Get the free Critical Illness Cover Application Form

Get, Create, Make and Sign critical illness cover application

How to edit critical illness cover application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness cover application

How to fill out critical illness cover application

Who needs critical illness cover application?

A comprehensive guide to the critical illness cover application form

Understanding critical illness cover

Critical illness cover is a type of insurance designed to provide financial support in the event that you are diagnosed with a serious health condition. This cover aims to alleviate the financial burden associated with medical expenses, loss of income, or other costs incurred during treatment. Securing a critical illness policy is essential for individuals who wish to protect their families and ensure financial stability in unforeseen circumstances.

The importance of having this coverage cannot be overstated, especially in a world where health emergencies can lead to overwhelming financial stresses. Many policies will cover a range of serious illnesses, such as cancer, heart attack, stroke, and organ failure. However, coverage specifics can vary significantly between providers, highlighting the need for thorough research and understanding before making a decision.

Overview of the application process

Applying for critical illness cover typically involves several key steps. First, research different insurance providers and the policies they offer. This will involve comparing the coverage options, costs, and specific exclusions. Once you narrow down your choices, gather the necessary documents such as identification and financial statements to support your application.

Understand the terms and conditions of the policy you are considering; this knowledge will help you make an informed decision. The timeline for completing this application can vary; however, it often takes between 15 to 30 minutes to fill out your application once you have all the information needed.

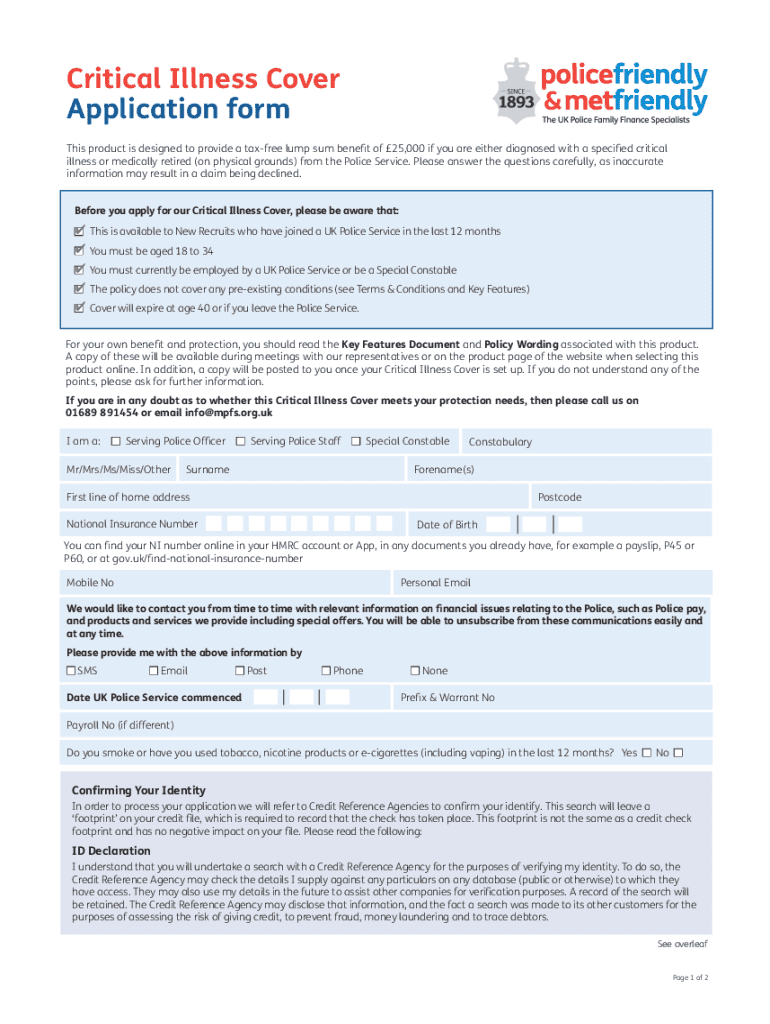

Essential information required for the application

When preparing a critical illness cover application form, you will need to provide essential information that falls into three primary categories: personal, medical history, and financial. Starting with personal information, it's crucial to fill in accurate details such as your name, age, and contact information. Additionally, your occupation and lifestyle factors may be relevant, as these can affect your risk assessment.

Concerning medical history, insurers typically request information on both your past and present health conditions, as well as family medical history. Full disclosure here is vital as it influences your coverage eligibility. Lastly, financial information should include your income, expenses, and any existing coverage you may have. This helps the insurer assess your needs accurately.

Navigating the critical illness cover application form

Understanding how to complete the critical illness cover application form effectively is essential. Generally, the form is divided into several sections. Section 1 asks for your personal details—ensuring accuracy is key here, so verify all information before submission.

Section 2 delves into your medical history, requiring detailed responses about any relevant health issues. Finally, Section 3 seeks a thorough disclosure of your financial situation. Ensure you avoid common mistakes like skipping questions or providing vague responses. Honesty and clarity can significantly enhance your chances of approval.

Interactive tools for application management

Using pdfFiller's tools can greatly simplify the critical illness cover application process. With features designed for editing application forms, you can easily input the necessary information without hassle. Plus, the eSigning functionality allows for immediate submissions, eliminating the worry of print and postal delays.

The platform also offers collaboration options, meaning you can invite others—such as family members or financial advisors—to review your application. This team approach can help to ensure that all information is accurate and comprehensive, allowing for a seamless submission process.

Post-application considerations

After submitting your critical illness cover application, understanding what happens next is crucial. The insurer will review your application, which typically involves an assessment of your health history and financial situation. The duration of this assessment can vary, and it’s recommended to follow up after a week or two if you haven’t heard back.

If your application is declined, don’t lose heart. It’s essential to review the reasons provided and explore alternative coverage options or reapply in the future. Sometimes, adjusting your application before resubmission can improve your chances of acceptance.

Frequently asked questions

It's common to have several queries regarding critical illness cover applications. One typical question pertains to what illnesses are covered; understanding policy terms and exclusions is imperative as this can dramatically impact your expected benefits. For clarification, seek support from your insurance company or utilize resources to aid in understanding the intricacies of your selected policy.

Consider also the deadlines for application processing and the protocol for seeking support through the application process. Insurance companies often provide customer service avenues to address your concerns and ensure you are adequately supported.

Best practices for managing your critical illness cover

Proper management of your critical illness cover is essential for continued peace of mind. Always keep track of your policy details, including the coverage amount, premium due dates, and contact information for your insurer. Regularly reviewing your coverage ensures that it remains appropriate for your evolving needs.

Additionally, understanding the claims process can help to avoid issues in the event you need to utilize your policy. Familiarize yourself with the timing and documentation required for claims submission. Accurate and timely submission is critical for ensuring that your benefits are received without delay.

Accessing your application anytime, anywhere

One of the significant benefits of using a cloud-based solution like pdfFiller is the ability to access your critical illness cover application anytime and anywhere. This flexibility can be especially beneficial if you need to make changes or review documents at a moment's notice.

Saving and retrieving your application forms securely ensures that personal and sensitive information is always protected while remaining easily accessible across devices. This level of convenience means you can manage your insurance obligations without being tied to a physical location or time constraints.

Final thoughts on securing critical illness cover

Taking the proactive step of applying for critical illness cover is a vital decision for securing financial stability in uncertain health conditions. The importance of being prepared cannot be overstated; ensuring you have the necessary coverage provides peace of mind for you and your loved ones.

With the insights and tools available through pdfFiller, navigating the application process for critical illness cover becomes more manageable. Adopting this approach not only simplifies the application but empowers you to approach your healthcare coverage needs with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute critical illness cover application online?

Can I sign the critical illness cover application electronically in Chrome?

Can I edit critical illness cover application on an iOS device?

What is critical illness cover application?

Who is required to file critical illness cover application?

How to fill out critical illness cover application?

What is the purpose of critical illness cover application?

What information must be reported on critical illness cover application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.