Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

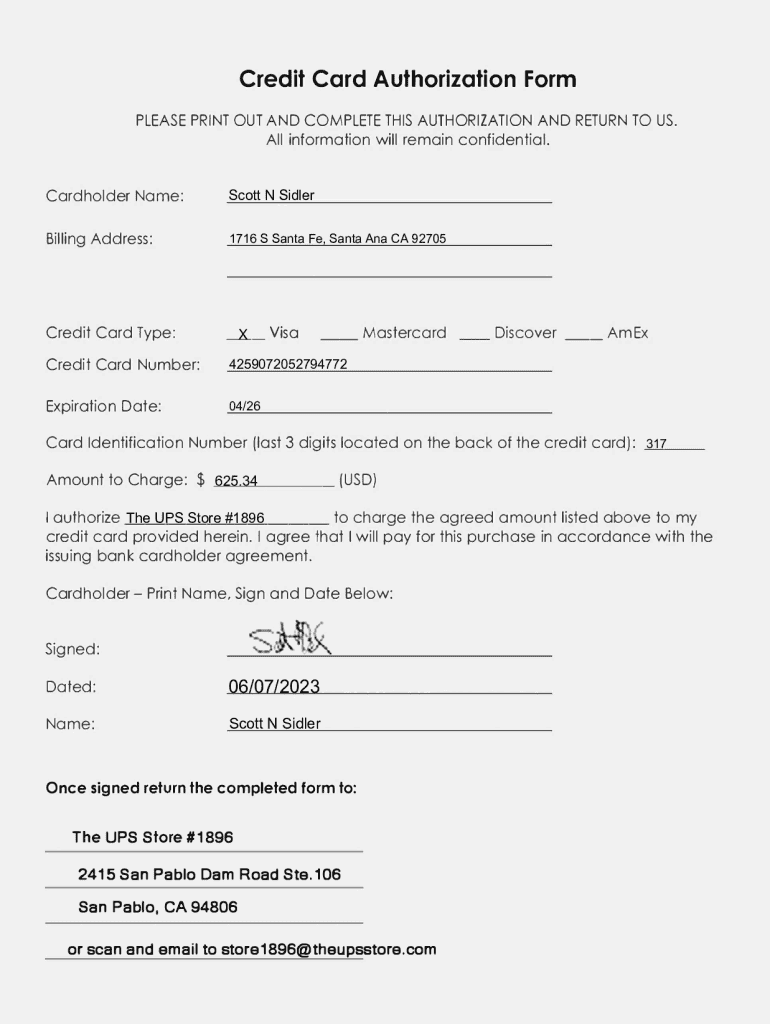

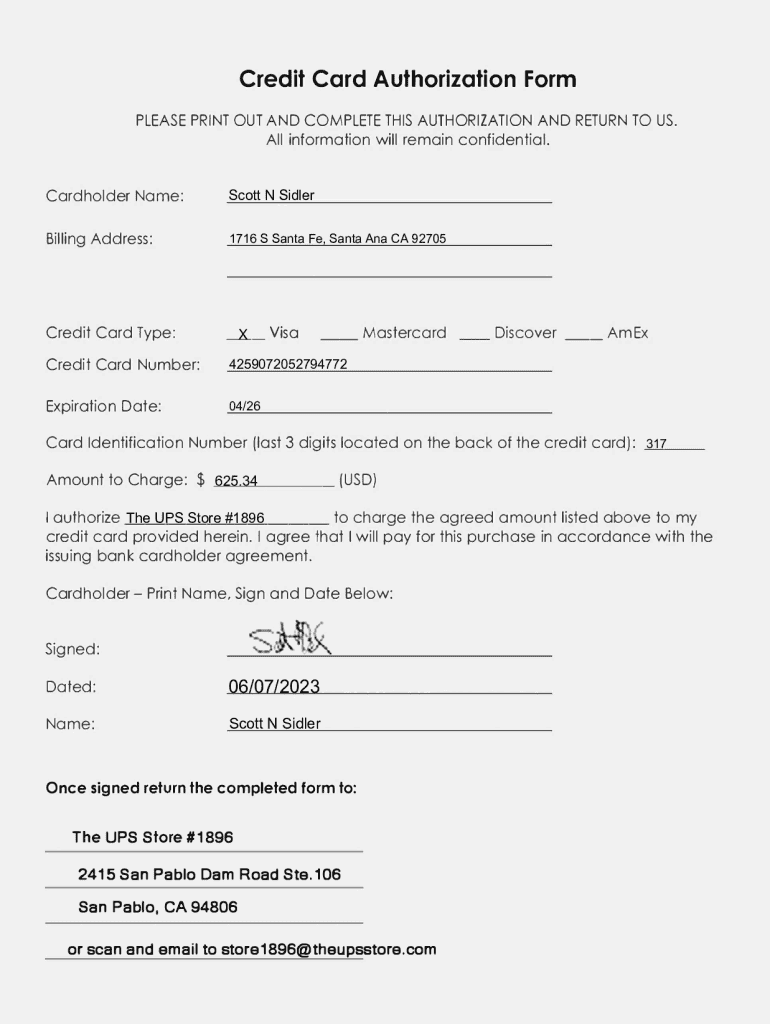

A credit card authorization form is a document that allows businesses to charge a customer’s credit card for goods or services provided. This form serves as a legal agreement between the cardholder and the merchant, specifying the terms of payment and authorization. By obtaining this consent, businesses ensure that they comply with legal standards while safeguarding themselves against unauthorized charges.

The importance of credit card authorization forms cannot be overstated—these documents provide essential protection for both merchants and customers. They help streamline transactions while reducing the risk of fraudulent activity, a concern that has become increasingly relevant in today's online commerce environment.

Components of a credit card authorization form

A well-structured credit card authorization form includes several key components that ensure both clarity and legality. Essential information must be included to protect all parties involved.

Firstly, the form should capture cardholder details—this includes the name, billing address, and contact information of the individual authorizing the payment. Following this, credit card information such as the card number and expiration date are required to complete the authorization. An authorization statement should clearly express the intent of the cardholder to allow the merchant to charge the specified amount.

Optional components may include space for entering the CVV code, which adds an extra layer of security. For businesses offering subscription services, recurring payment authorizations can also be integrated. However, it’s important to consider the legal implications of using these forms. While not legally mandated, having a credit card authorization form significantly strengthens a merchant's position in disputes.

How to fill out a credit card authorization form

Filling out a credit card authorization form may seem straightforward, but accuracy is critical to avoid potential disputes. Here’s a step-by-step guide to help ensure the process goes smoothly.

Ensuring accuracy can protect against misunderstandings and chargebacks. Additionally, using secure channels for submitting the form will protect sensitive information from unauthorized access while maintaining customer trust.

Customizing your credit card authorization form

Customization plays a vital role in adapting credit card authorization forms to fit your business needs. Using platforms like pdfFiller, you can modify templates to create forms that reflect your brand.

Adding branding elements such as your company logo, colors, and personalized messages can enhance customer engagement while giving your forms a professional appearance. pdfFiller offers accessible editing features, making it easy for you to tailor the form for your specific transactions.

Managing and storing signed credit card authorization forms

Once your credit card authorization form is filled out and signed, the next step involves effective document management. Best practices advocate for the secure storage of all authorization forms, which is crucial in protecting sensitive customer data.

It's recommended to retain these documents for a minimum of three to five years, as this duration covers the typical period for potential disputes. Implementing strong data protection strategies, such as encryption and access controls, will safeguard your customers' information.

Interactive tools for credit card authorization forms on pdfFiller

pdfFiller enhances the credit card authorization form experience with an array of interactive tools. These features support team collaboration and streamline the payment authorization process significantly.

Collaboration features facilitate real-time editing and communication, making it easy for teams to work together on documents. eSigning capabilities simplify the approval process, allowing customers to sign the forms digitally, thus eliminating the need for physical paperwork.

Nickel & diming: addressing common concerns

Merchants often encounter various challenges when dealing with credit card authorization forms. One common concern is how to handle declined payments. In such cases, promptly communicating with the customer is crucial. Inform them of the issue and verify the details provided to find a resolution.

Disputes can also arise from authorization forms. Should this happen, it's important to maintain records of the authorization and transaction details to support your case. Address frequently asked questions with clarity to improve customer experience, such as guiding customers on what to do if they refuse to fill out an authorization form or how to correct errors found in submitted forms.

Exploring related topics

Understanding the various facets of payment authorization becomes imperative when running a business. Exploring card-on-file options can streamline repeat sales, while comprehending the difference between credit card authorization and payment processing enhances your grasp of transactional mechanics.

Moreover, compliance with payment regulations is crucial for avoiding legal complications. Familiarizing yourself with these laws ensures that your use of credit card authorization forms aligns with industry standards, bolstering your business integrity.

Utilizing templates to get started

Getting started with credit card authorization forms is made easy with the abundance of templates available through pdfFiller. These ready-to-use forms save time and work as a solid foundation for your business's needs.

Users can easily download and customize these templates, tailoring them to their specifications. This efficiency allows businesses to focus on what matters most—serving customers and generating sales.

Feedback loop: share your experience

Engagement is key when using credit card authorization forms. Encouraging users to share their experiences can provide businesses with valuable feedback that enhances product and service offerings. Open dialogues lead to innovations and improvements, benefiting all involved.

Inviting customers to share their thoughts on the pdfFiller platform can lead to significant insights, ensuring that improvements are continually made. This feedback loop is essential for refining processes and enhancing the overall user experience.

Discover more resources

To further support businesses in payment processing and document workflows, pdfFiller offers a range of resources. Blog posts and guides related to payment processing can provide additional insights and practical tips for optimal use.

Exploring related topics can serve not only as a resource for problem-solving but also as a means for business growth, assisting companies in staying ahead in the competitive market.

Stay updated

Keeping abreast of the latest features and templates available on pdfFiller strengthens document management strategies. Users can sign up for newsletters to receive updates, ensuring they don’t miss valuable insights.

Receiving tips and best practices directly in their inbox helps users to streamline their processes, maintaining efficiency and enhancing productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization form without leaving Google Drive?

How do I fill out credit card authorization form using my mobile device?

Can I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.