Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

The Complete Guide to Credit Application Forms

Understanding credit application forms

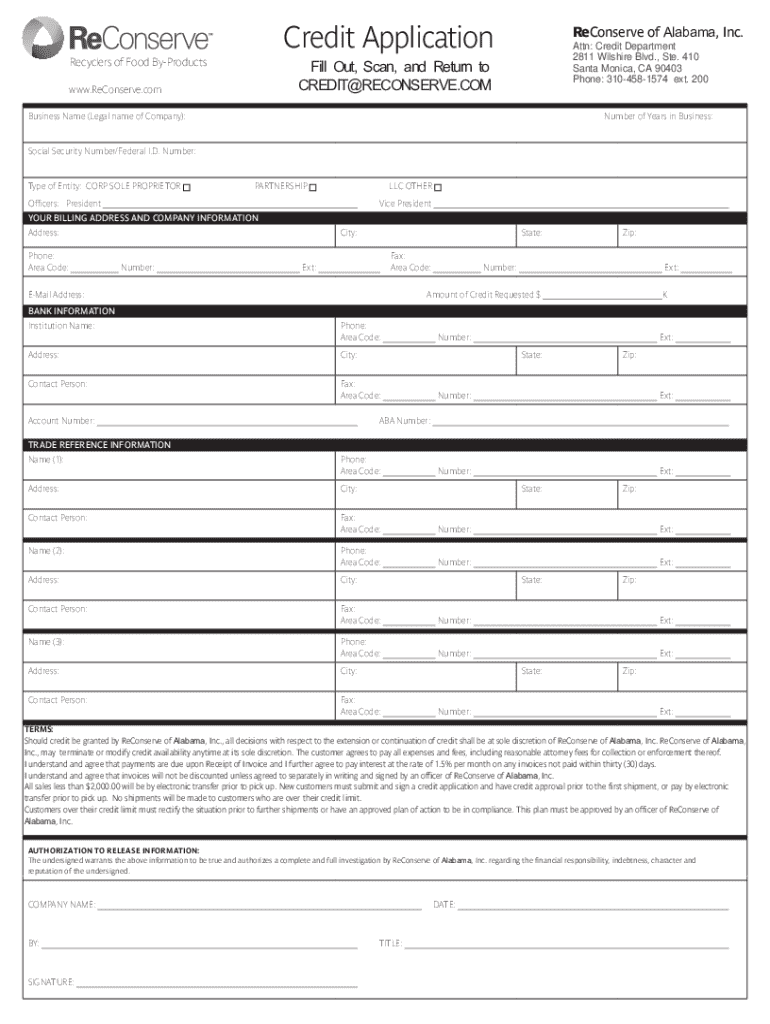

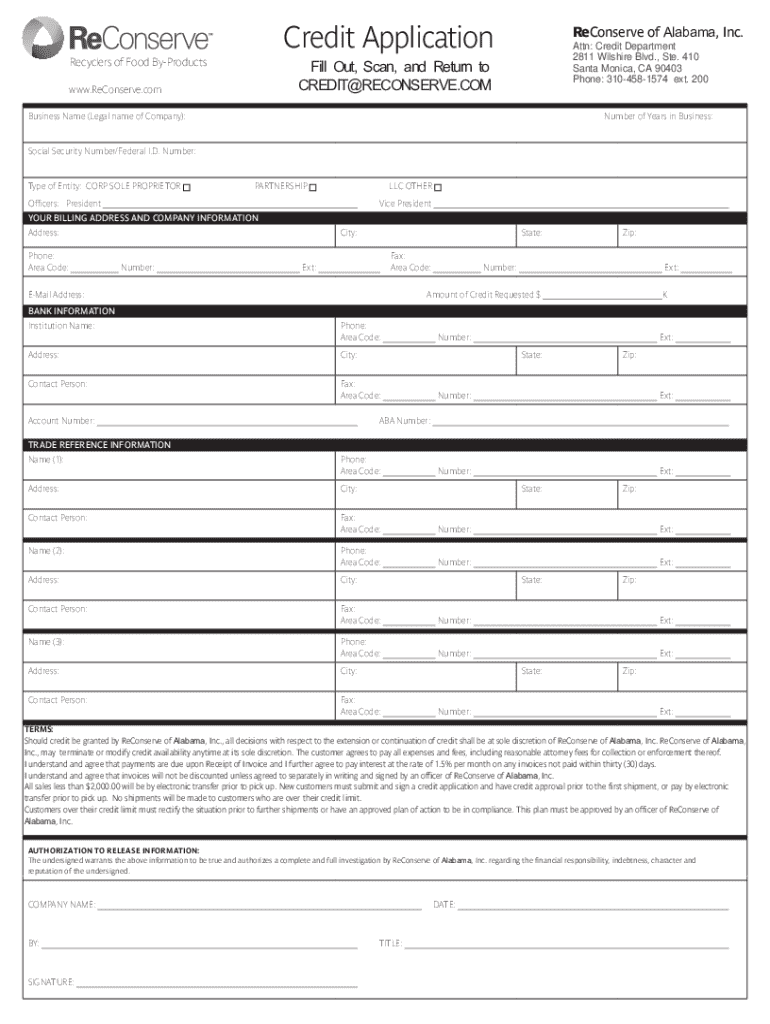

A credit application form is a crucial document used by lenders to gather essential information about an individual or business applying for credit. It typically includes personal details, financial background, and credit history, all instrumental in assessing the applicant's creditworthiness. Understanding this form is vital as it sets the stage for borrowing money, be it a personal loan, mortgage, or credit card.

Credit applications play a vital role in the lending process. They not only help lenders verify the information provided by applicants but also aid in determining loan amounts, interest rates, and repayment terms. Therefore, filling out a credit application accurately can impact the overall lending decision and terms offered.

Key components of a credit application form

The structure of a credit application form typically includes several key sections. First is the personal information section which requires basic details about the applicant such as full name, current address, and social security number. This information helps lenders verify identity and assess risk.

Following this, the financial information section dives deeper into the applicant's current financial situation. This includes data on monthly income, existing debt obligations such as loans and credit cards, and an overview of personal assets and liabilities. All of these figures help lenders gauge the applicant's ability to repay the borrowed money.

Finally, a credit history inquiry section is critical for assessing eligibility. Here, a lender may examine the applicant's credit score, which summarizes their credit history and habits. Understanding one’s credit score is essential for evaluating risk and making informed lending decisions.

Step-by-step guide to completing a credit application form

Completing a credit application form can seem daunting, but breaking it down into manageable steps simplifies the process significantly. The first step involves gathering all necessary documents for submission. This usually includes your identification proof and income verification documents such as payslips or tax returns.

Next, carefully fill out the form, ensuring that all sections are completed accurately. It’s crucial to avoid leaving any fields blank unless specified. Pay attention to common mistakes like incorrect social security numbers or misspelled names, as these can delay processing.

After filling out your application, take time to review it. Create a checklist of required documents and ensure completeness. Remember, honesty is crucial when reporting financial details, as inconsistency can lead to denial.

The final step is submitting the application. If applying online, follow the specific platform’s submission guidelines. For paper applications, ensure they're mailed to the correct address and consider tracking the shipment. Lastly, know the follow-up protocol; you can often check the status online or contact customer service.

Editing and signing your credit application form

After filling out the credit application form, use tools like pdfFiller to edit your form effortlessly. Start by uploading your form to pdfFiller’s platform, where you can modify any part of the document using various editing options. These tools allow for quick corrections and ensure that your application is accurate.

Once editing is complete, signing is the next step. With pdfFiller, eSigning is simple, offering benefits such as speed and security. Using eSignature tools allows you to sign documents without printing, saving time and reducing paper waste. This feature enables you to finalize applications swiftly, speeding up the overall process.

Managing and tracking your credit application

To effectively manage your credit application, checking your application status regularly is essential. Most lenders provide a way to track your application online. This way, you can stay informed about the progress of your application and be alerted to any issues.

Common reasons for delays might include missing documents or discrepancies in reported information. If your application is rejected, understand your rights and review the feedback provided. Take this opportunity to improve your application for future submissions, whether by enhancing your credit score or better documenting your financial situation.

Additional considerations and best practices

Keeping records of all submitted documents related to your credit application is good practice. This includes copies of the application form itself, along with any supporting documentation, to prevent loss of information and date discrepancies. Protecting personal information is critical in today's digital world, so ensure you're sharing documents securely and with trusted sources only.

Also, be aware of any fees that may be associated with applying for credit, such as processing fees or annual fees for certain types of credit products. Consulting with financial advisors can provide personalized guidance and help clarify terms and conditions that may be unfamiliar, offering further assurance as you navigate the credit application process.

Interactive tools and resources

To simplify the credit application process further, pdfFiller provides various interactive tools. For example, you can access customizable credit application form templates, perfect for efficient document creation. Additionally, a calculator for estimating loan amounts can help you determine what you can afford before applying.

For users seeking clarity, pdfFiller also offers a comprehensive FAQ section covering common questions about completing credit applications. Links to related forms, such as personal loan applications or financial aid forms, are available, making it a one-stop-shop for all your documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application from Google Drive?

How do I complete credit application online?

How do I fill out the credit application form on my smartphone?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.