Get the free Complex Risks Property Proposal Form

Get, Create, Make and Sign complex risks property proposal

Editing complex risks property proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out complex risks property proposal

How to fill out complex risks property proposal

Who needs complex risks property proposal?

Navigating the Complex Risks Property Proposal Form

Understanding complex risks in property

Complex risks in property management arise from a unique blend of factors that can significantly impact the value and safety of a property. These risks are multifaceted, including everything from environmental hazards to economic shifts. Addressing these risks is crucial for property owners and managers when preparing proposal forms, as a thorough understanding ensures better protection and access to appropriate insurance coverage.

The importance of these proposal forms lies in their ability to encapsulate the unique vulnerabilities of a property, thereby facilitating informed decision-making for potential insurance coverage. Common types of complex risks to consider include natural disasters like floods or earthquakes, which can lead to extensive damage, as well as market fluctuations that affect property values and regulatory changes that influence operational protocols.

The complexity of your property needs

Assessing the risks associated with your property starts with understanding its unique characteristics. Residential properties often face different risks compared to commercial and industrial properties. For instance, a residential property might be primarily concerned with burglaries and maintenance issues, whereas a commercial property may deal with liability risks due to customer interactions.

Several factors influence risk assessments, including location, the condition of the property, and the occupancy patterns. Properties situated in flood-prone regions require different risk mitigation measures compared to those in urban settings, where crime rates may be higher. Additionally, an aging property may carry more risk in terms of structural integrity, necessitating a more detailed proposal form.

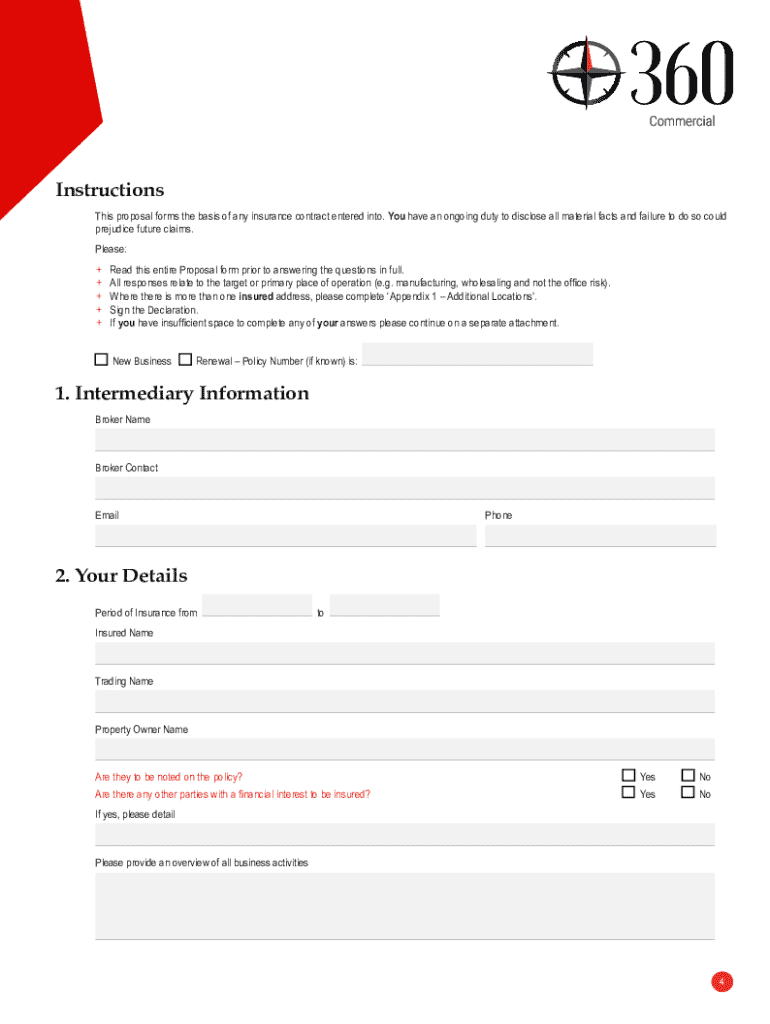

The complex risks property proposal form: key features

The Complex Risks Property Proposal Form typically includes several key sections that guide the user in providing necessary information. Notable sections often feature personal and property details, a risk assessment checklist, coverage options, and a space for additional documentation. This structured format ensures that all pertinent data is collected to assess the property accurately.

Interactive tools on platforms like pdfFiller enhance customization to this form. Users can employ dynamic fields to tailor their submissions according to specific risk scenarios they face. Moreover, leveraging existing templates can save time and ensure that important aspects are not overlooked, making the process more efficient for different property types.

Step-by-step process for completing the complex risks property proposal form

Benefits of using pdfFiller for your proposal

One of the standout features of using pdfFiller for a complex risks property proposal form is its seamless editing capability. Users can modify their forms to reflect changing circumstances swiftly, ensuring that their proposal remains relevant and accurate. Additionally, the eSigning functionality offers a crucial benefit, allowing for quick, secure digital signatures that facilitate faster processing by insurance companies.

Collaboration tools are another vital aspect. Team members can work concurrently on proposals, enabling real-time refinement and feedback. Furthermore, the cloud-based platform ensures that users can manage their documents from anywhere, providing access to critical information while maintaining the security and confidentiality of their sensitive data.

Why choose pdfFiller for your complex risks property needs?

pdfFiller provides comprehensive features tailored to meet diverse property requirements, making it an excellent choice for individuals and teams. The user-friendly interface simplifies the task of drafting, editing, and managing property proposal forms, ensuring that even users unfamiliar with document preparation can easily navigate the platform's functionalities.

By consolidating all necessary tools into one location, pdfFiller enhances the efficiency of the document preparation process. This allows property owners and managers to focus on critical decision-making rather than getting bogged down in administrative tasks.

Interactive tools for enhanced proposal preparation

Taking advantage of pdfFiller's online tools can significantly boost the quality and effectiveness of your proposal preparation. Live annotation features allow for collaborative document building in real-time, ensuring that every stakeholder can contribute their insights and expertise.

Moreover, risk estimation calculators integrated into the form provide additional layers of analysis. These tools help users accurately gauge potential impacts of different risks, leading to more informed coverage decisions. Specific templates designed for complex risk scenarios further streamline the process, saving users time and reducing the likelihood of overlooking critical details.

Managing your completed proposal

After completing the complex risks property proposal form, securely storing your documents in the cloud is essential. This approach not only safeguards against data loss but also enables easy access for later review or modifications. Employing features that track proposal statuses can help ensure that users are always aware of where their submissions stand in the review process.

As conditions change—whether due to new regulations or property updates—being able to easily update your proposals ensures that you remain compliant and adequately covered. pdfFiller’s functionalities make these updates straightforward, allowing for seamless revisions.

Preparing for follow-up discussions

Once you’ve submitted your proposal, thoughtful preparation for follow-up discussions with potential insurers is crucial. Consider preparing essential questions that probe deeper into coverage details, exclusions, and claims processes. This level of inquiry not only showcases your preparedness but also aids in establishing a more productive dialogue.

Additionally, documenting feedback you receive from insurers can prove invaluable for future proposals. This information can help fine-tune your ongoing risk assessment efforts and proposal development. Effective presentation of your proposal, combining clarity and professionalism, will enhance the persuasive nature of your discussions.

Frequently asked questions (FAQs)

Users often have common concerns regarding the complex risks associated with insurance coverage. Queries may arise around precise policy details, how to manage changes in risk assessments, or the nuances of particular property types. Offering clear, accessible answers to these questions is vital for empowering users.

Additionally, troubleshooting common issues encountered using pdfFiller’s proposal form can greatly enhance user experience. Providing tips for maximizing efficiency—from navigation shortcuts to helpful feature overviews—will encourage users to explore the software to its fullest extent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the complex risks property proposal in Gmail?

How do I edit complex risks property proposal on an iOS device?

How do I fill out complex risks property proposal on an Android device?

What is complex risks property proposal?

Who is required to file complex risks property proposal?

How to fill out complex risks property proposal?

What is the purpose of complex risks property proposal?

What information must be reported on complex risks property proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.