Get the free Credit Advice

Get, Create, Make and Sign credit advice

Editing credit advice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit advice

How to fill out credit advice

Who needs credit advice?

Comprehensive Guide to the Credit Advice Form

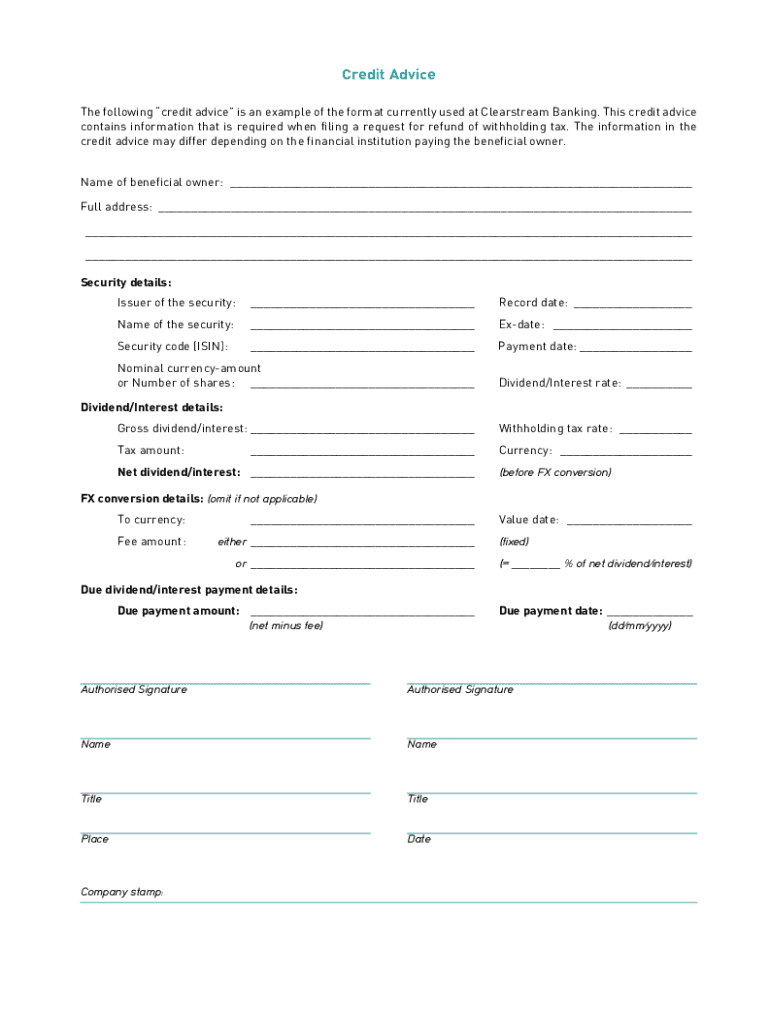

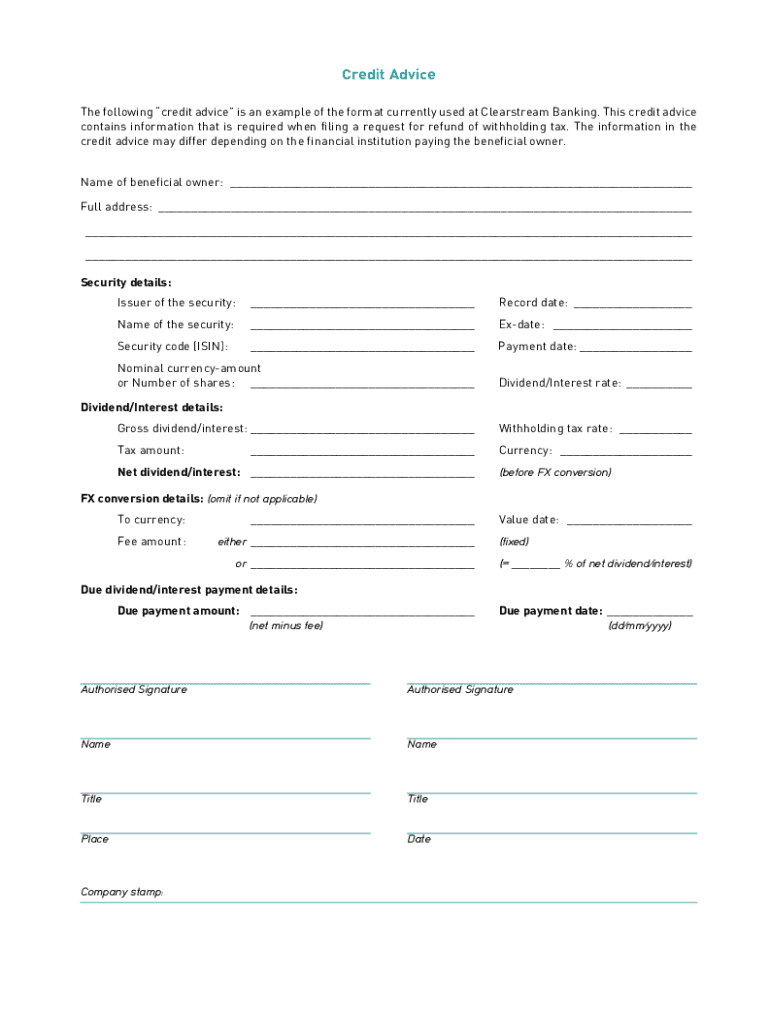

Understanding the credit advice form

The credit advice form plays a crucial role in the financial decision-making process. Designed to facilitate the communication between individuals seeking financial guidance and advisors, this form serves as a roadmap. Its main purpose is to gather information pertinent to the client's financial situation, allowing professionals to offer tailored advice. Common scenarios that necessitate the use of this form include situations such as applying for loans, restructuring debt, or seeking credit counseling.

Key components of the credit advice form include sections that require essential information alongside optional fields. The required data typically encompasses personal and financial details, while optional fields may solicit additional context, such as the individual's financial goals or preferred communication methods. Collectively, these elements ensure that advisors have a comprehensive understanding of the client's situation, which is paramount for effective consultation.

How to access the credit advice form

Accessing the credit advice form is a straightforward process, especially through pdfFiller. To locate the form on the website, start by navigating to the pdfFiller homepage. Once there, utilize the search bar at the top of the page; simply type in 'credit advice form,' and hit enter. This search will yield relevant results, and you can select the appropriate version of the form.

Alternatively, users can access and download the credit advice form by browsing through the financial templates section on pdfFiller. This section often features a variety of documents tailored for financial guidance and credit management. By ensuring easy access, pdfFiller empowers users to obtain vital financial forms conveniently.

Filling out the credit advice form

Completing the credit advice form is a critical step that sets the foundation for effective financial advice. The process begins with providing personal information such as your name, contact details, and any necessary identification. This helps advisors verify your identity and create a personalized experience. It's essential to ensure this information is accurate and up-to-date.

Following personal details, you’ll be required to furnish your financial information. This includes outlining your income sources, outstanding debts, and any other credit obligations. Being thorough in this section will not only help advisors understand your financial standing but also assist in crafting solutions tailored to your needs.

For the section on specific requests for advice, consider what aspects of your financial situation are most pressing. Do you seek help with managing debt, improving credit scores, or budgeting effectively? Clearly articulating these needs can significantly enhance the quality of guidance you receive. To make the submission process seamless, remember to avoid common pitfalls such as incomplete forms and ensure that all required fields are filled.

Editing and customizing the credit advice form

Using pdfFiller's tools, users can easily edit the credit advice form to suit their specific requirements. This platform offers various features for modifying forms. Users can add additional fields for clarity or remove any unnecessary sections. Such customization ensures that the form accurately reflects your personal financial scenario.

Moreover, pdfFiller provides functionality for collaboration. If you’re working with a financial advisor or a team, you can invite them to review and edit the form. This collaborative aspect allows multiple parties to provide input and ensures that all necessary information is captured. Furthermore, the platform keeps track of changes and comments made, simplifying the review process.

Signing the credit advice form

After completing the credit advice form, the next step is signing it. pdfFiller offers options for electronic signatures, making this process efficient and convenient. To eSign through pdfFiller, simply click on the designated signature field and follow the prompts to add your signature electronically. This method is not just easy but also legally binding, provided certain regulations are observed.

Managing signature requests adds another layer of convenience. If the form requires signatures from other parties, you can send it directly from the pdfFiller platform. Users can monitor the status of signature requests and receive notifications when others sign, ensuring clarity in the approval process. This feature enhances communication and speeds up the overall procedure.

Managing submissions and storing the credit advice form

Once the credit advice form has been completed and signed, it’s essential to store it securely. pdfFiller offers robust cloud storage solutions that ensure your documents are protected. Users can categorize and organize their forms for easy retrieval, making it simple to locate critical financial documentation when needed.

Retrieving and sharing your completed credit advice form can be done seamlessly through the pdfFiller platform. You can either download the form for offline storage or share links for online access. When sharing, always opt for secure methods, especially if sensitive information is involved. This comprehensive approach allows individuals or teams to maintain their financial documentation effectively and securely.

Frequently asked questions (FAQs)

Users frequently have queries regarding the usage of the credit advice form. Common inquiries often pertain to how to create an effective submission and what to do in case of issues during the process. Additionally, individuals may wish to understand the preferred methods for following up after submitting their forms. Familiarizing yourself with these FAQs can streamline the process and clarify expectations.

When troubleshooting form submission issues, check for incomplete fields or technical problems during upload. It's critical to ensure that all required information is accurate, as this will help prevent delays in receiving advice. Understanding the follow-up process after submission is equally vital, as timely communication with advisors can facilitate optimal outcomes from your request.

Additional tools and resources on pdfFiller

Beyond the credit advice form, pdfFiller provides a range of interactive features that enhance document management. Users can access templates for other financial documents, further enriching their experience and ensuring consistency across submissions. This versatility allows individuals and teams to handle various financial situations efficiently.

Furthermore, pdfFiller offers community support and learning resources. Accessing tutorials can help users navigate through complex document management tasks, while customer support options provide timely assistance when needed. This combination of tools fosters a productive environment, empowering users to take charge of their financial documentation and advice seamlessly.

Security and compliance with credit advice forms

Security is paramount when handling sensitive documents like the credit advice form. pdfFiller employs advanced security measures to safeguard user data. This includes encryption, secure data storage, and compliance with industry regulations, ensuring that your financial information remains confidential.

Additionally, understanding privacy concerns is crucial. Users can rest assured that information is handled and stored according to strict policies. Compliance with regulations surrounding credit advice is another aspect that pdfFiller takes seriously, which not only protects users but also fosters confidence in their services.

Testimonials and success stories

Real-life experiences often illuminate the value of using the credit advice form effectively. Many users have shared success stories about how streamlined document management has positively impacted their financial decisions. Effective use of the form can lead to informed advice and, consequently, improved financial health.

For example, a small business owner managed to consolidate debts and improve cash flow after utilizing the credit advice form to seek professional help. Such success stories highlight not just the power of documentation but also the tangible benefits of engaging with professional financial advice. These testimonials illustrate that when used appropriately, the credit advice form functions as a vital tool for financial improvement and planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit advice?

How do I complete credit advice online?

Can I create an electronic signature for signing my credit advice in Gmail?

What is credit advice?

Who is required to file credit advice?

How to fill out credit advice?

What is the purpose of credit advice?

What information must be reported on credit advice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.