Get the free Change/add Currency Accounts

Get, Create, Make and Sign changeadd currency accounts

Editing changeadd currency accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out changeadd currency accounts

How to fill out changeadd currency accounts

Who needs changeadd currency accounts?

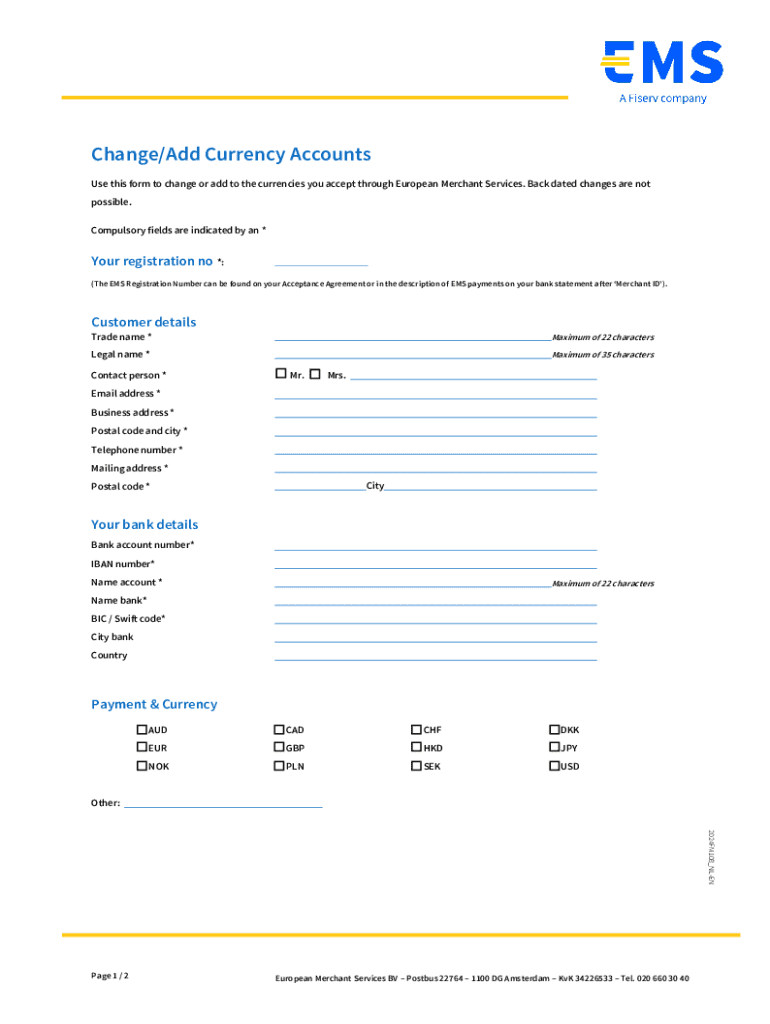

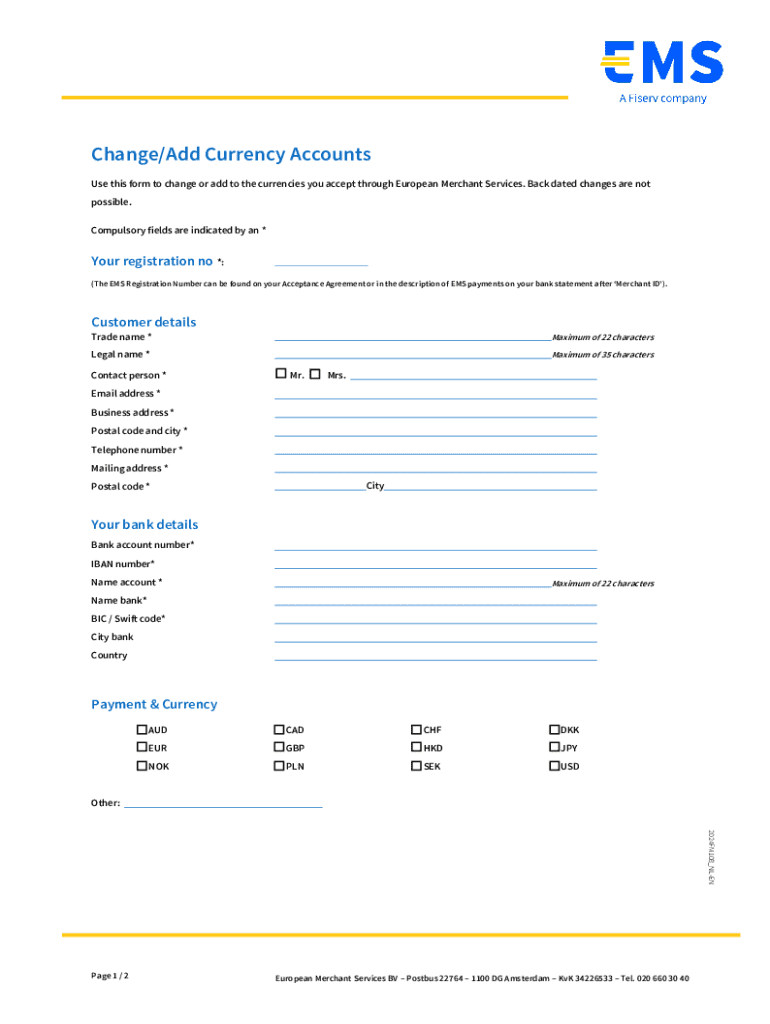

Comprehensive Guide to the Change/Add Currency Accounts Form

Understanding currency accounts

Currency accounts allow individuals and businesses to hold multiple currencies within a single account, facilitating smoother international transactions. These accounts can help manage the risks associated with fluctuating exchange rates and provide flexibility for those who frequently conduct business across borders.

For both individuals and businesses, currency accounts are vital. They minimize conversion fees and provide immediate access to funds in the required currency. For small businesses engaged in international trade, having a dedicated currency account can result in substantial savings, improved cash flow, and streamlined accounting.

When to change or add currency accounts

Recognizing when to change or add currency accounts is crucial for maintaining financial efficiency. Signs that it's time to take action include an increase in international transactions, requiring more foreign currency support. Changing business needs may also prompt the adoption of new accounts, especially if you are exploring new markets.

For frequent travelers, adding a new currency account may prove beneficial. Particular scenarios, such as relocating abroad or expanding a business's international reach, necessitate re-evaluation of existing accounts to ensure they align with current financial realities.

Key considerations before changing/adding accounts

Before proceeding with changing or adding currency accounts, several important factors demand consideration. Understanding currency exchange rates and fees is paramount, as these can significantly affect overall costs. Fees associated with international transactions, account maintenance, and currency conversion should be estimated for informed decision-making.

Researching requirements from financial institutions is equally essential. Different banks offer varying services and account features, including competitive exchange rates and minimal fees. Additionally, compliance with regulatory considerations is crucial, particularly for businesses operating in multiple jurisdictions, as they may face different regulations.

Step-by-step guide to changing currency accounts

To efficiently navigate the process of changing or adding currency accounts, follow a structured approach. Start by evaluating your current account—assess how often you use it and whether the associated fees are justified. Identify your requirements for a new account based on your current financial activities.

Next, research various financial institutions, comparing features, fees, and any additional services they may offer. pdfFiller provides interactive tools to assist in comparing options effectively. Gather required documentation, which typically includes identification and proof of residence. Then, you can fill out the Change/Add Currency Accounts form—which pdfFiller’s editing tools can help optimize—and ensure all necessary fields are completed accurately.

Maintenance and management of currency accounts

Ongoing maintenance and management of your currency accounts is essential to ensure they meet your evolving needs. Regularly monitoring account activity helps maintain financial oversight, preventing fraud and ensuring transactions align with expectations. Moreover, pdfFiller can assist in managing the documentation required for your international transactions, aiding in effective record-keeping.

To manage currency fluctuations more efficiently, setting up alerts for significant changes can provide valuable insights into the market. This proactive approach helps you make informed decisions about when to conduct transactions, maximizing the benefits of your accounts.

Frequently asked questions (FAQs)

When managing currency accounts, questions often arise. Users frequently inquire about the process for closing an existing currency account. Typically, you will need to submit a formal request, alongside any required identification documents to finalize closure. Furthermore, potential limits to the number of currency accounts you can hold may vary by institution, so it is advisable to check their specific guidelines.

Handling transactions during an account switch also raises concerns. Operating two accounts temporarily is often feasible to ensure all transactions are processed without disruption. As for customer support, most financial institutions provide robust resources to assist users in case issues arise, including dedicated hotlines and online chat functionalities.

Next steps after adding/changing accounts

Once you have successfully added or changed your currency accounts, reviewing account settings is vital. This includes ensuring privacy and security preferences are set according to your needs. Spending time familiarizing yourself with any new features offered by your financial institution can lead to more efficient management and utilization of your accounts.

Using pdfFiller to create tailored documents related to international transactions becomes beneficial. This tool allows you to manage invoices, receipts, and other important documents efficiently, ensuring a seamless workflow in tracking your finances across currencies.

Case studies and examples

Real-life examples of individuals and businesses navigating the currency account change process can provide valuable insights. One notable case is a small e-commerce business that expanded its market reach into Europe. By adopting a multi-currency account, they managed to eliminate high transaction fees, thus significantly reducing costs.

Another example is a frequent traveler who maintained multiple currency accounts. They strategically managed their funds, being able to avoid unfavorable exchange rates, demonstrating the effectiveness of having dedicated accounts for specific currencies. Their experiences underscore best practices for account management and the benefits that can be derived from actively maintaining multiple currency accounts.

Tips for seamless management of multiple currency accounts

Efficiently managing multiple currency accounts demands organization. One effective strategy involves categorizing records and transactions according to currency type, allowing faster access and streamlined financial tracking. Leveraging pdfFiller's collaborative features enables teams to share and manage records, enhancing teamwork in account oversight.

Integrating other tools with accounting software can create a cohesive financial management system. This integration allows real-time tracking of currency conversions and balances, facilitating informed decisions about when to transact or convert.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute changeadd currency accounts online?

How do I edit changeadd currency accounts online?

How do I fill out changeadd currency accounts on an Android device?

What is changeadd currency accounts?

Who is required to file changeadd currency accounts?

How to fill out changeadd currency accounts?

What is the purpose of changeadd currency accounts?

What information must be reported on changeadd currency accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.