Get the free Ct401-n

Get, Create, Make and Sign ct401-n

Editing ct401-n online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct401-n

How to fill out ct401-n

Who needs ct401-n?

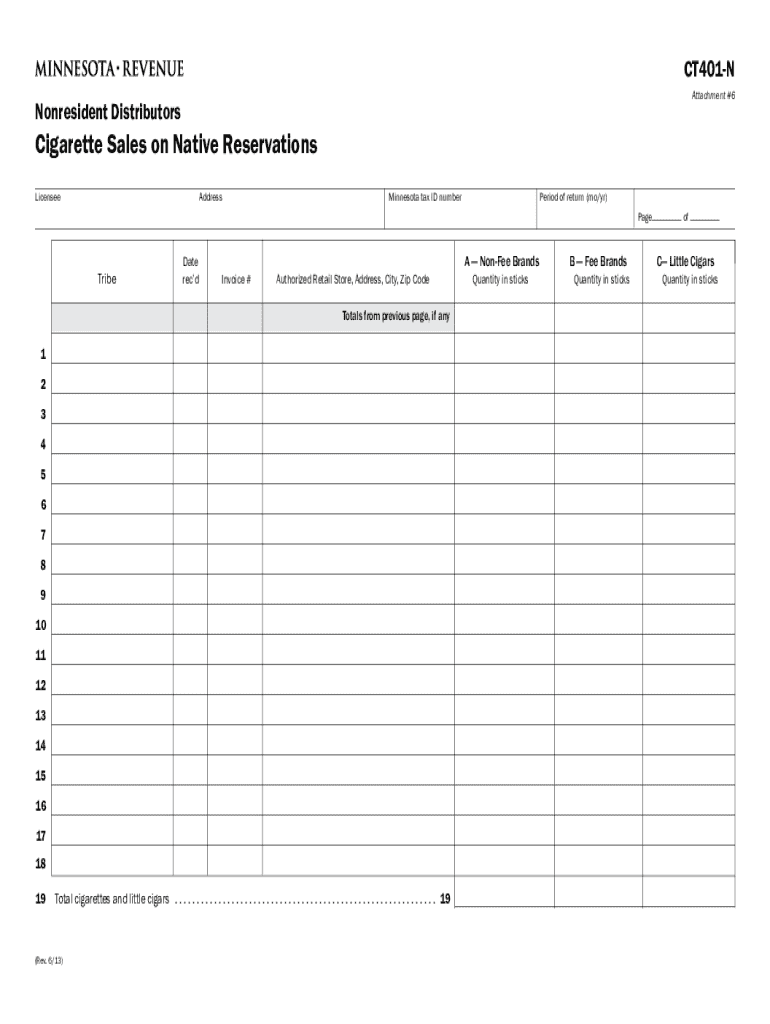

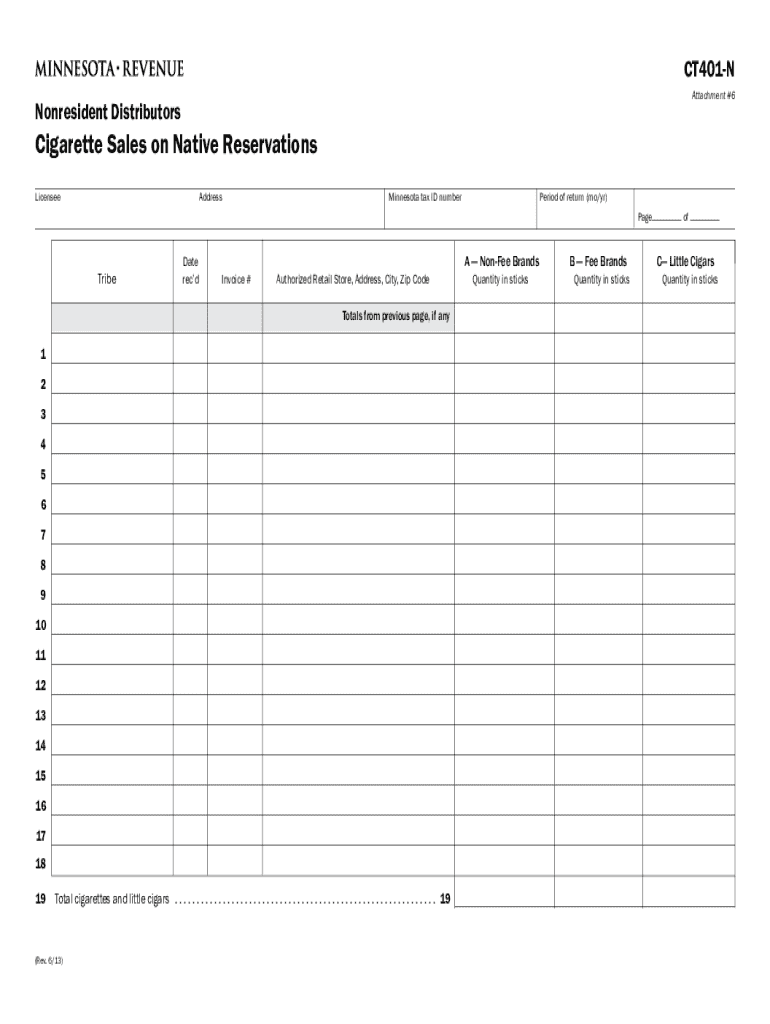

Comprehensive Guide to the CT401-N Form

Understanding the CT401-N Form

The CT401-N form is a pivotal document utilized in specific jurisdictions for regulatory compliance and reporting of financial data. Its significance lies in ensuring transparency and accuracy in fiscal activities, thus aiding governmental oversight and facilitating public trust.

Designed primarily for entities involved in certain financial transactions—ranging from individuals to businesses—the CT401-N form acts as a standardized tool for reporting income, verifying tax liabilities, and fulfilling state mandates.

How to access the CT401-N form

Accessing the CT401-N form is straightforward. It is typically available for download through official government websites or authorized platforms. For convenience, you can also visit pdfFiller, where it is hosted alongside editing and e-signature tools.

To ensure you have the most current version, regularly check the website or local tax authority updates. Version control is crucial for compliance and accuracy in your submissions.

Filling out the CT401-N form

Filling out the CT401-N form accurately is essential to meet compliance requirements. The form typically includes several sections where you will need to provide personal identification, financial disclosure, and compliance-related data.

Start by gathering all necessary personal information such as your name, address, and Social Security number. Next, you will need to report your income sources, tax liabilities, and any deductions you are claiming. This typifies critical information that the state uses to assess your tax liability.

Editing the CT401-N form

Once your CT401-N form is downloaded, you may find the need to edit certain sections for accuracy. Using tools available on pdfFiller allows for easy revisions. Such tools let you add text, change existing information, or delete unnecessary entries.

Collaboration is made simpler with pdfFiller, as it provides features for multiple users to edit the document simultaneously. This is particularly useful for teams working together on a single form.

Signing the CT401-N form

To complete the CT401-N form, it often requires a signature. pdfFiller enables eSigning, allowing users to sign documents electronically, which is both efficient and legally binding. This feature has made the signing process more versatile and time-saving.

Legal validity of digital signatures is upheld under many jurisdictions, meaning you can submit your CT401-N form with confidence. If you require multiple signatures, pdfFiller also supports obtaining signatures from multiple parties.

Submitting the CT401-N form

Once you have filled out and signed the CT401-N form, the next step is submission. This can typically be done electronically, via mail, or through designated government offices depending on local regulations. Always confirm the method of submission required for your form to ensure compliance.

After submitting the form, verify the successful submission either through confirmation emails or notifications from the governing body. Record keeping is crucial here as it helps manage deadlines and response tracking.

Managing your CT401-N form documents

Effective document management is vital, especially for forms like the CT401-N. pdfFiller provides tools for organizing your forms, allowing you to categorize them into tags and folders for easier retrieval.

This systematic approach makes it simple to track past submissions, access completed forms swiftly, and maintain organized records for reference in the future. This is particularly advantageous for individuals and teams managing multiple documents.

Troubleshooting common issues with the CT401-N form

Navigating the CT401-N form can sometimes lead to challenges. Common issues include missing fields, incorrect data, or submission errors. Understanding typical problems and their solutions is essential for a smooth process.

If you encounter difficulties, pdfFiller’s customer support is an excellent resource for assistance. You can also refer to the FAQs section dedicated to the CT401-N form for quick resolutions.

The advantages of using pdfFiller for CT401-N form management

Using pdfFiller for managing the CT401-N form streamlines the process from editing to signing and submission. Its cloud-based platform ensures users can access their documents from anywhere, making it a flexible solution for both individuals and teams.

Moreover, the platform enhances collaboration through its integrated tools, enabling you to work efficiently while also providing security for your sensitive information.

User testimonials and success stories

The impact of using pdfFiller on managing the CT401-N form has been overwhelmingly positive among users. Testimonials highlight enhancements in efficiency and accuracy during the form management process, often leading to smoother tax-related experiences.

Users appreciate the ease of editing and eSigning, which have significantly reduced time spent on paperwork. By sharing their experiences, users help build a community of best practices, shaping future interactions with the CT401-N form.

Future updates to the CT401-N form

As regulations and compliance requirements evolve, users can expect periodic updates to the CT401-N form. Staying informed about these changes is crucial to ensure submissions remain compliant.

pdfFiller is committed to keeping its platform aligned with these updates, ensuring users have access to the newest versions of the form along with guidance on how to navigate any changes.

Engaging with the community

Engaging with the community around the CT401-N form can greatly enhance your understanding and efficiency. By sharing experiences, you can learn valuable tips and strategies from fellow users.

Participating in webinars or workshops also offers opportunities to deepen your knowledge and stay ahead of best practices in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ct401-n online?

How do I fill out ct401-n using my mobile device?

How do I complete ct401-n on an iOS device?

What is ct401-n?

Who is required to file ct401-n?

How to fill out ct401-n?

What is the purpose of ct401-n?

What information must be reported on ct401-n?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.