Get the free Credit Advice - Debt Securities

Get, Create, Make and Sign credit advice - debt

Editing credit advice - debt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit advice - debt

How to fill out credit advice - debt

Who needs credit advice - debt?

Credit advice - Debt form: A comprehensive guide to managing your debts effectively

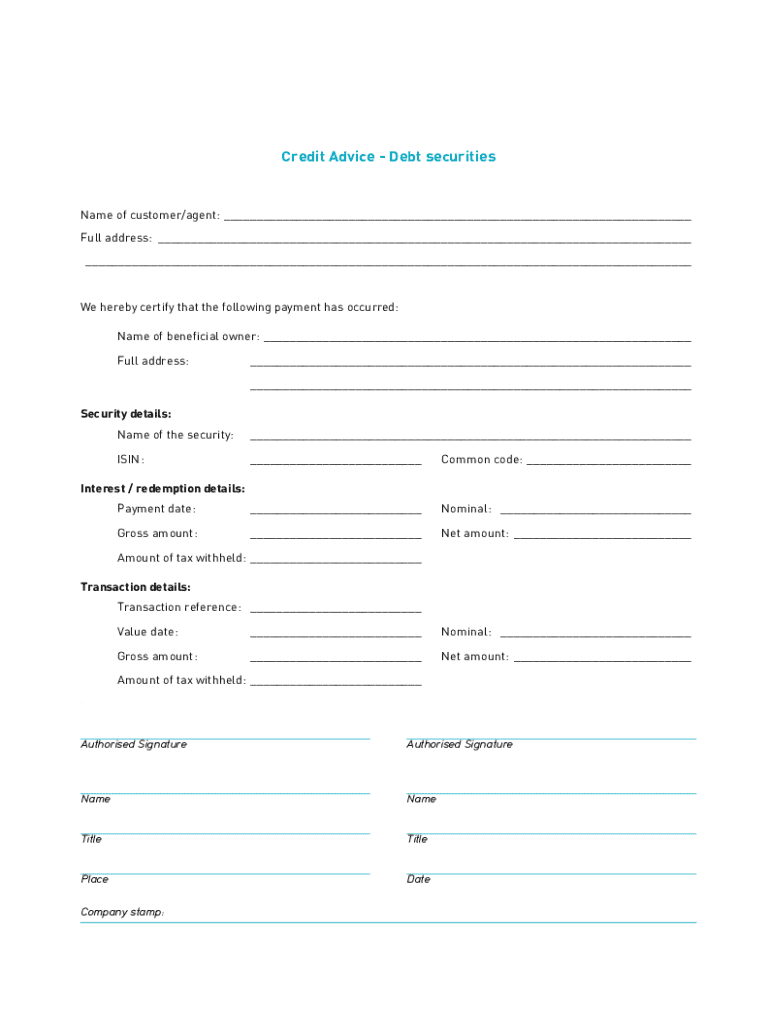

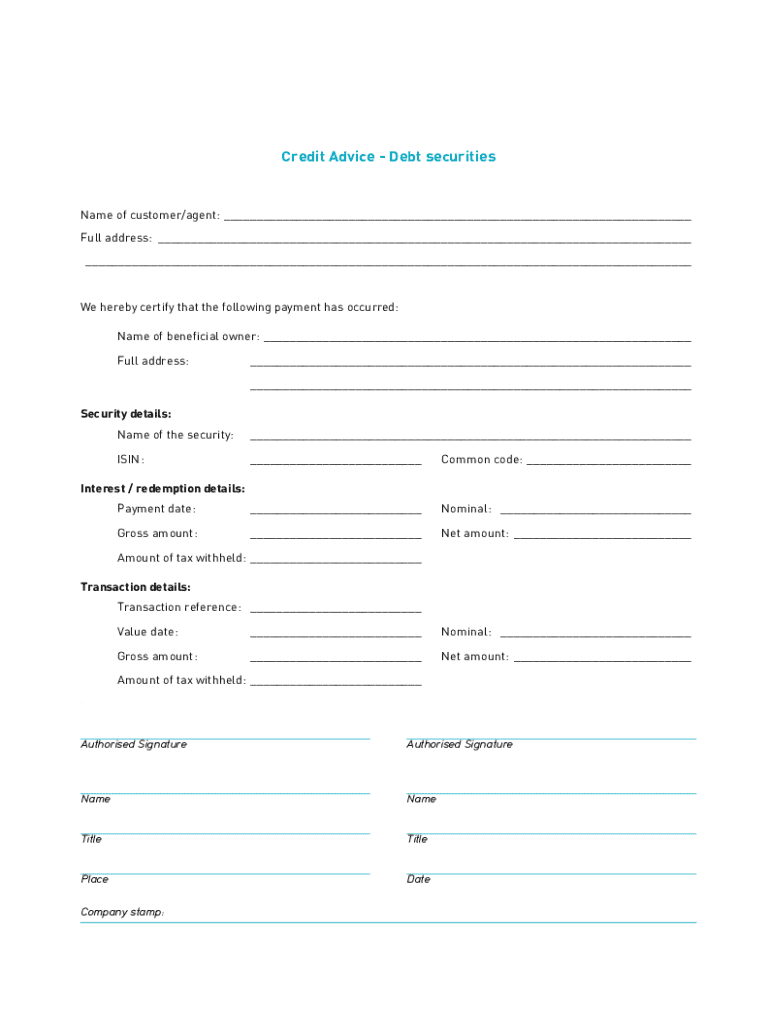

Understanding the debt form

The debt form is an essential document designed to help individuals and organizations clearly outline their financial obligations and seek appropriate credit advice. By detailing various aspects of their financial situation, users can better understand their debts and explore potential relief options. Completing this form accurately is vital, as it forms the basis for any advice or assistance that might follow.

Understanding the purpose of the debt form in credit advice involves recognizing its role as a communication tool between the borrower and their financial advisor or counselor. It facilitates a thorough assessment of financial health, allowing advisors to provide tailored advice that addresses specific challenges faced by the individual or organization submitting the form.

Precise completion of the debt form is necessary because inaccuracies can lead to suboptimal solutions. Missing information or errors in amounts can contradict the advice provided, adding unnecessary complexity to the support process. Thus, taking the time to ensure every detail is correct can prove invaluable.

Who should use the debt form?

Individuals seeking debt relief often find themselves in financially challenging situations. Whether due to unexpected expenses, job loss, or poor financial planning, these individuals usually fall into specific categories that make them suitable for using the debt form. Eligibility typically includes those who are struggling to keep up with monthly payments, those with declining credit scores, and anyone interested in consolidating their debts.

Financial advisors and debt counselors play a pivotal role in guiding individuals through the complexities of debt management. Utilizing the debt form allows them to quickly access crucial client information, helping them to formulate actionable strategies tailored to an individual’s unique financial circumstances. These professionals are responsible for ensuring clients understand their current financial health and the implications of their debts.

Organizations that assist clients with financial challenges can also benefit from the debt form. Nonprofits and community organizations can use it to accurately assess an individual's situation and triage cases effectively, ensuring they deploy resources efficiently to those who need it the most. The debt form becomes a vital instrument for many entities focused on financial literacy and empowerment.

Key components of the debt form

The debt form typically consists of several key components essential for compiling a comprehensive financial overview. The first section is the personal information section, which requires basic identifying details such as name, address, phone number, and email. It’s crucial that this information is accurate, as it affects all subsequent interactions with advisors and financial institutions.

Next is the financial overview section, where individuals must provide details about their income and monthly expenses. This breakdown should categorize spending—whether on housing, utilities, groceries, or discretionary expenses—giving a full picture of financial capacity.

The debt details section specifically asks users to list all debts, such as credit cards, student loans, mortgages, and personal loans, ensuring that accurate amounts are recorded to understand the total debt situation. Finally, the communication preferences section allows users to specify how they wish to be contacted, enhancing the personalized assistance they receive.

How to fill out the debt form effectively

Filling out the debt form effectively requires attention to detail and organization. Here’s a step-by-step guide to ensure you complete it with accuracy:

Common mistakes to avoid include omitting debts, which might provide an incomplete picture of financial health, and incorrect income figures that can lead to misguided advice. Always ensure to provide the most current and relevant information.

Tools for managing and editing your debt form

Using a platform like pdfFiller can greatly enhance your experience when managing and editing your debt form. This cloud-based document management solution allows users to easily make changes, collaborate with advisors, and ensure their documents are up-to-date, improving the process’s overall efficiency.

The benefits of cloud-based editing include accessibility from any device with internet access, allowing you to work on your debt form at your convenience. pdfFiller also offers interactive features such as eSigning capabilities and real-time sharing options, making collaboration with financial advisors more efficient.

Frequently asked questions (FAQs)

Navigating the submission and management of your debt form raises important questions. Here are a few common inquiries:

Resources for continued debt management

The journey doesn't end with submitting the debt form. Access to ongoing support and resources is crucial for successful debt management. Seek further credit advice through various financial literacy resources available online, such as budgeting tools, webinars, and articles.

Connecting with certified debt counselors can make a significant difference in navigating your financial landscape. Many resources exist locally and nationally to help find licensed professionals who can provide personalized guidance tailored to your situation. Additionally, exploring sample scenarios and actionable solutions online can illustrate how to manage different financial statuses effectively.

Important legal considerations

When completing the debt form, be aware of your consumer rights. Understanding these rights ensures you feel confident in the process and empowers you to protect your personal information. It’s vital to know how your data will be used and ensure that it will be kept secure throughout the credit advice process.

Data protection regulations apply to financial documents, meaning organizations must comply with local laws to safeguard your information. Familiarizing yourself with these rights can provide peace of mind as you navigate your financial challenges.

Tips for effective debt management post-submission

Post-submission, monitoring your financial health is an ongoing process. Setting up financial alerts can help keep you informed of due dates and payment statuses, ensuring you stay on top of your obligations. Timely reminders about your debts can prevent further issues down the line.

Creating a budget using data from your debt form can drive better financial decisions. Utilize an income and expenditure form to categorize and monitor spending progressively. Implementing established budgeting strategies can assist in effectively managing debts and working towards financial recovery.

Impact of not using the debt form

Neglecting to utilize the debt form can have serious repercussions. Without formal documentation of your debts and financial situation, you may miss out on valuable advice and support. Unclear records can lead to confusion regarding payment priorities and overdue debts, negatively impacting your credit score and overall financial health.

Ultimately, avoiding the debt form reduces your ability to take control of your financial situation. Seeking debt relief and proper guidance from financial advisors becomes much more challenging without the clarity and detail that a completed debt form provides.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit advice - debt for eSignature?

How do I edit credit advice - debt on an iOS device?

How do I fill out credit advice - debt on an Android device?

What is credit advice - debt?

Who is required to file credit advice - debt?

How to fill out credit advice - debt?

What is the purpose of credit advice - debt?

What information must be reported on credit advice - debt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.