Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

The Ultimate Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form serves as a contract between a customer and a business, authorizing the latter to charge a specified amount to the customer's credit card. This form is essential for various transaction types, especially in environments where physical card presence isn't possible. Its purpose is not only to gain permission for the charge but also to protect both the consumer and the merchant from unauthorized usage.

As online transactions proliferate, the security of these forms has become more vital. Making sure all information is accurately captured and securely stored protects against fraud, chargebacks, and potential legal ramifications for not verifying transactions adequately.

The importance of using a credit card authorization form

Using a credit card authorization form significantly reduces the risk of chargebacks. Chargebacks occur when a customer disputes a transaction, and without proof of authorization, businesses may face financial losses and increased fees from their payment processors. An authorization form acts as a protective measure, providing documented consent that can be referenced if a dispute arises.

Additionally, there are specific industries where the use of these forms is crucial; businesses such as eCommerce retailers and subscription services rely heavily on credit card authorization forms to secure recurring payments. By implementing these forms, they can validate customer's consent and ensure that transactions proceed smoothly.

Steps to complete a credit card authorization form

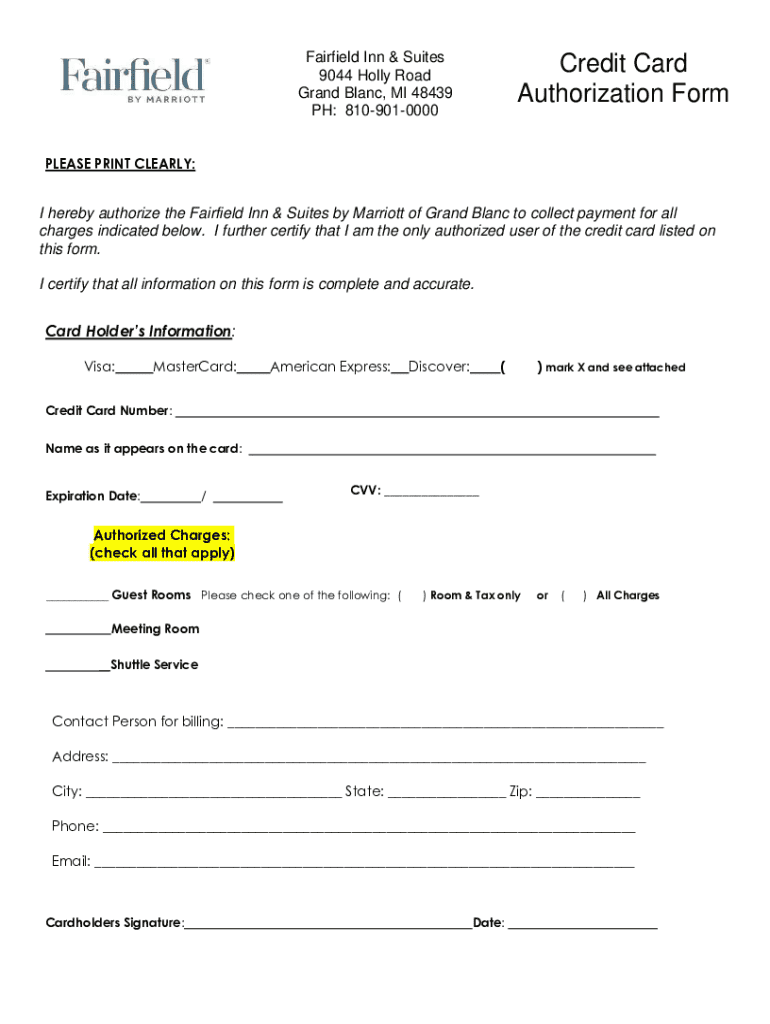

Completing a credit card authorization form involves accurately filling out several key sections. It's essential to include details like the cardholder's name, credit card number, and expiration date. Each of these fields must be meticulously checked to avoid errors that could lead to transaction failure or disputes.

Additionally, consider including optional security features such as the CVV code and the billing address to further validate transactions. These layers of security enhance the authenticity of the transaction, making it harder for unauthorized parties to misuse the card.

After completing the form, it’s imperative to get it e-signed. E-signatures are widely accepted and can significantly streamline the approval process. Platforms like pdfFiller make it easy to obtain electronic signatures, ensuring both parties can finalize the authorization without the need for physical correspondence.

Managing your credit card authorization forms efficiently

Once you've collected credit card authorization forms, managing and storing them securely is of utmost importance. Businesses must adhere to legal considerations concerning document retention, ensuring that all forms are securely stored and easily retrievable if needed.

Digital storage solutions, especially cloud-based options, provide robust security while allowing for easy access. pdfFiller equips users with the ability to manage templates and signed documents seamlessly, thereby improving overall efficiency.

How to edit and update authorization forms

Situations may arise where credit card authorization forms need to be edited or updated, whether due to changes in company policy or updates in payment processing regulations. Knowing how to navigate the pdfFiller platform allows for quick revisions while ensuring compliance is met.

Users can easily create, save, and modify templates in a few simple steps. This ensures that forms remain current and aligned with good practices while simplifying the process of gathering necessary approvals.

Common questions about credit card authorization forms

Understanding the nuances of credit card authorization forms often leads to questions. Individuals often wonder whether they are legally obligated to use such forms. While not mandated by law, utilizing an authorization form is a best practice that bolsters transaction security and reduces risks.

Another common query involves the absence of a CVV field on certain forms. This might seem unusual, but in specific contexts, it may be deemed unnecessary. However, always consider including it for added security.

Troubleshooting common issues

Sometimes credit card authorization forms may face rejection during processing. When this happens, the best course of action is to verify the details entered on the form against the customer's card information. Any discrepancies can lead to a rejected transaction, highlighting the importance of accuracy.

Additionally, addressing customer concerns swiftly builds trust. If customers express doubts or issues related to filling out the forms, provide them with clear, concise instructions.

Downloading and customizing templates

For those seeking to create their credit card authorization forms, pdfFiller offers free templates that can be easily downloaded. Users can find templates suited to their industry and customize them to fulfill specific needs.

The process to customize is straightforward; just select the desired template, make necessary changes, and save. Users can take advantage of a variety of interactive tools that enhance usability, including features for real-time editing.

Utilizing interactive tools for form creation

pdfFiller enhances form creation through interactive tools, allowing users to drag-and-drop fields and modify the layout to their liking. Such features improve the usability of credit card authorization forms and help businesses create professional-looking documents tailored to their audience.

Expanding your knowledge: related topics to explore

Staying informed on how to set up recurring payments and ensure transaction safety is vital in today's fast-paced digital environment. Engaging with additional articles related to payment processing and secure billing can provide further insights and enhance your understanding of effective practices.

Keeping up with industry practices

The world of payment processing is continually evolving, and staying up-to-date with the latest trends and technologies is crucial. Businesses must adapt to new payment mechanisms and consumer preferences. Regularly reviewing updated information helps in making informed decisions about credit card authorizations and security measures.

Join our community

Subscribing to the pdfFiller newsletter offers great benefits, including tips, updates, and resources on document management and electronic signatures. By joining the pdfFiller user community, you stay equipped with the knowledge and tools crucial for maximizing document efficiency and security.

Explore more solutions

Consider exploring more articles and guides available on pdfFiller about document management and electronic signatures to leverage the full potential of the platform. These resources not only enhance your understanding but also help in optimizing your workflow in document creation and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

How can I get credit card authorization form?

Can I sign the credit card authorization form electronically in Chrome?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.