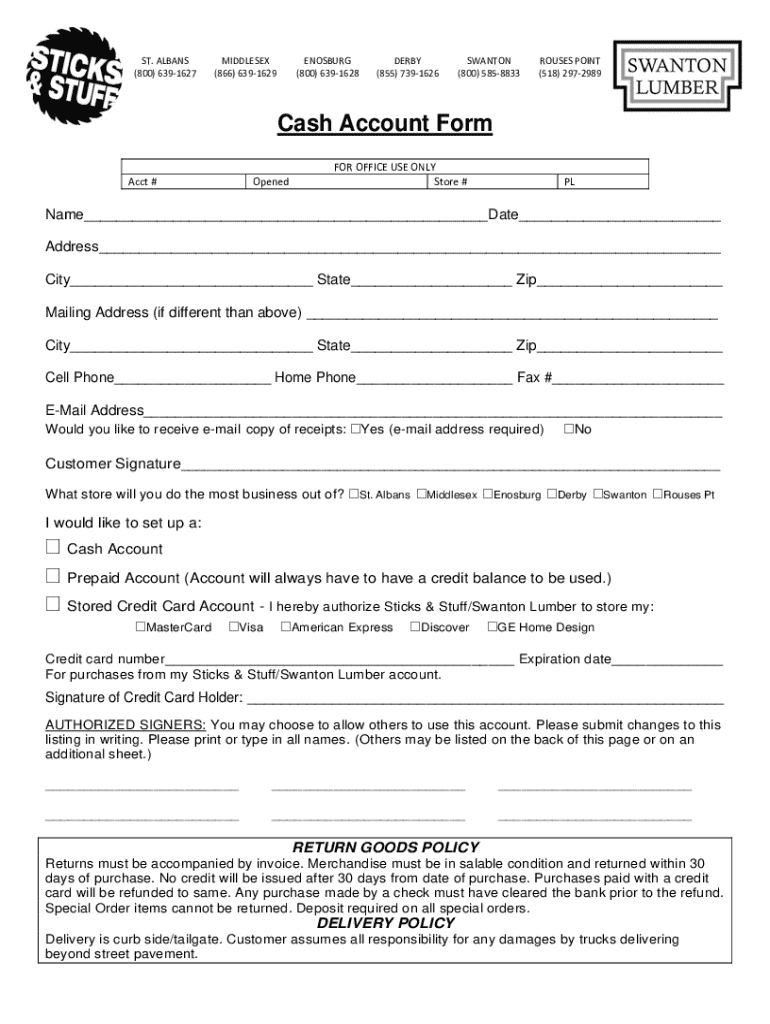

Get the free Cash Account Form

Get, Create, Make and Sign cash account form

How to edit cash account form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash account form

How to fill out cash account form

Who needs cash account form?

Cash Account Form - Your Comprehensive Guide

Understanding the cash account form

A cash account form is a critical document used primarily by individuals and organizations to manage and track cash transactions. Unlike other account types, cash accounts are specifically designed for handling immediate cash inflows and outflows without the need for credit or borrowed funds. This form becomes especially necessary for maintaining precise financial oversight and ensuring accountability in cash handling.

Filling out a cash account form correctly is essential for accurate financial reporting. It allows users to keep an organized ledger of all cash transactions, ensuring that every dollar is accounted for. Not only is this important for individual users, but it is also crucial for small businesses, non-profits, and larger organizations that rely on transparent financial processes.

Common applications of cash account forms include personal budgeting, managing petty cash in workplaces, and tracking project expenses in organizations. Ensuring the correct completion of this form helps prevent financial discrepancies and provides a clear picture of cash availability for various purposes.

Preparing to fill out the cash account form

Before starting to fill out a cash account form, it's important to gather all required documents and information. These documents play a pivotal role in ensuring accuracy and compliance when managing cash transactions.

Common mistakes to avoid include failing to double-check the provided information, which can result in errors that affect account functionality. Additionally, omitting required documents can cause processing delays, so it's advisable to checklist all necessary items before submission.

Step-by-step instructions for completing the cash account form

Completing the cash account form can seem daunting, but breaking it down into sections makes it more manageable. Here is a step-by-step guide.

Editing and customizing your cash account form

After filling out your cash account form, you may need to make edits or adjustments. With pdfFiller, making these changes is straightforward and user-friendly.

Signing the cash account form

Once your cash account form is completed and edited, the next step is signing it. With pdfFiller, eSigning is quick and convenient.

Submitting the cash account form

After signing, the next step is submission. Understanding the available submission methods ensures your cash account form is sent efficiently.

Tips for managing your cash account post-submission

Once your cash account form is submitted, proactive management becomes essential. Regular monitoring ensures that all transactions align with your financial planning.

Troubleshooting common issues

Despite careful preparation, issues can occasionally arise during submission or processing. Knowing how to address these challenges is key.

Best practices for document management

Proper document management post-submission is essential for maximizing the utility of your cash account form. Establishing a strong organizational system will serve you well.

Additional features of pdfFiller for cash account management

Utilizing pdfFiller goes beyond basic form filling; it offers an array of features that enhance cash account management.

Staying informed

To ensure you remain compliant and informed, staying up-to-date on cash account regulations is important.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cash account form to be eSigned by others?

How do I edit cash account form on an Android device?

How do I complete cash account form on an Android device?

What is cash account form?

Who is required to file cash account form?

How to fill out cash account form?

What is the purpose of cash account form?

What information must be reported on cash account form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.