Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Your Complete Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

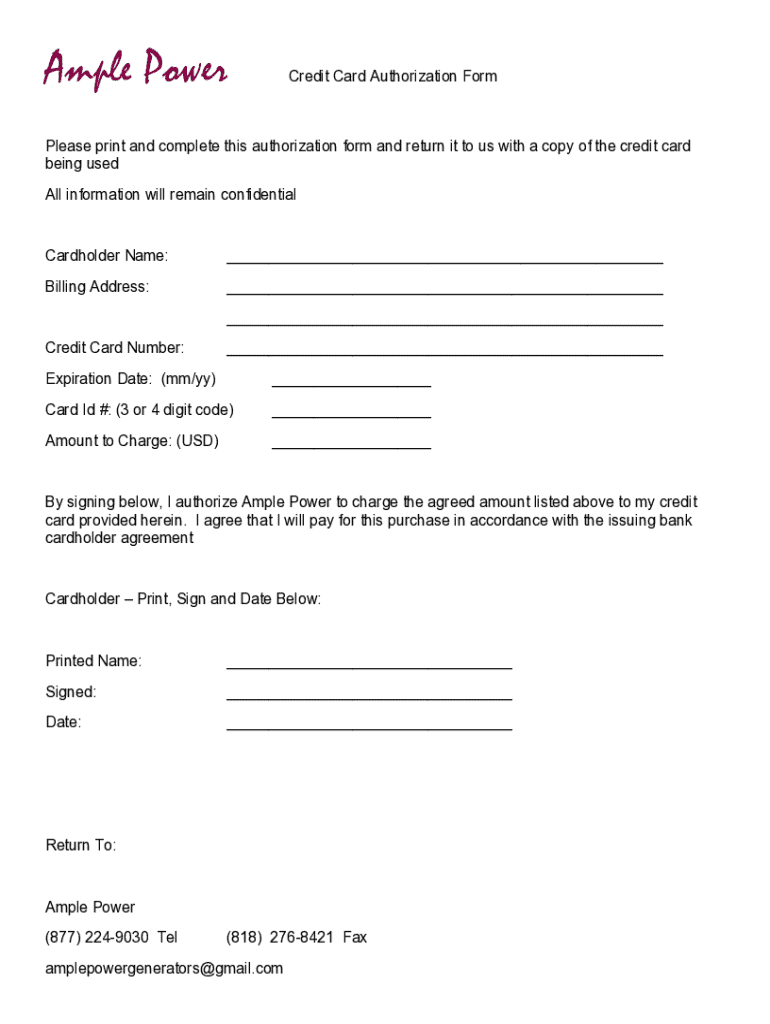

A credit card authorization form is a document that enables a merchant to charge a customer’s credit card for goods or services. It serves as proof that the customer has agreed to allow the merchant to process a payment using their credit card. This authorization protects both the customer and the merchant, ensuring that the transaction is legitimate and preventing unauthorized charges.

The use of credit card authorization forms is critical, especially in preventing fraud and chargebacks in transactions. They provide a clear record of the customer’s consent and intention, allowing businesses to confidently execute payments. Businesses across various sectors, such as retail, hospitality, and professional services, can benefit from implementing these forms to streamline their billing process.

Key components of a credit card authorization form

A comprehensive credit card authorization form includes several essential elements necessary for processing transactions. Key components found in these forms are:

While the above components are crucial, optional fields may include a CVV section, which provides an additional layer of security during the transaction. Card on file agreements are also beneficial, allowing merchants to store payment details for recurring transactions.

Ensuring privacy and security is paramount when handling credit card information. Compliance with data protection laws and payment card industry (PCI) standards should always be upheld.

When to use a credit card authorization form

Utilizing a credit card authorization form is essential in several scenarios, particularly for recurring payments and services that require pre-authorization. Businesses that work on subscription models, such as SaaS providers or gyms, must use this form to ensure that they can charge customers at agreed intervals.

Pre-authorization is equally crucial for service-based industries that require prior payment approval. This process helps safeguard against chargebacks, essentially where customers dispute a charge, claiming it was unauthorized. By presenting a signed authorization form, businesses can defend against such claims.

Case studies show that implementing credit card authorization forms has helped businesses enhance their customer trust and mitigate fraudulent activities. For example, agencies in the tourism industry often use these forms to secure bookings, boosting both customer confidence and revenue.

Filling out a credit card authorization form

Filling out a credit card authorization form is a straightforward process for cardholders. Here’s a simple step-by-step guide to ensure accuracy and validity:

To ensure validity and compliance with industry standards, merchants should provide clear instructions and verify that all information is current. It’s essential to inspect completed forms for any inconsistencies or missing information, as these can lead to processing delays.

Common issues may arise, such as incorrect card numbers or missing signatures. Addressing these proactively by establishing a checklist can simplify the completion process for consumers.

Managing credit card authorization forms

Proper management of credit card authorization forms is crucial not only for organizational purposes but also for compliance with regulatory requirements. Best practices for storing and retrieving signed forms include utilizing secure digital storage solutions that limit access to sensitive information.

For businesses maintaining physical copies, store forms in locked, fireproof cabinets to protect against unauthorized access. It is vital to follow retention policies and keep forms on file for the appropriate duration, typically between three to seven years, depending on local regulations.

When the retention period ends, ensure that all sensitive information is securely deleted to mitigate the risk of data breaches.

Legal considerations surrounding credit card authorization forms

Businesses must understand their legal obligations when using credit card authorization forms. Compliance with the Payment Card Industry Data Security Standard (PCI DSS) protects both merchants and customers by ensuring secure handling of credit card information.

While not legally required in all situations, using authorization forms may be legally advisable to cover merchants from potential disputes while providing clarity on the agreed terms of service. In this regard, many businesses find that it enhances customer transparency.

Failing to use proper authorization forms can lead to disputes and negatively impact a business's reputation. Therefore, understanding the legal implications and maintaining compliance is essential for business integrity.

Advantages of using pdfFiller for credit card authorization forms

pdfFiller offers a cloud-based solution that revolutionizes how businesses manage credit card authorization forms. Users can seamlessly create, edit, and sign documents with an easy-to-use interface, significantly reducing administrative burdens.

Among its features, pdfFiller allows for interactive capabilities that promote collaboration and document management. Users can invite team members to review forms and provide feedback, ensuring that all necessary compliance requirements are met in one simple platform.

Testimonials from users highlight the efficiency and reliability of pdfFiller, emphasizing its capacity to meet the document needs of diverse businesses.

Downloading and customizing templates

Accessing credit card authorization form templates on pdfFiller is simple and user-friendly. Users can choose from a variety of pre-designed forms that comply with regulatory requirements, making it easy to find a template that suits their needs.

The customization options available on pdfFiller allow users to modify forms according to their business requirements. Changing fields, adding logos, or adjusting terms and conditions can significantly enhance the form's effectiveness.

By following a few straightforward steps, businesses can quickly adapt a credit card authorization form template to fit their specific requirements, making transaction processing more efficient.

Frequently asked questions (FAQ)

Here are some common questions regarding credit card authorization forms, along with their answers:

Connect with us

Whether looking for support or further insights into managing credit card authorization forms, connecting with the pdfFiller support team is easy. Our team is equipped to provide guidance tailored to your needs.

By staying informed through our blog and social media channels, you can access a wealth of resources to help enhance your document management processes, ensuring your business remains compliant and secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card authorization form in Gmail?

How do I edit credit card authorization form online?

How do I make edits in credit card authorization form without leaving Chrome?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.