Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out capital contribution agreement

Who needs capital contribution agreement?

A Comprehensive Guide to Capital Contribution Agreement Form

Understanding the capital contribution agreement form

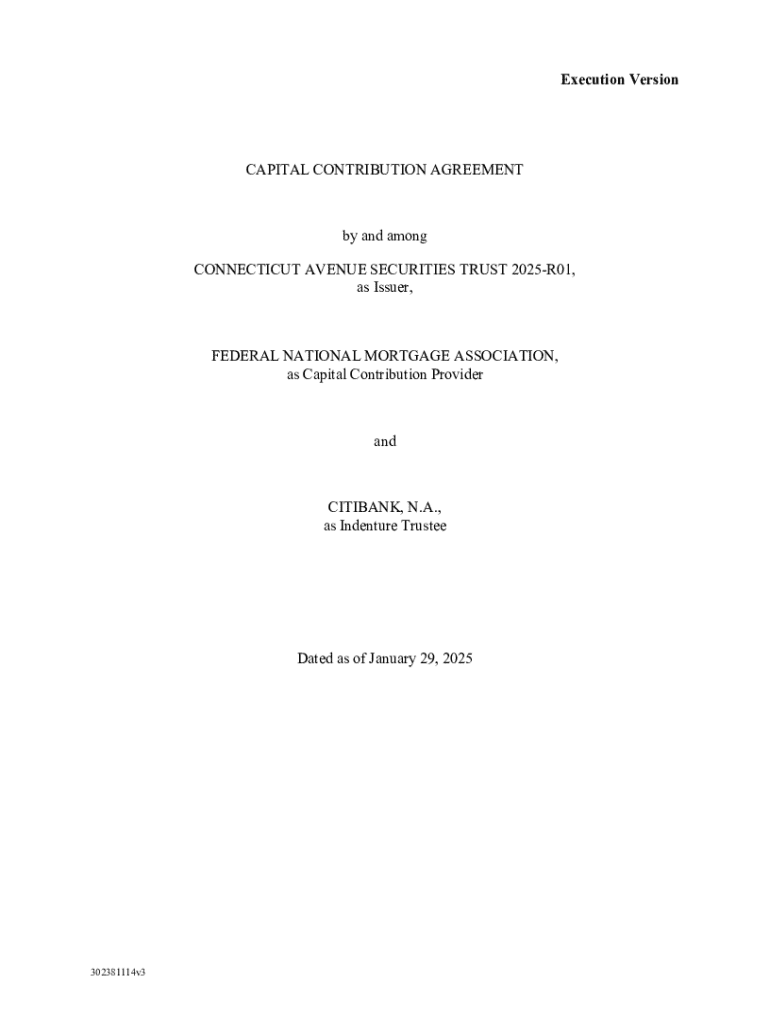

A capital contribution agreement form is a legal document that outlines the terms under which partners or investors contribute capital to a business venture. This agreement is crucial as it defines the contributions made by each party and their respective ownership stakes in the business.

Establishing a capital contribution agreement is pivotal when forming a business entity, such as an LLC or partnership. It provides clarity and structure, ensuring that all parties understand their rights and obligations, which can help prevent disputes in the future.

There are three main types of capital contributions: cash contributions, property contributions, and services contributions. Cash contributions involve direct monetary investment, property contributions include tangible assets like real estate or equipment, while services contributions involve offering skills or expertise instead of cash or property.

Key components of the capital contribution agreement

The capital contribution agreement must include several key components to be effective. Essential clauses are vital for safeguarding the interests of all parties involved. Key clauses include the identity of the parties involved—clarifying who is contributing capital and to what extent, detailed descriptions of each party's contributions, the percentage of ownership assigned to each party, and the specific rights and obligations that each party agrees to uphold.

Legal considerations must also be taken into account. Depending on local and state regulations, different rules may apply to how capital contributions are structured. Moreover, understanding tax implications is crucial; contributions can affect personal and business tax returns and liabilities.

Common mistakes to avoid when preparing a capital contribution agreement include inadequate detail about contributions, vague ownership percentages, and failing to account for future contributions or changes in ownership structure.

Step-by-step guide to filling out the capital contribution agreement form

Filling out the capital contribution agreement form requires organized information and attention to detail. Begin by gathering necessary information from all parties involved, including their personal and business data. It's vital to come prepared with an accurate valuation of each contribution to avoid disputes.

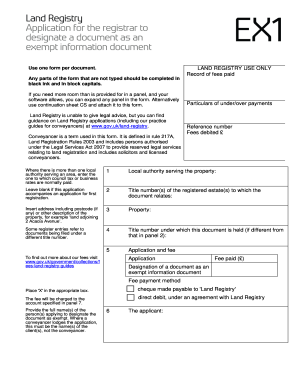

Once you have the required information, format the agreement. If using pdfFiller, start by selecting a template designed specifically for capital contributions. This platform allows for interactive tools that streamline customization of the document.

Each section of the form should be filled out methodically: Begin with party details, then describe the contributions, outline ownership percentages, and finalize the rights and obligations of each involved party. Ensure all information is accurate to avoid any contractual disputes in the future.

Collaborative editing and management

Using pdfFiller’s collaborative tools can significantly facilitate editing and managing the capital contribution agreement form. Team members can be invited for review, providing input and making necessary adjustments. This real-time editing capability ensures that everyone involved is on the same page.

Moreover, implementing effective version control is critical during the document management process. Tracking changes made by various collaborators helps avoid confusion and keeps a clear historical record of edits and agreements. Documenting these changes can also assist in identifying when and how specific terms were modified, ensuring transparency among all parties.

Securing your agreement with esignature

Once the capital contribution agreement is drafted, securing it with an electronic signature provides both convenience and legality. pdfFiller offers a straightforward method for signing the agreement electronically. Users can set up their eSignature and easily send the document for signature from any location.

eSignatures are legally valid in many jurisdictions, making them an efficient way to finalize agreements quickly. However, it’s vital to store signed documents properly to ensure smooth retrieval in the future. Utilizing pdfFiller, signed documents can be organized and accessed easily within the platform.

Frequently asked questions about capital contribution agreements

Many common questions arise regarding capital contribution agreements. One frequent inquiry involves the ramifications if a capital contribution isn't made. Generally, failure to follow through on agreed contributions can lead to contractual penalties, disputes, or dilution of ownership.

Another vital question relates to the modification of agreements after signing. While changes can certainly be made, it typically requires mutual consent from all parties involved. Outlining a clear modification process can prevent misunderstandings down the line.

Dispute resolution is another important aspect. Many capital contribution agreements include clauses detailing how disagreements are to be resolved, whether through mediation, arbitration, or litigation. Addressing this in advance can save time and resources in the event of a conflict.

Use cases of capital contribution agreements

Capital contribution agreements are widely applicable across various business structures. Startups and LLCs often utilize these agreements during their formation to define ownership and contributions clearly, which is particularly crucial for establishing strong operational foundations.

Partnerships and joint ventures also rely on capital contribution agreements to ensure all partners have a clear understanding of their contributions, ownership stakes, and the rights associated with those stakes. Established businesses may modify these agreements as they evolve, particularly when new partners join or existing contributions change.

Best practices for drafting a capital contribution agreement

Engaging with professional legal counsel is imperative when drafting a capital contribution agreement. Skilled attorneys can provide insight into regulatory compliance and help structure terms that protect all parties involved. Regularly reviewing and updating the agreement ensures it remains relevant as the business grows.

Setting reminders for contributions is another effective practice. This promotes accountability among partners and minimizes the risk of missing critical contributions that could impact the business's financial health.

Testimonials and success stories

Many individuals and teams have found success through well-crafted capital contribution agreements. For instance, a startup specializing in tech innovations managed to solidify their initial funding agreements using templates from pdfFiller, preventing misunderstandings that often arise in startups.

Users have shared how pdfFiller's platform simplified their processes, allowing them to efficiently draft, edit, and finalize essential documents without hassle. The accessibility of tools to assist with document management has proven invaluable in these cases.

Integrating the capital contribution agreement form into business operations

Incorporating the capital contribution agreement form into daily business operations promotes organization. Keeping all legal documentation in a centralized location ensures that relevant parties can easily access necessary paperwork. This visibility is vital for maintaining compliance and operational efficiency.

Beyond organization, utilizing the capital contribution agreement form sets a foundation for future business opportunities. Whether scaling operations or attracting new investors, having a clear structure in place allows businesses to pivot effectively and optimally leverage their resources.

Continuous education and training for teams regarding these agreements and their significance within business operations are essential. Ensuring that everyone involved understands the agreements’ terms and processes solidifies the foundation of a collaborative and responsible work environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

How can I get pdffiller form?

How do I make edits in pdffiller form without leaving Chrome?

What is capital contribution agreement?

Who is required to file capital contribution agreement?

How to fill out capital contribution agreement?

What is the purpose of capital contribution agreement?

What information must be reported on capital contribution agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.