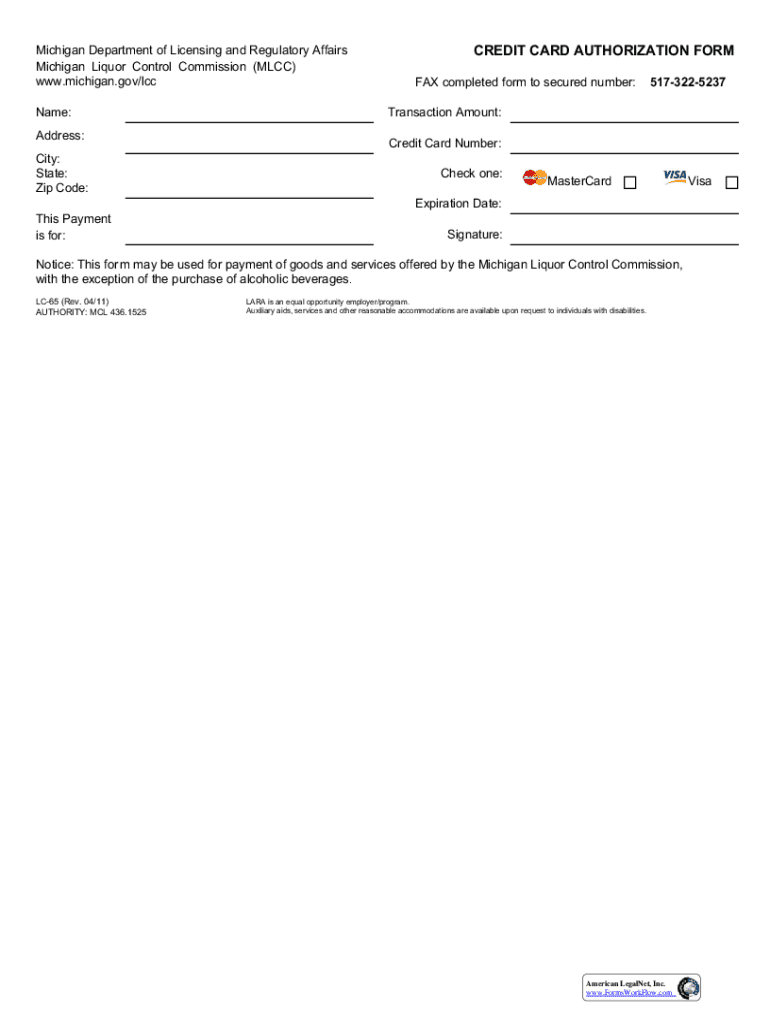

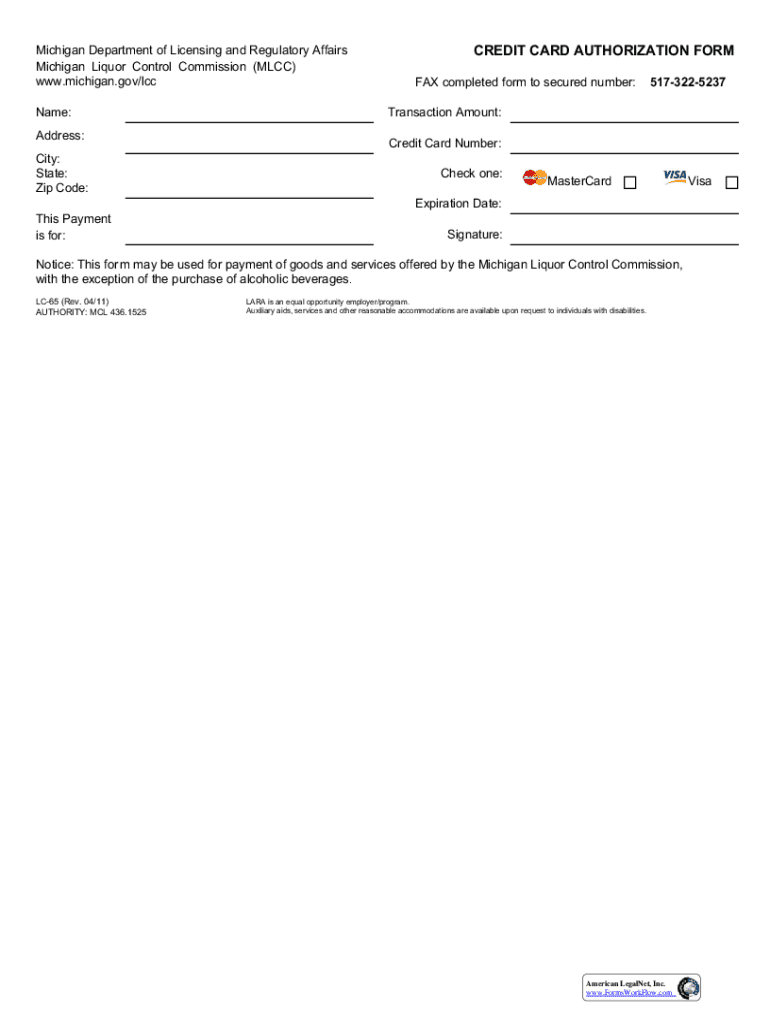

Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form is a critical document used by businesses to secure permission from customers to charge their credit cards for goods or services. This form outlines the terms of the transaction and acts as a safeguard against unauthorized charges. The importance of this document cannot be overstated, as it serves a dual purpose: it protects both the merchant and the consumer.

For businesses, a credit card authorization form is vital in minimizing the risk of fraud and chargebacks. For consumers, it offers peace of mind that their payment information is being handled securely and transparently. Key terms associated with credit card authorization forms include 'authorization', which refers to the consent given by the cardholder, and 'chargeback', which is a dispute initiated by the cardholder resulting in the reversal of a transaction.

Benefits of using a credit card authorization form

Utilizing a credit card authorization form provides several advantages for both businesses and customers. Firstly, it helps prevent chargeback abuse. Chargebacks can be costly for businesses; having an authorization form on file can provide evidence to dispute fraudulent claims. Secondly, enhanced payment security is a significant benefit. With the increasing incidences of cyber fraud, an authorization form can act as an additional layer of protection.

Improved transaction tracking is another critical benefit. Businesses can maintain accurate records of all transactions, making it easier to manage finances. Additionally, a well-structured authorization form fosters trust with customers, showing them that the business values their security and privacy. Lastly, it can streamline operational processes by ensuring that transactions are properly authorized and documented.

When to use a credit card authorization form

Credit card authorization forms should be used in various situations, particularly by sellers and service providers engaging in transactions with customers who may need to authorize payments beyond standard point-of-sale transactions. Ideal scenarios include service-based businesses, such as online subscriptions, hotels, and rental companies, where advance payments are necessary. Additionally, high-value transactions often warrant prior authorization to protect against fraudulent claims.

Best practices for requesting authorization include being transparent about the transaction and the terms, ensuring that the form is easy to fill out, and confirming that the customer understands what they are authorizing. As a rule of thumb, businesses should always prioritize obtaining authorization before proceeding with any transaction to mitigate risks associated with non-compliance.

Components of a credit card authorization form

A well-structured credit card authorization form typically includes essential elements to safeguard both the merchant and the customer. Key components include:

How to fill out a credit card authorization form

Filling out a credit card authorization form requires careful attention to detail. Start by providing accurate cardholder information, ensuring names and addresses are spelled correctly. Next, input the merchant’s information, which helps clarify the authorized recipient of the funds. In the authorization details section, input the card information securely. It is crucial to check the expiration date and CVV to prevent errors that could delay the transaction.

Common mistakes to avoid include overlooking required fields or submitting vague authorization terms. Misunderstandings can arise if the amount is unclear or if the timeframe for authorization is ambiguous. To ensure accuracy and completeness, double-check all information before submission and consult guidelines provided by the merchant.

Tips for safeguarding signed credit card authorization forms

Once a credit card authorization form is signed, safeguarding the document becomes paramount. Best practices for storing and handling these forms include implementing secure electronic storage solutions that limit access to authorized personnel only. Additionally, businesses should encrypt sensitive data to prevent unauthorized access.

Legal requirements for retention periods may vary by jurisdiction; thus, businesses must familiarize themselves with applicable laws governing document retention. Establishing a routine for auditing stored documents can further enhance security measures, ensuring that customer information remains protected at all times.

Interactive tools for managing your credit card authorization forms

pdfFiller offers robust interactive tools for managing credit card authorization forms effectively. Users can easily edit and customize forms online to suit specific business needs. The platform allows for modifications, such as adding company branding, adjusting layout, or incorporating additional clauses, enhancing the personalization of each authorization form.

Additionally, managing signed documents in the cloud simplifies record-keeping and ensures easy access for authorized users. The cloud-based system supports organized filing, making it simple to retrieve and review forms whenever necessary, thus greatly streamlining administrative tasks.

Frequently asked questions about credit card authorization forms

As with any financial document, questions about credit card authorization forms frequently arise. One common query pertains to the legal implications of using such forms. In general, having a signed authorization from the cardholder can safeguard businesses during disputes, providing a legally binding record of consent.

Handling disputes related to authorization can be complex. Businesses should maintain clear documentation and communication in cases where disputes arise due to fraud claims. Another frequent inquiry concerns the validity of electronic signatures on these forms; under many jurisdictions, electronic signatures are permissible and hold the same legal weight as handwritten ones, provided they comply with local regulations.

Real-life applications and case studies

Many businesses have successfully implemented credit card authorization forms to enhance their transaction processes. For example, a local gym utilized these forms to streamline membership payments in advance, minimizing payment disputes while reinforcing customer trust. They reported a significant decline in chargebacks and improved accountability.

Another case study involves an online consultancy that started using authorization forms for project-based payments. This approach enabled them to ensure payment before commencing work, leading to better cash flow management. By providing clear terms and securing signatures, they reported increased client satisfaction and fewer payment-related issues.

Downloadable resources

To assist users in creating their own credit card authorization forms, pdfFiller offers free downloadable templates. These customizable form options can cater to diverse business needs, making it easy to tailor the form according to individual requirements without starting from scratch.

Accessing these templates allows businesses to maintain uniformity in their processes while saving time. Users can modify the templates for specific scenarios, ensuring the authorization forms are relevant and compliant with regulations that apply to their industry.

Related topics of interest

Understanding payment processing fees and rates is crucial for businesses that handle numerous transactions. By comparing different solutions, companies can optimize their payment systems to enhance profitability. Exploring various payment solutions available for small businesses is equally important; this could involve alternating between credit card payments, online payment platforms, and mobile payment systems.

Additionally, managing customer data securely and ensuring compliance in financial transactions is increasingly relevant, as data protection regulations continue to evolve. Businesses must remain up-to-date with best practices to protect sensitive information and cultivate customer trust.

Subscribe for updates and more resources

Staying informed about new developments related to document management and financial security can greatly benefit businesses. By subscribing to pdfFiller's newsletter, users can receive timely updates, tips on form management, and informative resources that can empower them to optimize their operations.

Through these resources, users gain insights into best practices, trends in document management, and exclusive offers that enhance their experience with pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card authorization form in Gmail?

Can I edit credit card authorization form on an Android device?

How do I complete credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.