Get the free Cd Certificate

Get, Create, Make and Sign cd certificate

Editing cd certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cd certificate

How to fill out cd certificate

Who needs cd certificate?

Understanding the Certificate Form: A Comprehensive Guide

Understanding certificate forms

A CD certificate form, or Certificate of Deposit, is a financial document that represents a savings account with a fixed interest rate and fixed maturity date. It is primarily used in banking and investment contexts as a way to secure funds with a guaranteed rate of return.

The primary purpose of a CD certificate form is to document the details of the agreement between the bank and the account holder, laying out terms such as interest rate, maturity date, and withdrawal procedures. Common use cases include saving for short- to medium-term goals like buying a home or saving for education, as it provides a safe investment option.

Importance of certificates

CD certificates play a critical role in financial transactions by providing a trustworthy avenue for saving money. They are favored due to their risk-free nature and predictability in returns, making them an excellent option for conservative investors. Furthermore, understanding their importance leads to informed decision-making when selecting the best financial products suitable for individual or team needs.

For individuals, a CD can help in wealth accumulation without exposure to market volatility. Teams, such as small businesses or organizations, also benefit by using CDs for managing reserve funds while earning interest. The benefits include predictable earnings, safety of principal investment, and potential tax advantages depending on the account structure.

Types of certificates

There are fundamentally two types of CD certificates based on format: paper and electronic. Paper CD certificates are physical documents that provide a tangible proof of investment, while electronic CD certificates are digital documents stored online, facilitating easier access and management.

Moreover, variations based on institutions must be understood. Banks typically offer traditional CDs with varying interest rates and terms, while credit unions may provide slightly different terms, often with more favorable rates. Understanding these differences in terms and conditions helps individuals make more informed choices when investing.

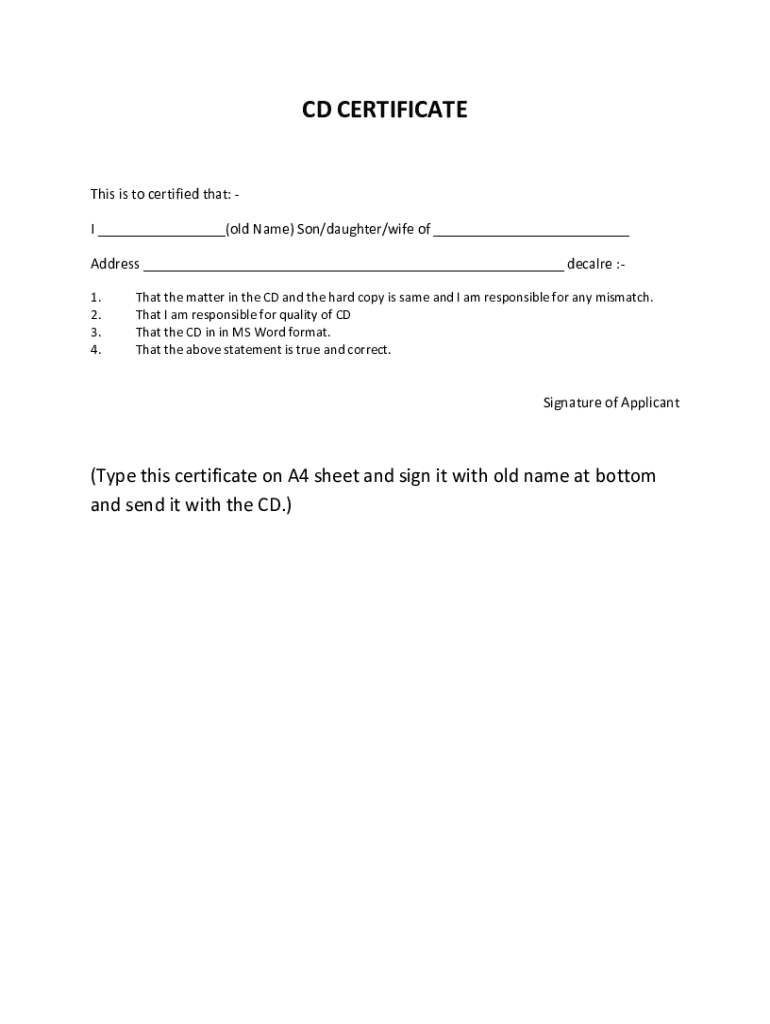

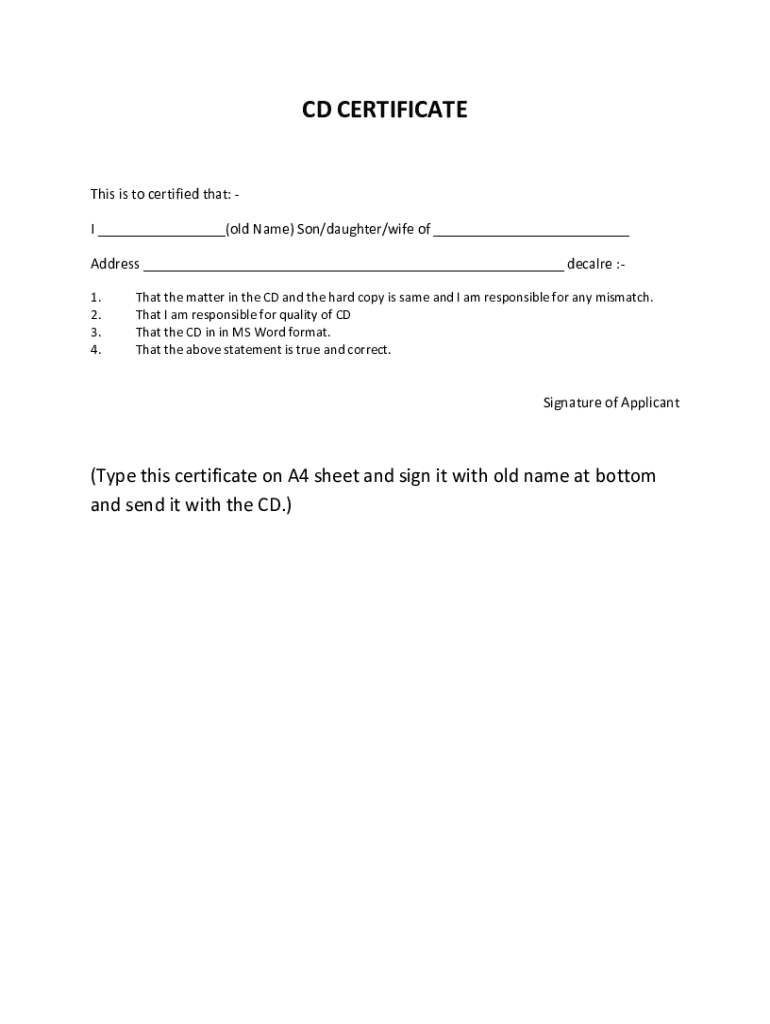

Key components of a certificate form

When filling out a CD certificate form, certain essential information is required. This includes personal details of the account holder, the amount being invested, and interest rate specifications. Clear understanding of these components is critical to ensure smooth processing and management of the account.

Understanding the terms and conditions is equally vital. Individuals should pay close attention to maturity dates, which indicate when the funds are available without penalties, and the withdrawal procedures, which outline how and when money can be accessed. Detailed knowledge about potential penalties for early withdrawal can save account holders from unexpected fees.

Step-by-step guide to filling out a certificate form

Before filling out a CD certificate form, preparation steps are key. This means gathering necessary documents such as identification and proof of address, while also defining personal investment goals to ensure that the CD aligns with your financial strategy.

Filling out the form itself breaks down into three steps: First, input your personal information section accurately. Next, provide details regarding your investment, such as the chosen amount and interest rate. Lastly, ensure you read and agree to the terms and conditions outlined in the document before submitting.

Finally, take the time to review all entered information to avoid mistakes. Submit the form either online through your financial institution's website or in person at a local branch, ensuring you keep a copy for your records.

Editing and managing your certificate form

Editing your CD certificate form is a vital process for maintaining accurate information. Utilizing PDF editing tools like pdfFiller allows users to modify their forms easily. Whether you need to change personal information or investment details, these tools provide a simple interface for updates.

Digital copies of your CD certificate form should be securely stored in the cloud, ensuring easy access from any device. Additionally, eSigning your CD certificate form can expedite processing. Electronic signatures are recognized legally, and using pdfFiller for e-signing facilitates a smooth signing experience.

Common mistakes to avoid when filling out a certificate form

Filling out a CD certificate form should be approached with careful attention to detail. Common mistakes include incomplete or incorrect information, leading to potential delays or penalties. Double-checking each section before submission can prevent these issues from arising.

Misunderstanding terms and conditions can result in unexpected groundwork as well. It is critical to fully understand the implications of maturity dates and potential fees to avoid losing your principal investment due to penalties. Always seek clarity on any confusing terms before finalizing your investment.

Frequently asked questions (FAQs)

If a mistake occurs on your CD certificate form, contact your financial institution immediately to understand correction procedures. Many institutions allow you to amend minor errors without issue.

To modify your CD investment after submission, approach your institution to learn about their specific policies on changes to existing accounts. Often, there are options for managing or adjusting investments post-setup.

At maturity, the principal investment and accrued interest become available for withdrawal. Typically, institutions notify account holders of maturity dates to facilitate the process.

Additional tips for success

Document management is crucial when handling CD certificates. Maintain a schedule for reviewing expiration dates and investment options periodically to make informed choices about your finances. Staying proactive can safeguard against missing opportunities.

Utilizing resources offered by pdfFiller, such as interactive tools, can make the process of filling out, editing, and managing CD certificate forms easier and more efficient. Leveraging these resources can empower individuals and teams to stay organized and focused on their financial goals.

User stories and testimonials

Numerous individuals have experienced benefits from using the pdfFiller platform, notably in managing their CD certificate forms. Personal accounts highlight the ease of filling out digital forms, which significantly reduces processing time and confusion.

Furthermore, teams have reported enhanced efficiency and collaboration when managing CD certificates using pdfFiller. The platform’s cloud-based nature allows multiple users to access documents simultaneously, making it ideal for businesses and organizations seeking to maintain organized financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete cd certificate online?

Can I edit cd certificate on an Android device?

How do I complete cd certificate on an Android device?

What is cd certificate?

Who is required to file cd certificate?

How to fill out cd certificate?

What is the purpose of cd certificate?

What information must be reported on cd certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.