Get the free Cfs 912

Get, Create, Make and Sign cfs 912

Editing cfs 912 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cfs 912

How to fill out cfs 912

Who needs cfs 912?

A Comprehensive Guide to the CFS 912 Form

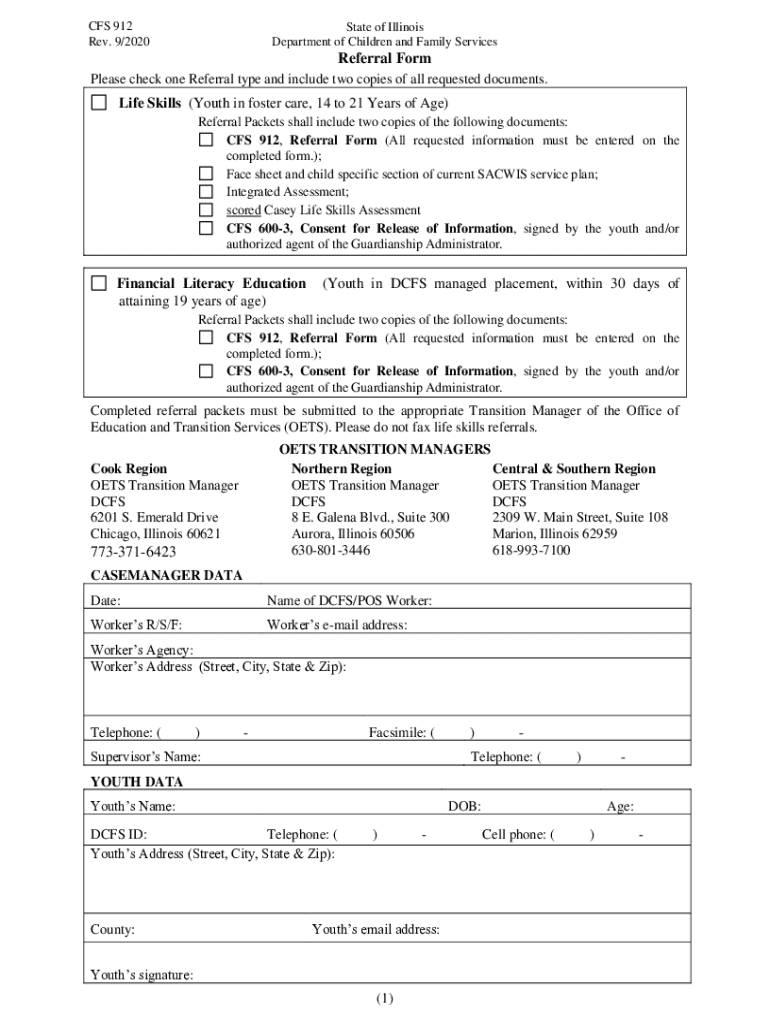

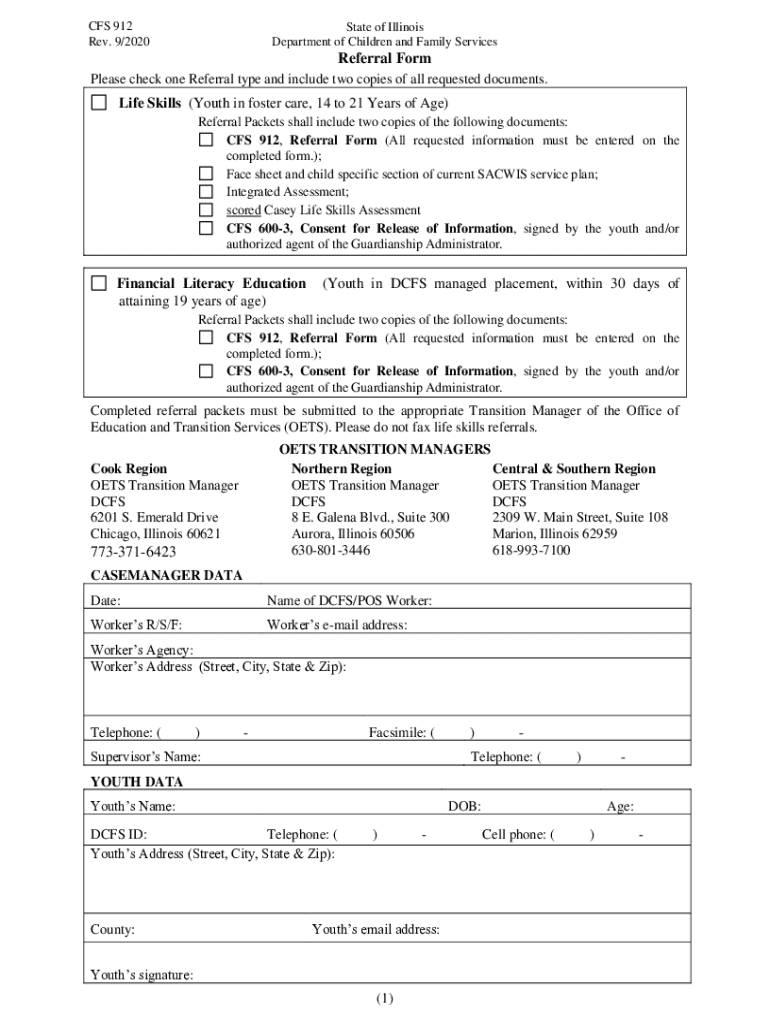

Understanding the CFS 912 Form

The CFS 912 form is a crucial document often utilized in financial reporting and compliance. It serves as a standardized tool that enables organizations to convey specific fiscal information effectively. The importance of the CFS 912 form cannot be overstated, as it not only ensures adherence to regulatory requirements but also enhances transparency in financial disclosures.

In the realm of finance, the CFS 912 form helps streamline the process of reporting and collects essential data that stakeholders need to evaluate an organization’s financial standing. By utilizing this form, companies can establish a clear record of their financial transactions and ensure compliance with federal and state regulations.

Who needs to use the CFS 912 form?

The primary users of the CFS 912 form include financial officers, accountants, and compliance professionals within organizations that are subject to financial regulations. This form is particularly vital for entities in regulated industries, such as banking, insurance, and any publicly traded companies that must adhere to stringent financial reporting standards.

Scenarios where the form is required can vary significantly. For example, when an organization applies for a loan or seeks to provide financial transparency to investors, the CFS 912 form becomes a crucial document. Moreover, whether companies are in initial public offerings (IPOs) or managing annual audits, they may be asked to present this form.

Key features of the CFS 912 form

The CFS 912 form is organized into several essential sections, each serving a distinct function. Among these sections, users often encounter a header that includes basic information such as the organization's name, contact details, and the reporting period. Following this header, the form details specific financial metrics, including revenue, expenses, and asset valuations.

Each section is meticulously designed to guide users in reporting accurate figures consistently. Understanding each section and its significance aids in ensuring that the data presented is not only complete but also compliant with necessary regulations.

Common terminology

To help users navigate the complexities of the CFS 912 form, familiarity with common terminology is vital. Below are some key terms often included in this financial document:

Step-by-step guide to filling out the CFS 912 form

Completing the CFS 912 form requires preparation and attention to detail. To start, gather all necessary documents, including financial statements, balance sheets, and cash flow reports. Organizing this data ahead of time will streamline the completion process and help in avoiding unnecessary delays.

As you move to fill out the form, it's crucial to take a systematic approach. Below are detailed instructions on filling out each section of the CFS 912 form:

Avoid common mistakes such as overlooking required sections or miscalculating financial figures, both of which can lead to compliance issues. By ensuring accuracy, organizations can better meet their reporting obligations.

Editing and customizing your CFS 912 form

Once you have completed your CFS 912 form, you might find it helpful to utilize interactive editing tools to ensure your document meets professional standards. Using platforms like pdfFiller offers many features for editing your PDF forms seamlessly.

To edit your CFS 912 form in pdfFiller, follow these steps:

In addition, adding a digital signature is a straightforward process when using pdfFiller. You can sign your document electronically, which not only saves time but also enhances your document management practices. Digital signatures expedite approvals and enhance the security of your documents.

Submitting and managing your CFS 912 form

Once your CFS 912 form is filled out and finalized, submission is the next crucial step. Various options are available for submitting your completed form, including electronic submission through available financial platforms or direct mail depending on specific instructions provided for your context.

The following guidelines can ensure smooth submission:

Additionally, you can utilize pdfFiller’s tools to track your submission status, helping you stay organized and informed about your documents.

Utilizing additional features of pdfFiller

pdfFiller offers more than just basic functionality for the CFS 912 form—it provides several additional features that enhance teamwork and streamline workflows. Collaboration tools allow teams to work on forms simultaneously, increasing efficiency and ensuring accuracy.

Users can also access templates and previous forms saved on pdfFiller, making it easier to duplicate information and save time. With ongoing document management capabilities, organizations can ensure a consistent and streamlined process for all documentation beyond just the CFS 912 form.

Collaboration tools for teams

For teams working on the CFS 912 form, collaboration tools in pdfFiller enable real-time interaction. This feature not only enhances productivity, but it also reduces the chances of errors that can occur when documents are passed back and forth. Utilizing comments and highlight functions ensures that all team members are on the same page and can contribute effectively.

User testimonials and success stories

Feedback from users has indicated significant improvements in workflow efficiency when utilizing pdfFiller for the CFS 912 form. Many users have reported smoother submission processes and enhanced collaboration among team members.

These testimonials highlight how pdfFiller's features, such as eSignature capabilities and document tracking, have transformed their experiences, making the cumbersome task of financial reporting much easier.

Related forms you may be interested in

In addition to the CFS 912 form, several related forms can assist in financial reporting and compliance. Some of these include:

Users can access these forms through pdfFiller, which provides a comprehensive library of templates for various financial documents, streamlining the process of form completion and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cfs 912 online?

How can I edit cfs 912 on a smartphone?

How do I edit cfs 912 on an iOS device?

What is cfs 912?

Who is required to file cfs 912?

How to fill out cfs 912?

What is the purpose of cfs 912?

What information must be reported on cfs 912?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.