straightforward, offering various forms and tax documents, ready for you to modify and fill out as necessary.

When filling out the basic information section, ensure that you provide your name, address, and identifiable numbers correctly. Mistakes in any of these areas can lead to miscommunication and processing errors. Check for typos or inaccuracies that might jeopardize your submission.

Afterwards, focus on the income and financial sections of the form. Here, report income from all relevant sources. Common sources of income include salaries, freelance work, dividends, and rental income. Providing detailed and accurate revenue information prevents inconsistencies and allows tax authorities to process your submission swiftly.

Lastly, conducting a thorough review and verification of the form before submission is crucial. Double-check all entries to ensure completeness and correct formatting. One common pitfall is the omission of important income sources. By conducting an end check on your form, you not only enhance the likelihood of acceptance but also ensure peace of mind as you file your taxes.

Editing and improving your submission

pdfFiller offers advanced tools for document management that significantly enhance your ability to edit, sign, and collaborate on your confirmation of tax information form. Within the platform, you can modify any section of the document, enabling you to refine your submission until it meets your requirements perfectly. The platform’s user-friendly interface simplifies navigating the features, such as drag-and-drop functionality for ease of editing.

Additionally, pdfFiller allows for seamless collaboration among teams, making it easy to manage permissions and share documents. This collaborative feature is particularly useful for businesses where multiple department members may need input on tax documents. Sharing access simplifies communication, reducing the risk of miscommunication regarding updates and essential changes.

Sign and submit your form

Once your confirmation of tax information form is complete, the next essential step is to electronically sign the document. pdfFiller allows you to easily edit and apply digital signatures directly within the document. This capability is particularly valuable in today’s fast-paced environment, enabling quick turnarounds for essential tax submissions.

You can submit your completed form via multiple methods. You have the option for online submission, which allows for quicker processing times, or you can choose to physically mail the form. The electronic route often ensures more efficient processing, but opting for traditional mailing should address protocols for achieving timely delivery, including appropriate postage.

Frequently asked questions (FAQs)

What to do if you encounter errors?

In case you stumble upon errors while completing your confirmation of tax information form, take note of the mistake and cross-check your entries against your gathered documentation. Depending on the nature of the error, minor corrections may be made directly if you’re using an electronic document. For substantial discrepancies, you may need to re-submit the form altogether, ensuring that all reporting is accurate and confirmatory.

Deadlines for submission

Each tax season carries its own set of deadlines for various forms, including the confirmation of tax information form. It is critical for filers to stay informed about these deadlines. Often, individuals and businesses alike have similar submission dates, meaning time management is key for ensuring a smooth filing process. Missing these deadlines can result in penalties, so reviewing annual IRS announcements can help keep you on track.

What happens after submission?

After you’ve submitted your confirmation of tax information form, it typically enters a processing period which may vary based on your tax authority's workload. Expect to wait several weeks before receiving any notification about the status of your submission. If you have not received confirmation, the best course of action is to follow up with the relevant tax authority to ensure that your documentation has been successfully processed.

Additional tools and resources

Interactive tools available on pdfFiller

pdfFiller is not just a repository of templates; it also boasts a suite of interactive tools designed to streamline your tax document creation and completion process. Whether you need calculators to help estimate your tax obligations or templates tailored to state-specific requirements, pdfFiller covers you. Each tool is accessible from a single platform, emphasizing the ease of navigating various resources without juggling multiple systems.

Document management best practices

In managing your tax-related documents, organization cannot be overstated. Establish a systematic approach to storing and categorizing your tax documents, whether digital or physical. Implement folders for various tax years and types of forms. Moreover, employing security measures such as encryption and password protection is crucial in safeguarding sensitive information. Understanding how to effectively manage your documents with best practices can save time and eliminate unnecessary stress during tax season.

Connecting with support

Accessing help centre and customer support

Navigating tax forms can be complex, and having access to customer support can make a significant difference. pdfFiller provides a dedicated help center where users can find answers to their queries and troubleshoot common issues with the confirmation of tax information form. If you require personalized support, you can also reach out to customer service representatives who are equipped to assist you with various inquiries.

Community engagement and feedback

In addition to formal customer support, pdfFiller encourages community engagement among users. Sharing experiences and learning from others can be an invaluable way to seek advice and improve your document management skills. Forums and feedback channels allow users to contribute their insights, creating a dynamic environment where valuable information circulates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my confirmation of tax information in Gmail?

How do I edit confirmation of tax information on an Android device?

How do I complete confirmation of tax information on an Android device?

What is confirmation of tax information?

Who is required to file confirmation of tax information?

How to fill out confirmation of tax information?

What is the purpose of confirmation of tax information?

What information must be reported on confirmation of tax information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.