Get the free Confirmation of Financial Advice

Get, Create, Make and Sign confirmation of financial advice

Editing confirmation of financial advice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation of financial advice

How to fill out confirmation of financial advice

Who needs confirmation of financial advice?

Understanding the Confirmation of Financial Advice Form: A Comprehensive Guide

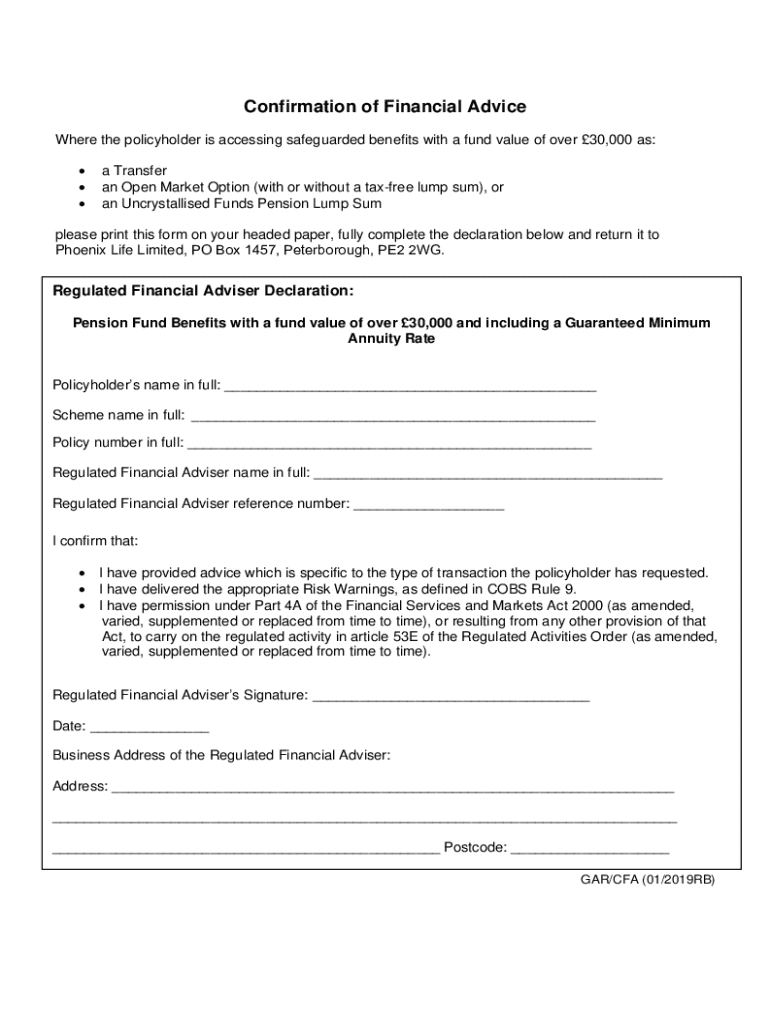

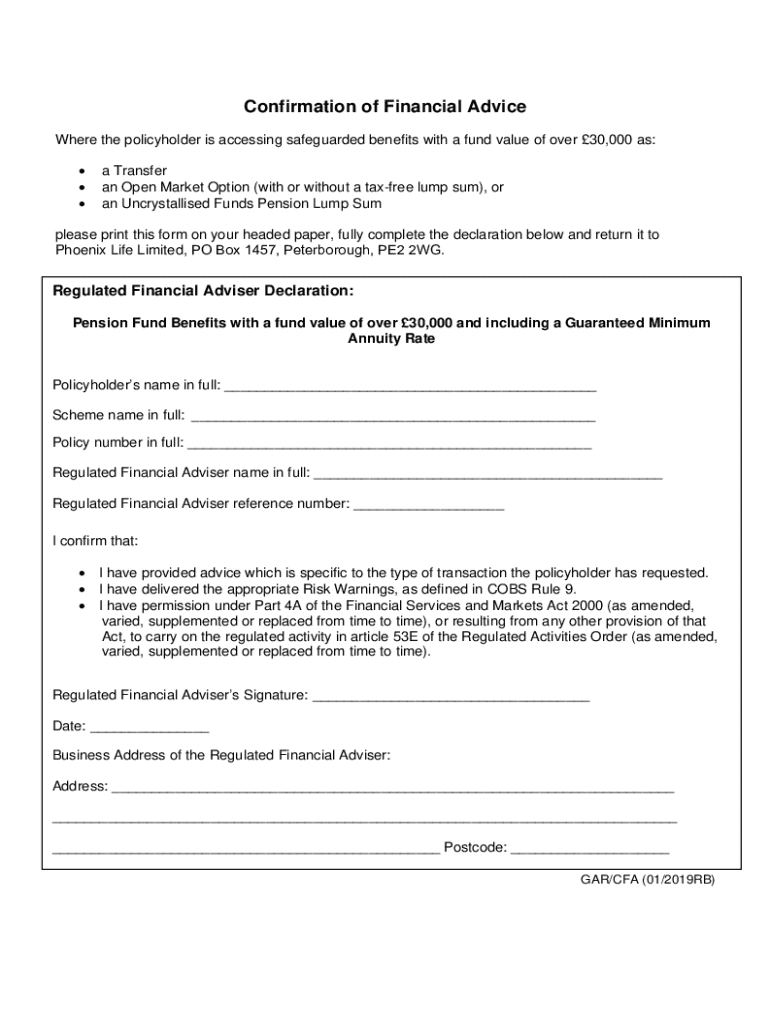

Understanding the confirmation of financial advice form

The confirmation of financial advice form is a crucial document in the financial advisory process. It serves as an official statement that outlines the advice provided by financial advisers to their clients. This form ensures that both parties have a clear understanding of the guidance given, thereby helping to mitigate misunderstandings and disputes in the future.

This form is significant in financial transactions as it not only records the advice but also acts as a legal safeguard for both clients and advisers. The importance of a well-executed confirmation of financial advice form cannot be overstated; it protects the adviser’s credibility and helps the client validate their decisions based on the advice received.

Who is required to fill out this form?

The responsibility for filling out the confirmation of financial advice form typically falls on financial advisers. However, individuals seeking financial advice should also be aware of its contents and implications. Essentially, the following parties may need to interact with this form:

Key components of the confirmation of financial advice form

A confirmation of financial advice form comprises essential information that must be accurately filled out to avoid potential legal issues. Key components include not only personal details but also specific information related to the financial advice provided.

Understanding these essential components is paramount. Here are the critical elements typically required in the form:

The process of filling out the confirmation of financial advice form

Filling out the confirmation of financial advice form can be straightforward if you understand the process. For individuals, it’s crucial to follow these detailed steps to ensure accuracy and compliance. Here’s how to proceed:

For teams or advisers, it's crucial to collaborate efficiently. Some special instructions include ensuring all team members are on the same page concerning the advice provided, and delegating sections of the form for quick completion and verification.

Common pitfalls to avoid

When filling out a confirmation of financial advice form, various pitfalls can lead to complications down the line. Avoiding these common mistakes will ensure a smooth experience:

Editing and signing the confirmation of financial advice form

After filling out the confirmation of financial advice form, careful editing is necessary to maintain professionalism and clarity. Using pdfFiller’s editing tools allows users to make changes effectively. These tools provide a seamless editing experience to enhance the document’s accuracy.

For electronic signatures, the process is streamlined for convenience. Here's why eSigning is essential and how to do it:

Collaboration and sharing capabilities

Collaboration is key when dealing with a confirmation of financial advice form, especially for teams working together. Sharing this form with colleagues or advisers can facilitate feedback and ensure that everyone is aligned.

Security and privacy considerations

Given the sensitive nature of financial information, protecting personal data is paramount. pdfFiller employs various security measures to safeguard document management, ensuring compliance with legal standards and privacy regulations.

When filling out the confirmation of financial advice form, take note of the following considerations:

Frequently asked questions about the confirmation of financial advice form

Understanding the nuances of the confirmation of financial advice form often generates various questions. Below are common queries that arise concerning this document.

Financial advice and its implications

Receiving financial advice often comes with significant implications. Clients should fully grasp the nature of the advice, including potential risks and rewards. Should clients disagree with the advice given, it's essential to communicate this with the adviser to explore alternatives.

Additional tools and resources for managing completed forms

After completing the confirmation of financial advice form, utilizing pdfFiller tools to manage these documents is invaluable. These tools help users store, retrieve, and manage the confirmation form seamlessly.

Navigating compliance and regulations

Navigating the regulatory landscape surrounding financial advice is essential. The confirmation of financial advice form has legal implications that necessitate understanding specific compliance obligations.

To ensure adherence to the latest standards, consider the following:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send confirmation of financial advice to be eSigned by others?

Can I sign the confirmation of financial advice electronically in Chrome?

How do I edit confirmation of financial advice straight from my smartphone?

What is confirmation of financial advice?

Who is required to file confirmation of financial advice?

How to fill out confirmation of financial advice?

What is the purpose of confirmation of financial advice?

What information must be reported on confirmation of financial advice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.