Get the free Credit Application for Manufactured (Mobile) Home

Get, Create, Make and Sign credit application for manufactured

Editing credit application for manufactured online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application for manufactured

How to fill out credit application for manufactured

Who needs credit application for manufactured?

How to Complete a Credit Application for Manufactured Form

Overview of credit applications for manufactured forms

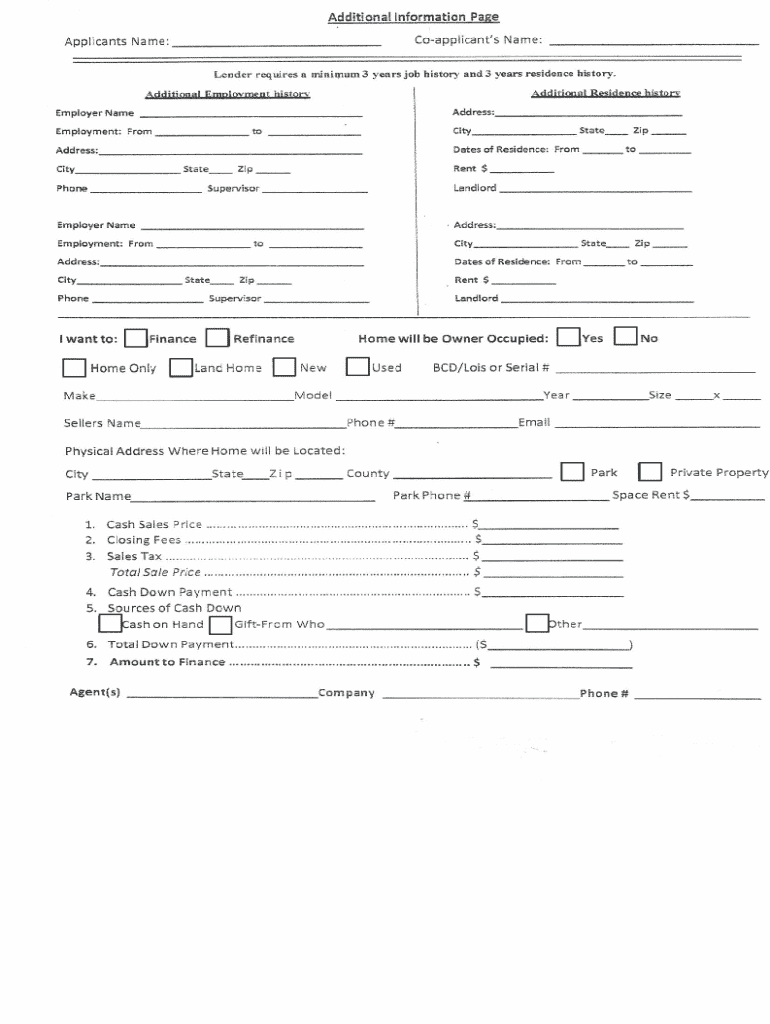

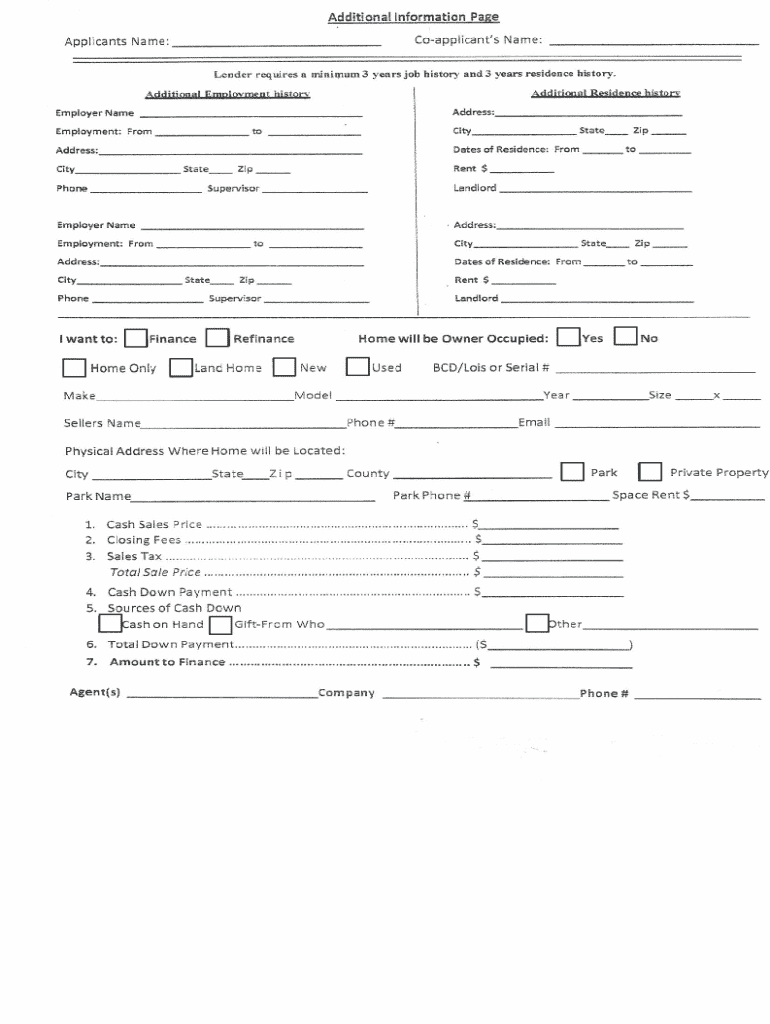

A credit application is a formal request submitted to a lending institution to obtain credit. This document is crucial for anyone seeking a loan, whether for personal use or business financing. Manufactured forms of credit applications serve as standardized templates that streamline the process for both lenders and applicants.

Providing accurate information on a credit application is paramount. Errors or omissions can lead to delays, rejections, or unfavorable rates, affecting the applicant's financial opportunities. Understanding how to properly fill out these forms is essential for success.

Common uses of manufactured credit forms include personal loans, auto loans, and mortgages. These forms help to assess an applicant’s creditworthiness and financial history, allowing lenders to make informed decisions.

Preparing to fill out the credit application

Before diving into the credit application, it’s critical to gather all required documentation. Different lenders might have slightly varying requirements, but generally, you will need identification documents, proof of income, and employment verification.

Identification documents such as a government-issued ID and your Social Security Number are standard. Additionally, banks will often require proof of income, which can be in the form of pay stubs, tax returns, or bank statements that showcase your financial health.

Thoroughly gathering personal and financial information is another essential step. This includes your name, address, contact information, and a comprehensive outline of your financial history, including income sources, current debts, and monthly expenses.

Accessing the manufactured form

To fill out a manufactured credit application, you'll want to take advantage of the features offered by pdfFiller. This robust document management tool provides a user-friendly interface for accessing, editing, and submitting forms.

To navigate to the credit application form via pdfFiller, you can either search for it directly or browse through available templates. Many forms, including credit applications, are available in both online versions and downloadable PDFs.

Step-by-step guide to completing the credit application

Filling in the personal information section accurately is the first step in completing your credit application. Double-check details like your name, address, and contact information as these are crucial for the application process.

In the financial details section, break down your income, listing all forms of income you receive. It's essential to also include current debts and obligations. Be as transparent as possible to avoid any issues during the evaluation.

After inputting your information, review and double-check everything. Use pdfFiller’s tools to visually inspect the data you’ve entered, which can help spot mistakes easily.

Manufactured credit applications often have unique fields that require special attention. Understand any conditional fields that may apply to your situation, enabling you to provide the most relevant information.

Editing and customizing the credit application

Once the initial information is entered, take advantage of pdfFiller’s editing tools to make any necessary adjustments. This can include correcting typos or adding additional information to clarify your situation.

Adding annotations or comments can make your application clearer and provide context to any unique situations you may be facing. This is especially useful when applying for larger loans where lenders want a better understanding of your circumstances.

For collaborative efforts, pdfFiller allows you to share the document with team members or advisors to gather input before final submission. This feature can be particularly beneficial if applying for a business-related loan.

Signing and submitting the credit application

Applying a digital signature to your credit application is a straightforward process, and it is increasingly recognized as legally binding. Within pdfFiller, you can electronically sign the application smoothly, ensuring a fast and efficient submission.

Submission options vary, including online submissions directly through the platform or printing and mailing the application. Familiarize yourself with the submission method preferred by your lender to ensure compliance with their requirements.

Common issues and troubleshooting

While filling out a credit application for manufactured forms can seem straightforward, challenges can arise. Common FAQs include inquiries about specific fields and requirements. Prepare yourself by proactively addressing potential questions.

If your application gets rejected, it’s important to review the feedback given and make necessary adjustments. Don't hesitate to reach out to customer support through pdfFiller for guidance. They can offer assistance and clarity on what steps to take next.

Additional tips for a successful application

To enhance the accuracy of your credit application, double-check all entries and validate the information with your documentation. Make a checklist to avoid common pitfalls, such as missing signatures or incorrect social security numbers.

An understanding of your rights as a credit applicant is also vital. Be aware that you have the right to understand the terms you are agreeing to and the criteria lenders use in their evaluation, which can inform better applications in the future.

Exploring resources for further support

pdfFiller offers comprehensive customer service options to assist you in navigating credit applications for manufactured forms. Whether through tutorials, FAQs, or direct customer support, you have access to a wealth of information to guide you.

Additionally, pdfFiller provides various tools for managing your documents, from editing to signing, making it a one-stop solution. Continuously expanding your financial literacy through the resources provided can further support your journey in navigating credit applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit application for manufactured?

How do I execute credit application for manufactured online?

Can I create an electronic signature for the credit application for manufactured in Chrome?

What is credit application for manufactured?

Who is required to file credit application for manufactured?

How to fill out credit application for manufactured?

What is the purpose of credit application for manufactured?

What information must be reported on credit application for manufactured?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.