Get the free Credit Card Authorization

Get, Create, Make and Sign credit card authorization

Editing credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization

How to fill out credit card authorization

Who needs credit card authorization?

Credit Card Authorization Form: How-to Guide

Understanding credit card authorization forms

A credit card authorization form is a document used to request approval for a credit card transaction from the cardholder. It serves as proof that the cardholder permits a service provider or merchant to charge their credit card for a particular transaction, whether it’s a one-time purchase or a recurring payment.

The importance of this form lies in its ability to protect both the merchant and the consumer. For merchants, it serves as a safeguard against chargebacks and fraud, while for consumers, it ensures their card information is handled securely and with their consent. Legally, these forms can act as a binding agreement that affirms the cardholder’s consent; thus, it’s crucial that they are filled out accurately and retained securely.

Benefits of using credit card authorization forms

There are numerous advantages associated with using credit card authorization forms. Firstly, they significantly reduce the risk of chargeback abuse where dishonest customers dispute transactions, affecting merchant revenues. Secondly, the use of such forms facilitates secure payment processing by ensuring that the cardholder is aware of and has agreed to the transaction, which contributes to a safer purchasing environment.

Furthermore, utilizing these forms enhances trust between sellers and buyers. When a customer knows a business is following proper procedures for payment authorization, it fosters a sense of security. This trust is especially important in sectors with high levels of online transactions. Finally, credit card authorization forms streamline transaction processes. By collecting vital information upfront, businesses can expedite billing and service delivery, leading to improved customer satisfaction and operational efficiency.

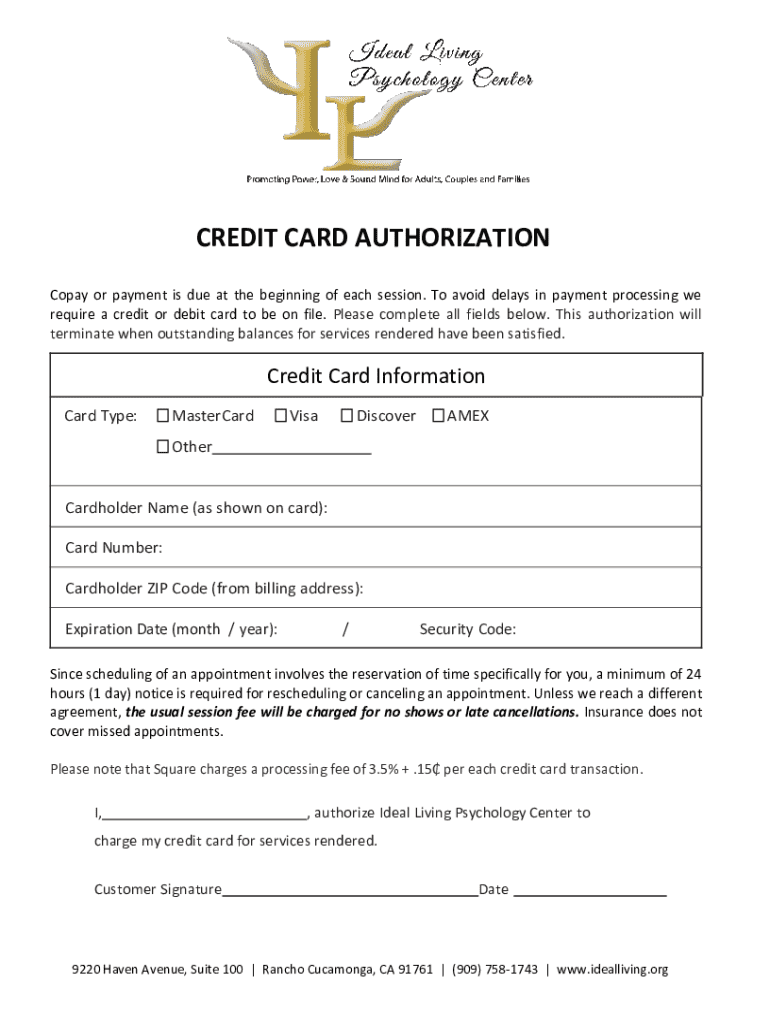

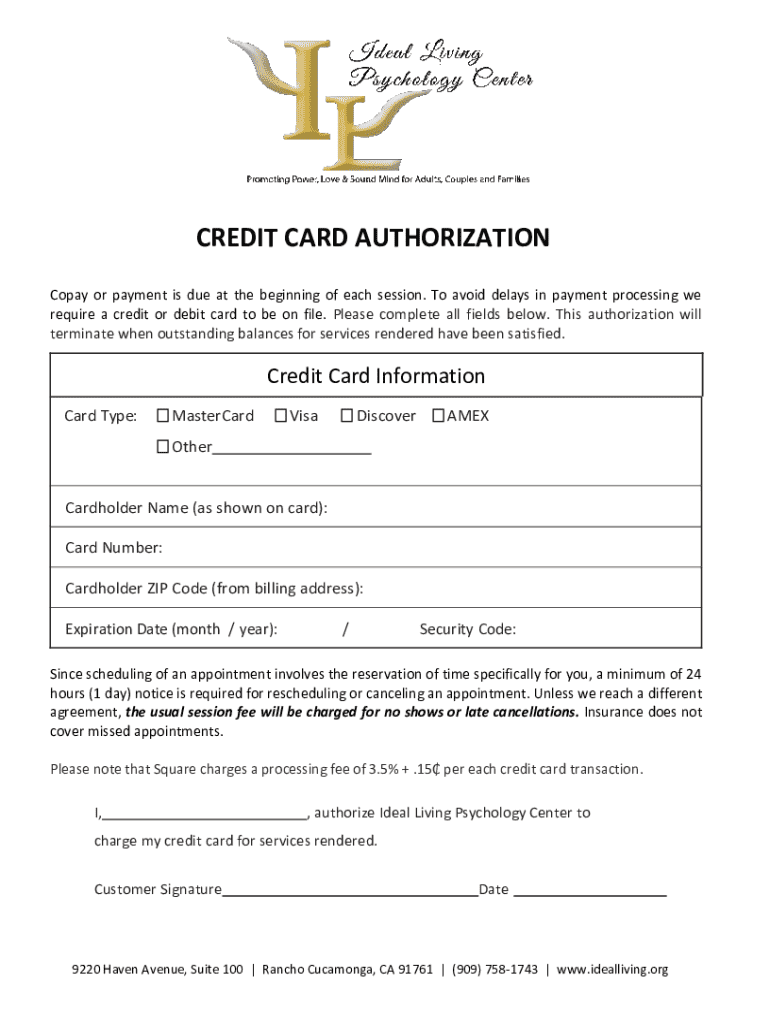

Key components of a credit card authorization form

To ensure a credit card authorization form serves its purpose, specific essential fields must be included. The basic fields encompass the cardholder's name, credit card details including the card number and expiration date, the amount to be charged, and the authorization signature of the cardholder. These elements are crucial as they form the backbone of the agreement.

Optional fields like the CVV and billing address can further secure transactions. It’s also important to stipulate terms and conditions related to the charge on the form, which can help clarify responsibilities and expectations for both parties.

How to create a credit card authorization form

Creating a credit card authorization form can be streamlined by using various tools and templates available online. Platforms like pdfFiller offer interactive tools that allow you to customize your forms easily. Additionally, downloading user-friendly templates can save time and ensure all necessary information is captured.

Here's a step-by-step guide on how to fill out a credit card authorization form correctly:

Situations where you should use credit card authorization forms

Credit card authorization forms are essential in various contexts. E-commerce transactions often require these forms to legitimately process payments while documenting consent. They are equally vital for recurring payments, such as subscriptions, where a clear record of authorization is necessary.

In remote services like consultations or deliveries, these forms guarantee that customers authorize payments in advance, which is especially important to prevent any disputes. High-risk industries, such as travel or luxury goods, also greatly benefit from using credit card authorization forms as they help to minimize the risk of fraudulent transactions.

Frequently asked questions (FAQ) about credit card authorization forms

Many individuals and businesses have queries about credit card authorization forms. One common question is whether one is legally obligated to use these forms; while not strictly required, they provide significant legal protections in disputes. Another frequent query pertains to the absence of a CVV space on the form; businesses may choose to omit this for security reasons as it is often not necessary for charging.

Receiving accurate and clear information regarding these forms is critical for compliance and operational efficiency.

Best practices for managing credit card authorization forms

Managing credit card authorization forms involves implementing best practices for secure storage and efficient access. Ensure that completed forms are stored in a secure environment, whether physical or digital, and that access is limited to authorized personnel only. Maintaining compliance with data protection laws is non-negotiable; thus, it’s crucial to keep up-to-date on regulations affecting document management.

Conducting regular audits of authorization forms can enhance efficiency, ensuring that outdated standards are replaced and relevant compliance needs are met. This diligence safeguards both your business and your customers’ information, keeping trust intact.

Related payment processing resources

Understanding the broader context of payment processing can enhance your knowledge related to credit card authorization forms. Familiarize yourself with payment gateways and their critical role in facilitating online transactions. Also, grasping the concept of card-not-present (CNP) transactions is essential, as they involve different risks and require more stringent measures for authorization.

Explore further with pdfFiller

For those looking to streamline their document management, pdfFiller offers a wealth of resources, including customized templates and tools tailored for credit card authorization forms. By signing up for pdfFiller, users can access interactive features that simplify the document creation and management process.

Beyond templates, pdfFiller enables you to enhance your document workflows with functionalities such as e-signatures and collaboration tools, ensuring that your business transactions remain efficient and secure.

Insights from industry experts

Industry professionals stress the importance of adopting robust practices when managing credit card authorization forms. Recommendations often include regular training for staff on compliance standards and incorporating technological solutions to keep up with evolving payment regulations. Success stories from businesses that have effectively implemented authorization forms highlight the benefits of reducing chargebacks and maintaining a strong security posture.

Community engagement

Participation and engagement with the community is vital for sharing insights on credit card authorization forms. Whether you have experiences to share or questions regarding best practices, the conversation is ongoing. Subscribing for updates and exclusive content from pdfFiller keeps you informed on developments in document management, while webinars and Q&A sessions offer further opportunities for learning and collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization to be eSigned by others?

How do I edit credit card authorization online?

How do I edit credit card authorization in Chrome?

What is credit card authorization?

Who is required to file credit card authorization?

How to fill out credit card authorization?

What is the purpose of credit card authorization?

What information must be reported on credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.