Get the free Consequential Loss Insurance Proposal Form

Get, Create, Make and Sign consequential loss insurance proposal

Editing consequential loss insurance proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consequential loss insurance proposal

How to fill out consequential loss insurance proposal

Who needs consequential loss insurance proposal?

Consequential Loss Insurance Proposal Form - How-to Guide

Understanding consequential loss insurance

Consequential loss insurance is a specialized insurance product that covers financial losses incurred as a result of an event covered by your primary insurance policy, typically property damage. Unlike standard property insurance, which covers direct losses, consequential loss insurance focuses on losses resulting from interruptions to your business operations or supply chain due to unforeseen events. This type of insurance is crucial for businesses that rely heavily on continuous operations, as it helps mitigate the financial impact of business interruptions.

The importance of consequential loss insurance cannot be overstated. When businesses face interruptions—whether due to natural disasters, equipment failures, or other catastrophic events—they can suffer significant revenue loss. Without proper coverage, these losses can jeopardize a business's stability and future. Common scenarios include factory closures due to fire, flood damage to facilities, or supply chain disruptions caused by political unrest or global crises.

Key terms related to consequential loss insurance include coverage limits, which refer to the maximum amount the insurer will pay for a claim, and exclusions, which are specific conditions or circumstances that are not covered by the policy. Understanding these terms is vital when considering a consequential loss insurance proposal form, as they directly impact your coverage decisions.

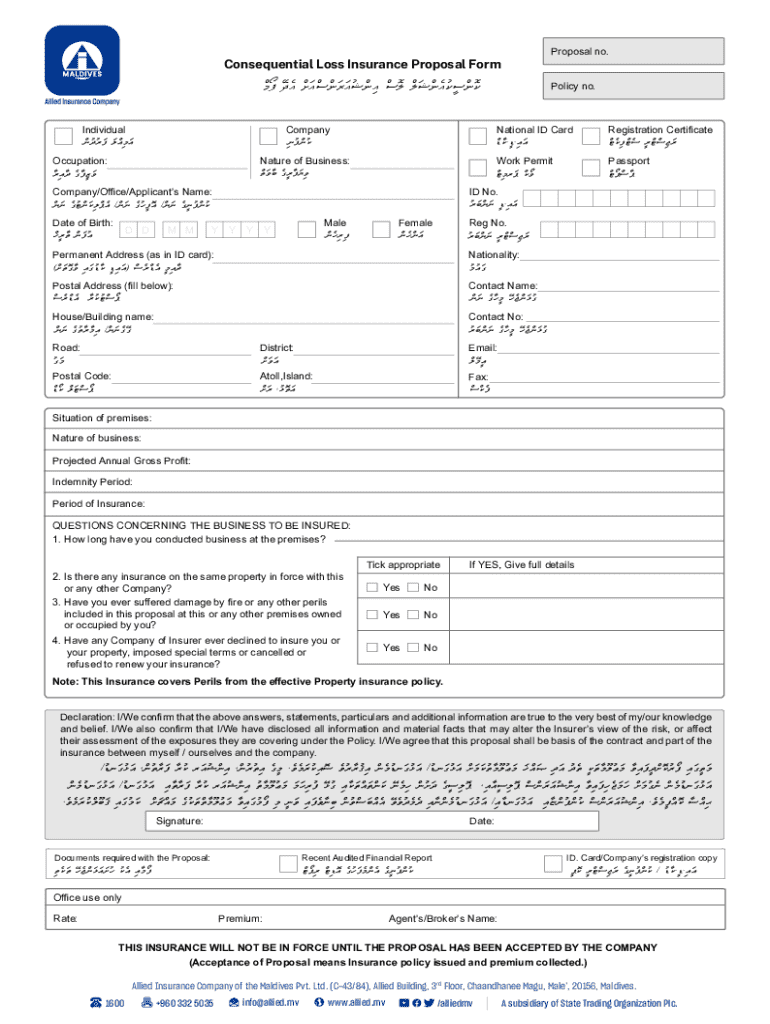

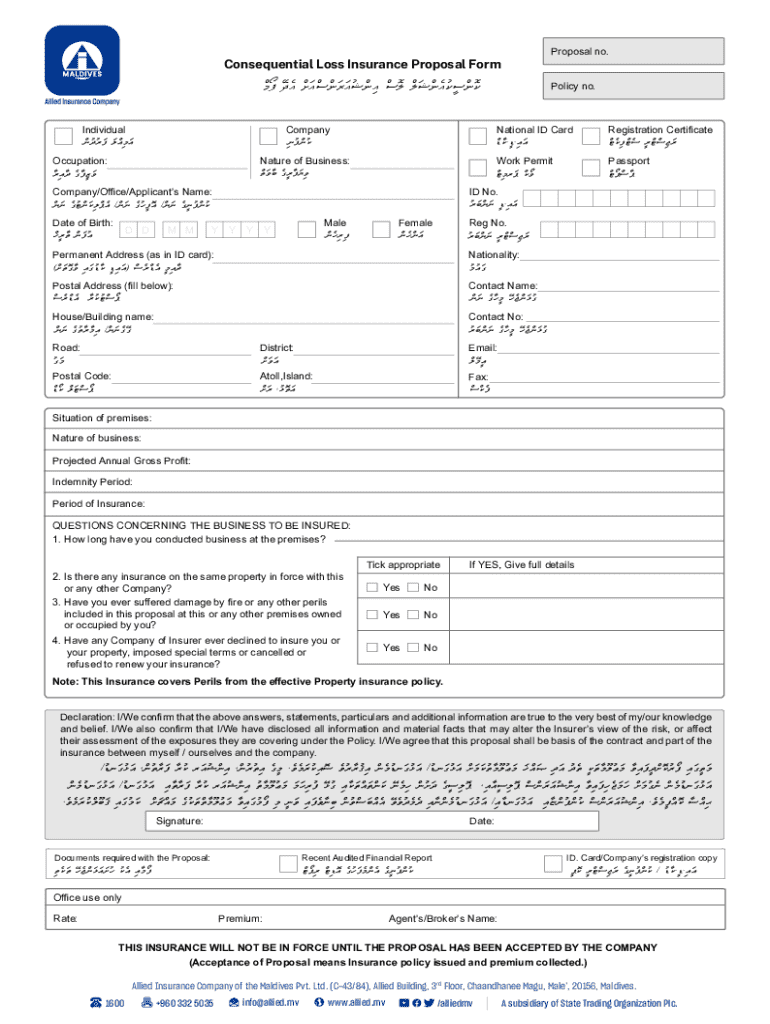

Overview of the proposal form

The Consequential Loss Insurance Proposal Form is a critical document in the application process for obtaining consequential loss coverage. It provides insurers with comprehensive information about your business, its operations, and the specific risks you face. The purpose of the form is to help insurers evaluate the risks associated with your business and determine appropriate coverage options.

Typically, the proposal form includes several key components: personal information, business details, asset descriptions, risk assessments, and proposed coverage options. Each section is designed to capture essential information that will help the insurer assess the viability and specifics of your coverage needs.

Step-by-step guide to completing the proposal form

Completing the Consequential Loss Insurance Proposal Form requires careful attention to detail and thorough preparation. Below is a step-by-step guide to assist you in filling out this important document.

Editing and collaborating on your proposal form

Using pdfFiller facilitates seamless editing of your Consequential Loss Insurance Proposal Form. With its intuitive interface, you can easily modify sections of your proposal to ensure all information is current and accurate. Additionally, the platform offers collaborative tools that allow team members to access and review the document simultaneously.

Taking advantage of pdfFiller’s features enhances the review process. Commenting tools enable quick feedback, and document history allows you to track changes, making it easier to see what adjustments have been made. For effective feedback, engage stakeholders early to gather insights and ensure that all perspectives are represented before finalizing the submission.

Signing the proposal form

Signing the Consequential Loss Insurance Proposal Form may involve specific e-signature requirements, depending on your jurisdiction and the insurers' policies. Using pdfFiller makes this process straightforward, allowing you to sign the document electronically.

To sign the document using pdfFiller, follow these steps: After completing the form, navigate to the signature section, select the e-signature option, and follow the prompts to create or upload your signature. Ensure compliance with legal standards for electronic signatures by confirming that your signature is recognized by local regulations.

Managing your proposal form post-submission

Once your Consequential Loss Insurance Proposal Form is submitted, tracking the status of your application is paramount. Using pdfFiller's document management tools, you can organize and monitor the progress of your submission, ensuring you receive timely updates from your insurer.

Effective document organization within pdfFiller aids in maintaining a clear overview of all related paperwork. Utilize folders to categorize documents by types, and employ tags for easy retrieval. This organization becomes invaluable should you need to reference documents during the claims process or review them for future updates.

Key considerations and best practices

When filling out the Consequential Loss Insurance Proposal Form, there are several common mistakes to avoid. Failing to provide complete information or underestimating asset values can lead to insufficient coverage or claims being denied.

To enhance your application’s chances of approval, ensure that your proposal is clear, concise, and backed by supporting documentation. Regularly review and update your insurance coverage, particularly after significant changes in your business operations or asset valuations, to maintain the relevance and effectiveness of your policy.

Frequently asked questions (FAQs)

When filling out the Consequential Loss Insurance Proposal Form, several common inquiries arise. Applicants often seek clarity on specific terms within the form and how they may impact their insurance coverage. For instance, what constitutes a consequential loss or the implications of certain exclusions are frequently asked questions.

Further, applicants may inquire about the best practices to enhance their proposals and increase the likelihood of approval. Understanding these elements is crucial, as they can significantly influence the success of your insurance application.

Interactive tools and resources

To facilitate the filling out of the Consequential Loss Insurance Proposal Form, pdfFiller offers a range of interactive tools that simplify document management. From templates to customizable form fields, these resources empower users to craft their proposals efficiently.

Additionally, links to helpful templates and resources are available to ensure that you have all the guidance needed for a successful submission. Should you require personalized support, pdfFiller's contact options allow you to reach out for tailored assistance throughout the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get consequential loss insurance proposal?

How do I edit consequential loss insurance proposal in Chrome?

How can I edit consequential loss insurance proposal on a smartphone?

What is consequential loss insurance proposal?

Who is required to file consequential loss insurance proposal?

How to fill out consequential loss insurance proposal?

What is the purpose of consequential loss insurance proposal?

What information must be reported on consequential loss insurance proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.