Get the free Comprehensive Policyholder Application Form

Get, Create, Make and Sign comprehensive policyholder application form

Editing comprehensive policyholder application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comprehensive policyholder application form

How to fill out comprehensive policyholder application form

Who needs comprehensive policyholder application form?

Comprehensive Policyholder Application Form - How-to Guide

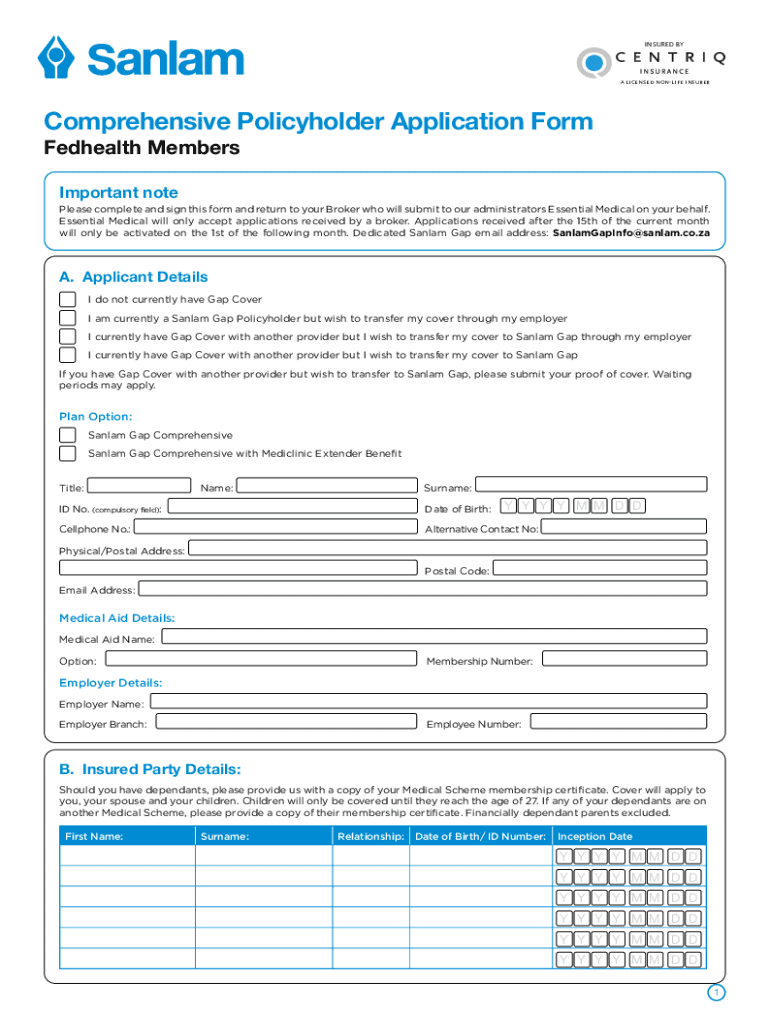

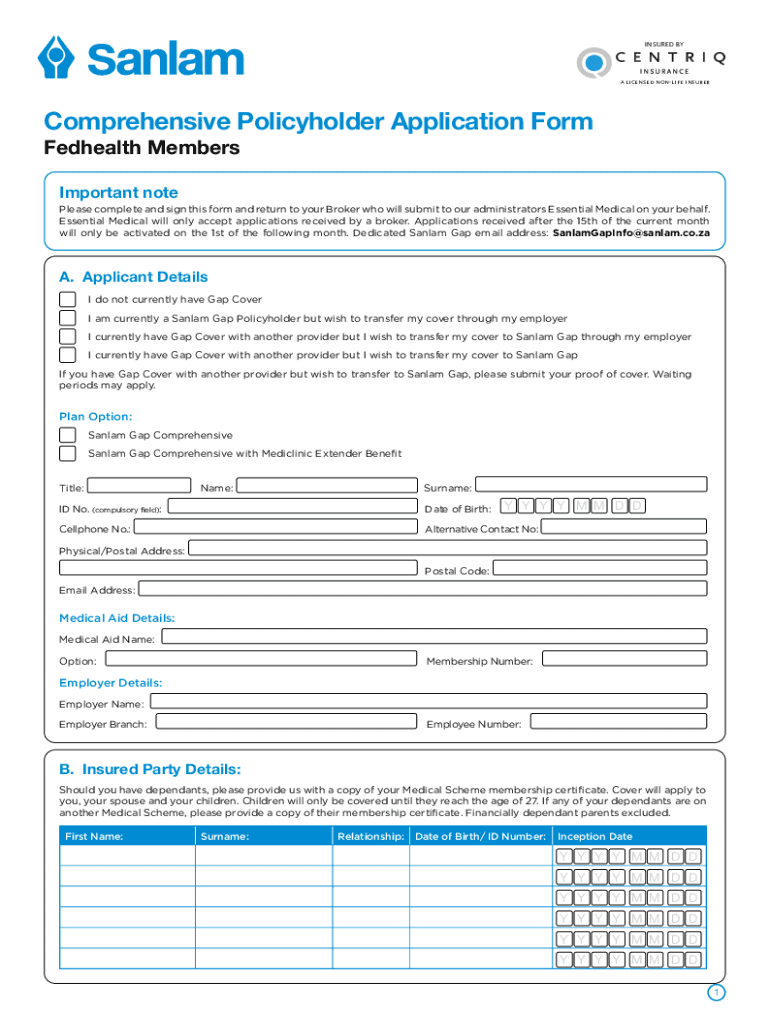

Overview of the comprehensive policyholder application form

A comprehensive policyholder application form is an essential document in the insurance industry, designed to gather vital information from individuals seeking insurance coverage. This form serves as a foundational step in the application process, ensuring that insurance providers have the necessary details to assess risk and determine policy terms. It streamlines the onboarding process and establishes a clear understanding between the policyholder and the insurer regarding the terms of coverage.

Utilizing a thorough application form is crucial for maintaining the integrity of the underwriting process. It not only assists in gathering indispensable personal, medical, and financial information but also helps in reducing errors that can arise from incomplete submissions. By leveraging tools like pdfFiller, policyholders can simplify their application management, ensuring a more efficient and user-friendly experience.

Understanding the components of the application form

The comprehensive policyholder application form consists of several key sections that applicants must complete. Understanding these components is vital for successfully filling out the form without causing delays in the application process. Let's break down the required sections:

Additionally, applicants may need to submit supporting documents, such as identification proof or medical records, to facilitate the underwriting process.

Preparing to fill out the application form

Before diving into the application, it's crucial to gather the necessary information to streamline the process and enhance accuracy. Start by collecting relevant identification documents, which will typically include a government-issued ID and a Social Security number. It's also helpful to prepare any financial background information or proof of income, as this data will be essential for establishing eligibility and determining coverage limits.

Moreover, having your medical history at hand is important; this includes prior conditions, surgeries, and current medications. By investing time in preparation, applicants can effectively minimize potential hurdles down the road.

To access the comprehensive policyholder application form, users can take advantage of pdfFiller's user-friendly platform. The following is a step-by-step guide to locate the form:

Step-by-step instructions for filling out the comprehensive policyholder application form

Filling out the comprehensive policyholder application form can seem daunting, but breaking it down into manageable steps can simplify the process. Let's go through each section methodically:

Following these steps will help ensure that you've addressed every aspect of the application, reducing the chance of missing critical information.

Editing and managing your application form

After filling out the comprehensive policyholder application form, it’s important to review and make any necessary changes. Using pdfFiller’s editing tools, users can easily add or remove information from the application form. If changes need to be made after submission, pdfFiller offers functionality for managing version control, allowing users to keep track of different versions of the document.

This document management feature enables users to maintain a clear history of changes, ensuring that they can return to previous versions if needed. Such capabilities not only enhance user efficiency but also contribute to overall compliance and organizational standards.

eSigning your application form for instant submission

Once the application form is filled out and reviewed, the next step is to sign the document electronically. PdfFiller's eSignature functionality allows users to create and apply an electronic signature with ease. This tool is not only convenient for users who may be on the move but also ensures that the application can be submitted instantaneously.

Electronic signatures are legally valid across many jurisdictions, ensuring that your application will be recognized and processed without delay. To sign your form, simply follow these steps:

Collaborating with team members on the application process

Collaboration plays a key role in managing the comprehensive policyholder application process, particularly for teams working on group policies. PdfFiller facilitates effective collaboration by allowing users to share the application with others directly through the platform. Real-time collaboration features enable team members to edit, comment, and suggest changes collaboratively, ensuring that everyone is on the same page.

Furthermore, keeping track of changes and comments made by team members enhances the final application’s accuracy and compliance. This collaborative approach not only expedites the completion of the application but also helps in building a more transparent workflow.

Common challenges and troubleshooting tips

While filling out the comprehensive policyholder application form may seem straightforward, applicants might encounter common challenges that could delay the process. These could include technical issues with the form, difficulties in understanding specific sections, or lack of required supporting documents.

If you face difficulties, pdfFiller's support offers troubleshooting tips and solutions. Some frequently encountered issues and their remedies include:

Ensuring compliance and accuracy in your application

Accuracy is paramount when completing the comprehensive policyholder application form. Providing correct information not only speeds up the processing time but also mitigates the risk of complications during the claims process. Inaccurate or incomplete applications can lead to delays or even denials of coverage, significantly impacting policyholders.

To ensure compliance, applicants should double-check their information and validate that all supporting documents align with the details in the application. Best practices for verification include:

Conclusion on managing your comprehensive policyholder application

Completing a comprehensive policyholder application form is a critical step in securing insurance coverage. By understanding the components and following structured steps, applicants can navigate the process confidently and efficiently. Emphasizing the importance of collaboration, accuracy, and the use of tools like pdfFiller will streamline future applications and document management needs.

As you embark on this journey, remember that pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. Embrace these resources to ensure that your insurance paperwork is handled with utmost efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify comprehensive policyholder application form without leaving Google Drive?

How do I fill out the comprehensive policyholder application form form on my smartphone?

How do I edit comprehensive policyholder application form on an iOS device?

What is comprehensive policyholder application form?

Who is required to file comprehensive policyholder application form?

How to fill out comprehensive policyholder application form?

What is the purpose of comprehensive policyholder application form?

What information must be reported on comprehensive policyholder application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.