Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Your Complete Guide to Credit Application Forms

Understanding credit application forms

A credit application form is a critical document that both individuals and organizations use when requesting credit from lenders. The purpose of this form is to provide a comprehensive overview of the applicant's financial background, which helps the lender assess their ability to repay loans or credit lines. Effectively, it's a structured way to gather essential data, influencing lending decisions.

In personal finance, a credit application form is often required for loans, credit cards, or mortgages. In contrast, businesses might fill out similar forms for lines of credit, equipment financing, or business loans. The significance of a well-completed credit application form cannot be overstated, as it can facilitate access to funds while also establishing a credit relationship with the lender.

Common uses of credit application forms extend across multiple industries, including banking, real estate, and retail. For instance, when applying for an auto loan, the dealership requires a credit application to assess whether the buyer qualifies for financing options. Overall, these forms are foundational to almost all credit transactions.

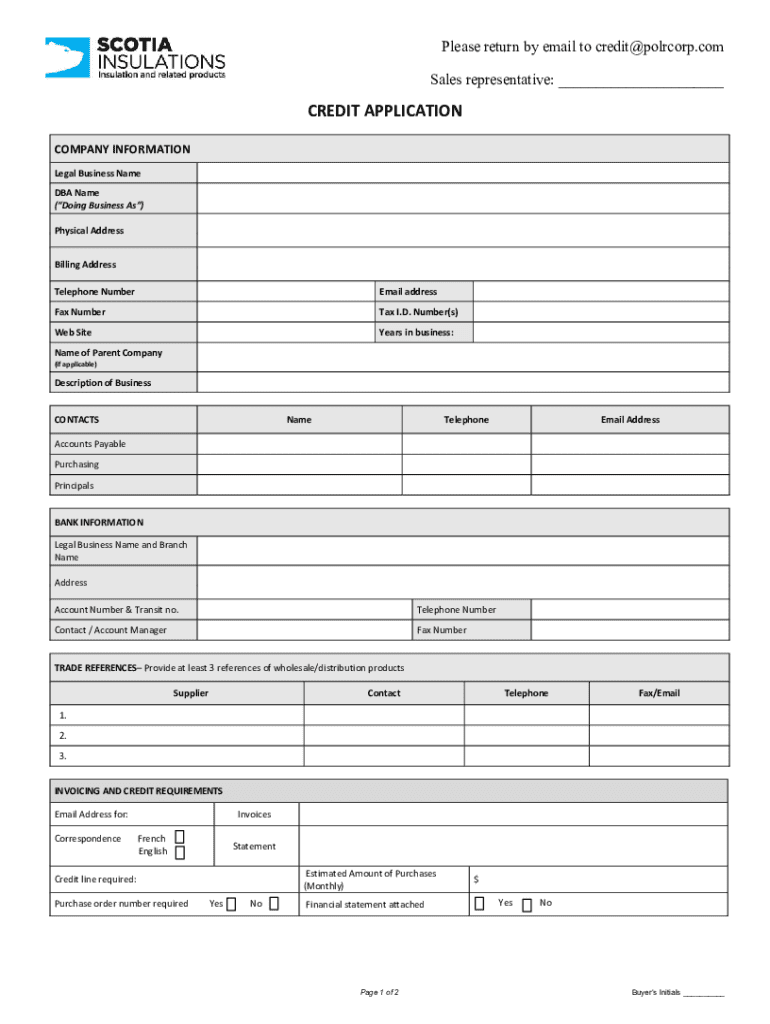

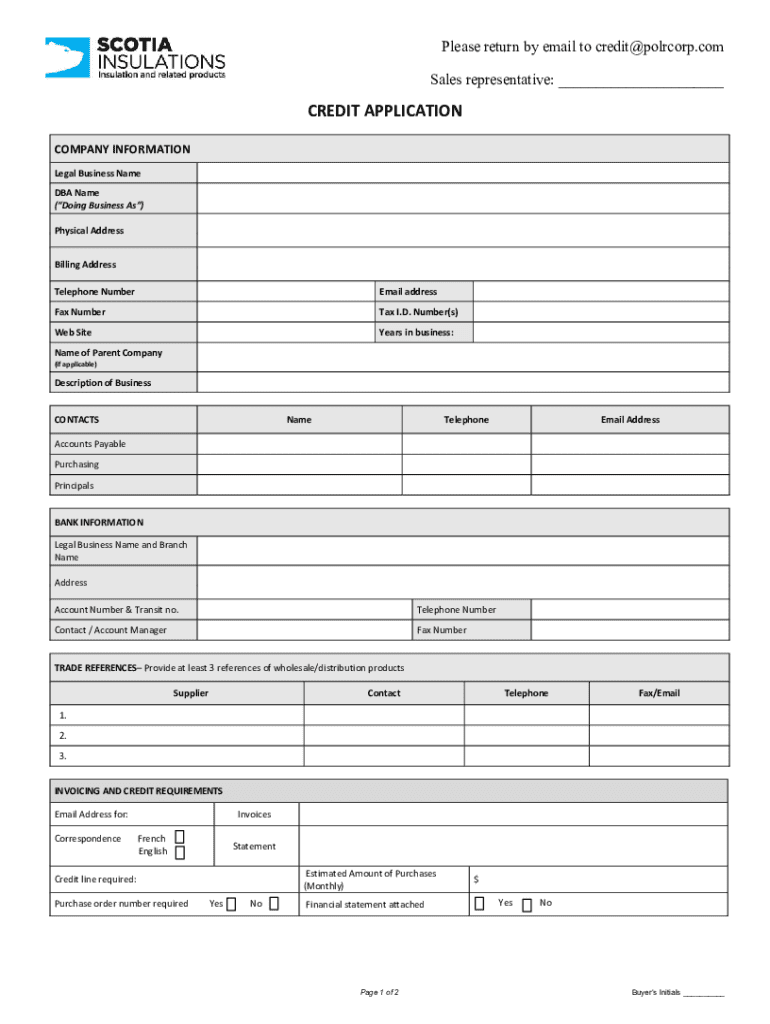

Key components of a credit application form

Filling out a credit application form might seem straightforward, but each section is significant. The primary sections typically include personal information, financial details, and consent sections, all of which gather essential data to evaluate creditworthiness.

The personal information section usually requires your name, address, and contact details. Additionally, a Social Security number or Tax ID is required for identification. Following this is the financial information section which delves into your income verification, employment details, and an assets and liabilities overview—giving lenders a clear picture of your financial standing.

Lastly, the consent and signature section assures the lender that you understand the terms and conditions of the credit application. It's crucial to disclose accurate information, as providing misleading data can lead to denial of your request or legal consequences.

How to fill out a credit application form

Filling out a credit application form requires careful attention to detail. Begin by gathering the necessary documents—this could include recent pay stubs, tax returns, and identification proofs. Essentially, having all your financial records on hand will ease the process, ensuring you don't miss any critical details.

Next, carefully complete the personal information section by providing accurate name, address, and contact details. Subsequently, report your income and employment history precisely. It's vital to be honest about your earnings, as overstating your income can lead to complications later on.

Moreover, when disclosing financial obligations, ensure you account for all debts and liabilities. Remember to double-check your entire application for accuracy and completion before submission—this helps avoid common mistakes like leaving out crucial sections or providing incorrect numbers.

Editing and customizing your credit application form

Before submitting a credit application form, it can be beneficial to edit or customize it for clarity and precision. Using tools like pdfFiller allows you to easily upload and edit your document for a clean submission. This step can enhance the presentation of your form, making it easier for lenders to read and evaluate your application.

With pdfFiller, you can utilize various editing tools to make adjustments to the document layout, font size, or format. You can also add interactive elements like checkboxes or dropdown menus to streamline responses and minimize back-and-forth communication. These personalized touches not only improve the aesthetics of your application but also make it more user-friendly.

When updating personal details—be it a change in income, address, or personal circumstances—pdfFiller allows for those modifications without necessitating a completely new application. This flexibility can save time and streamline your application process.

eSigning your credit application form

The advantages of electronic signatures are manifold. They offer convenience, expedite transactions, and enhance security. Using pdfFiller, you can easily create a digital signature to sign your credit application form from anywhere, without the need for printouts.

To sign using pdfFiller, simply create your signature within the platform. Ensure you place your eSignature in the right spot—typically at the end of the form, where it prompts for signature confirmation. It’s important to be aware of the legal acceptance of eSignatures, as regulations vary by state, though most jurisdictions recognize them as equally binding as handwritten signatures.

Managing your credit application form after submission

Once you have submitted your credit application form, staying informed about its status is crucial. Various online tools can help you monitor the approval process, with most lenders providing updates within a few business days. Knowing these timelines can help alleviate some anxiety during the waiting period.

Record keeping is equally important. Always save a copy of your application for your records. This practice not only provides a reference point for any future applications but also helps you organize your documents efficiently. Maintaining proper documentation can simplify future interactions with lenders, showing your diligence and attention to detail.

Common issues and solutions related to credit applications

Dealing with rejections can be one of the most daunting aspects of the credit application process. Applications may be denied for numerous reasons—including insufficient income, poor credit history, or incomplete forms. Understanding these reasons is the first step toward successfully reapplying. Review any feedback provided by the lender to identify areas for improvement.

Addressing potential fraud alerts is another common challenge. These alerts can arise from discrepancies in the information provided or a lender's system identifying unusual activities linked to your credit report. If you encounter a fraud alert, contacting the credit bureaus directly is essential, as they can help resolve the issue. Additionally, reaching out to your potential lenders can clarify why your application faced hurdles.

Best practices for future credit applications

Establishing a strong credit profile is key to improving your chances of future application approvals. Focus on consistent payment history and maintaining a low credit utilization ratio by keeping your debts manageable. These strategies foster a positive credit history, which is an essential factor for lenders when assessing future applications.

For those planning to apply for multiple credit opportunities, it's wise to manage inquiries efficiently. Each application may result in a hard inquiry, potentially affecting your credit score. Space out your applications and limit them to only necessary instances. This approach demonstrates responsible financial behavior to lenders, enhancing your overall creditworthiness.

Conclusion: Streamlining your credit application experience with pdfFiller

In summary, understanding and effectively navigating the intricacies of a credit application form is vital for successful credit acquisition. With pdfFiller, users can take advantage of features designed to enhance the overall application process. From editing and signing to managing documents, pdfFiller empowers individuals and teams to handle their credit forms with ease in a cloud-based platform.

By following the guidance provided in this comprehensive how-to guide, you can maximize your chances of a successful credit application while efficiently managing your documents. Leveraging technology not only improves processing speed but also helps you stay organized—seeking loans and financing solutions has never been easier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application in Gmail?

How do I execute credit application online?

How can I edit credit application on a smartphone?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.