Get the free Change of Beneficiary Form

Get, Create, Make and Sign change of beneficiary form

Editing change of beneficiary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of beneficiary form

How to fill out change of beneficiary form

Who needs change of beneficiary form?

Your Complete Guide to the Change of Beneficiary Form

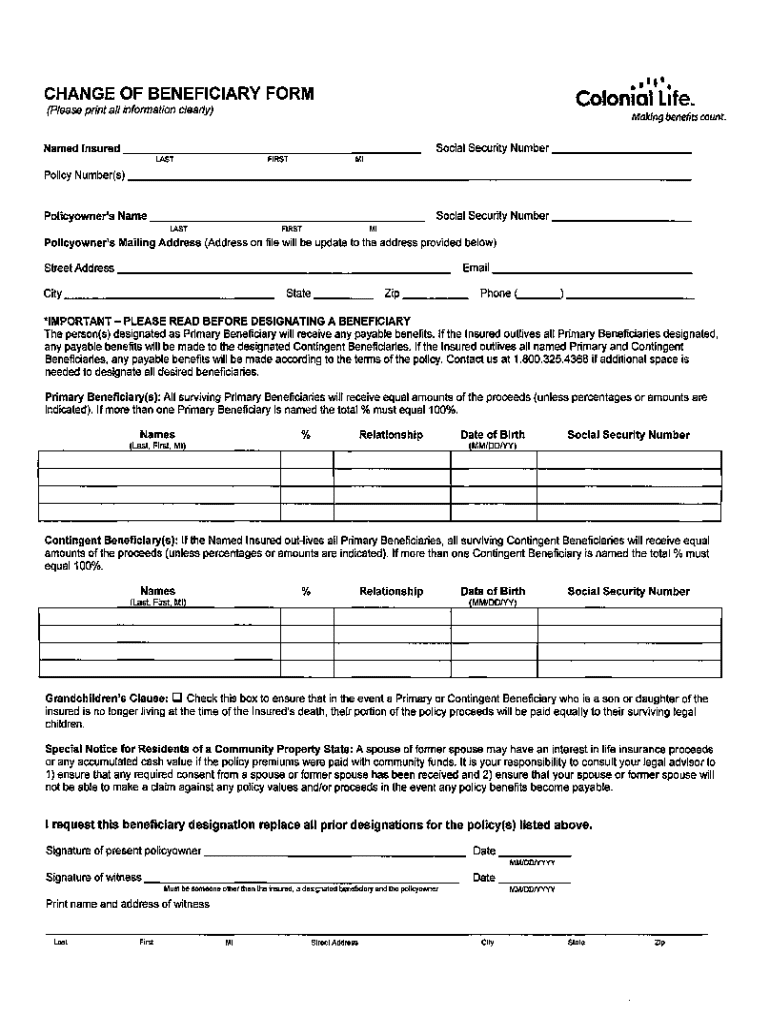

Understanding the change of beneficiary form

The change of beneficiary form is a crucial document used in various financial and insurance contexts, allowing policyholders to designate or amend the individuals or entities who will receive benefits upon their passing. Importance lies not only in ensuring that your chosen beneficiaries are accurately reflected but also in preserving legal rights and expectations for those individuals. Failing to update this form when life situations change — like marriage, divorce, or the birth of a child — can lead to future complications, both legally and financially.

Legal implications arise when beneficiaries are changed without proper documentation or consideration. Courts can become involved when disputes arise, particularly if the previous versions of the document are still accessible and contradict the new changes. Common scenarios for changing beneficiaries include changes in marital status, the death of a previous beneficiary, or changes in personal relationships that lead one to reconsider who should inherit.

Key components of the change of beneficiary form

Filling out a change of beneficiary form accurately is essential. The form typically requires basic personal information of the policyholder, including name, address, and policy number. Beneficiary details are equally important; each entry generally should include the beneficiary’s name, relationship to the policyholder, and possibly contact information or Social Security numbers depending on the provider's requirements.

Some essential terms you may encounter on the form include 'primary beneficiary', 'contingent beneficiary', and 'revocable beneficiary'. The primary beneficiary is the main recipient of benefits, while a contingent beneficiary receives benefits if the primary is unavailable. It's crucial to be aware of any additional documentation that might be necessary, such as identification or previous beneficiary consent, especially in cases involving multiple beneficiaries or significant sums.

Step-by-step instructions for completing the form

Completing the change of beneficiary form involves careful attention to detail. First, gather all the required information, including personal details and the relevant details about each beneficiary. It’s essential to have their full names, relationships to you, and any identifying numbers if needed. This initial step ensures you are fully prepared when filling out the actual form.

Next, access the change of beneficiary form. Most financial institutions and insurance providers have their specific forms available on their official websites for download. Once you have the correct form, start filling it out methodically. For example, if you are replacing a former spouse as a beneficiary, ensure you clearly mark her name for removal and input the new beneficiary’s details accurately, paying close attention to spelling.

Common mistakes to avoid include leaving fields blank, making alterations without initialing them, or using outdated forms. Review the completed form thoroughly to ensure all information is accurate before submission, as any errors could delay the processing of your change.

Submitting the change of beneficiary form

Submitting your completed change of beneficiary form can usually be done in a couple of ways. Firstly, many companies offer online submission through their secure portals, which is often the fastest method. Alternatively, you can mail a physical copy of the form to your insurance provider’s designated office. When submitting any physical documents, consider using certified mail to ensure their safe delivery.

Once you’ve submitted the form, confirming receipt is crucial. Follow up with your provider to verify that the updates were documented correctly. This can typically be done via email or phone call. Some insurance companies also provide online access to your account, where you can see your current beneficiaries listed.

Managing your beneficiaries after submission

After submitting your change of beneficiary form, it's vital to keep track of any changes you make. Regularly review your beneficiary designations, especially after life events such as marriage, divorce, birth, or the death of a beneficiary. Assessing your designations every few years or during major life changes ensures you avoid potential disputes that arise when your choices may not accurately reflect your current situation.

Situations prompting further changes can vary widely. You may find that someone you initially designated is no longer in your life or that you wish to include new family members as beneficiaries. Equipping yourself with an updated list of beneficiaries will help streamline future processes and ensure peace of mind.

Frequently asked questions about the change of beneficiary form

It's common to have questions surrounding the change of beneficiary form. For instance, what happens if a beneficiary passes away? In these cases, it’s essential to check the specifics of your policy to determine how the benefits are allotted among remaining beneficiaries or if new ones need to be designated. Can you change a beneficiary without their consent? Generally, the policyholder does not require consent for changes, but it’s courteous to inform them.

Another common query involves deadlines; there isn’t usually a strict deadline for submitting changes, but it’s advisable to do so promptly after any significant life changes. Some providers, however, could on occasion require forms to be submitted within a specific time frame for certain benefits. Lastly, it's worth noting that while most insurance companies do not charge fees for changing beneficiaries, some might potentially impose fees for specific conditions, like legal name changes.

Utilizing pdfFiller to simplify the process

Using pdfFiller can greatly enhance your experience when dealing with the change of beneficiary form. This powerful online platform allows you to store, edit, and manage your important documents effortlessly. With pdfFiller, you can access interactive tools for precise document management, ensuring that your changes are reflected accurately without unnecessary stress.

The platform also enables features like eSigning, which helps make the process of finalizing your forms straightforward and secure. Moreover, collaborating with family members or legal advisers on this critical document can be managed easily through pdfFiller, creating a streamlined process for all parties involved. Ensuring that everyone is on the same page regarding beneficiary designations can make the administrative tasks less cumbersome.

Real-life scenarios and case studies

To understand the practical implications of keeping beneficiary designations updated, consider the following scenarios. A young couple names each other as beneficiaries on their life insurance policies, but after a divorce, they fail to update their forms. In the unfortunate event of one’s death, it could lead to assets being unintentionally passed to an ex-spouse rather than their children or new partners.

In another case, an elderly individual might initially designate their children as primary beneficiaries. However, as friendships evolve and close friends become significant support systems, it may be worthwhile to revisit these decisions to strengthen important non-familial bonds. Proper management of beneficiaries creates clarity and reduces the likelihood of disputes and turmoil in such situations.

Conclusion: The importance of keeping beneficiary information current

The change of beneficiary form serves as a pivotal tool in ensuring that your intentions regarding asset distribution are honored, allowing you to maintain control over your financial legacy. As we’ve discussed, various life events can significantly impact who you designate as a beneficiary, emphasizing the necessity to keep this information current.

Take proactive steps to review and update your beneficiaries regularly, particularly when major changes occur in your life. By managing your beneficiary designations responsively, you can prevent complications and ensure that your loved ones receive what they are entitled to when the time comes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in change of beneficiary form?

How do I fill out change of beneficiary form using my mobile device?

Can I edit change of beneficiary form on an iOS device?

What is change of beneficiary form?

Who is required to file change of beneficiary form?

How to fill out change of beneficiary form?

What is the purpose of change of beneficiary form?

What information must be reported on change of beneficiary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.