Get the free Contributor/parent Non-tax Filer Statement

Get, Create, Make and Sign contributorparent non-tax filer statement

How to edit contributorparent non-tax filer statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contributorparent non-tax filer statement

How to fill out contributorparent non-tax filer statement

Who needs contributorparent non-tax filer statement?

Comprehensive Guide to the Contributor Parent Non-Tax Filer Statement Form

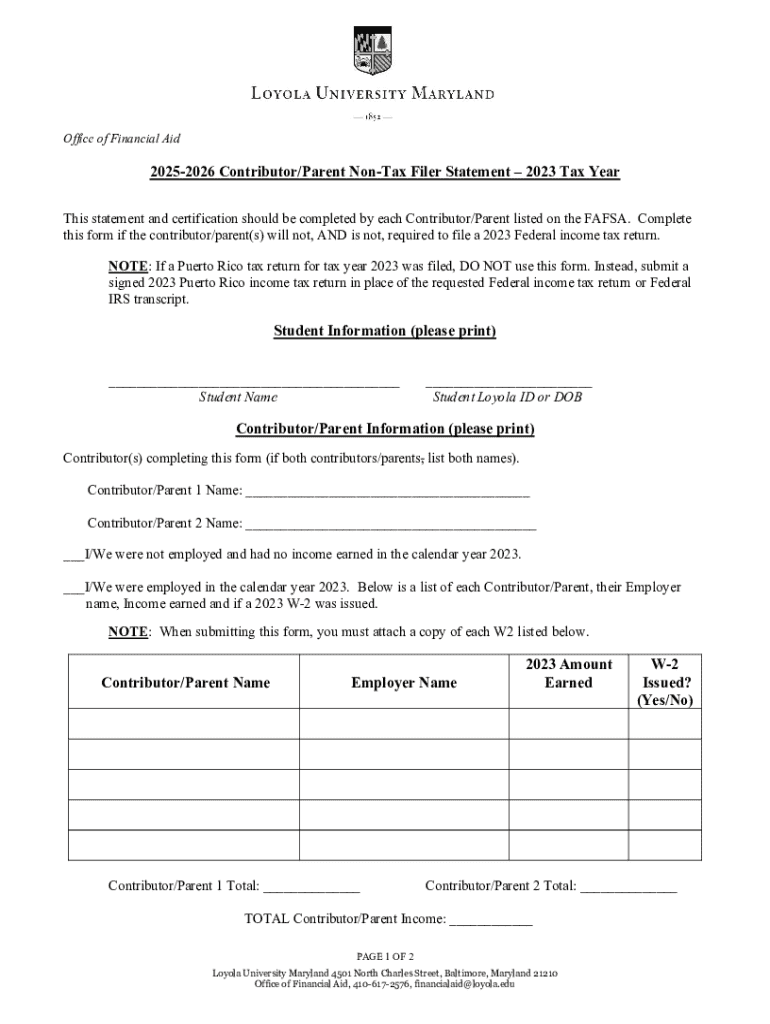

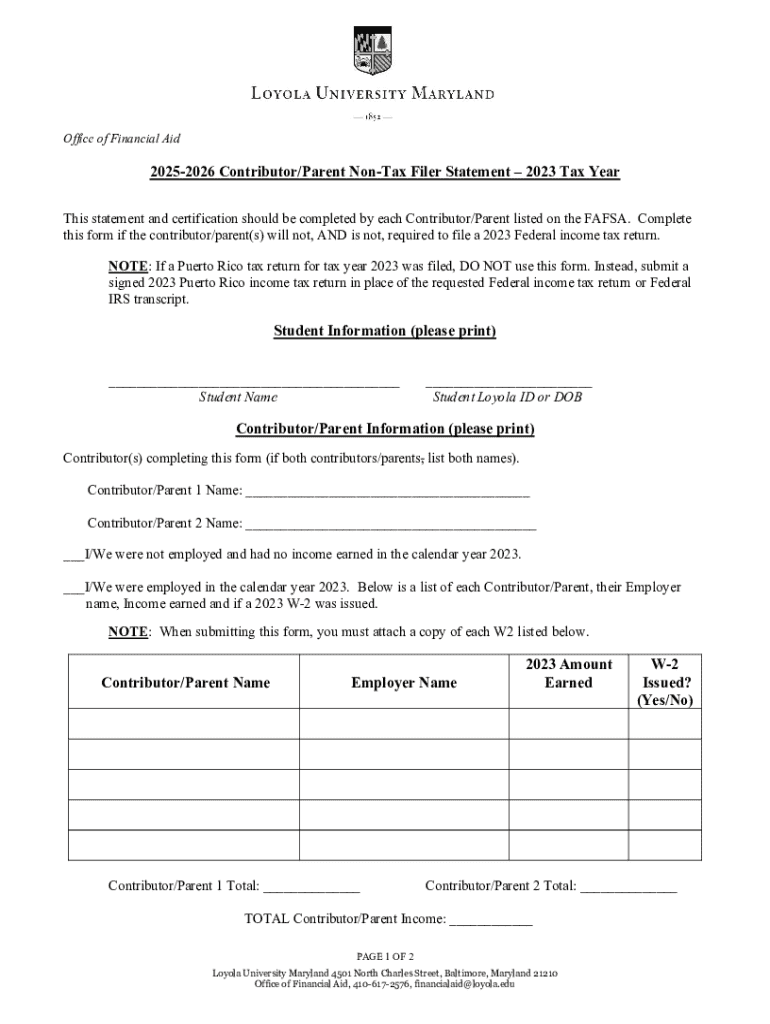

Overview of the Contributor Parent Non-Tax Filer Statement Form

The Contributor Parent Non-Tax Filer Statement Form is a specialized document designed to assist parents or guardians who do not qualify for tax filing obligations due to low income or other specific circumstances. This form serves as an official declaration that provides essential financial information to educational institutions and financial aid entities. It is crucial for determining eligibility for student financial aid and helps institutions assess the actual financial circumstances of prospective students.

For contributors and parents, this form plays a vital role in children’s educational funding. It ensures that students can access the resources and financial assistance necessary to further their education, thereby reducing barriers to access for those not traditionally represented in the tax system. Knowing when and why to use this form can aid in streamlining the student’s financial aid application process and, ultimately, pay for higher education.

Who needs the Contributor Parent Non-Tax Filer Statement?

Identifying who needs the Contributor Parent Non-Tax Filer Statement is integral to ensuring that the right documentation is submitted during financial aid processes. Generally, this form is required for parents or guardians who have not filed federal taxes in the past year due to their income level being below the taxable threshold. Potential contributors can include those who may receive non-taxable forms of income, such as Social Security benefits, welfare payments, or unemployment benefits.

Situations that require this form often involve students applying for federal student aid through the Free Application for Federal Student Aid (FAFSA). It is essential because it may affect the overall financial aid package the student can receive. The information on the form supports claims of financial need that may not be fully represented through standard tax documents. Consequently, it plays a significant role in qualifying for grants or reduced tuition rates.

Detailed breakdown of the form's sections

The Contributor Parent Non-Tax Filer Statement is organized into several key sections, each gathering crucial information needed by educational institutions to assess financial need accurately.

Section 1: Personal Information

This section requires straightforward personal details, including the contributor's name, address, and contact information. Accuracy is vital here, as any discrepancies could delay financial aid processing. Double-checking for spelling errors in names and ensuring current contact information is included will facilitate smoother communication.

Section 2: Financial Information

In this section, contributors must report all non-taxable income sources. Examples of non-taxable income can include certain types of benefits, child support, and alimony. Understanding precisely how to categorize different income streams can prevent misunderstandings during the financial assessment process.

Section 3: Certification

This final section requires signatures confirming the accuracy of the information provided. It's crucial to ensure that all contributing parties understand the information they are certifying, as any inaccuracies can have significant ramifications for financial aid eligibility.

Step-by-step instructions to complete the form

Completing the Contributor Parent Non-Tax Filer Statement Form can seem daunting, but following a detailed methodology can simplify the process.

Editing and managing your form with pdfFiller

pdfFiller offers an easy-to-use platform for completing and managing the Contributor Parent Non-Tax Filer Statement Form. With its robust editing features, users can effortlessly make changes to their documents without the need for printing or scanning.

Utilizing the pdfFiller platform for electronic completion

The seamless editing capabilities of pdfFiller make it a preferable choice for form completion. Users can easily add, delete, or modify text within the form, ensuring their entries reflect the most current information. Furthermore, pdfFiller's eSigning functionalities allow users to sign documents electronically, offering an efficient alternative to traditional signing methods.

Collaborating with others

Collaboration is made simple using pdfFiller. Users can share their forms with others who may provide additional information or checks. The platform also tracks changes, ensuring that users remain updated on who modified what, keeping all stakeholders informed.

Frequently asked questions (FAQs)

As with any official form, potential submitters often have questions about the Contributor Parent Non-Tax Filer Statement Form. Addressing common concerns can clarify the process and alleviate confusion.

Tips for submitting your Contributor Parent Non-Tax Filer Statement

When it comes to submitting the Contributor Parent Non-Tax Filer Statement Form, adhering to certain tips can enhance your submission experience and avoid pitfalls.

Common issues and resolutions

Despite a smooth submission process, applicants may encounter challenges with their Contributor Parent Non-Tax Filer Statement Form. Understanding common issues can help navigate these hurdles effectively.

Community insights and testimonials

Feedback from other users can shed light on how the Contributor Parent Non-Tax Filer Statement Form has been beneficial in real-world scenarios. Hearing from others can also provide motivation and direction.

Next steps after submission

Once the Contributor Parent Non-Tax Filer Statement Form has been submitted, various next steps can streamline the transition into the financial aid process.

Related forms and resources

Understanding the contributing factors to financial aid requires knowing the various forms associated with the process. Here are some related resources.

Contact information for further assistance

As with any official documentation process, having access to reliable support can make a world of difference. Here’s how you can seek help when filling out the Contributor Parent Non-Tax Filer Statement Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contributorparent non-tax filer statement for eSignature?

Can I create an electronic signature for signing my contributorparent non-tax filer statement in Gmail?

How do I edit contributorparent non-tax filer statement on an Android device?

What is contributorparent non-tax filer statement?

Who is required to file contributorparent non-tax filer statement?

How to fill out contributorparent non-tax filer statement?

What is the purpose of contributorparent non-tax filer statement?

What information must be reported on contributorparent non-tax filer statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.