Get the free CDFI CERTIFICATION APPLICATION & RELATED TOOLS

Get, Create, Make and Sign cdfi certification application amp

How to edit cdfi certification application amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdfi certification application amp

How to fill out cdfi certification application amp

Who needs cdfi certification application amp?

CDFI Certification Application AMP Form: A Comprehensive Guide

Understanding CDFI certification

CDFI certification signifies an organization's commitment to serving underserved communities. The Community Development Financial Institutions (CDFI) Fund, part of the U.S. Department of the Treasury, grants this certification to institutions that provide financial services to low-income and disadvantaged populations. Acquiring CDFI certification not only enhances an organization's credibility as a community-focused financial entity but also unlocks access to capital and resources, propelling growth opportunities and enabling more significant community impact.

Organizations that achieve CDFI certification can benefit from various federal funding programs and the ability to collaborate with other certified institutions. This recognition is crucial for those seeking to enhance their operational capacity and broaden their outreach.

Who qualifies for CDFI certification?

To qualify for CDFI certification, organizations must primarily serve low-income individuals or communities. Eligible entities include credit unions, banks, loan funds, and venture capital funds, among others. The application process scrutinizes whether the organization meets specific criteria, such as the focus on community investment and outreach strategies tailored towards underserved markets.

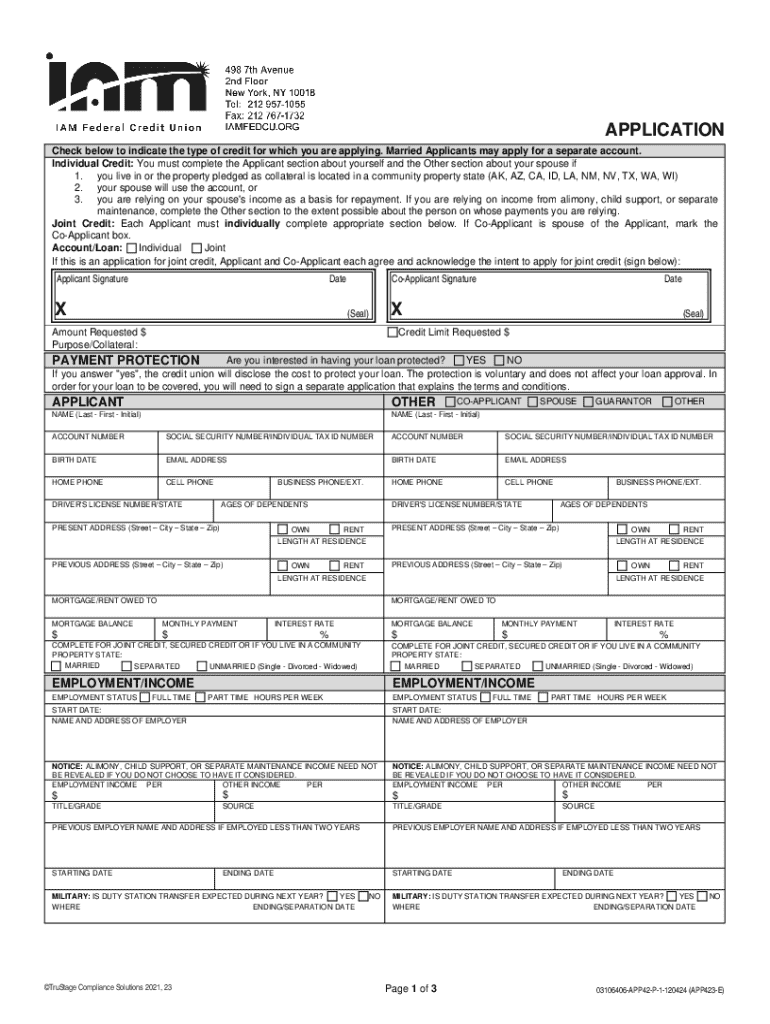

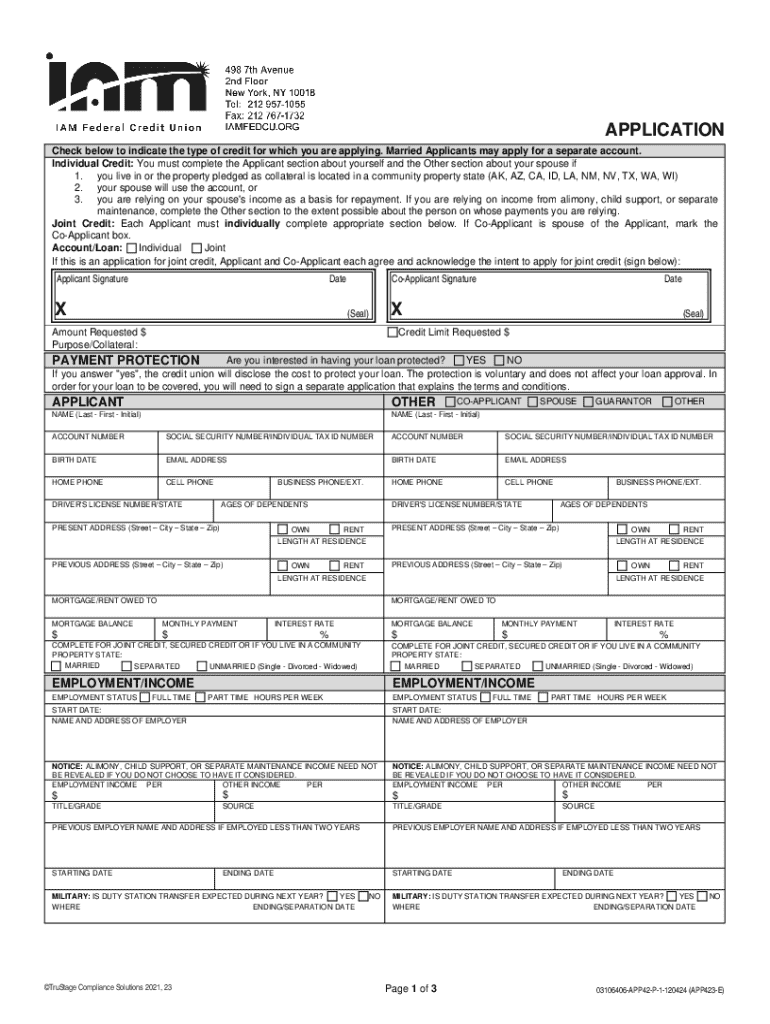

Overview of the CDFI certification application process

The CDFI certification application process involves several steps that potential applicants must navigate carefully to ensure successful submission. Initially, organizations are encouraged to review the official CDFI certification application guidelines thoroughly. Once the prerequisites are assessed, applicants must gather necessary documentation, which will later support their claims during the evaluation phase.

Common pitfalls include incomplete or inaccurate documentation, insufficient proof of community engagement, or missed deadlines for submission. It is critical to maintain meticulous records and stay updated with notification timelines for a smooth application process.

Timeline for application approval

The timeline for CDFI certification approval varies based on several factors. Generally, the review process can take anywhere from 3 to 6 months after the submission date. Factors influencing this timeline include the completeness of the application, the volume of applications being processed, and the need for any additional information during the evaluation.

Essential components of the CDFI application

When completing the CDFI certification application, ensuring the accuracy and comprehensiveness of each required document is crucial. Applicants should prepare a robust portfolio that includes everything from financial statements to evidence of community engagement. Some essential documents include organizational bylaws, governance structure, and impact measurement strategies.

Organization of documentation is vital; utilizing tools like pdfFiller enables seamless editing and planning, leading to a more efficient application process.

Required documentation

Interactive tools for application management

Utilizing interactive tools can significantly simplify the application preparation process. With pdfFiller, applicants can create, edit, and manage CDFI application documents seamlessly. The platform's features allow for electronic signature collection, ensuring compliance with requirements while reducing the time spent on document handling.

Moreover, collaboration options enable teams to work together, inviting feedback in real-time, which enhances the document’s accuracy and readiness before submission.

Using pdfFiller for document creation and submission

Tips for a successful CDFI application

Completing the CDFI certification application is a detailed and sometimes daunting task, but several best practices can enhance the chances of success. Successful applicants often emphasize the importance of aligning their mission statement with the core tenets of community development. Articulating a clear vision and measurable outcomes can resonate well with evaluators.

Providing examples of community impact along with robust financial projections can also be highly beneficial. These elements not only demonstrate organizational capabilities but also strengthen the application by providing evaluators with a tangible understanding of the applicant's contributions.

Common mistakes to avoid

While many organizations strive for success, common mistakes can hinder their applications. Overlooking details within the application form, providing ambiguous information, or failing to include required documents can lead to delays and possible rejection. Ensuring that all sections of the application are thoroughly completed and double-checked for accuracy is paramount.

Assessing your organization's readiness

Before initiating the application process, conducting a self-assessment can help organizations gauge their preparedness. It’s beneficial for applicants to ask themselves key questions about their community engagement strategies, financial health, and mission alignment. By identifying strengths and weaknesses, organizations can tailor their approach to meet certification requirements effectively.

Self-assessment checklist for CDFI certification

Resources and support for applicants

Numerous resources exist to aid organizations in the CDFI certification process. Various nonprofit organizations, community groups, and CDFI training institutes can provide valuable guidance. Online forums allow applicants to exchange experiences and advice, fostering a supportive network.

Contacts and networks for assistance

Webinars and workshops on CDFI certification

Participating in webinars and workshops dedicated to CDFI certification can further orient applicants. Such educational sessions often feature experts who share best practices and advice on successfully navigating the certification process.

Real-world success stories

Successful CDFI certifications can inspire new applicants. Case studies of organizations that have not only received certification but also thrived post-approval provide valuable insights. These examples highlight how certification has allowed them to expand their services or enter new markets, further benefiting their target communities.

Case studies of successful CDFI certification

Testimonials from certified CDFIs

Hearing from organizations that have successfully navigated the application process can be invaluable. Testimonials from certified CDFIs often reveal both challenges overcome and strategies employed to achieve their goals, emphasizing the long-term advantages of certification.

Navigating post-certification responsibilities

Once certified, maintaining CDFI status is essential. The CDFI Fund expects organizations to continue meeting operational and reporting requirements, preserving their credibility as community-focused entities. Regular reporting showcases ongoing impact, ensuring organizations retain their certification while promoting transparency.

Leveraging certification for future growth

Successfully obtaining CDFI certification opens doors to numerous opportunities. Certified organizations can attract new funding sources, develop key partnerships, and potentially enhance their reputational standing. Such advantages can facilitate growth and sustainability, ultimately magnifying their impact within the communities they serve.

Frequently asked questions (FAQs)

Throughout the application process, numerous questions may arise. Understanding prevalent inquiries can ease uncertainty and provide clarity. Queries often range from technical application issues to concerns about documentation details.

CDFI certification application clarifications

Troubleshooting common issues

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cdfi certification application amp to be eSigned by others?

How do I fill out cdfi certification application amp using my mobile device?

How do I edit cdfi certification application amp on an iOS device?

What is cdfi certification application amp?

Who is required to file cdfi certification application amp?

How to fill out cdfi certification application amp?

What is the purpose of cdfi certification application amp?

What information must be reported on cdfi certification application amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.