Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-to Guide

Understanding the credit card authorization form

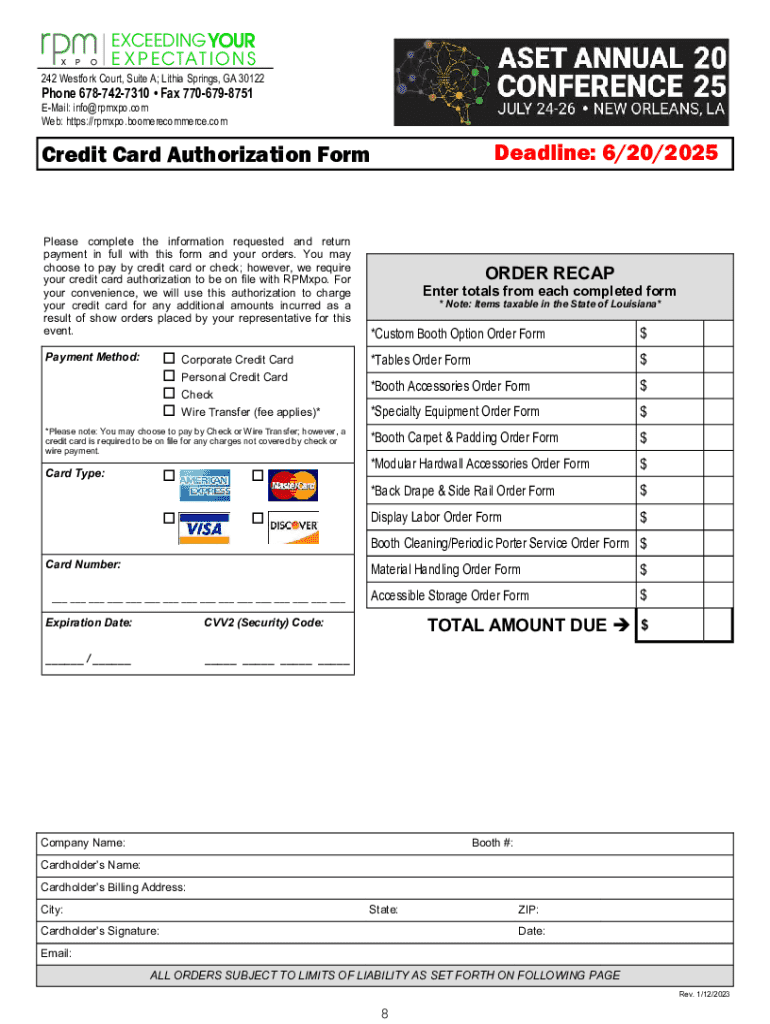

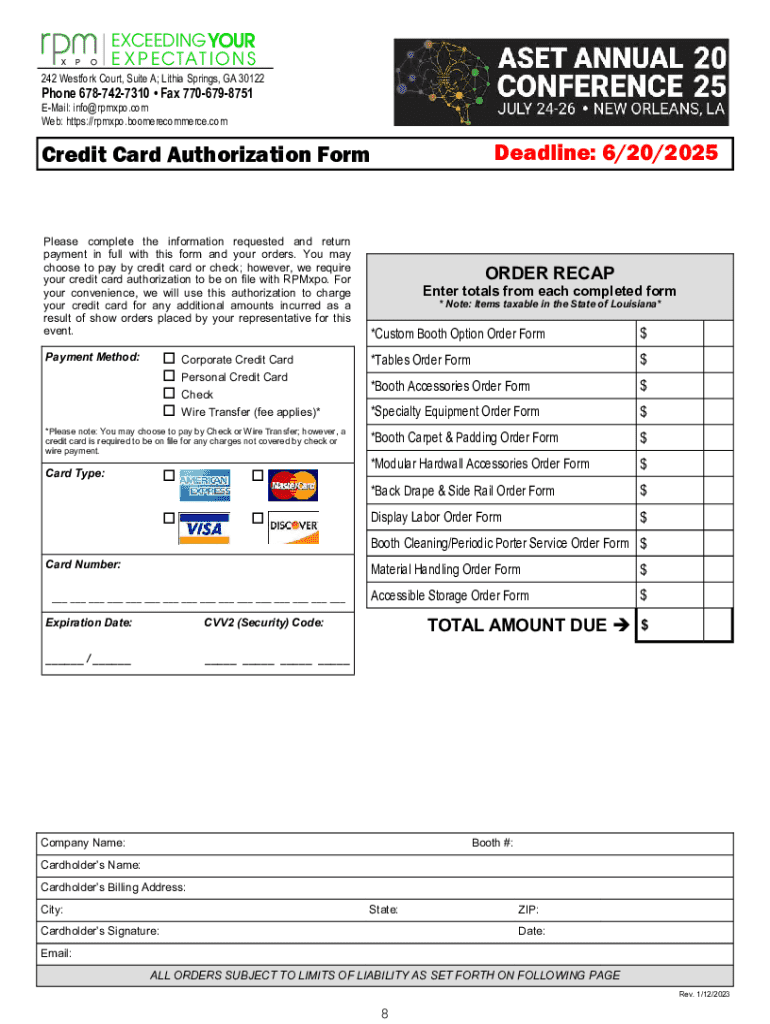

A credit card authorization form is a document that allows a business to charge a customer's credit card for goods or services. This form acts as a legal agreement between the cardholder and the merchant, ensuring that the latter has permission to charge the specified amount to the cardholder's account. Businesses often use these forms to protect themselves against unauthorized transactions and ensure that their payment processes are secure and efficient.

The importance of credit card authorization forms lies in their role in financial transactions. They prevent fraud by confirming the cardholder's identity and outlining the specifics of the transaction. Typically, anyone who processes credit card payments, including online retailers, service providers, or subscription services, needs a credit card authorization form. This ensures that they operate within legal boundaries and maintain trust with their customers.

Key components of a credit card authorization form

A well-structured credit card authorization form contains several essential elements that protect both the merchant and the cardholder. These include:

Common mistakes when filling out a credit card authorization form include providing incorrect card details, failing to specify the transaction amount accurately, or not reading the terms and conditions thoroughly. Ensuring accuracy and compliance with all necessary elements is crucial for the form's validity.

Benefits of using credit card authorization forms

Utilizing a credit card authorization form offers multiple benefits to businesses and consumers alike. One of the most significant advantages is preventing chargeback abuse. When the authorization is documented, it serves as evidence that the customer agreed to the transaction, which can protect merchants from losing revenue due to disputes.

Moreover, these forms enhance the security of customer information. By processing payments through a structured authorization, sensitive data is handled more responsibly, minimizing the risk of theft or fraud. This structured approach also streamlines payment processing, as both parties have a clear agreement on the transaction details.

Additionally, by using credit card authorization forms, businesses can enhance transparency and build customer trust, as individuals are more likely to feel secure about transactions that have clear terms and protections.

Legal considerations surrounding credit card authorization forms

While using credit card authorization forms is generally recommended, the legal obligation to use them can depend on the nature of your business and the jurisdictions in which you operate. For example, e-commerce businesses may be required to document authorization to comply with PCI DSS (Payment Card Industry Data Security Standard) requirements.

Understanding state and federal regulations surrounding credit card processing is essential for compliance. Violations can lead to penalties or increased chargeback rates. Therefore, merchants should implement best practices, such as keeping records for audit purposes and reviewing their form’s legality.

How to fill out a credit card authorization form

Filling out a credit card authorization form correctly is crucial to ensure that both the merchant's rights and the cardholder's protections are enforced. Here’s a step-by-step guide for individuals:

For businesses guiding clients in completing the form, it’s important to provide clear instructions and ensure that customers understand each part of the form, highlighting the importance of accuracy and security.

Storing and managing signed credit card authorization forms

Storing signed credit card authorization forms requires a thorough understanding of data protection practices. When discussing 'Card on File', it refers to the practice of keeping customer payment information securely stored for future transactions. While convenient, it’s essential to understand the implications for customer privacy and security.

Secure storage solutions, such as encrypted cloud storage or physical safes, should be employed to protect signed forms. Additionally, businesses should be aware of the recommended retention period for forms, typically ranging from three to five years, depending on legal requirements and business policies.

Frequently asked questions (faq)

Here’s a look at some common questions regarding credit card authorization forms:

Interactive tools for creating credit card authorization forms

pdfFiller offers an array of features that make it simple to customize credit card authorization forms. Users can leverage the platform to create professional-looking forms tailored to their specific business needs, enhancing efficiency greatly.

Crafting a credit card authorization form online through pdfFiller only takes minutes. The platform's intuitive interface guides you through the customization process. Additionally, pdfFiller facilitates eSigning and efficient document management, further streamlining the transaction process for both merchants and consumers.

Additional resources for businesses

To ensure effective credit card payment acceptance, businesses should consider various resources available. Understanding credit card processing fees can significantly impact profit margins, so businesses should evaluate their processing partners and explore competitive rates.

Moreover, resources focusing on improving customer data security can protect your business from potential threats. Educating your staff on data handling best practices contributes to maintaining customer trust.

Real-world applications of credit card authorization forms

Numerous businesses have successfully integrated credit card authorization forms into their transaction processes. For instance, a retail store implementing these forms noted a significant decrease in chargebacks and disputes due to clear documentation of authorization.

Moreover, leading businesses in the hospitality industry applied credit card authorization forms during bookings to secure transactions, thereby enhancing customer trust and ensuring compliance with industry regulations.

Related topics to explore

Exploring related topics, such as optimizing the online payment process or tips for reducing chargeback rates, can be beneficial. Likewise, investigating alternative payment solutions may present new opportunities for your business, particularly in today's fast-evolving commerce environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form for eSignature?

Can I create an electronic signature for the credit card authorization form in Chrome?

How do I complete credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.